Executive Summary

This report presents our opinion on the truth and fairness of Wesfarmers’s financial statements for the period ending 30 June 2015. Particularly, in this report, we express our opinion on the truthfulness and fairness of Wesfarmers’s balance sheet statement, income statement, and consolidated statement of comprehensive company incomes. Other documents that we analyze in this report include the company’s consolidated statement of changes in equity and company notes. Collectively, these documents outline a summary of Wesfarmers’s key accounting policies and financial performance. Our objective view of the truthfulness and fairness of these reports apply to Wesfarmers financial reports and those of its subsidiaries. Therefore, the references we use in this report, such as “the company,” “the group,” “we” and “us” collectively mean Wesfarmers Company and all its subsidiaries. Similarly, all the amounts mentioned in this report are in Australian dollars.

Opinion

In our opinion, the financial accounts of Wesfarmers are by the Corporation Act 2001. This assertion means that the company’s financial statements give a true and fair view of its financial position and performance for the period ending June 2015.

Basis for Opinion

The basis for our opinion premises on the fact that we conducted this audit by the international standards on Auditing (ISA) principles. Our responsibility, by these auditing standards, appears in the auditor’s responsibility for undertaking audit procedures (highlighted in the last sections of this report). Our independence from the company and its operations put us in an objective position of providing a reliable opinion of the company’s financial statements. Similarly, this position allows us to fulfill our ethical responsibilities as outlined in the ISA. Lastly, we believe that the evidence we have provided in this report is sufficient to provide a strong basis for the development of our objective opinion of Wesfarmers’s financial statements.

Audit Risk Areas

The key audit matters represented in this report refer to corporate, financial, and accounting issues, which in our professional judgment were of significant importance to our analysis of Wesfarmers’s financial accounts. The key audit matters presented in this analysis also refer to issues, which arose from our communication with those entrusted with the duty of managing the company’s operations.

However, our scope of discussion does not fully outline the number of issues we discussed with them. The audit procedures we undertook when investigating the audit risk areas of Wesfarmers are about the context of our audit process and our analysis of the financial statement of the company as a whole. From this basis of analysis, it is important to point out that the audit risk areas highlighted in this report did not influence our opinion of the audit statement. Similarly, we do not convey a direct opinion on any of the matters we describe here. Nonetheless, the main audit areas we discovered in our analysis appear below

Laws and Regulations

According to Martinov-Bennie, Roebuck, & Soh (2013), the regulatory environment could have a significant impact on the accounting and disclosure requirements of different companies. Wesfarmers is no exception because the company’s regulatory environment affects how it does its business. For example, the Federal Government of Australia has established environmental regulations to guide the activities of different companies involved in the mining and industrial sectors.

A breach of these regulations is an inherent risk for Wesfarmers Limited. Particularly, there are concerns that its coal mining activities and its use of chemicals for the fertilizer sector could breach existing regulations concerning carbon and greenhouse gas emissions (Wesfarmers Resources 2015). We analyzed these details after evaluating the company’s sustainability report of 2015. In this analysis, we found that the company has taken some positive steps in ensuring compliance with existing environmental laws. For example, the site water-balancing model developed by the company’s team is useful in helping managers to make important decisions about water inventory management (Wesfarmers Resources 2015).

The same model is useful in making decisions about the development of water infrastructure projects. The company’s sustainability report contains evidence of such decision-making advantages (Wesfarmers Resources 2015). For instance, the installation of additional water release points into Mckenzie River was a product of a thorough decision-making process that used the above-mentioned model. Consequently, the company was able to release 1,168ML of water from the site following the laid out regulatory approvals (Wesfarmers Resources 2015).

Most of the company’s environmental monitoring programs are also following the environmental authority and Transitional Environmental Program (TEP) requirements. This is why we did not detect major breaches in the company’s regulatory compliance procedures. However, based on the evolving nature of the company’s mining and environmental-related activities, the risks of environmental breaches could still emerge in the company’s future operations.

Existing laws surrounding the activities of Wesfarmers determine reported figures and disclosures in the company’s financial reporting mechanism. In our analysis of the company’s minutes of recent meetings, we found that the risk of related parties could compound the law and regulations risk of the company. According to Nonna (2014), related party relationships occur when different shareholders in an organization could influence the decisions, or actions, of others (joint venture relationships also fit in this category of analysis). Particularly, their investing, operating, and financing actions are of great importance to our analysis because they determine the financial direction of the company.

