Introduction

Qatar has been an absolute monarchy for many years. However, in 2003, the country’s political system was changed into a constitutional monarchy due to a desire to improve the present-day system. What must be understood is that as Qatar enters the 21st century, the state has determined that changes need to be implemented to ensure its continued existence.

With this in mind, Qatar has begun a campaign centered on utilizing soft power strategies to develop better relations not only with other states but with people and organizations as well. This is done to “build up” the country, so to speak, from an economic and sociological point of view. The case of Qatar is unique in that while its per capita income is among the highest in the world ($93,000 on average with a GDP of $200 billion ++), the fact remains that its industrial capacity is quite low. Simply put, nearly 85% percent of its economy is dependent on oil wealth, which is a finite resource.

It is with this in mind that in order to ensure the continued survival of the state, steps must be taken to address this dependence in the foreseeable future. Since Qatar is neither economically powerful nor is it population “rich” so to speak, this leaves it with the option of utilizing alternative methods of developing its regional and global profile. One way in which it has decided to do so has been through the utilization of soft power tactics in the form of sports diplomacy and cultural investments in order to make it more “likeable” for lack of a better term. Through such a strategy, the state expects that this should improve its profile to its regional neighbors as well as various international organizations. The end goals of the country would be to:

- Increase the amount of foreign direct investments into the country in order to improve its range of local industries

- Develop better relations within the region as well as in the arena of international relations

- As well as increase the amount of tourists that come into the country due to their interest in the local culture of Qatar

It is with this in mind that this paper will investigate the application of soft power, what methods Qatar would most likely attempt and whether or not they would be successful. The theoretical framework that will be utilized in order to frame the investigation of this study will be realism due to its focus on the anarchic nature of the international system and the manner in which states interact. Overall, it can be expected that this study should shed light on the application of soft power by an oil rich country in the Middle East and how this could relate to the actions conducted by other states in the region that are in the same economic and social situation.

Background of the Study

In order to understand Qatar’s actions, it is important to understand the current situation of Qatar and what its current domestic and foreign policy goals are. The primary domestic policy goal of Qatar focuses on creating a strong and resilient economy through investments in industries, infrastructure development, education and the creation of sustainable local environment. This vision is heavily influenced by the Dubai model which can be described as an economic model that focuses on the creation of a thriving local economy from almost nothing through the use of oil revenue as the primary means of encouraging growth and development in various sectors of the region. Basically, the Dubai model operates under the premise that by creating the right conditions, the Qatar can become a business hub that would attract foreign corporations and investments thus resulting in a better local economy. The supposed “end result” of such an endeavor would transform Qatar into a popular destination for tourism and business which would enable the local economy to survive after the region’s oil wealth has dried up.

It is due to this that the plan of Qatar as is to develop a means of economic diversification through a long term transformation of the economy from one that is predominantly oil-based to one that focuses on tourism, oil independence and knowledge based industries. It should be noted though that while sustainable tourism can be implemented through the implementation of new local strategies, a sustainable culture within the context of the oil dependent city of Qatar is an entirely different story. What you have to understand is that oil wealth is so ingrained within the current culture of Qatar that its absence would undoubtedly cause a cultural collapse. This is due to oil being the means by which local citizens experience substantial government benefits in the form of reduced prices for utilities. The continued depletion of Qatar’s oil reserves is a definite issue for the continued sustainability of the local culture and, as such, new methods of independence from oil need to be established.

In the case of the Qatar “vision”, this is accomplished by utilizing oil revenue as a means of creating conditions such as free trade zones, no corporate taxes (since the government derives its revenue from oil resources) and the creation of numerous ports to facilitate the import and export of goods. Significant investments into state owned construction firms also facilitated the development of increasing amounts of infrastructure projects which further bolstered the local economy. The conditions created within Qatar would result in more foreign workers and corporations looking for opportunities in the region which lead to the development of the UAE into a trading, tourism and I.T. hub for the region.

Description of Research Methods

The aim of this thesis paper is to discuss how Qatar has managed to use sports, culture, and art as tools to exert soft power in an effort to strengthen its influence on global politics. To complete the paper, the writer has relied on reviewing the available literature. The paper contains a review of literature from various sources, such as books, journals, and web documents. Government documents have also been used in the research. The research focuses on Qatar. As such, all source used in the paper are either directly or indirectly linked to the country (Pattison 34). Those sources that are found to have any relation to the country are left out.

The researcher has highly depended on the internet as the source of information for the research. The decision by the researcher to use the internet to source information was informed by the fact the internet provides vast resources (QTA 16). Internet sources are also more accessible since they are available for all. The cost of using internet sources for research is also considerably low. However, the writer of the paper does not fail to acknowledge the fact that credibility of the internet sources is often questionable. The reason behind this is that everyone has the opportunity to publish their work in the internet. Care should therefore be taken in the selection of the sources to be used for research especially when it involves writing of academic papers.

To obtain the articles, journals, and books required for the research from the internet, the researcher use well formulated search terms. The search terms are specific to the various aspects being covered in the paper. No specific search engine is to be used in the research. In the event that the researcher is not able to come up with the desired resources following the use of a particular search term, the search term was refined and made more specific to the issue being addressed in that particular section of the paper.

To guide the process of selecting suitable sources, the writer of the paper designed a number of criteria to be used for vetting the resources to be used in the research. A number of inclusion and exclusion criteria were used in the review of the available literature. The criteria for inclusion required that all the sources to be used in the research were related to Qatar. The reason behind this is that the research dwells on the country. The sources were also required to be relevant to the study. As such, each of the sources used must have been viewed to have helped the researcher tackle a certain aspect of the paper. The inclusion criteria also required that the sources used to be current. However, it is important to note that the thesis paper sought to address issues from different timelines.

The researcher also used a number of exclusion criteria to vet the sources to be used in the thesis paper. To begin with, sources that were viewed to address the aspects of the paper but were unrelated to Qatar were excluded. Sources that were viewed to be irrelevant to the different aspects to be addressed in the research were also left out. The exclusion criteria also required that sources that were considered to be out of date be excluded from the research. Any two or more sources that were viewed to be of conflicting views were also left out.

Literature Review

This section seeks to define the concept of soft power, its application and the potential manifestations of its use within the state of Qatar. It is expected that through a thorough investigation of the application of soft power, this section should be able to showcase why Qatar chose this method, the potential international relations strategies it will implement with soft power at its core and what can be expected from Qatar in the future. The keywords that will be utilized will consist of: co-opt, coerce, persuasion.

Background of the Study

Today, Qatar is changing significantly. It is no longer the traditional monarchical country it was in the past. It is now a modern nation. The transition has been characterized by the government allowing the people to enjoy a greater deal of human rights than was the case in the past (Ehteshami and Wright 924). In Qatar today, government agencies are rapidly transforming. They strive to address the social needs of the people. The country leadership is achieving these by putting in place the necessary infrastructure to promote the welfare of the people. The people of Qatar today enjoy some of the best working conditions in the world today. The government has also set up social amenities across the country to ensure that the citizens get to enjoy better social services (Dorsey 4). Sports are viewed as one of the strategies used by the government of Qatar to promote to improve on the welfare of its citizens. The people of Qatar are known to be great football and handball fans.

