Economy is the sum total economic resources of a certain region which enable it to provide services and goods to its inhabitants. These resources may include: infrastructure, land, trade, labor, manufactured goods, capital, and medicine among others. Global Economy thus can be seen as the sum total of the world human and physical resources that enhance survival of its inhabitants.

In this century every country in the continent has seen an economic recession which basically affects the livelihoods of the people for instance increased food prices. This is one the reasons why countries develop policies that may enable them improve their economy. Policies such as fiscal policy, sustainable food production, green cities and sustainable housing for city dwellers have been developed.

Michl (54) defines Fiscal policy as, “the use of government expenditure and revenue collection (taxation) to influence the economy.” According to Dwivedi instruments of fiscal policy include the following, “Surplus budgeting, Government expenditure, Taxation, and Public borrowing (602).

These instruments may have different effects on the economy.” For instance, surplus budgeting means reducing the government expenditure slightly below the revenue thus creating surplus. On the other hand government expenditure is the allocation of revenue to various areas of the economy for example education and health.

Taxation is the collection of money from the citizens directly or indirectly in which they don’t expect direct returns and public borrowing is borrowing in the form of loans either from the public or external sources.

The above instruments are adjusted in order to create a desired effect on the economy; as an illustration if the government increases expenditure in infrastructure development it expects that in the long run it will attract investors which in return create jobs and revenue in form of taxation. Depending on the economic state of a nation, the policy makers adjust each of the fiscal policy instruments so as to focus on the desired outcome.

How fiscal policy can be used to aggregate demand

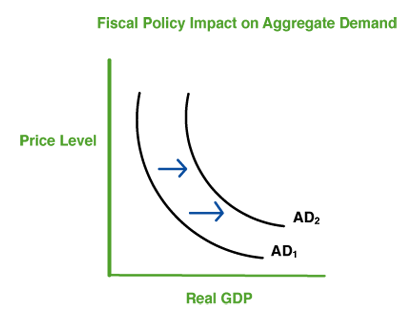

An expansionary fiscal policy tends to increase the amount of liquid income that citizens have hence improving the purchasing power which implies more money will be disposed to the economy. According to Reuters (4), “The aggregate demand will increase and thus reduce the deflation gap which may be caused by growth or unemployment.” The figure below shows a the effect of fiscal policy on aggregate demand;

Aggregate demand is dictated by investors and consumers of such goods and services from the investments. This means that the fiscal policy adopted mainly tends to increase the desire for investors to invest and the available market to have the power to purchase. Fiscal policy has a short term positive effect but on the long term if it is not checked it may cause undesired effects.

How effective is the fiscal policy? Is a question that needs to be carefully studied if economies will have to continue using this policy as a measure to react to economic recession. Thomas R. Michl (81) notes that, “fiscal policy were unlikely to succeed in combating unemployment because the jobs gained through the government spending would be cancelled out by jobs lost in the investment goods industries by crowding out.”

Thus fiscal policy may not be the best tool to use when economic recession is caused by natural economic factors. It is rather better to let the factors that contribute to the economy to regulate themselves naturally. For example, consumption may be affected by inflation by making consumers avoid unnecessary purchases and the desire to create more wealth thus having a positive effect on both investment and consumption which are the key instruments on aggregate demand.

Furthermore, increasing taxation may not affect consumption because the goods in which taxation may be imposed may be a necessity whose consumption must remain the same. For example increasing the cost of transportation may not be affected by taxation as much because it is a necessity in wealth creation. Another undesired effect arises from the increase in government spending without increasing taxes; this might lead to a recession and undesired deflationary gap.

Australian budget

The following is the fiscal policy stance of the Australian government for the financial year 2010-2011. According to Australian Government Website, “The Australian government budget website describes the government’s fiscal stance to comprise of: achievable budget surpluses, on average, over the medium term, keep taxation as a share of GDP below the level for 2007-08 (23.5 per cent of GDP), on average, and improve the Government’s net financial worth over the medium term.”

According to Marc (55), “The government will further allow the tax receipts to recover naturally as the economy improves and hold growth in spending to 2 percent a year until the budget returns to surplus.”