Based on the above statement, key management personnel of Wesfarmers and its most powerful shareholders (including their families) could influence the company’s decision-making processes, thereby causing variations in its risk profile. For example, depending on the nature of the relational party relationships in the organization, there could be a higher risk of material misstatement, compared to transactions that do not manifest this relationship.

Impact of the Audit Risk Area on the Company’s Financial Statements

According to Nonna (2014), companies are aware that non-compliance with environmental laws could have a significant impact on their financial reporting procedures. A breach of environmental regulations by Wesfarmers could create serious legal implications for the company. For instance, such a breach could lead to fines and penalties, as stipulated by the law. The company’s financial statements would reflect the same penalties through a decreased financial performance.

This is why Leung et al. (2015) say environmental regulation matters have become a matter of concern for many companies and an even greater point of consideration in the development of financial statements. Such concerns emerge from the growing importance of environmental matters to users of financial statements. Based on this framework of analysis, the management of Wesfarmers needs to realize that they must recognize, measure, and disclose such issues.

Although some companies may not agree that environmental matters are poignant to the development of their financial statements, Wesfarmers cannot fail to ignore their impact on the disclosure of their financial statements because according to the organization’s sustainability report, it strives to continuously create value for its shareholders and proactively manage its environmental impact to the community (Wesfarmers Resources 2015). Since environmental concerns are important to the company’s operations, the risk of material misstatement is real.

The risk of inadequate disclosure is particularly more vivid in this regard because it is easy for the company to fail to acknowledge the full impact of its environmental-related activities in its financial statements. For example, such a breach could lead to the non-disclosure of contingent liabilities in the company’s financial statements, thereby leading to the inaccurate reporting of financial data. Consequently, the company could suffer negative press, as it would possibly lead to the development of a bad reputation among the public who trusts it to be mindful of the impact of its economic activities on the environment. The company could also suffer from a resultant low of goodwill from investors because of the same issue.

The main environmental issues we found to affect the company’s financial statements include those that affect how the company reports assets in its financial statements. We find that these issues may lead to asset impairment or could create a need to write down their carrying value. As mentioned in this report, the company may also realize an increase in legal costs associated with non-compliance with environmental laws.

For example, the failure to comply with emission and waste disposal laws could lead to this outcome. Similarly, changes to legislation with retrospective effect may lead to the increase of accrual of remediation costs. Since Wesfarmers directly engages in the extraction industry, mining sector, and chemical manufacturing industry, it could experience increased environmental obligations because of the type of business it engages in. For instance, it could experience increased constructive obligations for its mining activities, particularly in areas where its ventures change or alter, the environment (topography of the region). According to the International Accounting Standards Committee, constructive obligations emerge in the following context

“Sometimes the actions or representations of the enterprise’s management, or changes in the economic environment, directly influence the reasonable expectations or actions of those outside the enterprise and, although they have no legal entitlement, they have other sanctions that leave the enterprise with no realistic alternative to certain expenditures” (Auditing and Assurance Standards Board 2015, p. 16).

So far, the company’s record has shown that it has voluntarily assumed the above obligation because of concerns for its long-term reputation with host communities and the public. Since it is difficult to estimate the impact of environmental issues on the company’s financial statements, Wesfarmers may be obligated to disclose its contingent liabilities in its financial notes. In extreme situations, the failure to comply with existing environmental laws could significantly affect the company’s operations as a going concern. As such, such an outcome would affect the company’s financial disclosures and significantly influence the basis for which it develops its financial statements.

The impact of the failure to comply with laws and regulations as an audit risk area could also affect the company’s financial statements through provisions and contingent liabilities that may arise through litigation procedures. The effects on the company’s financial statements could also occur through the additional provisions for asset retirement and employee redundancies (based on risks that emerge through regulatory approvals and breach of contract terms). Lastly, risk factors associated with taxation and the possible closure of production of facilities could have a significant impact on the company’s financial statements through the recoverability of VAT receivables and the taxation of environmental receivables. The auditing procedures to identify account balances for the above-mentioned risk area appear below.

