The main economic trends and features of the world cocoa market during the period 2009-2013

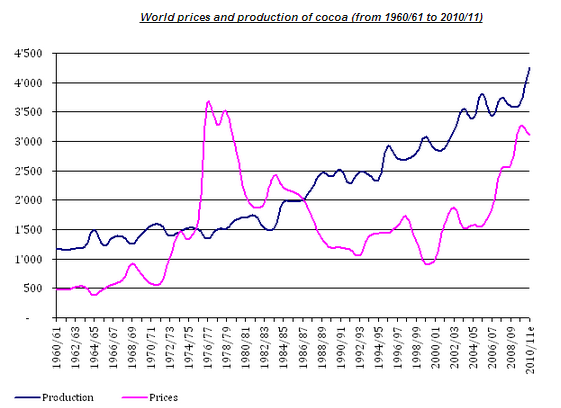

Cocoa is a crucial crop around the globe both for the cultivating countries and the consumer countries. It has a vast supply chain that extends from one corner of the world to the other. As a result of the increasing global demand for cocoa its production has also increased. It is estimated that since the year 2004, it has experienced an augmentation of 12% in terms of production (Cocoa Market Update 2009).

Considering the increase in demand of cocoa there have been many endeavours in the past to improve the sustainability of cocoa cultivation and even funds have been allocated for this purpose. But despite all such endeavours, there was a huge gap between the production and the quantity of cocoa that was traded in international markets. Following is a comparison (Cocoa Market Update 2012).

Table 1: Source: worldcocoafoundation.org (date: March 2012)

From the figures mentioned in table 1 it is evident that in comparison to the trading of cocoa done in 2010, there was an increase of about 30.26% in 2011. On the contrary, the production remained almost the same (a nominal increase of 0.24%). So what does this imply? It means that if the growing demand of cocoa is to be met, it is imperative to augment the production as well.

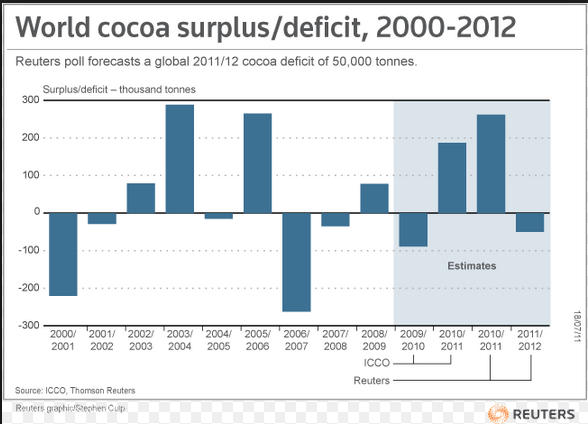

We are in year 2013 now and even though with the increase in demand the production has also increased, there is still a huge gap between the demand and supply of cocoa. In the year ending October’12 there was a deficit of 119,000 tonnes of cocoa production as compared to the demand. It is estimated that within the next year, starting from October’13 this deficit will escalate to 129,000 tonnes (Almeida 2013). The probable reason for this increase in deficit is that in comparison to the increase (3 – 5 percent) in demand during the next year the production is not expected to increase substantially.

One of the probable reasons for this deficit might be the low prices being offered to the farmers. The nominal increase in the price of cocoa (in comparison to its demand) has led many farmers to stop selling their crop unless the prices are increased (Abidjan 2013).

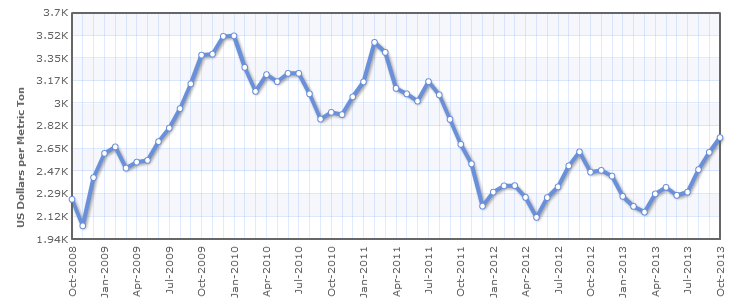

Following table depicts the increase/decrease in the price of cocoa over the past few years (Executive brief update 2012: Cocoa sector 2012).