The government seeks to support these sports by supporting both local and international teams through funding. As a result, the country’s citizens are in a position to realize their dreams in relation to sports. In this case, those who aspire to engage in sports are able to do so with relative ease since the government has created an enabling environment. Fans of the spot are also in better position to enjoy sporting activity that is of a better quality as a result of the government’s heavy investment on the sector.

The government of Qatar under the leadership of the Emir has also has been able to achieve a lot of economic development. Prior to the Hamad bin Khalifa Al Thani’s rule, Qatar was barely recognized across the world despite it having vast natural resources. Despite the small size of the country, it has an estimated 15 percent of the total world’s natural gas reserves. The Emir, Hamad bin Khalifa Al Thani however oversaw the rise of Qatar to the ranks of one of the richest and most influential countries in the world today (Abadi 19). Today, the country’s population enjoys the benefits of the extraction of natural gas at a much greater level compared to the past. Under the leadership of Hamad bin Khalifa Al Thani, Qatar was in 2012 named as the world’s wealthiest country. The Emir also sought to ensure that the country’s well is distributed among its citizens. The country also has the highest per capita in the world with its population enjoying an income of 100,000 US Dollars. The increase in the wealth of the country has helped improve the quality of life of the citizens.

The wealth generated by the country following the mining and sales of the natural gas also goes into improving the welfare of the country’s population. Under the rule of Hamad bin Khalifa Al Thani, the country invested a total of 85 Billion US Dollars for the purpose of stimulating economic growth. The money is used for the funding the country’s developmental projects, such as the acquisition of property across the globe (Beaumont 3). The property in turn generates the country more revenue and is seen as a strategy to ensure continued growth even in the future. The Qatar Foundation, which is also one of the many investment plans by the government, has also seen the country acquire property in foreign territories. The foundation has also helped in the funding of developmental projects in other developing countries across the world. Through the foundation, the government of Qatar has been able to exert a great influence on the rest of the world. For example, funding of sporting activities and individual teams across the world has seen the country receive international recognition especially from fans and sport lovers (The International Relations of the Persian Gulf 4).

What is Soft Power and how is it Applied?

At its core, soft power can be defined as a strategy that “co-opts” instead of coerces organizations, people or even states towards a particular end goal as defined by the state implementing soft power strategies. Basically, it is a means of influencing the opinion of the general public, organizations or other such entities regarding their views on a particular concept, country or set of policies. This is done not through force, rather, through direct or indirect methods of persuasion that focus on how people view what is being presented (Moore 3). Before proceeding, it is important to first differentiate soft power from hard power in order to get an overview regarding the process of persuasion that is commonly attributed to soft power strategies. Hard power on the other hand utilizes a country’s economic capacity or military force in order to assert control and influence the behavior of other countries in the international arena. It can be considered as an overt imposition of influence of one state over another due to innate differences in economic and military might. This strategy has its basis on the theory of realism which has the following assumptions:

- The international system is anarchic.

- There is no authority above states capable of regulating their interactions.

- States are individualistic in that they prefer to decide on their relationships with other states on their own rather than having those decisions dictated by an outside entity. Hence, the fact that states are considered the primary actors in international relations with no other entity (aside from a stronger state) being capable of dictating their actions.

- States mold the system using statecraft.

According to the realist perspective, sovereign states are the primary actors in international relations, and, as such, are the main movers in the international system

Based on these assumptions, it can be interpreted that the application of influence through hard power is due to the individualistic nature of states wherein power is the focal point behind state interactions in the international arena (Dorsey 4). Powerful states would thus dominate the international scene with weaker states being subservient to their will. Such a relationship can actually be seen in the case of the U.S., Russia and China wherein by virtue of their economic and military might, they assert their influence on their neighbors in order to achieve their individual goals. Examples of this can be seen in the interaction between the U.S. and Mexico regarding trade and regional migration, the interaction of Russia and Ukraine wherein Russia is actively trying to control the activities of its neighboring country that used to be part of the U.S.S.R while in the case of China it has attempted to increase its sphere of influence in the region through expansion into contested international waters utilizing its military and economic might to discourage active resistance from weaker countries such as the Philippines, Vietnam and Thailand. Thus, from the realist perspective, the application of hard power strategies is merely the manifestation of another aspect of realism which explains that states are considered rational unitary actors with all of them pursuing actions both internationally and domestically for the sake of their national interest. The use of hard power is merely the way in which states pursue an overt means of pursuing their national interest through the use of economic and military might as tools to get what they want. What must be understood is that despite regularly engaging in situations of necessary international cooperation (i.e. trade, bi-lateral treaties, multilateral agreements, etc.); states continue to strategize in order to maintain their national advantages.

Larger and richer nations perceive this move as one that increases their advantage while less power and smaller states accept being seen and treated as trivial characters on the international scene. One of the base principles of the realist theory explains that for each state, national interest becomes the overriding facilitator of decision making because of the necessity of national security and survival. As such, in pursuit of national security, states strive to amass resources, whether economic, military, or political, in order to ensure the survival of the state. This is one of the reasons why states even apply hard or soft power strategies in the first place, countries do not exist within a void and with the increasing interconnection of states due to globalization, this has resulted in the need to apply an assortment of methods in order to acquire “power” in the form of resources, trade agreements and economic might in order to ensure the continued existence of the state. Taking this concept into consideration, this creates the question of what happens when a state does not have economic or military might.

Soft Power and Qatar

Since this paper primarily deals with the application of soft power by Qatar, this section will focus on the use of soft power from the perspective of the resources and capabilities of Qatar as a state and its possible impact on the international arena. First and foremost, it is important to note that while Qatar has a considerable amount of natural resource wealth, this does not immediately equate into making the country into a powerful state. There is the issue of its population which consists of roughly 278,000 local citizens with 1.5 million foreign workers (the Middle East is heavily dependent on foreign labor). This makes the country “population poor” so to speak when compared to countries such as the U.S. which has 275 million citizens or China which has 1.5 billion citizens. While Qatar does have a high average income per capita ($96,903 which is ranked as being one of the highest in the world), the fact remains that its total GDP reached only $214 billion which is a fraction of the GDP of countries such as the U.S. which reached $15 trillion per year or China at $13 trillion. This shows that while Qatar has a relatively high income rate for its local citizens, the overall economic capabilities of the country is rather low.

The reason behind this is connected to the dependence of the country on its oil and natural gas wealth and the lack of investments into developing its own industrial manufacturing base. Simply put, the country has nowhere near the same industrial capability as compared to China or the U.S. since it lacks sufficient local manpower and factories. While it is true that the country is able to assert some level of international influence as a supplier of oil and natural gas, the fact remains that it is a small player in international markets when comparing it to Russia, the U.S. and various members of OPEC that combine oil and gas production with extensive local industries to support their respective economies. Combined with its relatively small population, Qatar simply cannot exert any significant form of military or economic influence at the same scale as that of the U.S. or other large states.

