Through the analysis of Carden (2010) involving natural disasters and their impact on product prices, it was shown that you must first take into consideration what type of product has been affected, the demand side of the product curve as well as the amount of reserves that is present in the current global supply chain (Carden 2010, pp. 81-84).

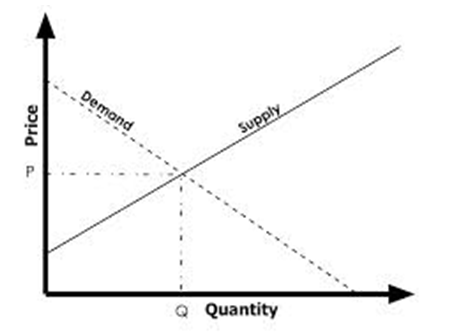

Since the product in this case is wheat, an examination of the work of Roberson (2012) is in order since through his examination of the supply and demand of wheat in the current global market it can be determined how a significant drop in supply would impact product prices. Roberson (2012) states that wheat is a highly sought after commodity since it is used in a vast array of products.

At any given time most countries have at the very least a 3 to 6 month supply of wheat (in the case of Asia the demand for wheat is lower) to meet local demand at which point supplies would be exhausted. With the current price of wheat set at $308.9 per metric ton, a drop of 50% in the global wheat yield would most likely result in a 50% increase in price resulting in $460 per metric ton (Roberson 2012, pp. 4-6).

(Roberson 2012, pp. 4-6).

However, do note that while it is normally the case that high demand and a low supply rate would immediately result in a large price hike, primary commodities such as wheat normally have significant government controls in place wherein practices related to price easing utilizing government stocks will occur.

For example, data from the U.S. dating back to 2006 showed that it had roughly 1,429 metric tons of wheat to act as a supply buffer should there be a sudden rise in wheat prices caused by a natural disaster (Increased Wheat Supplies To Ease Price Pressures 2008, pp. 4-5).

Taking this into consideration, a decline of 50% in global wheat yield would be met with a quantitative easing policy by the local government wherein the price of wheat would increase in increments of 10 to 15 percent over the next few months through the release of government wheat stocks until the price stabilizes at a particular rate.

A similar policy is also present in the case of the European states as well as within Russia due to the high demand for wheat in such regions. Do note that the demand for wheat is not as prevalent in Asia as compared to the rest of the world.

This is in part due to rice being their main staple as compared to wheat. It is based on this that it is likely that in the case of Silo, it would change its current supply strategy by focusing on Western markets for the time being such as the U.S., Europe and Russia and only attempt to focus on South Asia once supplies are back to normal.

Reference List

Carden, A 2010, ‘Disastrous anti-economics and the economics of disasters’, Economic Affairs, vol. 30, no. 2, pp. 81-84

‘Increased Wheat Supplies To Ease Price Pressures’ 2008, Emerging Markets Monitor, vol. 14, no. 24, pp. 4-5

Roberson, R 2012, ‘Blame food price increase on drought, not farmers’, Southeast Farm Press, vol. 39, no. 22, pp. 4-6