Report Summary

There is a growing notion that the UAE governments have relied extremely on the valuable oil and other precious natural resources, including gas as fiscal revenues for funding most of the government projects. The economy of the UAE is volatile and precarious because these oil resources are not sustainable, yet most of the UAE nations have increasingly focused on infrastructural development that is costly for these governments. The study administered questionnaires to 50 participants, who are the top officials of the NASDAQ Dubai and the central bank of the UAE.

In the study, approximately 60% of the respondents were adults with ages above 30 years, with the majority of them (78%) having significant professional experience of above 15 years working in financial institutions. The study hypothesized that the utilization of government bonds as fiscal revenues in the UAE nations was relatively low in most of the UAE economies or was at its formative phases in some few enlightened countries in the Middle East. Regarding the state of government bonds and bond markets within the UAE economies, participants provided mixed reactions with some claiming that bonds are considerably low, while others showed optimism in the growth of bond markets.

Comparatively, 72% of the respondents believed that indicators of growth in bond markets have increased, while 88% of respondents believed that bonds for expatriates have increased. Concerning the impediments to the growth of bond markets in the UAE, 78% of the participants stated that the UAE government over-relies on oil as a source of fiscal revenue. Moreover, 48% of the participants disputed that enough taxes are available for the UAE government to fund its operations, while 60% of the participants claimed that government loans impede the growth of bonds.

In examining the significance of government bonds as efficient fiscal revenues for the government and for the Emirati financial institutions, 68% of the participants remained inclined to the fact that bonds are efficient fiscal revenues. Evidently, 62% of the participants said that bonds allow nations to have effective long-term budgeting, while 62% of the participants claimed that bonds are stable sources of funds. Thus, from the study, it is evident that the economy of the UAE is volatile and susceptible to global economic crises and thus requires diversification to stabilize it. In this view, the Emirati government should utilize bonds as a way of diversifying its sources of revenues.

Introduction

Economic hardships witnessed across the world in the last decade have spurred a series of changes in several financial institutions globally (Kota & Kukunuru, 2011). Emanating from the fact that financial institutions have experienced remarkable changes in their practices since the advent of the serious global financial crisis of 2008/2009, Gulf Cooperation Council (GCC) countries have made fundamental changes to their financial systems (Yaseen, 2012). Although the financial crunches across the globe came with ferocious repercussions to many nations, with some up to date struggling to adjust to serious financial problems, the United Arab Emirates (UAE) has a different conception (Mehta, 2012).

In the UAE, “the primary task of the banking system has been to finance the government needs, public enterprises, and priority sectors through the mandatory holding of treasury bills and government bonds” (Yaseen, 2012, p. 153). During the financial crisis, banks in the UAE implemented some reforms that included integrating bond markets in the banking systems, that until today, its contribution is eminent but less understood.

Background of the Study

The UAE was initially simple a subsistence economy as it largely depended on agriculture, trade-in pearls, and nomadic husbandry, but since the discovery of oil extraction and exports, much has changed (Ellaboudy, 2010; Shihab, 2001). Before the emergence of the financial crisis in these nations, records from the year 2005-2007 reveal that the banking sector of the UAE had experienced an increase in the lending rates up to 30% (Mehta, 2012).

However, financial institutions during that juncture faced serious banking challenges as bank deposits grew at a slower pace than anticipated, and there was a need to devise new banking policies (Hashmi, 2007). Since the banking system of the UAE during the financial crisis faced low profitability and hampered growth due to decrease in wholesale funding, pressured investment securities, and plummeted local real estate markets, banking practices in the UAE needed to change (Ellaboudy, 2010). Mehta (2012) postulates that the banking system of the UAE reduced the lending rates and resorted to portfolio investment that comprised of a bond investment.

Being on the campaign towards financial globalization and a country considered as an Emerging Market Economy (EME) coupled with the impact of oil and gas export on its financial system, the bond market and equity investment of the UAE have soared (Das, 2010). Apart from dominating the practices of financial institutions within the GCC zone, the UAE is manipulating the international bond market investment, with its bank profitability and growth advancing to great developments (Schizas, 2012). Rising from being the majority group initially considered as substantial net debtors from the 1990s, with a sizeable borrowing from the US banks, the UAE bank system reformed and became net creditors during the 2000s (Saunders & Cornett, 2007).

The bond market investment and the security stock exchange market have grown exponentially and become significant investment practices for the Emirati financial institutions. Market growth in the bonds and securities aimed towards generating huge interests of the banking through potential lending firms in the UAE has generated substantial economic advancements.

Currently, the UAE secondary market has all the needed concepts such as professional financial institutions, a stable political system, and an open economic market. Muted performance and high volatility in most of the equity markets in Europe and the United States have lowered investors risk morale to the banks (Shihab, 2001). This seems to have given the UAE a substantial advantage to its financial globalization approach (Nicolau, 2010).

To the advantage of financial institutions of the UAE, with oil export as an imperative financial asset, investors even from Europe and US have sought refuge in bond investment from governments with stable creditworthiness including the GCC (Mackenzie & Rodrigues, 2012). Enormous exposure to foreign financial markets, including those from the US and Europe that have brought in large private flows to the UAE banking system, have influenced the growth of financial institutions and the domestic economy of the UAE (Haque, Arun, & Kirkpatrick, 2010). Investing in privatized international and slightly some domestic bond markets in the UAE have instigated a substantial development in the Emirati financial institutions and its economy.

High dependence on oil and gas revenues is something research cannot undermine as it has a direct influence on the bond and security market investment within the UAE (Ellaboudy, 2010). Oil and gas resources, regarded as safe financial assets, make the UAE have a large sovereign wealth and funding position (creditworthiness) and less dependent on government bonds and securities (Nicolau, 2010). Moreover, neither the local authorities nor the federal authorities of the UAE borrow money for fiscal financing purposes and domestic uses, and hence, foreign private bond markets are a major priority for the UAE (Saunders & Cornett, 2007).

