Situational Environment

Demand/Demand Trends-Industry Trends

Euromonitor (2012) reported that Mars was the market leader in 2010 by holding 47% market share and Snickers, Galaxy, Nestlé and other international companies captured additional 30% share in the UAE; however, local companies concentrate on product diversification to increase market demand by changing customer perception; thus, the market growth has increased significantly.

Social and Cultural Environment Trends

The culture and society of UAE presents a unique set of values and beliefs that are characterised by most of the countries of the Middle East. As an Islamic country, the values and cultures of the UAE are governed by the Islamic regulations, and so the people of the country want to eat Halal foods only.

The population of the country comprises of different nationals and ethnic groups where the actual Arabic language are used besides of English (which is popular language in business and other areas of communication).

In case of the Countline Healthy Chocolate Bars, socio-cultural factors would have a great influence on the business, and the marketer would make sure that the contents of the product do not contain anything that are contrary with the Islamic values.

Economic Environment and Trends

Indexmundi (2012) reported that the UAE has an open economy along with economic diversification, which helps to develop the country than any other GCC member states.

The economic growth based on many sectors including oil; however, the GDP of the country is $ 342.0 billion and per capita GDP estimated as $ 63,626, and the GDP growth is 5.2%, which demonstrates the current financial progress of the UAE (Indexmundi 2012); at the same time, the economy remained unchanged at the time of global financial crisis.

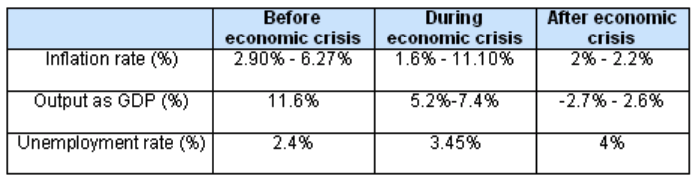

However, the central bank has designed fiscal policy to provide a sustainable way for exempting the negative influence of recession; therefore, the following figure shows more information –

Economic environment is preferable to the foreign investors as the UAE has Efficient, Effective, and Globally Integrated trade Environment as a member of WTO; thus, the market of chocolate industry is too competitive due to have many competitors in this sector.

Technological Environment and Trends

The technological advancement of UAE is not less the advancement of the western countries, such as, the UK and the US; in addition, the use of Information technology brings huge economic success for this country particularly in Dubai where most of the business transaction takes place; moreover, foreign investors are now more confident to start business here considering excellent progression.

At the same time, technological invention will play a crucial role to develop strong supply chain manage system, promote new items, and expand business operation by preserving and producing the organic chocolate bars; however, the marketers of this will concentrate on e0commerce system in order to target customers in the global market particularly GCC countries.

Demographic Environment and Trends

Total population of the UAE in 2012 is more than 5,314,317 (annual growth rate 3.05%); however, 80% people among the total population comes from foreign countries particularly from third world nation to change their financial position and only 20% people are local citizens; however, the following tables give more information in this regard –

Figure 2: Age groups and Ethnic Group.

However, the marketers of this company will target people of different culture along with children and teenagers; they will more concentrate on Dubai, Abu Dhabi, and Sharjah market because 84% of total population lives in these three Emirates (CIL, 2012 and Indexmundi, 2012).

Political and Legal Environment and Trends

Tarbuck & Lester (2009) stated that the UAE has twofold legal framework (local and the federal judiciary); however, as a major Muslim country in the world, Islamic Shari’a law is the main source of legislation though civil law principles are using to mitigate or resolve the disputes; no foreign lawyer or firm permitted in the court.

Therefore, the legal system of UAE comparatively harder to follow, but the policy makers have taken many initiatives like developed Dubai as a free trade zone due to have port with other facilities; however, first apply federal laws, for instance, the Companies Law, or the Civil Code (Tarbuck & Lester, 2009, p.5).

Moreover, the UAE is a suitable place for the business owner because there is no political clash and have a stable political system; in addition, the Emirates cooperate with each other to develop the country, which help the government to enact laws for the development of the trade and commerce, such as, regulations to control non-free zones (Tarbuck & Lester, 2009).

On the other hand, certainty of leadership, relationship with foreign countries, principles of good corporate governance, transparency, anti-money laundering, and flexible taxation policies provide investors a significant when deciding to invest or carry on business (Tarbuck & Lester, 2009, p.9).

