The fast-food sector is vital to the economy of various countries and various investors since it significantly contributes to economic growth. The industry is “expected to reach $931.7 billion by 2027, with a compound annual growth rate of 4%” (Kale& Deshmukh, 2020, para. 8). Starbucks Corporation is among the opportunistic quick-service companies that gain public attention regarding investments. The company started as a single small store in 1971 that became a coffee giant at the millennium’s end. Starbucks was founded by Jerry Baldwin, Zev Siegl, and Gordon Browker. The company underwent a series of revolutions to gain popularity in many countries. Starbucks Corporation serves six continents with 32660 stores spanning 79 countries. Therefore, the study topic is important since it gives insights on Starbucks Corporation benefiting investors from different countries. Investors should invest in Starbucks because it has profitable sales and constantly increases the number of customers which boosts finances.

Therefore, the scientific work will examine factors that will make investors want to invest in the researched company. Technological integration was essential among companies during the height of the COVID-19 pandemic. One of the main reasons why investors should invest in Starbucks is to own part of a business that has adopted drive-thru services which raises the finance of the company. Starbucks corporation was among the companies affected by the stringent public measures to control the spread of the virus. However, the closure of in-person stores was a blessing in disguise for Starbucks. This means that drive-thru services support small stores’ launches and exclusively focus on grab-and-go ordering (Volle, 2021).

Increased sales among Starbucks stores helped boost the company’s finances for growth. Starbucks has an excellent brand image manifested through its increased mobile app usage (Volle, 2021). Thus, the company is attractive to potential customers and technically advanced people. Furthermore, the technological adoption among the Starbucks stores makes it easy for the business to survive pandemics like the Coronavirus that affect business operations. Therefore, investing in Starbucks is profitable since the company has a broad consumer base with constant purchase volume and can stay through global economic crisis due to the pandemic.

Other advantage of the company that can attract investors is the technological development of the company. Moreover, the company heavily invested in mobile app technology that boosted its sales and keep a competitive advantage in the coffee business. Mobile app ordering improves consumer convenience and saves on ordering time. Starbucks’ mobile app has an efficient integrated payment system that can help track customers’ purchase history. The payment system overcomes the problems associated with traditional payment methods, making it difficult for investors to track its financial performance.

Furthermore, the company launched a mobile card app that allows customers to pay for their ordered coffee with various partner cards (Kale & Deshmukh, 2020). This indicates that mobile ordering app removes the hassle of waiting in line to order and waiting time for the coffee and food to be made. The company has gained a loyal and broad consumer base making Starbucks’ mobile app the most downloaded in Apple Store and the Google Play Store. Consequently, the company has over 30 million people who order through the mobile app (Bertels & Desplaces, 2021). This clearly indicates that mobile app customers make Starbucks attractive to investors since there is an assured and significant return on investment.

Another primary reason why investors should invest in Starbucks is to gain higher financial returns from a company that has established consumer loyalty programs. Consumer-based brand equity gains higher financial gains for a company. Starbucks has mastered the creation of customer loyalty programs making the company profitable. The company has designed a 90-day active Starbucks Rewards members to represent the most loyal and engaged customers (Grill-Goodman, 2021). Therefore, customers who become part of the offer receive benefits such as discounts, coupons, offers intended only for members within the loyalty program. The members can join the program by registering through the company’s official website or their smartphones applications. The website offers different features and benefits like “free adds-ons, ordering ahead and paying later through the smartphone application, free refills on brewed coffee, and free birthday treats every year” (Farfan, 2021, para. 3).

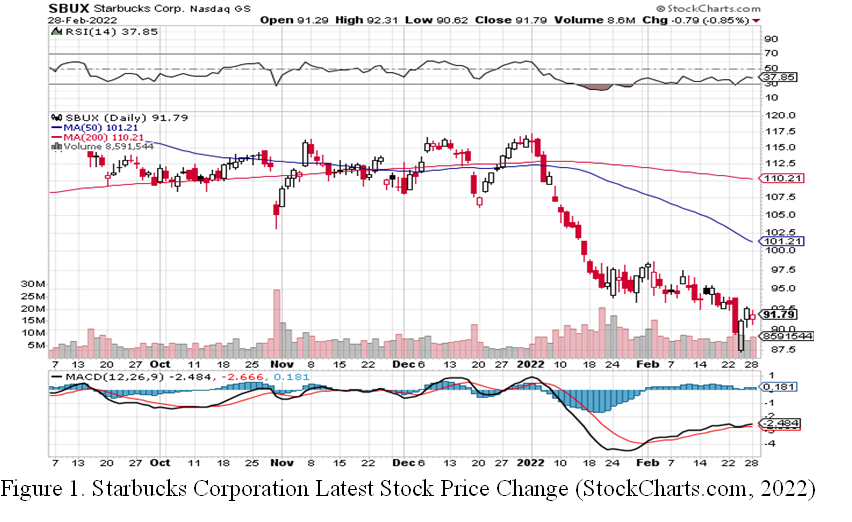

However, the customer loyalty programs make Starbucks attractive to invest in since it has assured a broad-consumer base, boosted the company sales, and facilitated stable company stock prices, as shown in Figure 1. The programs help build consumer-based brand equity that help increase the loyalty and value of the existing customers. Therefore, investing in Starbucks is profitable since the company has established a loyal consumer base boosting the company’s sales.

On the other hand, some people hold a contrary opinion and consider Starbucks to be a lucrative company to invest in. People argue that the company’s stock prices and the consequent return on investments are expected to drop due to the increasing number of competitors in the industry. Moreover, the company’s main competitors like Dunkin Donuts and Maxwell House and Folgers are successful organizations on the market. The competitors have developed technologies in mobile ordering that are more user friendly than Starbucks. Furthermore, the company is subjected to macro and political risks making it difficult to expand the business. Over 30 million customers use the company’s mobile app to place orders (Bertels & Desplaces, 2021). This indicates that mobile application customers are satisfied with the ease of use of the application, which increases the number of downloads of the application. While investors should invest in Starbucks, the company experiences stiff competition, macro and political risks that may lower its profitability.

In conclusion, Starbucks is a great investment since it has built customer loyalty programs to lucrative sales and is implementing drive-thru services and mobile ordering. The company has developed loyal consumer programs that have boosted the company’s sales and consumer-based brand equity. Therefore, investing in Starbucks can be beneficial since the company has adopted drive-thru and mobile ordering and consumer loyalty programs making the company profitable. Although Starbucks Corporation has dependable technology and operates in a well-advanced economy, the company can adopt effective competitive strategies to attract more investors. The competitive strategies include adopting competitive prices, business expansion in developing countries in Africa, and the addition of a healthy menu. In addition, the company can adopt competitive prices compared to its competitors like Tim Hortons and Mcdonald’s.

The prices will attract customers who choose Starbucks Corporation competitors. Expanding the business in developing countries such as Africa would increase the company’s annual earnings since its competitors have less invested there. Furthermore, Africa has a growing population that prefers coffee from Drive-Thru stores. Healthy menu options attract the growing population that is food-aware and intends to avoid lifestyle diseases like obesity. If Starbucks Corporation adopts an effective competitive strategy, it will attract more investors.