Executive Summary

This report presents the results of an internship in the Accounting Department of Aal Mir Group of Companies. Four specific learning objectives were determined for the internship: to study general accounting principles applied in the company; to learn accounting methods of analyzing financial data; to practice in preparing financial statements, and to learn how to use personal judgment regarding the application of accounting principles. Aal Mir Group is a leader among distributing companies in the United Arab Emirates, and it specializes in importing and exporting confectionery products. The company has several associates and many partners. In the organizational structure, the Accounting Department holds one of the key positions.

During the internship, I worked under the supervision of the Junior Accountants’ leader. I was responsible for studying accounting principles, guidelines, and techniques, as well as reorganizing databases and entering financial data. I also helped junior accountants in preparing regular financial reports and payment records, and I participated in preparing the company’s financial statements. As a result of the internship, I have improved my knowledge regarding working with financial statements, data analysis, and preparation of accounting records. I have enhanced my skills in working with databases and accounting software, as well as in applying accounting frameworks and theories in practice. Areas that need improvement include my knowledge regarding the auditing process and the application of advanced formulas. Suggestions for the company are related to the necessity of improving the list of objectives and tasks that students can complete during their internship.

Introduction

Accounting theory should be actively applied to practice. In order to develop practical skills in using accounting principles and methods of financial analysis while preparing reports and statements, it is necessary to create specific conditions for learners. An internship can be viewed as an effective opportunity to enhance professional capacities in the sphere of accounting. Therefore, the main motivation to participate in an internship project is based on the intent to apply the individual’s theoretical knowledge and learn specifics of using studied accounting methods and techniques in practice. This report provides details regarding the results of my internship in the Accounting Department of Aal Mir Group of Companies in Dubai, the United Arab Emirates (UAE). The focus of the report is on presenting my learning objectives, describing the company’s profile and its organizational structure, discussing the work setting and job details, analyzing the work experience and achievements, and providing suggestions and conclusions.

Objectives

Before starting the internship, I chose to identify some areas of interest on which I planned to focus during my practice. These areas included general accounting principles, the application of accounting theory to practice, and the professional use of financial analysis methods and techniques. Four main learning objectives were identified for my internship, according to the university’s requirements. I formulated the objectives as follows:

- During the internship period, I will study the general accounting principles that are applied in the company.

- During the internship period, I will learn accounting methods for analyzing financial data with a focus on differences in these methods.

- During the internship period, I will improve my practical skills in preparing financial statements, including income statements, cash flows, and balance sheets, in accordance with accounting principles.

- By the end of the internship period, I will be able to use my judgment regarding the application of accounting principles and rules with regard to tasks, circumstances, and policies adopted in the company.

Therefore, during my internship, I was focused on completing the stated objectives and achieving general practical goals. They included the improvement of my knowledge and experience regarding the use of accounting principles and methods, the application of financial analysis techniques, and improvement in decision making based on accounting theory and practice.

Company Profile

Aal Mir Group of Companies was founded by Mr. Motalleb Vakhshouri in the 1980s. The company became one of the most successful corporations in Dubai, the UAE. In the 1980s-1990s, Aal Mir Group grew in the field of trading and distributing confectionery products (“About Us: Who We Are”). However, changes in the market caused the company’s leaders to focus on importing a variety of products and food lines, not only in the UAE but also in Oman (“About Us: Who We Are”). Currently, Aal Mir Group has many brands, and it is one of the leading marketing companies in the UAE in particular and the Middle Eastern region in general.

It is important to note that Aal Mir Group’s vision is based on the company’s intention to address quality standards and meet customers’ expectations and requirements. As a result, the company is focused on continuous improvement to contribute to the progress of its employees, as well as to add to the development of the community and environment. The company’s mission is to distribute high-quality products to address the needs of the supply chain and consumers (“About Us: Who We Are”). Thus, the focus is on improving the company’s accountability, customer satisfaction, and operational efficiency. Furthermore, Aal Mir Group’s mission is also aimed at reducing any negative impact on the environment and toward developing investment opportunities (“Core Business Activities”). The company has also been successful in developing strong management and marketing policies with a focus on addressing consumers’ needs in the Middle Eastern region along with the Gulf Cooperation Council countries’ market (“Core Business Activities”). Much attention is paid to guaranteeing environment-friendly operations, beneficial relationships with suppliers, and on-time deliveries to partners and consumers.