Competitive Environment

Existing Products Currently Satisfy the Same Need as Its Product

There are many national and international chocolate manufacturing companies in the UAE, but they are not concentrating on the organic chocolate bars, which indicate little pressure from competitors; therefore, Countline Healthy Chocolate Bars would be unique products in this market, for instance, Mars, Nestle, and Twix brands occupied large market share in UAE, but they are not trying organic product.

Competitive Evaluation Including Strengths and Weaknesses

Strengths

- Customer perception is changing over time;

- Countline Healthy Chocolate Bars would experience huge success due to lack of competitors in this sector;

- Efficient employees, promotional plan, strategy of the company, production costs, supply chain management;

- More than 75% People of the UAE like chocolate bars (Euromonitor, 2012).

Weaknesses

- Euromonitor (2012) reported that sugar and cocoa prices continued to boost in 2011, but the government had not taken any measure in this regard;

- Manufacturers reduce the weight of the products and sell chocolate within existing price;

- Customers of the UAE historically not craze to purchase chocolate, so the spend less for this product;

- Manufactures like to spend little for the promotional activities though the government provides incentive in some extent.

Evaluation and Detailed Assessment of Marketing Mix Strategy

Product

The marketer of the new organic chocolate will focus on creating a product with unique taste and flavour; in addition, the marketer will try to bring out a new demand for organic chocolates among the customers of the United Arab Emirates so that the children of this region could have better health even after ingesting excessive amounts of chocolate products.

As a result, the marketer feels it necessary to promote a range of healthy ingredients through the Countline Healthy Chocolate Bars, which, for example, would include some essential substances for human health, such as antioxidants, chromium (to control blood sugar), magnesium, theobromine (to kindle the central nervous system and appetite), tryptophan, caffeine, and flavanols (a unique blend of phytonutrients).

Countline Healthy Chocolate Bars would be tremendously nutritious; it would be a snack to generate the ideal infiltrator and would be the best chocolate ever; moreover, people in all places would have excellent benefits from the product; on the other hand, the organic chocolate would not harm the environment by any means during the entire production process.

The new product would contain as much antioxidant contents as a glass of red wine and would be free from chemical herbicides, fertilizers, or pesticides; however, it is notable that the phenols in the product will develop the immune system, lessen the risk of cancer, and endorse heart-health as well as promoting overall energy levels.

Price

The marketer of the new organic chocolate will set a general pricing structure based on a series of price levels for different pack sizes, which would characterise flexible and reasonable pricing based on features, customer demands, and so on.

As the business would focus on making loyal customers, it would offer the product at comparatively reasonable prices in order to ensure that the customers sustain with the brand even though there are other substitutes offered by established competitors.

However, low pricing strategy would be undertaken because of a number of factors, which, for example, include the following:

- After the economic downturn, the purchasing power of the customers had reduced, which is still at recovering stage.

- There are some established businesses, which offer similar or identical products.

- The marketer of the new organic chocolate wishes to be the cost leader in the industry in order to gain competitive advantage.

- It will purchase machines for the production process from the local market to reduce initial costs.

Promotion

The new organic chocolate should build strong brand image; therefore, it is important to point out its strengths through advertisements, which would assist the business to persuade the customers; in the content of the promotions, it would highlight the positive effects and emphasis on the importance of the chocolate in public health and environment.

It would use print media (like newspapers and magazines), radio campaigns, online IMC, outdoor IMC, and special campaigns through the social networking sites like twitter, Hi5, and facebook for advertisements; however, it will not be feasible for the business to promote itself through TV, as it would require huge investment.

Distribution

The organic chocolate would be distributed to various retail stores all around the UAE to make the product easily available to the end consumers. The distribution channel should be designed to make sure that the products are into shelves of the stores at regular intervals.

Reference List

CIL. 2012. United Arab Emirates Population. Web.

Euromonitor. 2012. Chocolate Confectionery in the United Arab Emirates. Web.

Indexmundi. 2012. Country Profile of the UAE. Web.

Indexmundi. 2012. United Arab Emirates Population. Web.

Tarbuck, A. & Lester, C. 2009. Dubai’s Legal System: Creating a Legal and Regulatory Framework for a Modern Society. Web.