This helps to prove the assertions involved in the realist theory regarding the application of hard power wherein smaller states are relegated into “secondary positions” when it comes to the realm of international relations simply due to the fact that they cannot exert the same level of power and influence as larger states when it comes to the “traditional” exercise of power that is represented by hard power methodologies. It is due to this that the application of soft power tactics becomes the only viable route that Qatar can implement in order to pursue its own domestic and international agendas with regard to the continued preservation of the state as well as its own internal development. The reason behind this is due to the fact that soft power methodologies focus on an “indirect” method of influence wherein the persuasive aspect of the application of power is not done through coercive force, rather, it is through people, governments or organizations simply “liking you” for lack of a better term.

Methods of Soft Power Application

It is important to note that the application of soft power focuses on 3 distinct factors, namely: culture, political values and the foreign policies enacted by a country. Starting with the concept of foreign policies, this aspect of soft power focuses on the way other states perceive how one state interacts with other states. Interaction when it comes to international relations is often based on the process of reciprocity (i.e. I do – you do, I do not – you do not) which is a simplified yet accurate way of describing the various bi-lateral and multilateral agreements that countries enter into whether informally or through the application of treaties. As such, the way in which a state is perceived by other countries is often a crucial factor when it comes to how they interact and come to an agreement when it comes to a wide range of possible issues. One extreme example that can help to clarify this concept in action can be seen in the case of North Korea and the way in which it interacts with its neighbors.

News channels such as CNN, BBC and Al Jazeera are rife with a various news stories that depict North Korea as being a belligerent rogue state that continues to threaten its neighbors via declaring the intent to utilize nuclear weapons, has a deplorable human rights record and for all intents and purposes is considered as being the equivalent of a prison state (Gause 7). It is based on this assessment that various countries, organizations and even people are often reluctant, if not outright unwilling, to enter into any form of cooperative agreement with North Korea. What must be understood is that North Korea’s foreign policy initiatives focuses on keeping international influences at bay due to the government’s fear that if sufficient levels of foreign ideology were to enter into the country, this could potentially compromise the stranglehold that the government has over its populace. The end result is that North Korea tries whatever it can to keep other countries from interfering in its domestic agendas and does so by threatening other states with acts of war. This shows how foreign policy initiatives can have a definite impact on the way in which other states view a country and influences the way in which that state can interact with its peers in the international arena (Hey 7(a)).

On the other end of the spectrum, countries such as Canada which focuses its foreign policy initiatives on peaceful coexistence and providing international aid during emergencies (i.e. natural disasters) has resulted in the country being looked upon favorably by other states and, as such, this influences the “weight” so to speak of its influence when it comes to bi-lateral and multilateral agreements and other forms of cooperative behavior with other states. However, it should be noted that through its very nature as an “indirect” method of persuasions, foreign policy initiatives that are centered on soft power cannot directly influence the way in which other states will act (Bremmer 9). For instance, a state that is implementing this sort of strategy cannot expect other states to go along with its plans simply by requesting them to do so. Such a strategy only works through hard power methodologies wherein the direct application of force or the threat of the use of force is often enough to convince states to align themselves with the interests of the more powerful state. In the case of foreign policy initiatives as a tool of soft power, a state would merely align itself along a particular path and utilize diplomacy to convince other states to go along the same path by virtue of their perception regarding that particular state (Nye 94 (a)).

One prime example of this in present day international relations can be seen in the establishment of the Kyoto Protocol by Japan that focused on reducing the amount of greenhouse gasses produced by industrialized and developing countries. Utilizing the generally positive view of other countries towards itself, Japan was able to formulize an international consensus from which it was able to benefit (i.e. reduced greenhouse gas emissions) (Hvidt 85). This shows how positive perception developed through foreign policy initiatives can help a state in fulfilling its domestic and international agendas in a roundabout way. However, it should be noted that this method has no absolute guarantee of success since a state would merely be persuading other states by virtue of its projected character (i.e. foreign policy) and, as such, there is always the possibility that the states in question would simply refuse.

Another of the resources associated with soft power comes in the form of a country’s inherent culture and the way in which it is perceived by other states, organizations or even people (Ottaway 32). Culture, in the methodology of soft power dynamics, frames the perception of external actors regarding a particular state and influences the way in which interactions are formulated, developed and then subsequently implemented. For instance, within the past two decades, Qatar has attempted to emulate the success of regional neighbors (i.e. Abu Dhabi and Dubai) when it comes to developing itself as a “hot spot” so to speak for tourism, trade and business development. One of the reasons behind the success of Dubai can be attributed to the way in which it has reformulated its internal culture to be more accepting of western ideas and standards. For instance, one of the most prevalent notions associated with the Middle East has been its extremely conservative nature when it comes to the treatment of women. This comes in the form of limitations in the way they dress, their local rights as well as an assortment of distinctly misogynistic laws focused on ensuring the dominant nature of the local patriarchal society.

However, such an internal culture was frowned upon by the international community due to its current orientation towards the development of equal rights for both men and women. It is due to this perspective that Dubai re-oriented its local culture to be more “internationalized” when it comes to its treatment of women as well as other aspects of its conservative society (Brumberg 56). The end result was a distinct liberalization of the local culture which created a “boom” so to speak in the adoption of western trends in fashion, ideas and even foreign culture. This created a cultural backdrop that made Dubai more appealing to western countries resulting in more international companies coming into Dubai in order to setup their offices or to engage in regional/international trade (King 1). On the other end of the spectrum, countries such as Saudi Arabia which continue to espouse the same conservative culture that most people associate with the Middle East finds itself lacking when it comes to foreign direct investments as well as the entry of foreign firms into its domestic market (Looney 21). Currently, more than 90% of Saudi Arabia’s GDP is dominated by the oil industry with 8 to 9 percent originating from its local industries.

This is due to a distinct lack of sufficient local industrialization as well as the absence of international firms that would bring in new manufacturing processes into the culture. The overall lack of entry is attributed to the negative perception that other states and organizations have towards the culture within the country which they view as being overly conservative, especially when it comes to its treatment of women. The difference in the situations between Dubai and Saudi Arabia shows how the external perception of a state’s culture can impact its relationship with other states, organizations or even groups of people (Kamrava 57). If external actors were to view the cultural aspects of a state in a more positive light, the more likely they are of engaging in trade agreements, cultural exchange and other positive benefits. This highlights the importance of culture when it comes to the soft power methodology and shows how changes to a state’s internal cultural (as seen in the case of Dubai) can yield significant gains (Joseit 1). From such an assertion it can be assumed that since Qatar is attempting to emulate the success of Dubai and avoid the issues found in Saudi Arabia, it is likely that it would attempt some means of making its local culture “more acceptable” so to speak to the members of the international community. This aspect will be focused on in the findings and analysis section of this paper which will delve into the current activities of Qatar and determine how they are in line with the soft power strategies that have been mentioned so far.

The last tool of soft power that will be examined in this section involves the concept of political values and how it is connected to the relationships between states. One of the most poignant examples of the importance of political values can be seen in the case of the U.S. and U.S.S.R when it came to their respective political orientations (i.e. Democracy versus Communism) (Fukuyama 31). Their difference in opinion created a considerable level of tension which manifested itself in the form of the Cold War. This shows that political values does impact the way in which states interact with one another since states that have opposing political views are more often than not going to come into conflict with one another. In the case of Qatar, the findings and analysis section will attempt to determine what changes the government may have implemented in order to make its political values more in line with an orientation that would encourage good relations instead of adverse interactions.