Organizational Hierarchy

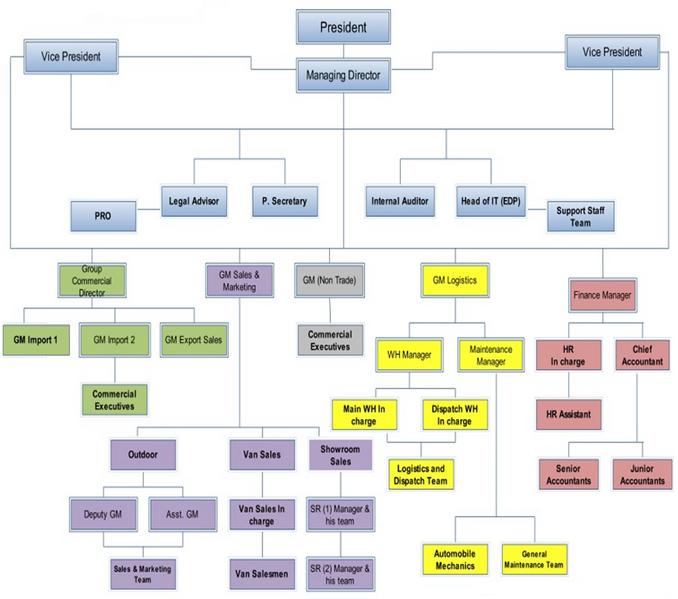

Aal Mir Group of Companies is a large distributor in Dubai, with several associates and subsidiaries that focus on promoting different brands. The company is headed by Mr. Mir Motalleb Vakhshouri, the president. The other executives who organize and monitor the strategic development of the company include two vice presidents and the Managing Director. The legal advisor, the secretary, the internal auditor, and the head of the IT Department directly report to the Managing Director and vice presidents (“Aal Mir Group of Companies Management Chart”). The key departments in Aal Mir Group are the Sales and Marketing Department, the Logistics Department, the Accounting Department, and the Commercial Department. Aal Mir Group’s organizational chart that demonstrates the structure of the company is presented in Figure 1.

The Commercial Department controls the Group’s trading and non-trading activities. Commercial executives report to the Group Commercial Director. Group managers in this department control several branches of import and export activities. The Group Manager is responsible for the Group’s export sales reports to the Group Commercial Director. This department has direct contacts with the Sales and Marketing Department that is divided into Van Sales, Showroom Sales, and Outdoor units (“Aal Mir Group of Companies Management Chart”). The work of these units depends on the activities of the unit managers and their teams including high-class specialists in their areas. The Logistics Department is headed by the Group Manager in Logistics, and it is divided into Warehouse and Maintenance units headed by managers who work as team leaders. The Accounting Department operates in connection with the Human Resources (HR) Management Department because leaders of these units report to the company’s Finance Manager (“Aal Mir Group of Companies Management Chart”). Specialists within the Accounting Department collect data that is related to the operations of all units in Aal Mir Group.

Work Setting

The Accounting Department in Aal Mir Group is headed by the Chief Accountant, who reports to the Finance Manager. In his turn, the Finance Manager controls the financial activities of the company and reports to vice presidents and the Managing Director. The main positions in the Accounting Department are as follows: Senior Accountants and Junior Accountants. Teams of senior and junior accountants are led by supervisors (“Aal Mir Group of Companies Management Chart”). Senior and junior accountants are responsible for the continuous analysis of financial documents related to the company’s operations, including its subsidiaries and associates. Accounting records, reports, financial documentation, and results of financial analysis or forecasting are usually approved by the Chief Accountant and reported to the Finance Manager in order to inform the executives’ decision-making.