International reports concerning the UAE reveal that the issuance of public or government bonds as instruments of fiscal policy is not a major practice of financial institution as the private bond market greatly helps the UAE to face economic crises (Cuzovic, 2012). Das (2010) notes that the capitalization of the private and corporate bond markets is slowly becoming a common practice in most of the UAE financial institutions, rather than the government bonds.

Whilst the government bonds are less active than the domestic and foreign private bonds in the UAE, the impact of bond financial business as fiscal policy in these nations has a positive influence on their economy (Shihab, 2001). Both government bonds and private bonds practised by financial institutions of a nation assist in boosting the economy of the nation concerned. According to Schizas (2012), bonds strengthen financial systems of the nations, an aspect that helps in promoting investor confidence, encourage more active participation in the financial markets, and somewhat helps in GDP growth, and hence, benefiting the UAE’s domestic economy.

Nicolau (2010, p. 28) postulates that “the bond market generally attracts investors who are looking for a steady stream of income with reasonable, but low risks.” With low risks associated with bonds, Nicolau (2010) believes that a vibrant government bond market in the UAE is probably the most imperative, the primary source of fiscal revenue that would boost the government’s budget and long-term planning.

Before the financial crisis in 2008, the two main sources of raising funds in the UAE were from the Initial Public Offering (IPO) or loans from banks with high-interest rate payments. In the UAE, this has been affecting the national economy, as the government has to struggle with financial difficulties and sometimes lose important public resources due to incessant debts (Darrat, Abosedra, & Aly, 2005). Bond as a capital market investment is more advantageous to both the investors and the government than the loans, which normally come with high risks. Within the financial markets, bonds work well with the investors, who are seeking a stable and secure source of income (Cuzovic, 2012).

More interesting is that the recent advancements in the UAE seem to generate an important impact on their financial globalization process. Hashmi (2007) asserts that joining the World Trade Organization (WTO) and the creation of the Dubai International Financial Corporation (DIFC) in the UAE banking sector are some of the interesting developments that may boost bond markets.

As Dubai is nearly becoming a powerful economy, Ahmed (2000) believes there is a need for a new capitalism approach. Recent Dubai capital market research indicates a rising bond market in the UAE, with a continuum of investors interested in financial markets across the Middle East countries (Hashmi, 2007; Mackenzie & Rodrigues, 2012). Currently, the UAE secondary market has all the needed concepts such as professional financial institution, a stable political system, and an open economic market (Connolly, Stivers, & Sun, 2005).

The UAE has active primary and secondary markets for common stocks, unlike the past when rising bonds were rarely issued or selectively issued to selected groups of government entities or individuals. From a recent report from investigations on Emirates NBD Bank and NASDAQ Dubai, bond markets are becoming a booming business (Moosa, 2010). Lately, the recent government bond issued (worth $750 million US dollar) by the NASDAQ Dubai ranks second-largest public bond ever issued, and Emirates NBD listed it as the second-best in the annual securities exchange (Mehta, 2012). This augments the total worth of the traditional bonds from NASDAQ Dubai to approximately $5.75 billion.

The Research Inquiry or Problem

Financial markets act as an important facet of fiscal resource of the government as they support budgetary and government long-range planning needs. Although financial markets have much significance to the growth of the domestic economy, governments trading on risky fiscal revenues normally threatens the national economy (Darrat, Aly, & Abosedra, 2005). Despite substantial evidence of imperative government bonds from developed economies, the emerging economies, including countries within the UAE, are failing to acknowledge their impact. Research has established that bond markets in the UAE are still in their emergent stage regardless of having more than a decade in their progressiveness (Haque, Arun, & Kirkpatrick, 2010).

Being a potential creditor across the Middle East, the UAE has continuously failed to acknowledge the full capacity of the bond market in improving financial institutions and enhancing the growth of its domestic markets (Saunders & Cornett, 2007). Despite outstanding research and evidence on the importance of financial bond market from developed economies, including the US and other nations of the Western hemisphere, bond markets in the UAE have remained underutilized.

Building a strong economy begins with strengthening the financial systems of the nation, and since the UAE is still an emerging economy with several capitalist opportunities, the demand for bond markets should not remain unrealized (Ibrahim & Alqaydi, 2013). Emerging Market Economies including the UAE are increasingly becoming a favourite investment destination for the Western nations, and this might be a great opportunity for building a strong economy of the UAE (Ibrahim & Alqaydi, 2013). The overdependence on the current stable oil reserves for fiscal revenue may likely put the UAE at stake, as several tensions around the world are resulting from such revenues (Moosa, 2010).

Diversification is an important strategy for creating a portfolio to invest. It is known among financial experts that the more a nation divides investments among different types of financial avenues, the less the risk and the more the return (Kota & Kukunuru, 2011). Vitally, this research seeks to examine the importance of financial bond markets to the Emirati financial institutions and the UAE economy.

Aim and Research Questions

The main intent or purpose of the proposed capstone project is to examine the imperativeness of bond markets to the financial institutions of the UAE and its national economy. As primary research, all the arguments will hinge upon the collected data from NASDAQ Dubai and the central bank of the UAE, being the areas of study. In an attempt to understand the significance of financial bond markets for the Emirati financial institutions and the UAE economy in general, the underway study will use the following research questions in examining the stated issue.

- As per the current situation, what is the current state of bond markets in the UAE?

- What is the main hindrance to the growth of financial bond markets and government bond issuance in the UAE?

- What is the main importance of issuing bonds and investing in bond markets by the Emirati financial institutions?

- What is the significance of financial bond markets and the practice of the issuance of bonds to the national economy?