Direct Application of Soft power

When it comes to the application of soft power, there are a variety of direct and indirect methods in which this can be accomplished. While this definition may seem strange given the earlier assertion that soft power is an indirect means of influencing the actions of other states, there are differences in which soft power as a method of influence can be implemented while still holding true to its original definition. One of the more obvious examples of this in action comes in the form of government assistance programs to other countries or specific organizations (QTA 3). These programs show a “positive side” to a country’s internal and external policy initiatives and are meant to create a good impression on the party, organization or state that it is offered to. Examples of this can be seen in the various assistance programs that the U.S. gives out to countries that have been adversely affected by natural disasters as well as the Erasmus Mundus scholarship offered by the E.U. to graduate students from third world countries. The direct application of economic soft power in this instance is decidedly different from its hard power counter (Hey 9 (b)).

The assertion of economic force through hard power can be seen through trade embargos, product restrictions or even economic isolation which a powerful state such as the U.S. can do by virtue of the size of its economy and its level of influence in various global markets. Economic soft power is far more subtle and focuses more on small scale initiatives that create a positive impression (i.e. financial assistance during disasters, scholarships for poor students, etc.) (Grix 299). It is a strategy that is well suited for countries such as Qatar since, by virtue of the size of its economy, it cannot reasonably attempt any form of hard power strategy on the same scale as countries such as U.S. or regional blocks like the E.U.

Indirect Application of Soft power

Aside from the direct application of soft power, there are also indirect methods which often manifest through the “investments” into cultural appeal. One of the most widely known examples of this can be seen in the internationalization of Japan’s culture. Aspects of such a culture in the form of food, anime and manga as well as cultural exchange programs with various countries such as Canada has resulted in many people viewing Japan in a positive light. Investments in culture are not limited to mere cultural exchange programs but can also encompass aspects related to cultural promotion through museums, performances and various travelling exhibits (Kechichian 5). For instance, China has actively been utilizing soft power strategies through the use of its travelling “circus” of acrobats, martial artists and gymnasts whose performances in various global venues draw considerable audiences (van Ham 3). In the case of Japan, the internationalization of its “anime culture” has created a literal explosion of interest in the country as seen in the millions of anime and manga fans in the U.S., France and various other countries.

Investments into the promotion of local cultural on the international scene can be tied to the concept of “perspectives” wherein the more people like the culture of a country that they are being presented with, the more likely they are to have a positive view regarding that state and, as a result, this can manifest into positive ramification (Hinnebusch 6). For instance, the promotion of Japan’s anime and manga culture as well as aspects related to its unique native foods and cultural nuances is primarily responsible for the sheer amount of international tourists that visit the country on a yearly basis. This application of soft power through culture is similar to how Paris has promoted itself as “the city of love” (Johnston 2). Aside from this, other aspects of investments in culture resulting in positive perspectives regarding a country can also be seen in the case of museums, investments into the preservation and popularization of ancient architecture as well as the promotion of art and culture sites. Locations such as the National Museum of Natural History in the U.S., the Louvre in France and the Parthenon in Greece act not only as sites that encourage tourism to a country but can be considered as a means of soft power due to the positive perspective they create regarding a particular location (Toumi 1).

It should even be noted that soft power through culture is not entirely dependent on pre-existing sites or cultural artifacts but can actually be created in order to boost the positive perspective that people would associate with a certain region or town. One prime example of this is the Cannes Film Festival which was initially developed through government assistance programs in the development of local cultural initiatives and has since developed into a widely popular tourist event drawing thousands of people and a variety of different actors and actresses (Yom 74). This shows how culture can be utilized as an indirect method of gaining soft power since it increases the knowledge people have of a certain location, their willingness to associate it with something positive which usually translates into positive interactions with not only the local populace but with the local government as well (Panero 21). Another interesting aspect related to this is connected to the boost in tourism that is also associated with the successful application of this soft power strategy which translates into considerable boost for the local economy. Do note though that one of the inherent problems with the methods of direct and indirect soft power application that have been mentioned so far is that unlike hard power strategies, there is no absolute guarantee of success (Katz 38).

While it is true that not all hard power strategies are successful, as seen in the case of the Vietnam War and the continued existence of North Korea as a rogue state, the fact remains that its application does come with a modicum of success when it comes to the intended outcome (Blatt 34). For instance, a more powerful country would utilize hard power in the form of exerting its economic strength over a weaker country in order to get the trade concessions that it wants. Thus, the application of power in this case has the possibility of enacting an intended outcome as per the theory of realism and the anarchic nature of states wherein weaker states are often considered “subservient” to the actions of stronger states. However, in the case of soft power strategies, the application of power in this case in order to reach an intended outcome has absolutely no guarantee of success (Henderson 2). For example, a country would apply methods of cultural appeal to one state in the form of a travelling museum or circus performances; it may render financial or medical assistance during periods of calamity and it could offer and assortment of scholarship programs to poor students in that state, yet, despite all these overtures, the application of soft power does not have the same type of “force” needed in order to enact a direct outcome (Transparency International, Corruption Perception Index 1).

Qatar could implement the soft power strategies it just mentioned in order to gain some form of trade relation with the Philippines for instance, however, the decision to actually go through with it is still up to the state that is being approached. The application of soft power strategies merely makes other states more willing to deal with and associate with the state implementing such a strategy but it is in no way an absolute guarantee towards the implementation of a country’s goals (Amara 1). Soft power merely makes other states more amenable and willing to cooperate with the requests of another state. As such, this shows the inherent limits associated with soft power strategies and will be utilized to evaluate the FIFA World Cup 2022 that will be held in Qatar, the various sponsorships that the state is currently pursuing (i.e. football teams) as well as the cultural events that the state is currently implementing. It is expected that through this evaluation, the success of Qatar’s current endeavors can be properly assessed.

Summary

Based on what has been presented in this section, this helps to set the tone in the findings and analysis section when it comes to understanding why Qatar is acting the way it does. Simply put, soft power is the most viable method that it can implement when it comes to its domestic policy agenda of developing its local economy to be independent from oil. As such, its foreign policy would focus on enhancing its relations with other states, improving the way in which people and organizations viewed Qatar and ensuring a level of prominence that is ascribed to the country by virtue of cultural investments (i.e. museums or cultural attractions) in order to create significant demand towards regional and international tourists visiting the country. It is with this in mind that the next section will investigate these aspects and examine the soft power strategies that Qatar has chosen to achieve its foreign policy objectives.