Auditing Procedures to Identify Account Balances

In this report, environmental matters refer to steps meant to prevent, or abate, damage to the environment. They also entail attempts to improve the conservation of renewable and non-renewable energy sources. Some of these initiatives are requirements of Australia’s environmental laws and regulations. Our understanding of environmental matters also includes the consequences of violating environmental laws and regulations, the consequences of environmental damage to others and natural resources, and the consequences of vicarious liability imposed by law.

To understand concerns about the breach of environmental regulations, as an area of legal concern for Wesfarmers, it is pertinent to evaluate this issue with laid out standards for environmental regulations Accountability’s AA1000 and Assurance Standard (AA1000AS) because these two legal provisions provide the framework for the company’s activities (Wesfarmers Resources 2015). To this extent of analysis, we also analyzed the organization’s adherence to AA1000 Accountability Principles.

These principles focused on issues that centered on materiality, inclusivity, and responsiveness of the company to material issues in its financial statement, as well as the information it contains in its internal audit report. We also reviewed the net performance data according to the Australian Standards on Assurance Engagements (ASAE) 3000 (Wesfarmers Resources 2015). The performance data also included financial information contained in the company’s databank.

Based on a review of the company’s financial information with the above-mentioned data, we can provide a moderate assurance of the company’s information according to AA1000AS. This assurance did not only cover specific aspects of the company’s report; instead, it focused on all of the company’s systems and activities that were relevant to the reporting period. Nonetheless, it is pertinent to point out that we considered the following exceptions:

- The process of identifying a breach of environmental regulations as an inherent company risk only involved in the analysis of financial data that had a far-reaching environmental or social impact on the organization’s activities.

- The work presented in this report does not include the opinions of another auditor who conducted an environmental risk analysis of the company’s operations, under the National Greenhouse and Energy Reporting Act 2007. Therefore, this work does not replicate previous works, particularly, in the area of greenhouse gas emissions where a bulk of the report focused on. Consequently, our analysis of the risks posed by breaches in greenhouse gas emissions includes all the financial information reported under the National Greenhouse and Energy Reporting Act 2007.

- Other auditors have undertaken an analysis of Wesfarmers’s waste and water collection methods. This report does not replicate their work; instead, it builds on them.

- An assurance of selected performance data according to ASAE 3000 was also limited in this report.

As part of our role in exercising our professional judgment about the effects of Wesfarmers’s legal obligations, our knowledge of the business, the company’s risk assessment procedures, its internal control measures, and the consideration of prevailing Australian laws and regulations surrounding coal mining activities and other environment-related matters of the organization guided our analysis.

We also considered other substantive procedures surrounding the compliance with existing environmental laws in our analysis. This statement generally outlines the sequence of the auditing process. Indeed, after acquiring sufficient knowledge of the business, we assessed the risk of material misstatement in the company’s financial statement by assessing the impact of environmental laws and regulations on the company’s financial performance. This analysis was important in informing our judgment regarding the identification of environmental legal breaches as a significant audit risk area. It also helped us to understand whether to consider environmental matters as a significant point of concern when auditing the company’s financial statements.

Operational Risks

As part of its business risk profile, Wesfarmers has an operational risk associated with stock management. Poor stock valuation, theft, and embezzlement of cash are some issues inherent in this risk profile. The company’s internal systems in stock management bear the key to understanding this inherent risk because the poor monitoring of stocks could lead to the material misstatement of the company’s financial information.

Indeed, as Leung et al. (2015) point out, the risk associated with poor stock inventory management is a material misstatement in audit planning. There is also a high possibility that errant officers may misappropriate or embezzle receipts through fraudulent accounting practices, or steal physical assets if they have the opportunity to do so (Auditing and Assurance Standards Board 2015). The lack of strong internal controls may also tempt some of them to use the company’s assets for personal use.

The large-scale nature of the company’s operations compounds this problem because there are millions of cash transactions documented each week in the company’s retail outlets. The risk associated with the overstatement of stock values is more poignant in this analysis because it could lead to a lower net realizable value of the stock. Price fluctuations are also part of the symptoms that could emerge because of this inherent risk.

Impact of the Audit Risk Area on the Company’s Financial Statements

The revenue collected from the company’s long-term contracts caught our attention when examining the operational risks of the business because we discovered that the terms and conditions stipulated in the company’s long-term contracts affected its operational revenue. Similarly, we found out that the revenue collected from the company’s long-term contracts was enough to influence the organization’s total revenue collection.