Research Design and Methodology

The Proposed Research Methodology

Research methodology implies all the processes involved in undertaking research, with the focal aspects being between data collection, data analysis, and discussion of results (Crewell, 2013). The entire research methodology of the proposed study will entail a qualitative survey methodology that seems more feasible in evaluating the existing problem from the participants. Qualitative research provides researchers with an opportunity to explore their interest in understanding the meaning that people have constructed or even how they view their world and the real experiences of the world (Driscoll, 2011). Qualitative researchers have a unique opportunity of studying issues in their natural phenomenon. “It is qualitative research and understandings that provide scholars with the insights to conceptualize issues and problems differently, thereby providing the foundation and building blocks for theoretical advancements, refinements, and even initiations” (Tewksbury, 2009, p. 56). Examining the stated problem requires more participation from the participants and qualitative research is suitable in this case as it locates the main observer of the real world.

Research Design

Qualitative and quantitative research methodologies have been the most common techniques for scientific inquiry (Yin, 2006). However, the mixing of both qualitative and quantitative methodologies in a single research design known as a mixed research methodology has currently yielded significant results in scientific investigation inquiries (Creswell, 2013). The proposed research employed the mixed research methodology to investigate the research problem since a combination of qualitative and quantitative gave room for proper data collection qualitatively and quantitatively, and allowed a deeper synthesis into the problem under investigation (Teddlie & Yu, 2007).

The mixed research methodology involves all the processes of collecting, analysing, and interpreting both quantitative and qualitative data in a single study in an inquiry program (Creswell, 2013). “As a methodology, it involves philosophical assumptions that guide the direction of the collection and analysis of data and the mixture of qualitative and quantitative approaches in many phases in the research process,” (Creswell, 2013, p. 5).

Researchers claim that a combination of qualitative and quantitative designs into mixed methodologies provides strengths that often offset the weakness found in the two research methods (Teddlie & Yu, 2007). According to Tewksbury (2009), combining the two research methodologies gives researchers unique opportunities to draw in-depth inferences about the study since they complement each other in the study processes. Mixed methods have the ability to provide evidence that is more comprehensive regarding a certain research inquiry and helps researchers to answer questions that neither qualitative or quantitative alone can answer (Creswell, 2013). The study concentrated on collecting qualitative and quantitative data from the participants, with its analysis basing on both quantitative and qualitative data analysis techniques. The study used 50 structured and semi-structured questionnaires, which the researcher administered through the email to the respondents

Research Participants

Scientific understanding of the research principles and the identification of research participants are the most crucial aspects in the process of undertaking primary research (Teddlie & Yu, 2007). The main study participants for the proposed capstone project targeted by this study were the top finance officials of the NASDAQ Dubai, which is an international leading bond issuer with great long-term business investment within the Middle East.

In addition, comprising the study participants involved the top management officials from the central bank of the UAE, who possess a pool of knowledge pertaining to the trends in the bond markets right from the historical perspective of the bond markets in the UAE. The research targeted about 50 top management officials from both organizations, a number that was quite appropriate for this research because it comprised above 30% of all the officials, and thus, it was a representative sample. Using purposive sampling, the study selected individuals, who deem appropriate for the study in that they could answer the research questions professionally (Teddlie & Yu, 2007). In this view, the research understood that financial managers have great knowledge of bond markets.

Secondary Research Data

Secondary data refers to information gathered from existing research publications on studies undertaken from various grounds but carrying a similar theme. According to McQuarrie (2005, p. 53), “secondary market research refers to any data gathered for one purpose by one party and then put to a second use by or made to serve the purpose of a second party.” The study combined both secondary and primary data, and the main sources of secondary data included journals, books, and other government reports and publications that enriched the intended research with a powerful background. With different commentary obtained from existing research publications, a study gains a comprehensive insight into the research problem examined (Kothari, 2004; McQuarrie, 2005). The study used Google Scholar as a search engine to access a reliable journal, books, and other relevant publications. Secondary data will help in consultations, setting objectives, and assessing theories and related arguments in the existing empirical evidences.

Primary Research Data

Primary research entails carrying out an investigation on a problem by collecting data from the study participants and analysing them, which contrast, secondary research that focuses on already collected and analysed data. According to Driscoll (2011), it includes first-hand information gathered afresh through primary data collection methodologies, including direct observations, surveys, and even interviews. Primary data enrich secondary information and even establish facts about the existing theories (Tewksbury, 2009).

For the purpose of the proposed research, primary data will come from direct interviews targeted at participants from the NASDAQ Dubai and the central bank of the UAE. The two organizations have the required capacity to provide information pertaining to government financial statistics and important primary data on bond markets from within the UAE. As recommended by Kothari (2004), akin to this research, structured interviews with a set of predetermined questions aided in collecting the needed primary research information, with the researcher employing highly standardized recording techniques.

Data Collection Instruments

Data instruments are normally the tools that researchers use in gathering data from the selected participants (Yin, 2006). The main data collection instruments used for the research were the questionnaires. For quite some time, researchers have regarded questionnaires as the most appropriate tools for collecting scientific data (Yin, 2006). Both qualitative and quantitative research designs have scientifically proven to utilize questionnaires as reliable data collection instruments (Creswell, 2013).

Questionnaires are the data collection instruments that most participants have familiarized with, and this increases their reliability in this research since there would be little direct influence of the researcher to the responses that participants would provide (Yin, 2006). Questionnaires are generally easy to construct, easy to administer and easy to guide participants during the data collection process as they allow researchers to be physically present during the data collection process (Yin, 2006). The questionnaires also have the ability to collect large amounts of data at relatively low cost compared to other data collection instruments.