Table 2: Source: agritrade.cta.int (date: November 2012)

The aforementioned figures clearly show that the prices of cocoa increased up to 2008 and then, except in the year 2010, the prices of cocoa have experienced a downfall. This is converse to the increasing demand of cocoa and the increasing prices of cocoa products as well.

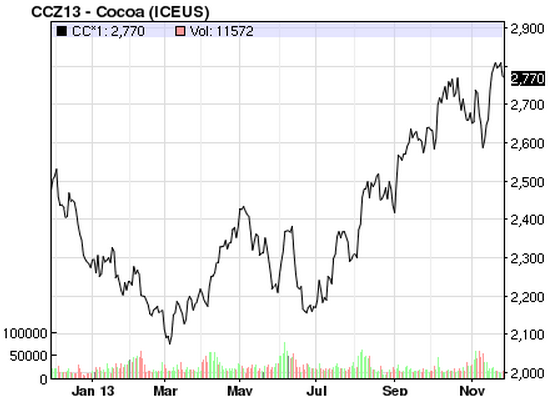

In comparison to last year’s cocoa prices, there has been an increase but the main increase has been witnessed during the months of September, October, and November – though the prices were not stable. The following graph depicts the prices for the past year (Latest price & chart for cocoa 2013).

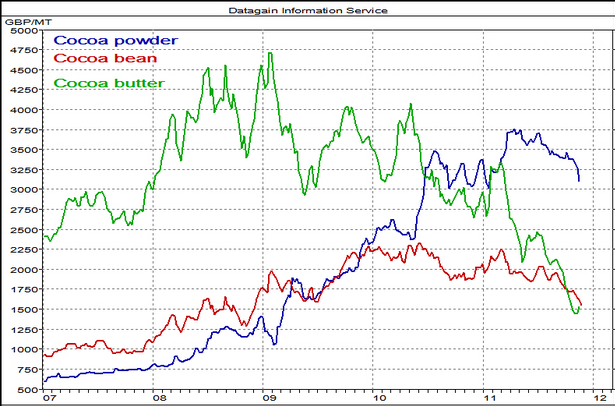

The following graph denotes the price fluctuations on cocoa beans.

The price fluctuation depends on several factors. The major one is probably the production levels. Environment plays a vital role in the production of cocoa beans. Another reason is the political situation in the cocoa producing nations. Demand is also a deciding factor for the prices of cocoa beans (Drakoln n.d.).

There have been some supply shocks during this period that had a great impact on the prices. An unexpected disruption in the supply of cocoa in March 2011 resulted in first-time-ever high prices. The chocolate industry was severely affected by this increase (Bittersweet lesson: Global cocoa beans shortage poses challenges to commodities buyers 2011).

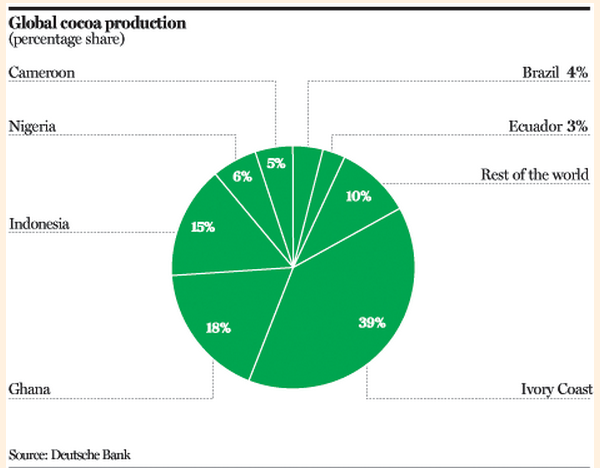

The major supplier of cocoa beans is Côte d’lvoire with an yearly production of more than 0.8 million tonnes. Ghana is also one of the major producers of cocoa. Other nations such as Brazil and Indonesia are also considered to have ample production of cocoa (Cocoa 2013).

The factors which led to change in the demand for cocoa during 2009-2013

During the past couple of years, the world has witnessed too many fluctuations in the demand and supply of cocoa. The following chart depicts the surplus/deficit of cocoa from 2000 to 2012 (Executive brief update 2011: Cocoa sector 2011).

The following graph shows the surplus/deficit of cocoa for the last decade:

The factors that led to the change in the demand for cocoa during 2009-2013 are as under:

The global recession: There are certain products that are a necessity but certain products depend on our discretion. It is up to us to buy them or not. Chocolate, a product of cocoa is one such discretionary product. Now, coming to our discretion, it mainly depends on our finances. The recent global recession compelled most of us to compromise on our discretionary products (Terazono 2013). As such, the demand for such products, including cocoa, decreased during the past couple of years (Dutram 2011).