The process of recognizing the amount of revenue that Wesfarmers would realize in its different business segments could influence the judgment of the company’s management. We also identified the revenue recognition process of long-term risk, as an important audit risk area because side arrangements, or contractual terms and conditions in the contracts, may affect the original agreements, or the amount of money the organization would get from the first agreement.

We also noted that the organization could wrongfully omit or add these side agreements, terms, and conditions in the company’s financial statements. In addition to analyzing the company’s internal controls to record its long-term contracts, we also counterchecked the same facts with the company’s clients and double-checked their responses with corresponding journal entries. Based on these audit procedures we did not find material cases of side agreements surrounding the execution of the company’s long-term contracts.

There could be an overstatement or understatement of the company’s operational revenue, which could further lead to the reporting of inaccurate revenue of the company’s retail business performance. The operational risks of Wesfarmers’s retail business could also lead to frequent stock-outs of the company’s products. It could also lead to inefficiencies in the company’s operations. The loss of physical and financial resources could also occur because of the company’s operational risks. Louwers (2013) adds to this observation by saying that this risk could also lead to an overstatement of stock in the company’s balance sheet for its retail segment.

Auditing Procedures to Identify Account Balances

To identify areas of possible misstatement arising from the influence of relational parties in the company’s operations, we examined the possibilities of the company’s failure to disclose such relationships. We also discussed the company’s potential of failing to account for transactions that have yielded the same relationships. The aim of engaging in such a process was to conclude whether the fair representation was realized, or not.

Similarly, we engaged in the same process to identify whether there were risk factors for fraud that could affect the company’s current account balances. In line with the above concerns, we asked some of the employees to disclose any cases they knew of relational party interests in the business’s operations. We also checked the organization’s internal audit report and past external audit reports to determine whether there are areas of possible misstatement. We also reviewed the company’s procedures for identifying such relationships and similarly examined the organization’s meetings to understand whether there were causes of relational party interests in the organization.

Business Risk

Changes in the business environment could affect Wesfarmers’s bottom-line. Such changes could arise from variations in events or circumstances surrounding its different business operations. The actions, or inactions, of some of its managers, could also affect its business performance, including its ability to execute its business plans, or its capability to execute some of its fundamental business strategies. Understanding the context of how some of these variables would affect the business’s performance would protect the managers from making mistakes about the execution of its business plans. Some important audit areas to consider in the context of this analysis include industry development plans, the inclusion of new products and services (business expansion), and current or prospective financing requirements for the business.

To adjust to some of the company’s business risks, its managers have adopted different strategies to improve its efficiency and effectiveness in the management of its different business divisions. For example, in 2012, Wesfarmers introduced an integrated management information system to manage the activities of its retail segment (Wesfarmers Resources 2015). Some of these measures could exert undue pressure on the company’s management.

From an audit standpoint, such measures could include key ratios and operating statistics, key performance indicators, and employee performance measures. Industry trends, forecasts, budgets, and variance analysis could also affect the company’s management strategy. Leung et al. (2015) add to this analysis by saying analysts’ reports and credit rating reports could influence the types of management decisions the company could make to manage its business risks.

In our analysis of the business risk, we also identified the expansion into overseas markets as a significant business risk for the business because Wesfarmers has participated in several international market expansion strategies, including acquisitions and mergers that have failed to generate profits. Some of its main business activities involve the sale of some of its business divisions for purposes of improving the organization’s efficiency and competitiveness. Since the company intends to continue pursuing such strategies, their possible failure, or possible inability to meet the intended goals, adds to Wesfarmers’s business risk profile.

Uncertainty in insurance is also another inherent risk in Wesfarmers’s business risk profile because according to industry reports, there has been an increase in insurance claims stemming from natural disaster losses and credit risks (KPMG International 2016). The complexity associated with calculating insurance risk and the high numbers of calamities and catastrophes around the world causing widespread deaths have compounded this problem. Lastly, there are concerns regarding the efficiency and effectiveness of the company’s IT system. Particularly, these concerns stem from the organization’s ability to monitor this system. Unless examined by an independent risk management team, the effectiveness and efficiency of this integrated management information system would always be in question. Its implication on the company’s financial books appear below

Impact of the Audit Risk Area on the Company’s Financial Statements

The reliability of data recorded through the company’s integrated management system would ways be in question if the system is prone to errors of omission or commission. The business risks identified could affect the business’s accounts receivables and affect the computation of the business’s profit and loss and balance sheet statements. For example, the business risks could cause changes in business profitability and loss statements.