Mixed research methodology recommends the use or a combination of both questionnaires and interview schedules in collecting data for mixed research (Teddlie & Yu, 2007). The researcher developed 50 open-ended and ended questionnaires to assist in collecting data from the participants. Normally, qualitative data involves information collected from participants using interviews integrated into the open-ended questionnaires (Tewksbury, 2009).

Researchers use closed-ended questionnaires or structured questionnaires to collect quantitative data, which normally involves numerical figures, statistical data, or any alphanumerical data. In this study, the researcher developed 60 questionnaires with 25 questions for collecting responses from the 50 participants from NASDAQ Dubai and the central bank of the UAE. Where necessary, the study collected some quantitative data regarding bond issuance activities for the UAE financial institutions. The researcher met the respondents on a scheduled pre-visit before agreeing to dispatch the questionnaires through their email addresses to collect their responses.

Analysis and Discussion Methods

The surveys included qualitative questions and quantitative questions. For quantitative questions, the responses involved data collected using scaled responses in the form of the Likert scale and the Statistical Package for the Social Sciences (SPSS) was useful in analysing the qualitative data provided. The study presented its responses in tables for comprehensive qualitative and quantitative analysis. The study analysed the perceptions of the managers regarding the current state of the bond markets in the UAE, examined the statistical data provided in secondary materials, and examined the responses that participants provided. Content analysis aided in analysing the data provided, as it was imperative to identify how the participants construct the meaning of the ideas regarding the inquiry. The qualitative discussion involved a comprehensive, detailed discussion of the ideas, facts, opinions, and arguments from responses provided in the Likert scale incorporated in the questionnaires. The study analysed data qualitatively, with results presented in argumentative form depending on the conceptions presented by the participants about the research problem.

Proposed Timeframe for the Study

The Capstone Proposal

The entire capstone project may take just about three months for its completion. A week is enough to formulate the capstone project group, which will work mutually towards the completion. Comparatively, identification of the problem to investigate may take a similar duration. The entire process of developing the proposal will probably take approximately two months. In a breakdown, discussing the problem or the inquiry under the investigation with the group members may take a period of roughly two weeks, where consultation with other friends and the supervisor.

A week is enough to investigate the possibility of acquiring primary and secondary data, where the researchers will concentrate on identifying reliable books, journals, and government publications to support the background of the study. The capstone groups will use this time to search for relevant information from online libraries and other archives available to the researchers. The writing of proposal aspects such as the secondary data compilation, formulation of objectives, and discussion of the methodology will take a period of about three weeks.

Final Capstone Project

The project begins with the compilation of the primary data from the identified participants during a three-week period, which includes developing data instruments (interview materials), consulting relevant sources, conferring with the supervisors, and correcting errors in the instruments. Reconnaissance will take place in approximately one week for the participants to familiarize with the study zone and probably seek authorization to conduct the study in an attempt to avoid unethical research practices. Piloting may also occur during this moment to examine the effectiveness of the data instruments.

Two weeks will be essential in gathering primary data from the participants, recollecting reliable evidence from the participants, and managing the data. The study will take another two weeks of sorting the data, analysing the information, interpreting the provided information, discussing the data, concluding, and recommending on the inquiry, before finally presenting the report to the institution for further assessments. A report on the participation of the members of the institutions will finalize the report.

Analysis, Results, and Discussion

The Current State of Bond Markets in the UAE

Bond markets in emerging and low economies are generally low as these nations rely on tangible market resources rather than capital market resources such as financial markets. Most emirates rank within the emerging economies with most of their capitalism efforts centred towards trading on natural resources predominantly the rick oil dens. Dubai, Saudi Arabia, Oman, and Qatar are countries that rank among the fastest-growing global economies of the twenty-first century. Dubai is an emerging market with financial firms that are still developing to meet the financial demands of millions of Dubai people.

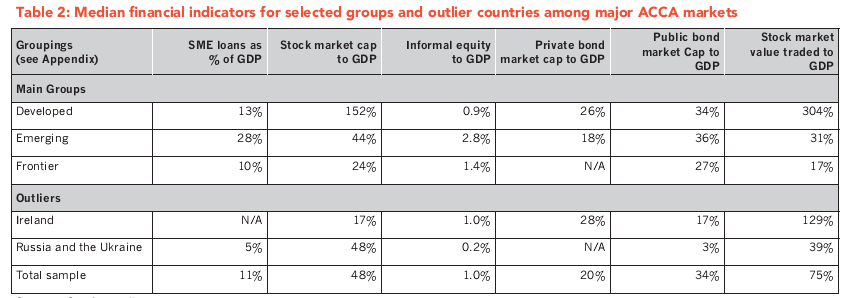

Currently, there is relatively high and steady growth of financial bond markets within the GCC countries with empirical evidence demonstrating a fast growth of financial institutions and bond markets within the majority of the emirates. A cross-national study undertaken to examine the state of the bond market and financial institutions in emerging and frontier nations, revealed a lot about the UAE bond markets.

The notion in the above analysis is that emerging economies are gaining power in their financial institutions and bond markets seem to flourish compared to the developed and frontier economies. Generally, the state of financial bonds within the UAE is improving gradually. The table above indicates that public bond markets in emerging economies are relatively high at approximately 36% compared to the public financial bond markets within the developed nations and the frontier or emerging nations, which stand at 34% and 27% respectively. Comparatively, private financial bonds stand at 26% in developed economies, while in emerging economies the private financial bonds stand at 18%. This connotes that Government Development Bonds (GDB) are improving as the financial markets expand financially within the emerging nations. Notably, private financial bonds are dwindling gradually within the emerging economies, but they fluctuate depending on other factors of government financial systems.