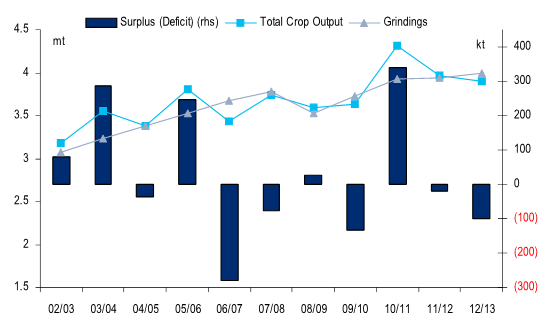

Price of cocoa: The price of cocoa plays a major role in its demand. The price depends on the production. If the price is high, the demand will be less and vice versa. During the periods when the production is high the prices come down and this has a negative impact on the cultivation. Farmers tend to opt for some substitute for cocoa farming. The following graph depicts the rise and fall in the cocoa prices (Cocoa prices mainly respond to cocoa supply and demand factors 2012).

Demand for cocoa products: With the increase in the demand for cocoa products, it is obvious that the demand for cocoa itself will increase. During the past couple of years, the demand for chocolate has increased tremendously – owing to the various flavours available. The future of the chocolate industry is also very encouraging. Statistics suggest that by the year 2020, there will be growth of 30% in the chocolate industry (Goodyear 2013).

Variations of cocoa products: Manufacturers of cocoa products are incessantly coming up with new varieties that have different tastes and uses; like for example, recently dark chocolate was introduced. The liking of the product by consumers increased its demand and so did the demand for cocoa (Josephs & Rai 2013).

Substitutes: Due the rising prices of cocoa products like cocoa butter, manufacturers have come up with a substitute for it. The Global Shea Alliance claims that manufacturers are increasingly using cocoa butter equivalents (CBEs) instead of cocoa butter (Nieburg 2013).

The factors influencing the production and supply of cocoa during the period 2009-2013

The production of cocoa mainly depends on the price being offered. Due to lesser price being offered to the farmers, many farmers have shifted to alternative crops that bring in more money. Following is a graph that shows the price fluctuation of cocoa and its main products (Market movements – March 2012 to 2013 2013).

The report suggests that there has been a decline of 4% in the price of cocoa since the demand was less than the supply.

Another major deciding factor is the climatic condition. West Africa is considered to be the major producers of cocoa beans. During the last couple of years the weather in this region has been dry that has hampered the production of cocoa beans (Chocolate crisis: Cocoa bean production will fall short of demand this year 2013).

One surprising reason for lower production levels, as claimed by Dr. Asante, is the smuggling of cocoa being done. Other reasons that he claimed were low prices for cocoa, non-maintenance of cocoa farms and insufficient inputs (Government asked to withdraw subsidies on cocoa inputs 2013).

Following are the major producers of cocoa in the world:

Ivory Coast is by far the largest producer of cocoa – it alone contributes 40% of the world’s total cocoa production. Since 1980, the country’s cocoa production has doubled. But of late Ivory Coast’s cocoa production has begun to decrease and its future is uncertain. The cocoa trees are getting old and as such the yield has become poor in quality. Another reason is the corrupt politicians who resist any changes due to their own interests (Blas 2010).

In Australia, the reasons for lower levels of cocoa production are different. According to Craig Lemin, high labour costs, less experience, shortage of genetic resources, and absence of cocoa processing industries in the country are the major factors responsible for lower production levels of cocoa (Lemin 2005).

Ways in which governments might influence the market for cocoa production and the price of cocoa

The cocoa industry has experienced great transformation during the past couple of years. Corporate clients have come forward to contribute towards the upliftment of the working conditions of the cocoa-farming community. The governments of different nations have also played a crucial role. Certain programmes like, The Cocoa Improvement Programme 2008-2012 have helped the cocoa farmers to a great extent (Cocoa industry transformed to sustainable commitments 2013).