Findings and Analysis

Sports Diplomacy

Any major sporting event whether it comes in the form of the Olympics, the World Cup or a variety of other events has the advantage of creating substantial economic activity within the country it is hosted in. This is due to the sheer amount of visitors such events draw as well as the greater degree of exposure of the country which results in better prospects for tourism in the near future (Cornelissen 482). From a soft power perspective, sports diplomacy is a form of direct application of power due to the amount of money invested into what can be described as a government program whose aim is to increase the prestige of the country via a sporting event and this make it better known in the international arena (FIFA 1). One particularly prominent example of this particular policy in action can be seen in the case of Brazil and South Africa whose respective states, despite having considerable economic problems, have some of the best soccer teams and soccer stadiums in the world which has resulted in both countries gaining fame as well as tourists (Barany 6). The application of sports diplomacy as a soft power strategy centers on the concepts of prominence and financial gain.

Prominence, Sports Diplomacy and Soft Power

Prominence in the realm of soft power is connected to perception which, as explained in the literature review section of this paper, is an important aspect in the soft power methodology since it directly influences how states, organizations and even individuals would be willing to deal with a state (Fromherz 7). What must be understood is that while the theory of realism explains that states are the primary actors in international relations, there are also other actors in the field who are just as important to states when it comes to fulfilling the goals of their internal and external policies. This can be seen in the example of Dubai and its focus on developing itself into a trade and tourism hub. Aside from investing into sports diplomacy in the form of its various venues for sporting events, Dubai has invested considerably in enhancing its reputation as a “playground” so to speak for tourists looking to experience unprecedented levels of luxury, comfort and excitement.

This is in line with its domestic policy goals of not being dependent on its oil wealth due to the finite nature of the consumer product (Crystal 6). Thus, by establishing Dubai as a tourist attraction as well as hub for trade and investment, this creates a certain level of prominence which affects the relationship that it would have with other states, countries and organizations (Herb 7). Dubai places a considerable emphasis on its relationship with consumers and business groups since the state acknowledges the fact that these two groups are likely to contribute towards the continued prosperity of the city (Kamrava 8 (b)). A similar strategy is at play in the case of Qatar as seen through its extensive investments into infrastructure development, however, one of the main problems that both Qatar and Dubai are experiencing is the fact that while there has been extensive investments into real estate development, the needed industrial infrastructure that should be in place in order to ensure economic prosperity once the oil “dries up” so to speak is still largely absent. Since governments focus on ensuring the continued survival of the state and the main economic resource that Qatar relies on is finite, the primary goal of the country would be to develop some means of addressing the issue (Antwi-Boateng 42).

This is where the concept of “prominence” enters into the picture through the soft power tool of sports diplomacy. In order to attract foreign direct investments into the country as well as bring about some form of industrialization, it would be necessary to make Qatar more appealing to foreign investors (The Guardian 1). This where the application of soft power utilizing sports culture as a tool enters into the picture wherein Qatar is actively trying to garner more international attention since it cannot utilize hard power strategies in order ensure the survival of the state. However, while the utilization of soft power through sports diplomacy is a unique and arguably effective approach, as seen in the case of Brazil and South Africa, the methods currently being utilized by Qatar must be assessed when it comes to their overall effectiveness (Berrebi 421). The benefits accrued through sports diplomacy must last and should not be a onetime occurrence. There must be consistent returns on investment for it to be considered viable.

Financial Gain, Sports Diplomacy and Soft Power

Countries simply do not invest in sports diplomacy simply because they are soccer fans. There must be an underlying benefit that creates a positive result for the state in order for the investment to be justifiable since states are all subject to the fact that the amount of money that they can spend is finite in quantity and that their governments are ultimately held liable by the general public for the type of spending that occurs (Ulrichsen 1). It is due to this that as a direct method of soft power application, the general focus of sports diplomacy is the exchange of money for prominence (Kaufmann 12). Financial gain in this case comes in the form of that prominence directly benefiting the economic goals of a country. Prominence, as an application of soft power, helps to influence the perspective people, organizations and other states towards having a positive outlook regarding a particular country which enables a country to gain the necessary reputation to bring in economic benefits (Kamrava 540 (a)). This often comes in the form of tourism, foreign direct investments and other similar instances wherein by viewing the country in a positive light, investors and tourists inevitably go there (Worth 7).

This was mentioned in the literature review regarding the differences between Saudi Arabia and Dubai and shows how the concept of “perspectives” influences the economic success of a state. Taking all these factors into consideration, it can thus be assumed that sports diplomacy can be considered as a form of “advertising” that is meant to generate awareness regarding a particular country (Hudson 3). In the case of Qatar and its recent attempts at implementing such a strategy, there are three instances that standout and showcase the use of soft power through sports diplomacy in order to improve bi-lateral relations while at the same time creating a positive perspective for people regarding the country of Qatar and the Qatari brand. These instances will be discussed in the next section that delves into the sports diplomacy of Qatar and its implementation through sponsorships or direct ownerships of sporting teams.

Sports Diplomacy, Soft Power and Advertising

Utilizing the theory of rational behavior that assumes all states will act rationally towards a particular goal, it can be stated that the use of sports diplomacy by countries will of course attempt to present the product (i.e. themselves) that they are “selling” in the best possible light (Peterson 5). While there are numerous methods of doing this such as traditional print ads or modern viral marketing campaigns, as evidenced by the “Its more fun in the Philippines campaign or the “Malaysia truly Asia” advertisements, some countries opt to take the route of utilizing state funded sponsorships as a method of advertising their country (North and Weingast 803). This often takes the form of having some popular actor, actress or athlete showcase either their support for the product or their use of it in order to entice people to buy the product themselves. In the case of Qatar, this takes the form of its sponsorship of Barcelona F.C (Spain).

The sponsorship of this team allows Qatar to be presented in a positive light to millions of fans as this team has the world’s largest fan base. The application of soft power in this case comes in the form of the indirect method of power application that focuses on developing the awareness of the general public regarding Qatar and the Qatari brand (Rabi 58). One example of this can be seen in the case of the Qatar logo being placed on the jerseys of the team as well as promotional aspects related to Qatar Airlines. The logic behind this particular method of advertising stems from the fact that people are more likely to purchase a product or utilize a particular service if they see someone else happily using it, studies even show that the likelihood of product patronage goes up astronomically if it is seen that a pop culture icon is utilizing a particular type of product (Korany, Dessouki and Hillal 11). This speaks volumes of the influence of pop culture on consumer buying behavior as well as consumer choice. From a soft power perspective, the use of sponsorships for sports teams is a way in which a country can “get its name out there” so to speak and create a certain level of familiarity (Losman 4). For countries like Qatar whose foreign policy goals are oriented towards ensuring the independence of the state from oil and gas and a greater focus on industrial development, garnering attention for the country in order to generate more interest from foreign firms is an absolute necessity and helps to explain its actions when it comes to sponsoring sports teams like Barcelona F.C.

Aside from sponsoring a team, there is also the instance where Qatar has actually purchased a soccer team as seen in the case of its ownership of Paris Saint-Germain “PSG” (France). The ownership of this team displays Qatar’s soft power as it serves as an entry point into the French culture and international French speakers/audiences. To understanding the reasons behind the purchase, it is important to analyze it from the perspective of a soft power methodology as well as a public relations perspective in relation to pop culture and its influence on the general population (Brannagan and Giulianotti 23). Various forms of consumable media in the form of print ads, billboards, commercials, online marketing campaigns and a plethora of other types of advertising initiatives are rife with the images of various popular individuals showing just how prevalent product endorsements are in the advertising campaigns of numerous companies (Global Integrity Report 3). Of particular interest is the concept of sports marketing and how consumer patronage of particular sports brands are affected by the relationship between sponsorships and advertisements. Sports marketing can be defined as “the activities of consumer and industrial product and service marketers who are increasingly using sport as a promotional vehicle”. In other words, there has been an ongoing and increasingly expanding trend where countries utilize sports as a manner in which they promote their country (Cordesmann 31).