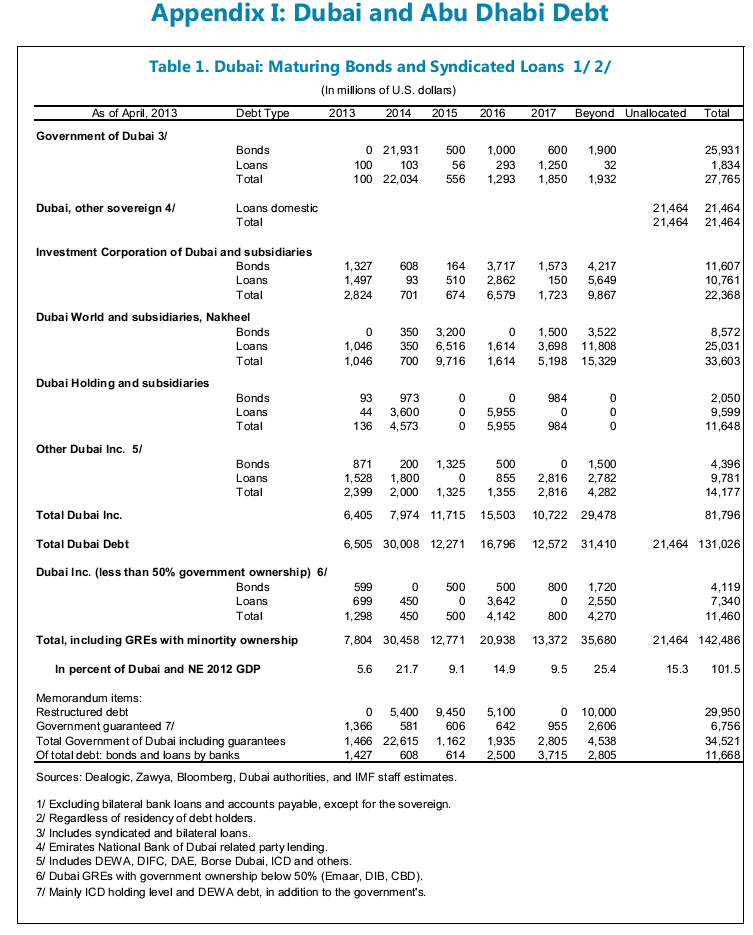

Economists believe that when government finance borrowing is high, there is normally a high possibility that the government bond markets have improved. Emerging economies such as the UAE have the highest expenditure and low saving capabilities since many government finances have spread to development projects including infrastructure building, which is normally costly. An empirical research on major emerging economies including the UAE undertaken by the International Monetary Fund organization provided concrete evidence about the state of bond markets within the emirates. Abu Dhabi and Dubai are major economies of the UAE whose financial capacity seems to influence trade and financial markets within the UAE economies. Growth of GDP in Dubai and Abu Dhabi and the constantly increasing numbers of expatriates associates with the increased relative financial ability of the two economies, which have recently emerged as investment destinations for big financial institutions. The two subsequent tables provide recent statistical data related to bond investments in Abu Dhabi and Dubai.

Economic theorists believe that a decrease in government borrowing directly associates with increased maturity in the bond markets. According to Khalid (2007), the bond market has significant importance in any economy, especially in emerging economy where saving and investment opportunities seem limited (p. 43). The table above represents the present situation in the maturity of bond markets, which seem to associate directly with the reduction in borrowing. As per last year, the government of Dubai was still experiencing high borrowing that seems to reduce as bond markets improve in the UAE financial markets.

As bond markets tend to improve, the government general debt would probably increase due to the amount of pending loans that financial institutions owe the government. The above table indicates that 2014 Dubai would probably have the highest bond growth as it fluctuates in each subsequent year. Analytically, since bond market also relies on the state of commodity prices, which largely depend on oil markets, the UAE bond market may keep fluctuating. A similar situation is happening to the Abu Dhabi, which is normally among the most influential economies of the UAE that regulate financial markets and determine the entire economy of the emirates. Bond market in the Abu Dhabi as presented in the table seems to grow with time as the levels of government loan debts reduce with time.

Primary Empirical Evidence

The study collected data from participants regarding their age bracket and professional experience, as they are crucial in determining their level of expertise in financial matters and especially the history of bond markets in the UAE. The research also collected data regarding the perception of participants on the prevailing situation of bond markets in the UAE, major impediments to growth of bond markets, and the perceived significance of bonds as sources of fiscal revenue to national governance in the UAE. See table 3 and 4 containing demographic data

Table 2: Analysis of Demographic Information of Respondents (Age bracket).

Table 3: Analysis of Demographic Information of Respondents (experience).

In table 3, that contains the age bracket information, the majority of the respondents, 23 (46%) of them had an age bracket of 40- 45 years, 10 (20%) were of ages between 30-35 years, 8 (16%) were of the age between 25- 30 years, 7 (14%) ranged between 25- 30 years, while the least, 3 (6%) were below 5 years. Table 4 that contains information about work experience of respondents showed that 29 (58%) of the respondents had experiences of between 15-20 years, 6 (12%) had their work experience ranging between 20-25 years, while 8 (16%) had experiences ranging between 10-15 years. This information meant that the research managed to obtain experienced respondents with enough experience regarding government and private financial and capital market in the UAE.

Participants’ perceptions about the current state of bond markets in the UAE

The following are responses of participants regarding the prevailing status of bond and internal capital markets in the UAE.

Table 4: Participants’ responses about the current state of bond markets in the UAE.

From the primary research undertaken, respondents showed a strong optimism about the state of financial bonds and the bond markets within the UAE. Based on simple questioning to draw the qualitative information through assessing their attitudes and opinions towards the state of financial bond markets, the majority of the respondents gave an optimistic idea about the UAE bond markets. On the question: What can you say about the current state of bond markets in the UAE, the respondents responded as follows. 31 (62%) out of the 50 respondents interviewed indicated that the UAE bond markets had improved, 8 (16%) of them said that the UAE bond market was still lagging behind, 6 (12%) indicated that the markets were unpredictable, while the least of them 5 (10%) said the bond markets were outstanding. The two optimistic responses combined, approximately 72% that make the majority believed that the UAE bond markets have incredibly improved and doing better than previous years.

