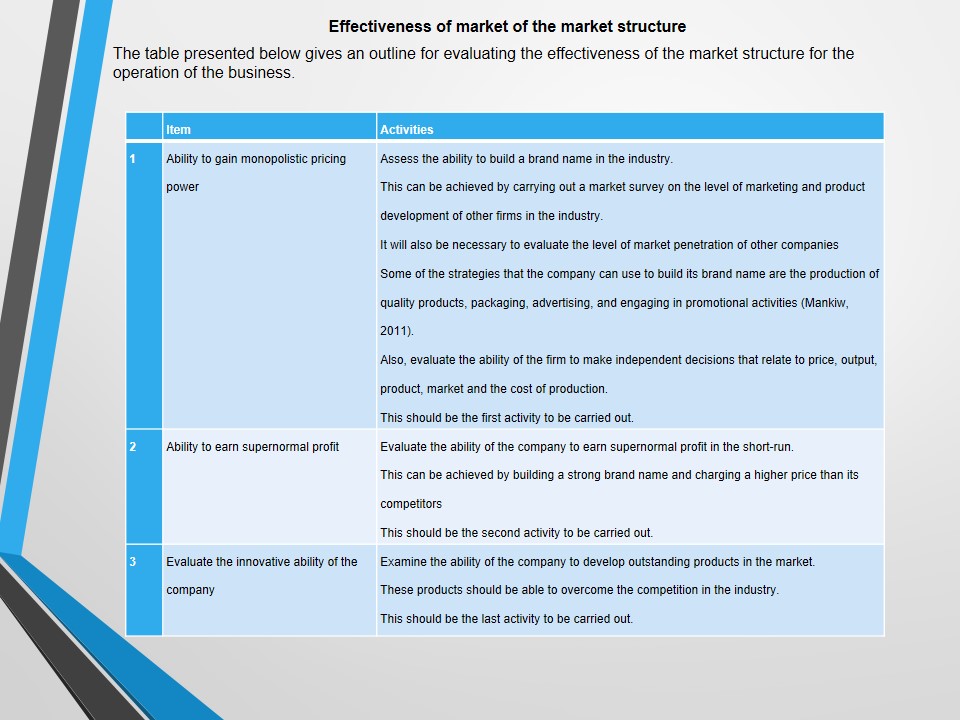

Effectiveness of market of the market structure

The table presented below gives an outline for evaluating the effectiveness of the market structure for the operation of the business.

The XYZ Company operates in the athletic apparel industry.

There are few firms in the industry and they sell highly differentiated products.

This implies that the products manufactured by firms operating under this market structure have close substitutes.

The market structure for athletic apparel has low barrier to entry and exit.

Thus, it can be concluded that XYZ Company operates in a monopolistic market structure.

A monopolistic market structure is effective for the business operations of XYZ Company.

Change of business operations from the market structure

- Factors that can cause the change:

- The first factor that can cause the business operations of XYZ Company to change from monopolistic market structure to another market structure is the profit earned by the company.

- Supernormal profits in a monopolistic market structure attract new entrants.

- An increase in the number of firms will change it to perfect competition. Under the new market structure, there will be several firms producing homogenous products.

- The second factor is government regulation.

- The equilibrium position of a firm occurs at the point of intersection of marginal revenue and marginal cost curves.

- However, a firm operating under monopolistic market structure charges a price that is higher than the marginal cost. This implies that the firm is not efficient.

- The government can regulate the firms by setting a price at the point where it equals to marginal cost. This will also cause the market structure of the company to change to perfect competition (Mankiw, 2011).

- Effect of the change:

- Under perfect competition, XYZ company will be a price taker. This implies that it will not have control over the price prevailing in the market. This feature of the market structure will limit the ability of the company to earn higher profit as was in the case of monopolistic competition.

- Further, the innovative ability of XYZ Company will reduce because the incentive of a high amount of profit is eliminated. Thus, the company will produce similar products as those produced by other firms in the industry (McGuigan, Moyer & Harris, 2014).

- Circumstances under which the company should discontinue its operations:

- Under a monopolistic market structure, a firm will minimize resulting economic losses in the short-run by shutting down its operations. This should occur when the price charged by the company is less than the average variable cost.