Therefore, to receive detailed financial data regarding the company’s operations, those specialists who work in the Accounting Department have direct contacts with representatives of the Sales and Marketing Department, the Logistics Department, and the Commercial Department (“Aal Mir Group of Companies Management Chart”). The reason for this is the necessity to receive detailed financial information regarding operations and to collect background data to complete reports and prepare balance sheets. I should state that during my internship, I mostly interacted with the leader of the Junior Accountants group, who was assigned as a supervisor to coordinate my work in the Accounting Department. As a result, I was able to study how junior accountants complete their regular tasks while learning the principles of the Accounting Department’s work.

Job Description and Project Details

My job responsibilities during the internship were determined by the supervisor, who asked me to cooperate with the group of junior accountants. Thus, I was assigned different tasks depending on the time frame working as an intern, and my responsibilities were associated with performing the following activities:

- Week 1. I was to develop working relationships with junior accountants, review the documentation and guidelines used, study accounting principles and techniques, and help in reorganizing databases.

- Week 2. I was responsible for assisting junior accountants in reorganizing electronic databases and entering financial data into the computerized system. My responsibilities also included the preparation of regular financial reports and payment records.

- Week 3. I was responsible for assisting in developing financial statements, including income statements, cash flows, and balance sheets. My responsibilities also involved working with the accounting software to enter data.

- Weeks 4–6. I was responsible for working as an assistant for the supervisor and junior accountants. Moreover, I was responsible for entering financial data, processing information with the help of accounting software, preparing spreadsheets, and using functions and formulas.

Work Experience

In order to describe my work experience in detail, it is important to explain my interactions and activities, which were associated with a list of the responsibilities that I had in the Accounting Department of Aal Mir Group. During the first week of my internship, I communicated with my supervisor and worked with the documentation that was used in the department. My task was to study accounting principles as applied in the company, examine non-confidential financial documents for the years 2014–2016, and complete assigned tasks regarding the reorganization of documents. I was asked to help junior accountants systematize files and enter data into the company’s computerized system. I was able to examine the information provided in the company’s accounting guidelines. Moreover, I communicated with the junior accountants, and we worked together to organize the schedule for my internship and assistance in the Accounting Department.

During the second week of my work as an intern, I assisted a group of junior accountants in entering and storing financial data. I was responsible for organizing the company’s folders and databases in an electronic form. This experience was oriented to help me apply in practical use my theoretical knowledge regarding accounting documents and records. I was also responsible for preparing daily reports and records for sharing in the Accounting Department. Thus, I improved my skills in using Excel. The supervisor also asked me to help in preparing payment records. In so doing, I needed to coordinate with representatives of other departments, as well as suppliers and partners, to resolve some issues. The results of my work were monitored by the supervisor.

During the third week, I had a task to assist the leader of Junior Accountants in preparing financial statements, including income statements, cash flows, and balance sheets. I was asked to learn how to use the accounting software and apply accounting principles and methods as well as financial analysis techniques. I was responsible for preparing the primary data for further analysis by accountants. I was also responsible for entering the data into the accounting program under the supervision of the team leader in order to generate financial statements. It is also important to state that during the third week, I interacted with the supervisor and some junior accountants to obtain advice on how to work with the specific accounting program.

After receiving the full orientation regarding the work with financial documents and statements during the first three weeks of my internship, I was assigned to assist the junior accountants in their routine work on a regular basis. My responsibilities included entering financial data, working with the accounting software and computerized spreadsheets, and the application of functions and formulas under the supervision of junior accountants. As a result, I was able to learn the key principles of creating financial statements and making judgments regarding observed trends. It is important to note that I was also responsible for helping junior accountants in preparing supporting documents and providing justification for reports depending on cases, circumstances, and policies. It was valuable to work as a part of the team to provide junior accountants with the required assistance. During the last week of the internship, I was focused on getting feedback from the supervisor regarding my achievements with an eye to identifying gaps in my theoretical knowledge and practical skills.

Achievements

It is possible to analyze my personal and professional achievements associated with working in the Aal Mir Group with reference to the learning objectives that were set for my internship. First, I needed to study general accounting principles as applied in Aal Mir Group of Companies. I completed this objective during the first and second weeks of the internship when I reviewed general documents and guidelines applied in the company. I can state that I have coped with this task successfully because I was able to study principles declared in the company’s documents in the context of accounting theories, guidelines, and standards learned during my studies. As a result, I now understand the difference between various accounting standards, realize the principles of their application, and differentiate situations for using this or that technique. Therefore, I can note that I have also achieved the second goal of my internship. I received complete information regarding the practical application of different accounting methods and frameworks to financial data.