The research also wanted to know the opinion of the UAE bank officials and professionals about the kind of circumstances that likely indicate the perceived improvements in the financial bond markets. Of the 50 respondents, who answered this question, 25 (50%) strongly agreed, 9 (18%) agreed, 3 (6%) were undecided, 11 (22%) disagreed, while 2 (4%) strongly disagreed that the loan borrowing by the UAE government has reduced tremendously. The theoretical notion of the association between bonds and loans is that when governments rely on bonds, their dependence on loans reduces. Notably, the majority (68%) responses from the bank professionals reveal a similar association. Economic theories elucidate that enhanced bond markets attracts investors. 29 (58%) of the respondents strongly agreed, 15 (30%) agreed, while 6 (12%) disagreed with the notion that the number of foreign bank investors had increased steadily. For the majority, it is possible that improved bond markets in the UAE have attracted bank and other investors to the UAE.

The respondents were optimistic that bond markets had improved based on the number of foreign bank expatriates that have shown their interest in the UAE financial markets. From the interview, 27 (54%), agreed, 9 (18%) strongly agreed, 7 (14%) were undecided, 5 (10%) disagreed while 2 (4%) strongly disagreed with the notion that the number of foreign bank expatriates has enhanced in the UAE. By a majority of (72%), it is likely that the number of financial expatriates that bond markets have spurred has enhanced. From the experience of 50 respondents, 17 (34%) agreed, 8 (16%) strongly agreed, 5 (10%) remained undecided, 13 (26%) disagreed while 7 (14%) strongly disagreed that bond markets associate with commodities in the sense that there were significant fluctuating changes in prices of commodity goods. The responses are almost on unpredictable facts behind the assumed association between commodity prices and bond markets. This means that the association between bond markets and commodity goods needs further empirical investigation.

Impediments to Growth of Financial Bond Markets

The existing literature seems to indicate that although some nations within the UAE are experiencing enhancements in bond markets, the economic experiences are uneven and differ depending on an individual nation. A series of political and economic issues are affecting the growth of and reliance on government bonds as part of efficient financial investment opportunity within the UAE. The soaring price of oil across the UAE is the foremost impediment to the growth and development of bond markets within the UAE. Others include excess concentration on infrastructural development that seems to push the UAE government into incessant bank debts in terms of loans.

Theorists of economic issues and global financial markets have normally tried to establish the connection behind commodity prices and monetary policies. This section would probably unveil the facts behind the notion of direct association between commodity prices, especially crude oil and the performance of bond markets within the UAE come into play.

Perhaps, the greatest economic mover in the contemporary world is the oil producing community in which the UAE dominate with almost 62% of all the accessible oil across the world. The World Bank requires crude oil of the highest quality with fewer expenses in its refining process to maximise the profitability gained from trading on commodity goods such as crude oil and other precious natural resources. Countries within the GCC institution, including the United Arab Emirates are the major producers of fine and clean crude oil of high quality compared to other oil producers. The UAE government tends to use such advantage to manipulate the prices of crude oil, something that gives them a positivism attitude towards the value of oil as the most significant source of fiscal revenue. Bond markets in the UAE largely depend on the performance of crude oil in the commodity market, as it is influential to other economic facets.

In the Abu Dhabi Economic Vision of 2030, investigators noticed that for the past three decades, Abu Dhabi has been heavily reliant on oil as their primary source fiscal revenue approximated to bring about 74% of the national income between the years 2000-2005. Despite global oil prices occasionally plummeting and most of the times rising and constantly fluctuating because of the dollar values, the recent international oil shoots have led to the proportion of the above value to increase to 84%. Subsequently, in 2006, Abu Dhabi reported an increase worth $5.8 billion resulting from the booming oil business in the UAE and internationally. According to Nicolau (2010), “the rise or fall of oil prices has a broad impact on the cost structure of business in all sectors of the economy” (p. 32). An increase in the oil prices relatively results in decreased reliance on government bonds for fiscal supports as oil brings enough returns to sustain the government budgetary allocations.

Responses about barriers to growth of bond markets in the UAE

The following table contains the responses of respondents regarding the factors impeding growth of financial bond markets in the UAE.

Table 5: Participant responses on the barriers to growth of bond markets in the UAE.

In a bid to answer questions regarding major factors contributing to unstable and low growth of bond markets in the UAE, the research questioned all the 50 participants regarding this problem. The study first wanted to investigate the notion that over-reliance on oil as a national business of most emirates is the reason behind poor investment in the bond markets. Out of the 50 participants, 29 (58%) strongly agreed that the government of UAE has the tendency of relying too much on oil as sources of fiscal revenue, 10 (20%) agreed to this notion, 7 (14%) disagreed while 4 (8%) strongly disagreed.

This means over reliance on oil affects bond markets in the UAE. The study also investigated reliance on loans as an impediment to bond investment in the emirates. Out of 50, 17 respondents representing 34% strongly agreed with this idea, 13 (26%) agreed, 2 (4%) were undecided about the loans impact, 12 (24%) strongly disagreed while 6 (12%) disagreed that reliance on loan is hampering bond investment.

The real estate business is another lucrative commercial activity in which numerous organizations and the national government of Emirati rely on for economic wellbeing (Yaseen, 2012). The research wanted to examine the perceptions of Emirati bank professionals about the influence of real estate megaproject businesses on bond markets. Out of 50 bank professionals, 23 (46%) disagreed that the lucrative real estate business in the UAE generates enough capital to run the UAE government, 11 (22%) of them strongly agreed, 9 (18%) agreed, 4 (8%) strongly disagreed, while only 3 (6%) were undecided.

