“Why Variable Pricing Fails at the Vending Machine?” is an article written by DAVID LEONHARDT. This was published in “The New York Times” on June 27, 2005. The said article is available for reading on the below web page. (Leonhardt, 2005).

The article throws light on the marketing blunder committed by coca-cola when they announced that they were planning to install vending machines fitted with temperature sensing circuits that raised the price of coca-cola when the weather gets hot. The news drew a lot of flak from the public who viewed this as a device to make them spend more for the same product.

Demand for certain products may increase or decrease according to the changing circumstances and needs of the consumers. The basic economic theory states that in a market economy when demand for a product goes upwards so does the price of the product. Like in the case of cold drinks, we can see that in the summer season, there is heavy demand for soft drinks and cold drinks. Obviously, this is the time when producers and suppliers take advantage of the situation and increase the price of the product for gaining that extra profit according to the rising demand of the product. So when the demand is high in hot weather and the market for cold drinks rises, the smart manufacturers affect discreet price increases, which are usually ignored by the market.

We should note that the keyword here is “discreet.” In the case of Coco-cola Company’s vending machine, the economic theory of Demand and Supply reflecting the price stands true. But instead of announcing that the company has an idea of increasing the price of cold soda on summer days, with the help of vending machines equipped with thermometers, the chief executive of Coca-Cola, M. Douglas Ivester should have said that it was developing a new vending machine with a thermometer that would lower prices when the weather was cold.

It should have been obvious to the Coca-Cola think tank that the public is going to look down upon any innovation that seems even remotely designed to take more money out of their pockets. It’s no wonder that the company had to save its face by shelving the whole idea after trying to defend themselves by issuing statements like, “Coke was actually looking for ways that vending machine technology could lower the cost of a drink”. To make matters worse, many coke drinkers were upset with the idea and the rival companies got a chance to show Coca-cola in a bad light for exploiting the consumers. (Coca-Cola needs to master simple lessons about price discrimination).

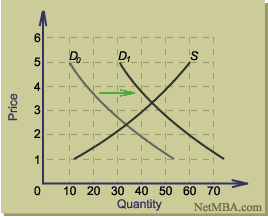

The fact is that Coke isn’t the first company to devise a scheme to make more money by charging different prices to groups with different demands for the product. Economists call this practice “price discrimination”. The constant monitoring of the shifts in Equilibrium Price and predicting the seasonal shifts in demand would give a company plenty of opportunities to make their profits optimum. As defined in the Essentials of Economics by Bradley R. Schiller, Equilibrium Price is the price at which the quantity of a good demanded in a given time period equals the quantity supplied.

The above graph shows the relationship between price, quantity, and demand. (Supply & Demand, 2002-2007).

The drive of the corporate world to find a system to achieve equilibrium price on an ongoing basis is what has increasingly become price discrimination. Contrary to the negative connotations of the term, this is one idea that has found great success in the marketing schemes of all kinds of different companies and products. In any economy, we can see that wants are unlimited and resources are limited.

Here if the theories of demand and supply related to price do not exist, the resources cannot be allocated appropriately to satisfy all desired users of those resources. If the price is not increased according to the increasing demand, the availability of products will decline and only a few consumers will be able to enjoy them, therefore, to balance the economy, price rise with demand is necessary, which will again reduce the demand, and increase the supply, and increased supply will produce more products, but due to the rise in price the demand will come down and the attributes of the product will remain in balance. Here again, the producers will try to reduce the price for selling the rest of the inventories. This chain continues till the price reaching an equilibrium level.

Some products such as flight tickets, club memberships, etc have been practicing price discrimination very openly and with tremendous success. In fact, economists find that this is fair for all people concerned. Because all the common price discrimination practices have the effect of lowering prices to customers who are price-sensitive while keeping the prices at a higher level for those who are less particular about price.

For example, if you were price-conscious you would have to plan your holiday two months in advance in order to reserve your flight tickets with your price discriminating airline at the lowest possible prices. If you do not so price-sensitive, you could impulsively pack up and go to the airport at the last minute and take a ticket over the counter at a higher price. This arrangement satisfies all the parties concerned. The airline is happy to get the flights reasonably full weeks before the flight. They can make up the losses on late bookings.

The author cites several examples to establish this point to the effect that this kind of price fluctuation has become a part of the new economy. To underline that the customers are so accustomed to the price variations irrespective of the issues like that of Coke vending machines, the author says, “With that matter cleared up, consumers then returned to doing exactly what had caused them such horror: paying more, sometimes a lot more, for all kinds of items when they were in great demand than when they were not.”

However, price discrimination seems to be more rampant in the case of goods or services whose intrinsic value is not easily measurable, such as a ticket to the opera or a holiday package rather than a bottle of coke or a magazine.

All this points to one particular fact that consumer behavior has changed during the last decade or so in favor of price discrimination. This is completely in sync with the economic theories of the relationship between demand and price as explained in the Essentials of Economics by Bradley R. Schiller.

Conclusion

In the article “Why Variable Pricing Fails at the Vending Machine?” the author has succeeded in establishing the new trends in price discrimination. The author provides sufficient proof that such a situation exists and this trend is here to stay. The article gives insight to the new-age marketers that they can gain a lot from the cautious use of this theory. It is also clear that these trends are in line with the basic theories of economics such as the price-demand curve and the theory of price equilibrium. Both these theories as explained in the “essentials of economics” sufficiently provide the grounds for the new economic trends.

Reference

Coca-Cola needs to master simple lessons about price discrimination, Article. Web.

Leonhardt, David. (2005). Why Variable Pricing Fails at the Vending Machine, NYTimes. Web.

Supply & Demand, (2002-2007). Net MBA. Web.