Much attention was paid to completing the third objective, according to which I was to practice in preparing different types of financial statements while applying specific accounting principles and techniques. This task can be described as challenging, and I am satisfied with my results in developing my skills in this area. Thus, I have improved my knowledge and capacities related to entering and storing financial data, applying formulas and functions, using spreadsheets, and preparing income statements, cash flows, and balance sheets. It was important to learn how to work with the accounting software used in the company and what types of data and formulas should be entered to generate reports. I can state that now I can be described as an advanced user of the accounting program applied in Aal Mir Group. To achieve high results, I had to communicate a great deal with the supervisor and junior accountants in order to receive the required consultation and advice. This type of experience is important for me because I was able to work with different examples of reports and financial records during my internship.

I have also completed my last objective, associated with using judgment while applying accounting principles and rules with reference to certain tasks, circumstances, and policies adopted in Aal Mir Group. When I helped junior accountants to process different types of data and generate reports and statements, I was able to observe how team leaders and experienced accountants justified their use of various formulas, functions, and algorithms. When I did not understand the principle of this or that decision, I had an opportunity to ask for clarification and receive comments regarding the issue. Therefore, it is possible to state that I have improved my skills in making judgments and forming justification to support certain decisions. Furthermore, during the internship, I developed my communication and cooperation skills because I was able to work as a member of a team to achieve collective results.

Suggestions

Although my experience associated with my internship in Aal Mir Group was positive, it is possible to propose some recommendations to advance internship programs used in the company and the university. To improve the experience of interns and guarantee their involvement in a working process, it is necessary to provide the management of companies where interns plan to work with lists of tasks that can be assigned to young specialists. Therefore, it is important to determine, for all interns, a list of objectives that are expected to be completed during the internship. These objectives should be correlated with the list of activities and responsibilities that can be performed by interns in different types of organizations.

Such lists with general objectives are proposed within the university, but it is important to expand upon and improve them in order to provide interns with more options to choose from. Furthermore, it is necessary to note that each organization has specific requirements regarding interns’ performance, and it is essential to state what specific tasks can be performed by interns in concrete working environments in order to adjust their lists of objectives to these requirements as well as employers’ expectations. In addition, it is important to systematize the university’s requirements regarding the improvement of interns’ skills in such fields as communication, ethics, and leadership in order to guarantee higher results.

Conclusion

While evaluating the internship experience, I can state that I was able to develop my understanding of accounting principles and apply my knowledge to practice. However, it is necessary to focus on some specific conclusions that are important to take into account while assessing my internship. There are four main conclusions to mention:

- The internship has helped me improve my knowledge in such areas as the creation of financial statements, analysis of data, and preparation of accounting reports and records.

- As a result of the internship, I have enhanced my skills in working with databases and specific accounting software. I recognize all the main processes associated with preparing financial statements, and I can perform tasks required to complete financial analysis at basic and advanced levels.

- The internship has helped me demonstrate and improve my abilities in applying accounting frameworks and theories, processing financial data, and making judgments and conclusions under different circumstances.

- As a result of my work in Aal Mir Group, I can identify some personal and professional areas that need improvement in relation to my practical skills: working with auditing standards, risk analysis, and the application of advanced formulas, functions, and algorithms to conduct financial analysis according to cost accounting methods.

The conclusions are important in developing my practical skills as a qualified accountant. In spite of the fact that the internship has helped me develop my capacities and professional skills, there are still areas that need further improvement. I should state that the reason is in the fact that an auditing process was not covered as a part of my internship, and I was not able to apply complex formulas to financial analysis. However, I have received a good opportunity to work as an accountant in a large organization.

Bibliography

“Aal Mir Group of Companies Management Chart.” AalMir. 2013, Web.

“About Us: Who We Are.” AalMir. 2013, Web.

“Core Business Activities.” AalMir. 2013, Web.