This implies that although it is a powerful investment, real estate has an average impact on bond markets. In the analysis of real estate business in Dubai, Ellaboudy (2010) investigated the national earning in terms of sectors. Using International Financial Statistics (IFS) of 2009, Ellaboudy (2010) noticed that real estate is among the major national sectors that generate lucrative profits, but always has fluctuated performances depending on other business sectors.

Government taxation is a common international practice that helps many nations to collect revenues to support their national budgetary programs (Ibrahim & Alqaydi, 2013). The UAE government imposes low taxation on commodity goods and national services, due to the lucrative oil business that generates huge economic benefits to these economies and their national bank organizations (Ahmed, 2000).

The research sought to examine the association between government tax revenues and the bond markets. About 18 (36%) of the respondents disagreed that there is normally enough tax from people that supports running of the UAE government, 11 (22%) agreed with this notion, 10 (20%) strongly agreed, 6 (12%) strongly disagreed, while 5 (10%) of the respondents were unsure. The majority (48%) disagreed while minority (42%) agreed. On average, it implies that taxation in most emirates is low and the direct influence of government tax revenues in bond markets and internal capital markets is relatively low.

Some powerful non-oil sectors have had a significant impact on the UAE economy, although mostly oil-financed since they rely on oil prices and capital inflows. The performances of the retail trade, telecommunications, tourism and others relatively influence the stability of internal capital markets in the UAE. In this view, the research wanted to examine the direct influence of the performance of non-oil sectors on the performance of bond markets in the UAE. Out of the possible 50, 22 (44%) of the respondents strongly disagreed that revenue from the telecommunication, tourism and other industries is enough to support government long-term planning, 12 (24%) disagreed with this perception, 7 (14%) strongly agreed, 6 (12%) agreed while 3 (6%) remained undecided. From the majority perspective, it implies that although powerful in driving the national economy of the UAE, telecommunication, tourism and retail trade have a minimal influence on the growth of financial bond markets.

Importance of Issuing Bonds and Bond Investments

Above all, the main intent of this report was to enlighten and encourage the use of bonds in national governance through establishing the efficiency of bonds on national governance, in the UAE. The reason of low reliance on bonds in national governance in the UAE is the lack of knowledge about the accrued benefits of bonds. According to Cuzovic (2012), financial institutions and governments mutually depend on each other for economic enhancement and understanding the importance of bonds on both the Emirati financial institutions and the government is essential. Lucrative bonds businesses in emerging economies such as the UAE attract investors who benefit the government and the Emirati financial institutions. Schizas (2012) postulates that “capital markets promote economic development and growth by facilitating and diversifying firms’ access to finance” (p. 1). This section discusses the importance of bond investments and issuance to the UAE economy and to the Emirati financial institutions.

Importance to the national economy on Emirates

The UAE is an emerging economy with little opportunities of making considerable savings since most of the government finances remain channelled towards infrastructural development and utility development (International Monetary Fund, 2013). Contemporarily, the UAE has increasingly focused on developing effective and efficient modern infrastructure network that will connect its economic sectors globally and improve its trade links (Connolly, Stivers, & Sun, 2005).

Abu Dhabi and Dubai have embarked on massive investment across their utilities and transportation systems to ensure that infrastructural systems do not impede the yearned economic development programs. Electricity, water megaprojects, and road construction are consuming considerably large amount of the national budgets of most of the Emirati economies. In 2005, infrastructure development alone consumed approximately $2.7 billion of the national government spending of Abu Dhabi out of the overall budget of $33 billion (Mackenzie & Rodrigues, 2012). Such massive development programs consume government budget and often influence the saving and investment abilities. The following table presents the responses of participants regarding the significance of bonds to the economy of emerging nations such as the UAE.

Table 6: Participant responses on the importance of bonds to economy of the UAE.

To examine the efficiency of government bonds and their significance in the development of emerging nations such as the UAE as fiscal revenues, this research collected the perceptions of respondents about bond relevance. Out of the 50 respondents, 25 (50%) strongly agreed, 11 (22%) disagreed, 9 (18%), 3 (6%) remained undecided while 2 (4%) of the respondents strongly disagreed that bonds are part of internal capital markets that are responsible for economic development as they provide efficient access to finance. Such responses indicate that since the bonds and internal capital markets are relatively low, most bank officials from the UAE have little experience with bond business and their association with government funding.

On average, however, respondents understand the value of bonds in supporting the government as fiscal revenues, with the majority of the respondents (68%) agreeing that they provide efficient access to finance. According to Khalid (2007), bond markets provide governments with the opportunity to make efficient investment and financing decision.

Making substantial savings and investment for governments in the emerging economies is one major challenge as government expenditure often exceeds the available financial resources (Ibrahim & Alqaydi, 2013; International Monetary Fund, 2013). The research collected the responses of bank officials regarding the impact of government bonds of government savings and investment in emerging markets. Among the 50 respondents interviewed, 19 (38%) strongly agreed that using government bonds helps the UAE economy to keep developing since they lack sizeable saving and investment chances, 12 (24%) agreed with the statement, 11 (22%) disagreed, while 8 (16%) strongly disagreed.

A major sign that economists look at emerging nations is whether the nation has sizeable saving and investment (Kota and Kukunuru, 2011). An apparent perspective from the responses is that bond markets in the UAE, as an emerging economy, are efficient in assisting economic progress because emerging economies lack stable savings and investments.

Economists believe that government bonds are significant in assisting governments in the emerging nations to have a better prospectus financial planning and budgetary balancing. According to Khalid (2007, p. 44), “bond market also helps to make efficient investment and financing decisions, improve efficiency in the design and implementation of monetary policy, risk management, liquidity management, and foreign exchange risk management.” The study wanted to examine the effectiveness of bonds in the UAE government’s financial planning and collected opinions of the respondents.