It could also cause a change in inventory and lead to the impairment of property or plant values. This type of risk could also affect the recoverability of deferred tax assets and general market risk disclosures. These risks could come from different changes in the company’s risk profile. For example, the pressure on margins (lower prices and higher costs) could be affected in this regard. Currency fluctuations also emerge as an external market force that would equally affect the company’s financial statement. Particularly, it would affect the balance sheet statement through changes in the valuation of the company’s asset values. An increase in debt service costs could also be a direct result of foreign exchange fluctuations. In extreme cases, there could be a financial market meltdown because of such risks.

The business risk associated with the company’s market expansion strategy could cause the potential overstatement of the company’s inventory. The possibility of recording the company’s stock at a value that is higher than the net realizable value is also real. In our assessment, this outcome leads to valuation and assertion assessment at risk. Uncertainties in the global and regional economic space could also lead to the potential overstatement of accounts receivables in the company’s profit and loss statement.

Similarly, it could lead to the inability of customers to pay their debts, thereby affecting current account balances in the balance sheet. We came up with these findings through a valuation and allocation process assertion at risk. The above-mentioned risks may have a significant impact on Wesfarmers’s financial books because it could lead to inaccurate reporting of short-term and long-term liabilities in the company’s financial statements. The same issue could also lead to the company’s inability to meet its contractual obligations.

Auditing Procedures to Identify Account Balances

Our auditing procedures to identify account balances in this risk profile, first, involved analyzing Wesfarmers’s external business environment (understanding the auditing universe) using the PESTEL analysis tool. In our analysis, we assessed different external forces affecting the organization, including the political, economic, social, technological, environmental, and legal forces affecting the organization’s business operations. To understand the audit universe, we identified areas that had high risks, identified critical control systems that addressed high inherent risks and addressed the uncertainty that emerged from a review of the critical control systems.

To understand Wesfarmers’s business process analysis, we strived to understand the company’s business processes, mapped the company’s internal control environment, and identified areas of control weaknesses. These steps are by the audit review process as outlined by the Chartered Accountants of Australia and New Zealand (2016). To do so, we used the SWOT analysis tool to get a holistic view of the organization’s business operations.

This business analysis tool helped us to get a wholesome view of the company’s strengths, weaknesses, opportunities, and threats. We also got information about the company’s business by evaluating its policy and procedures manual, annual reports, and internal meeting reports from the Australian Securities Exchange (2015). Some of the information obtained from this analysis was corroborated or disputed by some of the company’s employees (non-audit staff). We also had discussions with some of the organization’s management and staff. We also used an analysis of existing audit reports as the framework to prepare our audit report.

Our analytical process also included a study of comparative relationships among the available data. We used this information to identify expected and unexpected fluctuations in the company’s financial statements. In line with this analytical process, we analyzed the company’s financial information with similar information reported in past financial reports. We also analyzed the same information with the company’s financial projections and budget analysis, including a comparison of the company’s performance with industry averages.

Here, it is important to understand the substantive procedures for the different classes of risks identified in this report because this audit report is subject to our opinions. For purposes of preparing this report, we read the company’s general ledger to identify its account balances. Analysts have discussed this technique in professional standards in SAS Nos. 106 and 109 and affirmed its reliability in preparing auditing reports (Chartered Accountants of Australia and New Zealand 2016).

It is a pervasive technique that has far-stretched implications on the overall audit strategy. We identified unique financial entries to get credible financial data about the company. Since the sources of information used to examine the company’s books were credible, we concluded that the company’s account balances were reasonable. The risk assessment procedure provided credible evidence that helped us to identify possible areas of misstatement and correct them. To do so, we looked for unusual amounts or financial postings in the company’s annual statements that could explain its operations or risk profile. Particularly, transactions that were below the lower limit for individual items in the company’s financial report were of importance to our analysis.