- When the price charged by the company in the short-run is less than the average variable cost, then the cost of carrying out production is higher than the cost incurred by the company when not producing.

- Actions that can minimize the possibility of shut down:

- The first strategy is that the management needs to control the costs of production.

- The variable costs can be controlled by improving efficiency in the production process so that there is no idle capacity and wastage of resources.

- Also, the management can seek for cheaper supplies and labor so that the variable cost per unit is lowered.

- The management should also produce new high quality products that will attract more customers (Arnold, 2011).

- Pricing policy:

- XYZ Company should implement a high-low pricing policy.

- The company will charge a high price for its regular products and a low price for its promotional products to attract customers (Boyes, 2011).

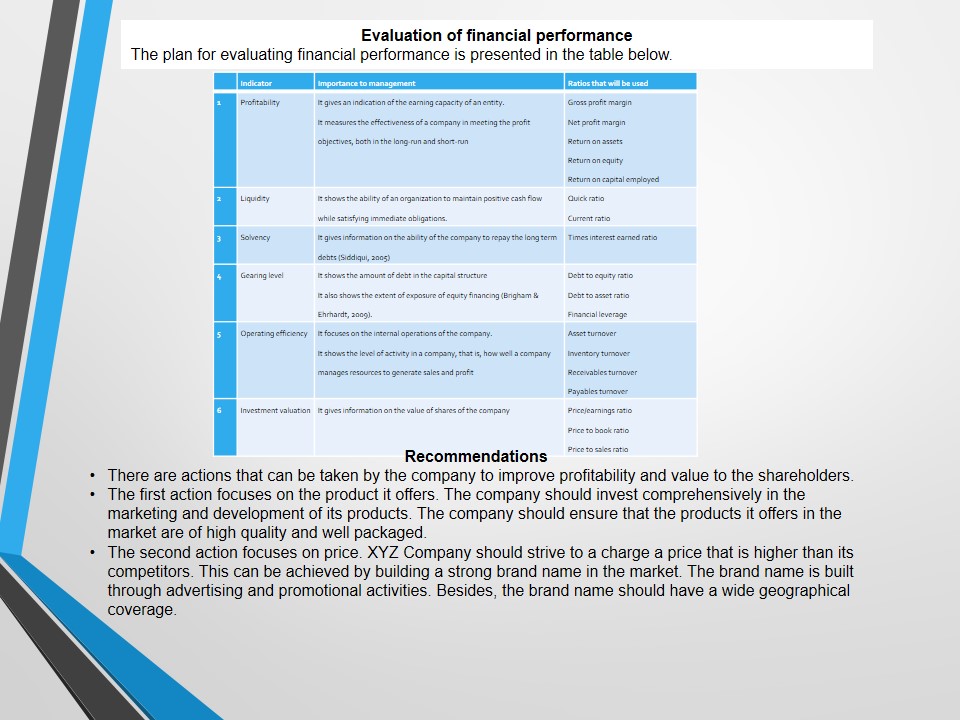

Evaluation of financial performance

The plan for evaluating financial performance is presented in the table below.

Recommendations

- There are actions that can be taken by the company to improve profitability and value to the shareholders.

- The first action focuses on the product it offers. The company should invest comprehensively in the marketing and development of its products. The company should ensure that the products it offers in the market are of high quality and well packaged.

- The second action focuses on price. XYZ Company should strive to a charge a price that is higher than its competitors. This can be achieved by building a strong brand name in the market. The brand name is built through advertising and promotional activities. Besides, the brand name should have a wide geographical coverage.

References

Arnold, R. (2011). Economics. USA: Cengage Learning.

Boyes, W. (2011). Managerial economics: markets and the firm. USA: Cengage Learning.

Brigham, E., & Ehrhardt, M. (2009). Financial management theory and practice. USA: Cengage Learning.

Mankiw, G. (2011). Principles of economics. USA: Cengage Learning.

McGuigan, R., Moyer, C., & Harris, H. (2014). Managerial economics: applications, strategies and tactics. USA: Cengage Learning.

Siddiqui, A. (2005). Managerial economics and financial analysis. New Delhi: New Age International (P) Limited.