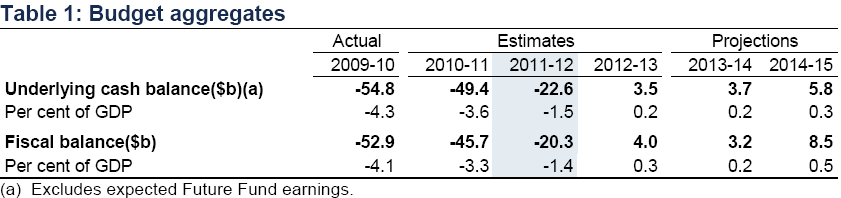

The government puts into consideration any physical calamities that may occur so as to mitigate its effects on the budget as fast as possible. The table below shows budget aggregates and their projections.

According to a research done by the Melbourne Institute the Australian (8), “Inflation pressure is rising.” The report indicates that ‘inflation rates increased from 3.2 percent to 4.5 percent in the months of March and April respectively.’ As an assertion to the research report, Michael Chua, a research fellow at the Melbourne Institute said, “This month’s report indicates inflation pressure is mounting after a relatively stable period.” (8) This implies that the fiscal stance may have not been achieved as much in terms of inflation control.

Australian inflationary measures

The Australian high dollar rate has seen the mining industry gain whereas other areas of the economy like tourism and local imports have been affected negatively. Thus inflation has been experienced. The government though optimistic, has fears of the return of economic recession in America and the Europe.

The current inflation pressures on the Australian government can be mitigated by disaster preparedness as one of the major effects of inflation. The Australian consumer is also expected to reduce expenditure so as to create a balance thus combat inflation.

The Reserve Bank of Australia (9) said that, “It remained concerned about the outlook for domestic inflation and said it was too soon to know if demand would soften enough to restrain price pressures over time.” It also expressed its fears on the ‘unsettled global financial markets.’

The Australian government put in place a fiscal policy for the financial year 2010-2011; was the policy the most appropriate? According to the Australian, “these fiscal rules mean we are on track to return the budget to surplus.” The country expected to go back on track and achieve a 2 percent surplus on its budget. So far the government can only brag about a 1 percent surplus. This means that despite the government not hitting on its minimum target, it has brought back a surplus budget after the global economic recession.

The gains made are attributed to the tough spending measures the government imposed in its fiscal policy. The government further intends to retain the strict measures, which it argues will help it deliver a surplus within three years of the deficit peaking as a share of the economy.

It further argues that this will be a smaller duration as compared to the four years it used in the 1980’s. Overall, the economy has improved slightly which may be attributed to the strong Australian dollar which has improved revenue from the mining industry. Michl (66) argues that “High interest rates discouraged the consumers from borrowing consequently less expenditures.”

In one way or the other the government has achieved its goals; however, there are no air tight policies. The negative effects are the failure to mitigate inflation which is a major dissatisfaction on the citizens.

In conclusion, fiscal policy is the control of government expenditures against taxation. There are four major instruments for implementing fiscal policy that include the following according to Michl (5), “Surplus budgeting, Government expenditure, Taxation, and Public borrowing.” Each of these instruments can be controlled in a particular way so as to achieve the expected results.

The government would reduce tax rate thus it will enhance compliance and collect more taxes, increase the lending rate thus reduce purchasing power, reduce government expenditure which may cause unemployment or reduce public borrowing hence reducing the national debt margin. The fiscal policy adapted by the Australian government seems to have worked mainly through the stringent rules imposed on the stimulus package.

Works Cited

Australian Government Website. budget.gov.au, 2010. Web.

Australian Government Website, Geoffrey. Business with The Wall Street Journal. theaustralian.com.au/business, 2011. Retrieved

Dwivedi, D N. Macroeconomics: Theory and Practice. New Delhi: Tata McGraw Hill, 2010. Print.

Marc, Robinson. Medium Term Fiscal Policy Issues and Challenges in Australia, Melbourne: Queensland U of T, 2001. Print

Michl, Thomas R. Macroeconomic Theory: a Short Course. New York: M. E. Sharpe, 2002. Print.

Reuters, CNBC First in Business World Wide. cnbc.com, 2011. Web.