We also assessed the risk of material misstatement at two levels – overall financial report level and assessment level. At the overall financial report level, we assessed business risks that related pervasively to the financial report as a whole. It had different implications for the company and informed our judgment of the management’s integrity and the general IT environment of the company. At the assertion level, we analyzed the inherent risks of the business and the control risks.

The inherent risks of the business referred to the relation of an assertion to material misstatement of the business. Here, the main assumption was that there were no related controls. When identifying balance sheet statement issues, we realized the importance of focusing on significant risk areas in the company’s business operations, such as accounts that have a judgment or estimation involved, assets that are susceptible to loss and manipulation, and transactions that are unusual or complex.

Handling Cash and Cash Equivalents

Under the accounting requirements provided by IAS7, Wesfarmers should present changes in its cash flow to its shareholders (Auditing and Assurance Standards Board 2015). Using a statement of cash flow, the company should classify the cash flow into financing, investment, and operational activities. The fundamental principle of IAS7 requires the company to prepare such cash flow statements to analyze changes in cash and cash equivalents (Auditing and Assurance Standards Board 2015).

In our report, cash and cash equivalents refer to cash on hand and demand deposits. It also refers to short-term and liquid investments, which the company could easily translate to cash. Investments that are highly subject to the risk of changes in value also fall within the same category. Handling cash and cash equivalents is a possible audit risk area for the company because it creates a high volume of inherent risk for management.

In other audit reports, cash handling is not only identified as a high-risk function but also an important activity in studying an organization’s account balances (Chartered Accountants of Australia and New Zealand 2016). It is important to consider the effects of this risk because the amount of money Wesfarmers holds as cash, or its equivalents, is important in implementing the organization’s overall business strategy.

Some of the misstatements, which may not be discovered, include the failure to bill a customer, and the embezzlement of cash that may occur from the unlawful interception of receipts before recording. The result may be the account being written off as bad debt. According to our analysis of the company’s cash flow statement, the following risk areas are worthy of concern:

- Possibility of a duplication of the vendor’s invoice

- Possibility of improper payments of personal expenses

- Possibility of payment of raw materials that have not been delivered

- Possibility of overpayment of employee’s work hours

- Possibility of interest overpayment above the going concern

Some mistakes that could emerge from the process of bank reconciliation include the failure to include checks that have already been cleared by the bank. Such cheques could have been included in the cash disbursements journal. Another possible mistake could be the misstatement of cash received by the clients, after the balance sheet date. The mistake arises when such figures are recorded as cash receipts for the current year of analysis.

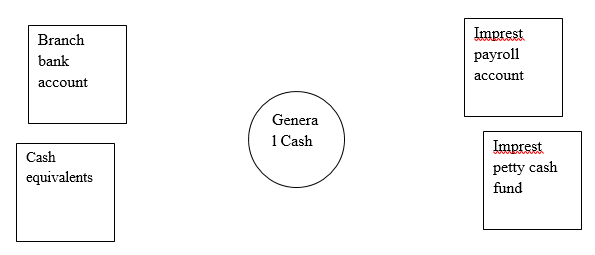

Deposits that could be fraudulently recorded as cash receipts for the year could also emerge as an area of possible misstatement if they are deposited in the bank but recorded as a deposit in transit (Chartered Accountants of Australia and New Zealand 2016). Payments on notes payable could also be another area of possible misstatement if the company debits it in the account but fails to declare it in the company’s records. The types of cash accounts that could yield the above misstatements include the general cash account, imprest account, imprest petty cash fund, branch bank account, and cash equivalents. The diagram below shows the relationship between the general cash and the above-mentioned cash accounts.

Handling cash and cash equivalents could lead to fraudulent financial reporting, which may arise from a fraudulent financial recording by the company’s financial officers or the top management (Auditing and Assurance Standards Board 2015). There is also a possibility of manipulating operating results through the reliance on inappropriate assumptions to estimate current account balances.