What must be understood is that through the dynamics of public interest in pop culture that extends into the realm of sports, people become increasingly fascinated with various sports stars to such an extent that they attempt to emulate them in every way possible (Herb 41). These results in them buying sports jerseys in the same style and color as their favorite athlete, buy products which that particular athlete uses and even drink the same type of drink they see an athlete drinking (Evans and Grant 4). All of this conforms with the inherent notion that if a particular athlete is using it then it must be good (El-Nawawy and Iskander 12). Companies exploit this by utilizing sponsorships in the form of endorsement deals by having certain athletes always and only use their particular brand. Notable examples of this can be seen through athletes such as Michael Jordan and his endorsement deal with Nike which led up to the creation of the Air Jordan sneaker brand, Manny Pacquiao and his varied endorsement deals with Nike and Gillette and lastly Tiger Words and his association with nearly hundreds of brands the most notable of which was Nike (Norris 2). The result of these endorsements has been to bring the branding and knowledge of the product beyond what can be seen in advertisements and print ads lending it an extra sense of credibility since audiences always see their favorite athletes utilizing that particular brand (Nauright 1325).

When it comes to the application of soft power and sports diplomacy, it is the level of association between a particular sporting celebrity and the sponsor that creates the positive correlation that the state applying soft power tactics is after. As mentioned in the literature review, soft power is inherently connected to the concept of perception and, as such, brand correlation through a sports celebrity does create the level of association that would be considered as beneficial. In the case of PSG, the brand association is not limited to a single sports star; rather, it applies to the team as a whole (Khatib 417). The purchase of a French soccer team in this instance is done not only because of sports diplomacy (i.e. developing a better relationship between Qatar and France), rather, it is also connected to the concept of brand development wherein the “brand” in this particular case is embodied by the Qatar logo and other associated symbols that can be linked to Qatar. Every time the team plays, the various logos of Qatar placed on their jersey are seen by the audience which inevitably creates a connection between the team and the brand being depicted. It is due to this that a level of positive association is created which aids significantly in building up the Qatari brand.

What this example shows is that sports diplomacy in the form of sponsorships and team ownership can be utilized as a form of cultural soft power yet in this case the focus is not on the inherent culture of the country itself, rather, it focuses on the sporting culture that is being focused upon (i.e. soccer) and utilizing in order to create a better global perception regarding Qatar as a whole (Fandy 13). Basically, the ownership of PSG is done as a means of advertising the existence of Qatar and bring greater attention to the country which could result in long term economic gains in the form of foreign direct investments, tourism as well as an assortment of other possible benefits (Ministry of Foreign Affairs 2). Before proceeding, another factor that should be noted is that investing in the sports teams of other countries can also be considered as a form of indirect soft power implementation since it creates better relations between the two states. This particular aspect will be delved into in the next section involving the sponsorship of Qatar in an Arab soccer team (Beaumont 3).

One of the more interesting sponsorships that Qatar has entered into involves the AlAhli (Saudi Arabia) soccer team. What makes this compelling to examine from a soft power methodology point of view is that this is the only Arab team Qatar is sponsoring and the fact that it is a Saudi Arabian team makes it interesting as Saudi and Qatar have a strenuous relationship with many ups and downs. To understand why Qatar is doing so, it is important to look at it from a direct soft power perspective wherein instead of a government assistance program helping another state; this takes the form of a sponsorship program (Pattison 1). For instance, if through the sponsor program AlAhli were to win several matches, this would creative positive national sentiment within Saudi Arabia which in turn would greatly benefit Qatar as well due to the association with the team. This would go a long way towards improving the strenuous relationship between the two countries.

Going back to the information presented in the literature review regarding the focus of soft power on developing the image of a country, it can be seen that the actions of Qatar when it comes to AlAhli is simply a manifestation of its desire to place itself in a better regional position. Conflict with a neighboring country would not aid in the slightest when it comes to improving the condition of the state, however, improving the relationship it has with its neighbors could result in trade agreements, higher amounts of tourists and other positive bi-lateral and multilateral benefits that come with pursuing such an action (Rathmell and Schulze 10). As such, when reviewing the domestic policies of Qatar when it comes to removing its dependence on oil with issues related to foreign policy objectives of establishing itself as a hub for tourism and trade like Dubai, it makes sense that Qatar would utilize the soft power strategy of sports diplomacy in order to improve its relations not only with its regional neighbors but also with various countries that it perceives as being beneficial towards the long term goals of the country.

Issues with Qatar’s Strategy

When it comes to the application of soft power, it must be viable, must not result in negative connotations being associated with your country and above all can be backed with evidence that a state is oriented along the path that they are supposedly on. It is with this in mind that there are several issues regarding Qatar’s strategy involving sports diplomacy that should be taken into consideration (Zahlan 13). The first are allegations of employee abuse stemming from various construction workers stating that they are under paid, overworked and are subject to deplorable living conditions. Aside from this are issues related to the corruption allegations from contractors hired to finish the stadiums and buildings where guests would be staying for the FIFA World Cup 2020. The inherent problem with the issues that have just been mentioned is that they take away from how Qatar is presenting itself to the international community. Since soft power is heavily dependent on how a state is perceived, allegations of corruption and worker abuse would significantly detract from the overall impression countries would have towards Qatar (Abadi 11).

However, it should also be noted that allegations involving corruption and worker abuse are actually quite common when it comes to the buildup surrounding sporting events and it is due to this that while the image of Qatar has been tarnished, it has not been significantly impacted to the extent that people would not attend the event (Nye 34 (b)). For instance, the build up to the Sochi Winter Olympics also had similar problems in the form of the annexation of Crimea by Russia as well as allegations involving corruption and worker abuse during the construction of the Olympic village however the event still went on without significant problems though there were a few boycotts done by athletes that were opposed to both the annexation of Crimea as well as the viewpoint of Russia regarding homosexuals. The next section will focus on factors relating to the viability of the event and whether or not it would actually be worth it from a soft power perspective given the significant levels of capital expenditure involved.

Examining Factors Related to the Local Economy

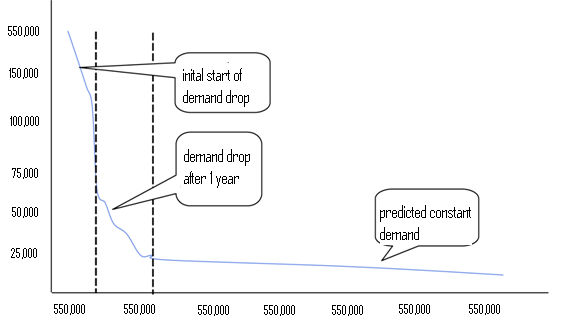

Ordinarily, hosting FIFA world Cup 2022 would not be a problem if there was sufficient local demand which offsets the costs involved in construction of new hotels, resorts, roads and stadiums for the expected 400,000 guests that will arrive (Zayani 42). However, when assessing the current situation of Qatar the obvious problem with its current investment into sports diplomacy lies in the fact that Qatar has a population of barely 1,800,000 people and, as such, local demand for the new infrastructure developments would be quite low after the 2022 World Cup (Alsharekh 32). One way of seeing this in action is through the supply and demand illustration in Figure 1.