Initially, the governments of the cocoa growing nations had certain subsidies that were given to the cocoa farmers. But due to the sluggish performance, the governments are thinking of withdrawing such subsidies. Like for instance, in Ghana the free spraying of pesticides is scheduled to be halved due to the uncertain future of cocoa (Dontoh 2013). The cocoa grinders have also not been spared. As Ange Aboa reports, the tax-break that was in existence in Ivory Coast has been put to an end (Aboa 2012). All such incidents have proved to be detrimental as far as the cocoa production is concerned.

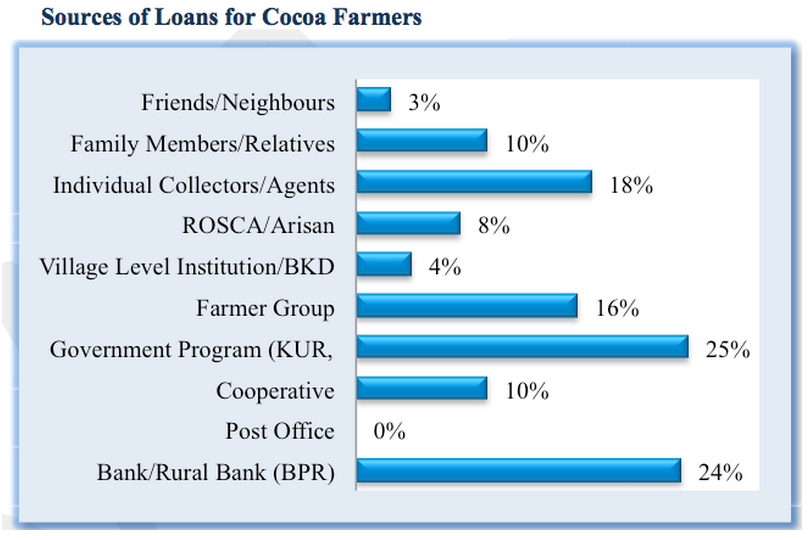

In order to bail out the cocoa farmers form the financial dilemma and to maintain a continuous supply of cocoa, the government of Ivory Coast gave a fixed price guarantee to its cocoa farmers. Keeping into consideration the financial crisis of cocoa farmers, the government of Indonesia is extending loan facilities to them. The following chart shows that the contribution of the government is the highest (Dusza 2013).

The governments should actually find ways of increasing the price that is being given to the farmers. Instead of cutting down the subsidies and tax reliefs, they should convince the consumers (manufacturers of cocoa products) to increase the prices. In order to boost the morale of the farmers, governments can also give some sort of land incentives to them.

References

Abidjan 2013, Ivory Coast cocoa farmgate prices rise ahead of new season. Web.

Aboa, A 2012, Ivory Coast to scrap grinding subsidy, lift transport support. Web.

Almeida, I 2013, Record chocolate sales boosting cocoa demand to leave shortages. Web.

Bittersweet lesson: Global cocoa beans shortage poses challenges to commodities buyers 2011. Web.

Blas, J 2010, Falling cocoa yield in Ivory Coast. Web.

Chocolate crisis: Cocoa bean production will fall short of demand this year. 2013. Web.

Cocoa 2013. Web.

Cocoa industry transformed to sustainable commitments 2013. Web.

Cocoa Market Update. 2009. Web.

Cocoa Market Update. 2012. Web.

Cocoa prices mainly respond to cocoa supply and demand factors 2012. Web.

Dontoh, E 2013, Ghana cocoa board to cut subsidized pesticides as revenue falls. Web.

Drakoln, N n.d., Commodities: Cocoa. Web.

Dusza, B 2013, Cashing in on mobile money: The cocoa farmer supply chain in Indonesia. Web.

Dutram, E 2011, Three reasons why cocoa ETF (NIB) is leaving investors bitter. Web.

Executive brief update 2011: Cocoa sector 2011. Web.

Executive brief update 2012: Cocoa sector 2012. Web.

Goodyear, D 2013, The future of chocolate: Why cocoa production is at risk. Web.

Government asked to withdraw subsidies on cocoa inputs 2013. Web.

Josephs, L & Rai, N 2013, Chocolate prices soar in dark turn. Web.

Latest price & chart for cocoa 2013. Web.

Lemin, C 2005,Coco: A potential new crop for Northern Australia. Web.

Market movements – March 2012 to 2013. 2013. Web.

Nieburg, O 2013, Cocoa butter equivalent demand rising rapidly, says Global Shea Alliance. Web.

Terazono, E 2013, Hot chocolate demand sends cocoa prices soaring. Web.