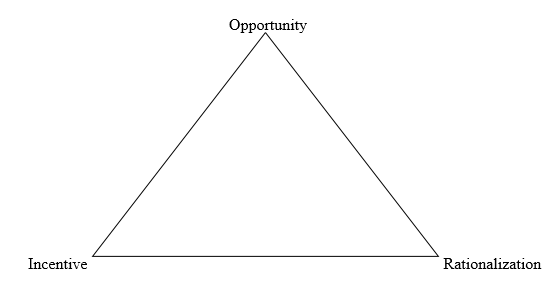

People may also be tempted to conceal or manipulate financial results of weekly or daily operational activities if they handle cash and its equivalents because they could be tempted to pocket the revenue and hide it in the books. There is also a high possibility of omitting or delaying the recognition of events if they handle cash and its equivalents or engage in complex transactions to misrepresent events or hide the true nature of financial transactions. To understand the occurrence of this risk, it is pertinent to understand that three factors could lead to the increased risk profile of this risk profile – opportunity, incentive, and rationalization (Chartered Accountants of Australia and New Zealand 2016). The diagram below represents their interaction

The identification of this audit risk is part of our responsibility as auditors to identify the intentional act by one, or more, individuals in the management team to commit fraud or engage in financial misstatements for purposes of gaining an unfair advantage over others. Indeed, as the Chartered Accountants of Australia and New Zealand (2016) points out, the auditor is supposed to consider the risk of material misstatement when undertaking the audit process.

Many reasons could explain why the company could not identify fraud when employees handle cash and cash equivalents. Poor internal controls are the major reason explaining why fraud could occur. In fact, according to Chartered Accountants of Australia and New Zealand (2016), this reason explains why 47% of fraudulent activities occur. Overriding existing controls is also another reason that could explain the presence of fraudulent activities in the organization.

The management normally has the power to override such controls. Therefore, there should be more oversight on management not to engage in such deception. Industry-specific risks and the lack of accountability in the organization could also lead to the same problem. Since Wesfarmers is a dynamic risk, it is important to point out that this risk is contextual to the type of business the organization engages in. Collusion between employees could further compound this problem because there would be a deliberate effort by employees to circumnavigate the system and engage in fraudulent activities.

The risk of fraud that could emerge when handling cash and its equivalents should be treated with utmost importance because fraud could cost Wesfarmers millions in losses. According to a 2012 KPMG report, 194,454 incidences of fraud cost Australian and New Zealand organizations more than $372.2 million in losses (KPMG International 2016). Most of this fraud (86%) was reported in the financial sector (KPMG International 2016).

People who work alone committed this type of fraud. However, there are also increased cases of people who collude with one another to commit the same offense. There are many reasons why the company’s employees could engage in such activities. However, the main ones are greed, and pressures to meet personal financial obligations. Lifestyle pressures are also top of the list of reasons that employees engage in fraudulent activities.

To minimize the possibility of fraudulent activities in the organization, Wesfarmers need to conduct awareness training among employees to increase their awareness of such activities in the organization. Enhancing some of the organization’s internal controls is also another strategy that could improve its preparedness to manage such issues. Within this framework, employees should have the liberty to notify concerned parties about the possibility of fraud in the organization.

Impact on Financial Accounts

Incorrect or inaccurate figures about Wesfarmers’s cash and cash equivalents could affect its balance sheet because the balance sheet should show the correct cash and cash equivalents at a given point in time. The cash flow statement could also contain material errors if this risk persists because it is supposed to show accurate changes in cash and cash equivalents over time. Errors associated with handling cash and cash equivalents could mostly affect the company’s bank accounts and marketable securities. Its money market funds are also likely to be affected by the same problem.

The risk of handling cash and cash equivalents could also affect profit and loss account balances because such figures affect how companies use their excess cash. For example, such figures would affect how Wesfarmers finances its purchase decisions. In this regard, the possibility of realizing inappropriate revenue documentation is high. The possibility of inappropriate expense recognition is also high. These effects could easily come from unwarranted market pressures and stretched/tough business goals because each division of Wesfarmers’s business has unique goals that it is supposed to meet. Some of the company’s business divisions have failed to realize their goals because of inappropriate performance management, which has significantly affected its operations and current account balances.

For example, some aggressive assumptions about some of the company’s business processes have led to inadequate disclosures of the company’s business. Some cost-saving measures adopted by the company also pose possible challenges to the business operations because wavering employee loyalty could be compromised because of some of these initiatives. The misappropriation of assets or an increase in theft incidences could increase because of this problem.