It is assumed that at the start of 2022 World Cup the demand on Qatar’s infrastructure developments will be placed at 550,000 units (400,000 predicted foreign guests and 150,000 local visitors). The supply in this particular graph will be set at a constant 550,000 thousand estimated real estate units based on the possibility that Qatar will have sufficient infrastructure capabilities to match demand. At the beginning (meaning during the World Cup) there is a perfect equilibrium between demand and supply however after the World Cup the 400,000 thousand visitors will of course leave (The International Relations of the Persian Gulf 1). Unfortunately this leaves the 550,000 real estate units supply which are permanent fixtures within the local economy (DOHA 2012 2). While initially there is a certain degree of demand within the economy from local and foreign sources, the fact remains that the law of diminishing marginal utility states that eventually there will be a gain or loss from the continued consumption of a particular unit of supply and this takes the form of diminishing demand within the graph. However, do take into account that unlike other types of supply, real estate developments last much longer and are not exactly “consumed” in the traditional manner (i.e. hotel rooms, apartments for rent etc.) as such these remain constant.

From the graph it can be seen that there will be insufficient local and foreign demand to match the supply of real estate units created within Qatar and as a result this would cause considerable problems within the local economy immediately after the event (Nonneman 4). This takes the form of the sheer amount of leftover apartments that will not have sufficient local demand to actually meet the oversupply (Browne and Geiger 75). While it is true that the local government has stated that the remaining real estate units can be absorbed into the local economy due to the eventual increase in demand, history has proven that such a way of thinking is highly flawed. For instance, when examining the recently concluded Winter Olympics that were held in Sochi, Russia the various apartments and buildings that were constructed specifically for the event and were supposed to create a new resort town in the area have largely been abandoned (Gengler and Tessler 4). The same pattern can be seen in the various venues and real estate developments that have been oriented specifically towards sports diplomacy (i.e. the Olympics) in cases such as Greece, China, the U.S. and the U.K. wherein venues, apartment buildings and stadiums have largely gone unused after the event has been over. It is also important to point out that some of these countries where this aspect of soft power has been implemented have large industrial bases and have significant population levels; however, despite these advantages there is a constant trend in unused real estate (Atkinson 29).

Examining the Decision Making Process

When examining the bid of Qatar, it can be stated that this is the country’s attempt at presenting itself as a global destination for business and tourism. The problem with this though is the fact that Dubai, which is quite close to Qatar, has already attempted this strategy with billions poured into infrastructure development culmination in the creation of the Palm islands, the World Islands and the Burj Al Arab (Dargin 7). Since the strategy of Qatar is basically an emulation of what was done in Dubai, it is doubtful that it will be able to succeed given the fact that tourists could just go to Dubai which has a far more established reputation as compared to Qatar (Brannagan, In’utu and Wolff 1). Furthermore, as evidenced by other countries that have hosted sporting events such as the Olympics and other World Cups, the money poured into the development of event locations is often not profitable (Ehteshami and Wright 913). Based on the various arguments presented it can be seen that while the 2022 World Cup will bring substantial amounts of profit for various local businesses while it occurs it can be expected that after it is over the sheer amount of hyped up infrastructure development without sufficient localized demand can and will result in problems for Qatar’s economy in the near future.

Soft power through Arts and Culture

The concept of the application of soft power through arts and culture when it comes to Qatar and the development of a museum of Islamic Art is based once again on the concept of perception, however, in this case it is supplemented by the “importance” people ascribe to a particular location and how this influences their opinion. For instance, the Museum of Islamic Art (MIA) became operational in the first day of December 2008 (Field 21). The museum has been instrumental in enabling Qatar to use Culture and Art as a tool of soft power. The reason behind this is that Qatar through the help of MIA showcases a vast collection of artwork that is testament to the diversity, vitality, and complexity exhibited by art obtained from the Islamic world (Heritage Foundation 1). The Mathaf Museum, also commonly referred to as the Arab Museum of Modern Art is also a component of QM. The facility showcases a collection of contemporary and modern art obtained from Arab world.

It was opened in December 2010. This collection of art creates a certain level of “perceived cultural significance” wherein the mere location of a museum devoted to the art of an entire culture makes it important and creates the desire for people to ascribe a certain level of respect for the location (Kinninmont 5). The most obvious example of this in action can be seen in the case of the Louvre in Paris wherein its distinction as one of the greatest repositories of European art has resulted in a considerable level of fame and important being placed on not only the Louvre but on Paris since it is considered one of the cultural centers in the region (Agha 14). This of course has a considerable amount of benefits in the form of investors more willing to invest in a location that is well known which helps to ensure that the country continued to prosper due to foreign direct investments (O’Donnell 34). It is based on this that when examining the case of Qatar and its investment into a museum specifically for Islamic Art, it is obvious that they are attempting some form of cultural soft power in order to emulate the success of the Louvre and other similar cultural institutions in order to attract more people and investments into Qatar.

Other aspects of soft power in practice can be seen in the actions of Sheikha Mayassa, sister to the ruling Emir of Qatar. She has been instrumental in the purchases and acquisition of artworks displayed in most of Qatar’s museums. Through art QM plays a great role in promoting Qatar’s soft power. It achieves this through the presentation of Qatar as a progressive nation to the western world. Though this has been repeated several times already, it can clearly be seen that the actions of Sheikha Mayassa focuses on improving the overall impression that world has regarding Qatar when it comes to its place in the Middle East. By making the country into a cultural and sports center for the region, this makes it seem more viable for foreign direct investments from international firms as compared to a country that may have oil wealth but has little in the way of international fame or something that makes it stand out from other countries in the region (Rattling Governments and Redefining Modern Journalism 32).

On a relatively minor note are the various film festivals, cultural events and cultural villages that the Qatari government has created in order to enhance its cultural presence. While nowhere near the same level as the Cannes Film Festival or the various cultural events found in South East Asian countries like the Philippines, Thailand and Indonesia, they are a sufficient enough start towards the goal of the state towards developing its cultural significance to the point that it would attract more tourists to the country.