Approximately 11 (22%) of the respondents strongly agreed, 21 (42%) agreed, 2 (4%) remained undecided, 9 (18%) disagreed while 5 (10%) strongly disagreed that government bonds allow nations to have an effective long-term budget for crucial government projects. From the responses collected, it is eminent that government bonds, as sources of fiscal revenues are important in enhancing national budgeting. To add from their opinions, the respondents claimed that bonds help governments to arrange and plan budgets for long-term investment purposes.

For any emerging nation, it is often risky to borrow money from the profit-making financiers, since they operate with limited savings and have little abilities to make quick refunds as most government finances are constantly supporting development programs (Das, 2010). The study examined the notion that bonds are less risky and collected opinions from the financial experts in the UAE. Out of the 50 participants, majority 23 (46%) of agreed that bonds are source of stable financing program for government since they involve little fiscal risks, 8 (16%) strongly agreed, 7 (14%) disagreed and 7 (14%) strongly disagreed, while 5 (10%) remained undecided about this notion. Regarding comparison of bonds to loans, 16 (32%) agreed that bonds are more efficient than loans in financing megaprojects that require huge amounts of finance, another 16 (32%) disagreed, while 11 (22%) strongly agreed. Since majority, agree that bonds are source of stable financing programs and less risky compared to loans, they are suitable for government financing.

Conclusion and Recommendations

From the accumulated theory, literature, and the primary investigation undertaken about bond markets in the UAE, the bond markets are relatively low, but steadily growing in some emirates, while still low in other emirates. The empirical evidence of this report indicates that reliance on bonds as fiscal sources of government finance has remained hampered by over-reliance on the lucrative oil trade, loans from financial institutions, and slightly from the real estate business. It is important to understand that for emerging economies with little ability to make savings and investments, government bonds can provide efficient financial support compared to loans given by financial institutions at considerably higher rates than normal. In recommendation, it is high time the UAE government embark on bonds as sources of fiscal revenue.

References

Ahmed, S. (2000). Global Need for a New Economic Concept: Islamic Economics. International Journal of Islamic Financial Services, 1(4), 1-15. Web.

Connolly, R., Stivers C., & Sun, L. (2005). Stock market uncertainty and the stock-bond return relation. Journal of Financial and Quantitative Analysis, 40(1), 161-194. Web.

Creswell, J. (2013). Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. New York: SAGE Publisher. Web.

Cuzovic, D. (2012). Growth, Finance and Regulation. Perspectives of Innovations, Economics & Business, 10(1), 5-13. Web.

Darrat, A., Abosedra, S., & Aly, H. (2005). Assessing the Role of Financial Deepening in Business Cycles: The Experience of the United Arab Emirates. Applied Financial Economics, 15(7), 1-16. Web.

Das, D. (2010). Contours of Deepening Financial Globalization in the Emerging Market Economies. Global Journal of Emerging Market Economies, 2(1), 45-67. Web.

Driscoll, D. (2011). Introduction to Primary Research: Observations, Surveys, and Interviews. London: The Saylor Foundation. Web.

Ellaboudy, S. (2010). The Global Financial Crisis: Economic Impact on GCC Countries and Policy Implications. International Research Journal of Finance and Economics, 41(1), 180-193. Web.

Haque, F., Arun, T., & Kirkpatrick, C. (2010). Corporate Governance and Capital Markets: A Conceptual Framework. Web.

Hashmi, A. (2007). An Analysis of the United Arab Emirates Banking Sector. International Business & Economics Research Journal, 6(1), 77-88. Web.

Ibrahim, M., & Alqaydi, F. (2013). Financial Literacy, Personal Financial Attitude, and Forms of Personal Debt among Residents of the UAE. International Journal of Economics and Finance, 5(7), 126-138. Web.

International Monetary Fund (2013). United Arab Emirates 2013 Article IV Consultation. Web.

Kota, S., & Kukunuru, S. (2011). Inelasticity of Emerging Economies to Financial Crisis. Journal of Global Business and Economics, 3(1), 1-21. Web.

Kothari, C. (2004). Research Methodology: Methods and Techniques. New Age International Publishers. Web.

Mackenzie, M., & Rodrigues, V. (2012). US companies take advantage of sweet spot to issue bonds. The Financial Times, 1(1), 28. Web.

McQuarrie, E. (2005). Secondary Research. London: SAGE Publications. Web.

Mehta, A. (2012). Financial Performance of UAE Banking Sector- A Comparison of before and during Crisis Ratios. International Journal of Trade, Economics, and Finance, 3(5), 381-387. Web.

Moosa, I. (2010). Stock market contagion in the early stages of the global financial crisis: the experience of the GCC countries. International Journal of Banking and Finance, 7(1), 19-34. Web.

Nicolau, M. (2010). Financial Markets Interactions between Economic Theory and Practice. Economics and Applied Informatics, 16(2), 27-36. Web.

Saunders, A., & Cornett, M. (2007). Financial markets and institutions: An introduction to the risk management approach. Boston: McGraw-Hill/Irwin. Web.

Schizas, E. (2012). The rise of capital markets in emerging and frontier economies. Web.

Shihab, M. (2001). Economic Development in the UAE. Web.

Teddlie, C., & Yu, F. (2007). Mixed Methods Sampling A Typology With Example. Journal of Mixed Methods Research, 1(1), 77-100. Web.

Tewksbury, R. (2009). Qualitative versus Quantitative Methods: Understanding Why Qualitative Methods are Superior for Criminology and Criminal Justice. Journal of Theoretical and Philosophical Criminology, 1(1), 38-58. Web.

Yaseen, H. (2012). The Convergence of Financial Institutions in GCC Countries. The Journal of Global Business Management, 8(1), 153-159. Web.