The Chartered Accountants of Australia and New Zealand (2016) says that excess cash would also imply different managerial directions for the company. For example, it could imply that the company has not figured out the best way to deploy the cash. This could be a problem for the company’s shareholders would want to see the same amount of cash work for them to make a profit. Based on this assessment, Wesfarmers should realize that there is an opportunity cost to holding a lot of cash.

The company would possibly pay this cost through the return on equity in its account balances. The ideal situation would be investing this cash to improve the organization’s financial position. Nonetheless, there is an ongoing debate surrounding the number of cash companies, such as Wesfarmers should hold because it still needs to be liquid to manage its daily expenses. The best way Wesfarmers could circumnavigate such challenges is to use its quick ratio and current ratios to determine the right amount of cash to hold. The Audit procedures we used for this inherent risk appear below

Audit procedures

When understanding the risk of product failure or misuse, we established the correct quality systems. Similarly, we reviewed the organization’s processes to evaluate whether it complies with existing standards surrounding the same. We also followed the right standard operating procedures to provide an accurate review and set of instructions for the company’s management and customers to review.

We also focused on the company’s internal control system to identify possible areas of fraud or errors. Here, we were careful not to be inappropriate or provide incomplete assessments of inventory information records by failing to identify areas of fraud or inventory value manipulation. Consequently, we adopted a comprehensive approach of using adequate procedures for counting inventory. The audit procedures for assessing the inherent risk associated with cash and cash equivalents involved the use of computer programs to track cash movements in the company’s system.

To get a proper understanding of the kinds of investments we included as cash and cash equivalents, we used the organization’s guidance notes, which highlighted the organization’s investments that had a maturity period of fewer than three months. We excluded equity investments from this analysis. However, those that were in the substance of cash and cash equivalents were included in the analysis. For example, preferred shares acquired within three months fell within this category.

Bank overdrafts that were payable on demand also fell in the same category because they were an integral part of the company’s cash management system. They include a component of cash and cash equivalents. Our guiding principle when applying the above methodologies rests in our quest to uncover misstatements that result from fraudulent financial reporting and misstatements that arise from the misappropriation of assets. As part of our auditing process, we also included procedures to identify areas of material misstatements by making inquiries to top managers, and flagging down unusual or unexpected relationships in the company’s financial accounts.

Responsibility of those Charged with Governance and the Management of the Company’s Financial Systems

It is the responsibility of the company’s management to prepare the organization’s financial statements and present a fair view of the same. They should do so by IFRS. The company’s management is also required to institute internal controls that are necessary for the preparation of these accounting statements. These statements should be free from material misstatements and fraud or errors. Therefore, generally, the company’s management has the responsibility of overseeing the company’s financial reporting process.

Responsibility of the Auditor for the Preparation of the Audit of the Financial Statements

The auditor has a responsibility to reasonably assure that the company’s financial statements are free from error or financial misstatements. The auditor’s responsibility also stretches to assuring that the audited statements are free from error and fraud. Based on these obligations, the auditor should provide a statement that has an opinion on the company’s financial statements. Although providing this reasonable guarantee is a huge responsibility on the auditor’s part, it is not a guarantee that the audited report, albeit prepared by ISA standards would detect all material misstatements, errors, and fraud. The issues we consider to be material in this analysis are those that would have a significant economic impact that would possibly impact the decision of users who would want to use the financial information provided herewith.

References

Auditing and Assurance Standards Board 2015, Auditing Standard ASA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of a Financial Report. Web.

Australian Securities Exchange 2015, Wesfarmers 2015 Annual Report. Web.

Chartered Accountants of Australia and New Zealand 2016, The risk-based audit approach. Web.

KPMG International 2016, Internal Audit, Risk & Control Services. Web.

Leung, P, Coram, P, Cooper, B & Richardson, P 2015, Modern Auditing & Assurance Services, Wiley John + Sons, Sydney.

Louwers, T 2013, Auditing & Assurance Services, McGraw-Hill/Irwin, Sydney.

Martinov-Bennie, N, Roebuck, P & Soh, D 2013, Auditing and Assurance: A Case Studies Approach, LexisNexis Butterworths, Sydney.

Nonna, M 2014, Auditing and Assurance: a case studies approach / Nonna Martinov-Bennie, Peter Roebuck, Dominic Soh, LexisNexis Butterworths, Sydney.

Wesfarmers Resources 2015, Sustainability Report. Web.