Understanding the Concept of Cultural Change

It should be noted though that with the development of Qatar into a more “open society” comes the issue of cultural change and how this may affect the state. What is being seen at the present in the case of the local Qatar cultural as a direct result of the influences of foreign visitors is a distinct modernization of the culture (ex: changes in clothing preferences, food preferences, etc). These changes are actually considered “worrisome” by the current department of cultural preservation within Qatar since it implies that the original local culture has declined to such an extent that it is barely a shadow of what it was in the past. However, what must be understood is that this cultural shift is a normal part of cultural development and it should be understood as such. For example, when examining the present day abaya weaving techniques employed by local artisans, many of them utilize techniques that incorporate modern day tools and machinery in order to produce the designs and weaving patterns seen in many of the shops in Qatar. Items such as glue, dyes and wax are used in present day weaving methods as opposed to the more traditional natural colors of the fibers utilized. Despite this, the abayas created by local artisans at the present can still be considered a reflection of the Qatari culture, however, instead of being a reflection of the local culture that existed hundreds of years ago it is more of a reflection of the Qatari culture as it is at the present which is an amalgam of modern and traditional aspects. This change does not detract from the culture as a whole; rather, it shows how cultures tend to reflect different aspects along distinct points in their individual life cycles.

Dynamic Development of Culture

It is based on this that that this paper has developed the notion that to consider culture as a static event that is isolated to particular periods of time is actually fallacious. Rather, what is known as culture to most people is actually a dynamic process that constantly changes over the years into different iterations. To a certain extent, it can be stated that the different cultural periods throughout history are nothing more than stages in a development cycle that never truly ends. It is based on this perspective that the cultural distinctions within Qatar at the present will very likely undergo even more changes in the coming years into something completely different to our present day experience of culture yet the society of this future iteration will still define themselves as Emiratis, Americans, Italians, British, and Germans.

Potential Impact of International Culture on Qatar

In the case of international culture, what occurs is a state of cultural imposition wherein local cultural predilection, values, behaviors even methods of speaking are imposed on a local populace resulting in a deterioration of the local culture. The effects of cultural imposition and cultural influences on local populations as a result of influences brought on not only by foreign worker influences but the manner in which local cultures change in order to be more “acceptable” in the eyes of the international community, radically changes the mannerisms that subsequent generations adopt within that society.

Taking this into consideration, it can be seen that the impact of international culture on Qatar can be likened to a type of cultural shift wherein through imposition and subsequent assimilation, old cultural behaviors, values, and various aspects unique to the Qatar’s culture are in effect repressed or removed in favor of the ideas, notions and cultural styling of the international community. Based on this, it is at times questioned whether internationalization and tourism truly benefit certain countries in that local cultures are subject to an international standard that may or may not be reflection of how their culture developed.

From a certain perspective, it can be seen that internationalization in effect helps cultures become more “in line” with the global perspective of how the world chooses to view them. Not only that, there is also the issue of advances in architecture and technology transfer that also occur as a result of culture sharing as seen in the case of architecture within Qatar which has begun to follow Western stylistic designs. On the other hand, the sheer cultural decay that happens does not seem to be quite as worth it as history has made it out to be. It is based on this that it can be seen that there are benefits accrued as a result of internationalization but such benefits are often clouded by the adverse cultural effects that international culture has on local areas and people.

Positive Impact of Foreign Workers on Tourism

It should be noted that despite all the negative ramifications that the influx of foreign workers has had on the cultural traditions of the UAE, this does not mean that have not been some significant social effects as well. One of the positive effects of having a diverse workforce is that it makes the region more acceptable in the eyes of tourists since the number of different workers from different countries would enable foreigners to speak to someone who comes from the same region as them. A greater number of tourists means higher income levels for local hotels, shops and other assorted businesses which in turn creates a considerable degree of prosperity. Festivals within the Philippines which are sponsored by local councils often bring tourists as far away as the U.S., Europe and Canada which creates a subsequent influx in tourism income to the various businesses located within that area.The reason this is being brought up is due to its potential to help Qatar rival the various tourism destinations such as Spain, Cyprus, Greece, Italy, Tunisia, Turkey, Croatia and Egypt.

Conclusion

When going over the case of Qatar and its application of soft power through the use of sports diplomacy and culture as a means of improving its “profile” so to speak in the international arena, this paper has shown that while the strategy does have a considerable level of merit, there are some issues that need to be taken into consideration. The first of these issues is connected to the cost associated with the construction of roads, stadiums, and apartment buildings for the FIFA 2020 World Cup. While it is true that some form of monetary investments are needed in the case of sports diplomacy, the fact remains that nearly $300 billion has been spent by Qatar in order to prepare itself for the world cup. The inherent problem with this focus is that while it would definitely prepare the country, there are still questions regarding the long term viability of the plan. Simply put, there is no guarantee that the constructed facilities will continue to garner the attention that Qatar is after.

First and foremost, are the several dozen apartment buildings that are being converted into hotels that are being placed in and around the various stadiums that are being built. After the world cup is over, the demand for using the apartments would effectively be reduced to a very small percentage. Another factor to take into consideration is Qatar’s limited population and the fact that it is unlikely that all of them would wish to own an apartment near a football stadium. Thus, when combining these two factors together, it becomes immediately obvious that the sheer amount of investment into developing apartment buildings near the football stadiums would be doomed to failure due to the lack in local demand. While Qatar may be banking on increased demand into local real estate once its international profile has increased due to its investment into sports diplomacy, there is still no guarantee that this will immediately occur. One issue is the cost versus utility issue surrounding the stadiums themselves, simply put, the long term viability of the stadiums is in question given the lack of a substantial local fan base for football in the country. This paper would like to assert that while football is popular in Qatar, it is nowhere near as popular nor as prevalent as compared to its popularity in Western European countries.

This means that the number of football games with a significant audience would likely be minimal if none at all for games held within Qatar. In fact, the only reason that the world cup would be held in Qatar in the first place was because Qatar had bid on it. If it was not for this action, it would have been highly unlikely that Qatar would have been chosen as an appropriate venue for the World Cup. With this information in mind, it becomes obvious that in terms of sustainability, the football stadiums are unlikely to be utilized extensively beyond their current role in 2020. Also, it is unlikely that international spectators would attend football matches in Qatar if they were not significant enough (i.e. in the same league of popularity as the world cup). Qatar could potentially offset this by sponsoring multiple football matches between different teams within the country; however, it is unlikely that these would be able to draw significant amounts of international attention. What must be understood is that sports diplomacy as an application of soft power must actually be sustainable in order to be considered as effective. It does not make sense to invest billions into an endeavor only for it to be unsustainable in the long term. However, when examining the case of Qatar and the various facets of information that have been presented thus far, it can be seen that this is exactly what is occurring. This is not to say though that the assumptions of this paper are 100% accurate, between now (2014) and 2020, it is likely that Qatar could implement a wide variety of potential strategies to address the issues that have been brought up.

However, unless evidence to the contrary will be brought up, this paper’s stance is that the current application of soft power via sports diplomacy in the case of the FIFA World Cup 2020 is a failure. Utilizing sports diplomacy without any significant plan to ensure long term viability cannot be considered as a success in any sense of the word. It should be noted though that aside from the FIFA World Cup, Qatar’s other endeavors utilizing sports diplomacy can be considered as a success. Its investments into various sports teams around the world has enabled it to forge good relationships with other countries and this has contributed significantly towards improving its status in the international arena. Aside from this, the use of cultural investments as a soft power tactic is also quite interesting and should help in increasing the profile of Qatar as well. However, it may take a considerable amount of time before this comes into fruition.

Policy Recommendation: Strategies for Stability