Able corporate is a manufacturer of portable electric power tools and sells them in the B-2-C and B-2-B market. The case background on the company shows that the company requires a definite strategic direction in order to become profitable. The company’s internal conditions have been described in the case wherein the company demonstrates three basic problems:

- the company has had no investments in the past, and

- were running a line of outdated products.

The cost structure of Able is non-competitive and high. The plants were obsolete and cost of production high. The sole positive area of Able is its innovativeness. However, the problem that can be observed in this respect is the company’s lack of marketing acumen, which has led to its competitors merely copying its product and gaining market share. Thus, Able Corporation’s internal conditions are a problem, which has been illustrated in the case, has led to the non-profitable condition of the business.

This paper aims to provide a strategic solution to the business and show which are the area where Able Corporation need to concentrate in order to gain market share and run profitably. For this, the first step will be to review the company’s external environment.

In order to understand the external market of Able Corporation we need to look at the industry position. As the products that the company makes are used in construction purposes by households as well as builders so we will look at the housing starts from the US (U.S. Census Bureau, 2009) census data and the industry report of the construction industry in the US (Datamonitor, 2009).

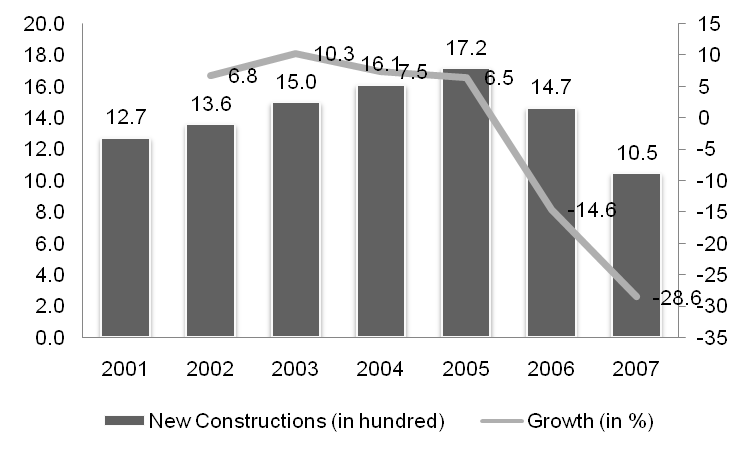

The historical household starts are analyzed in order to understand the demand for the product in the household market. Figure 1 shows that the demand for new homes in the US had increased from 2001 until 2005. The growth in the real estate sector for the domestic households increased from 6.8 percent in 2002 to 10.3 percent in 2003 and then started declining. This demonstrates that the demand for portable electric power tools had declined in since 2003 to present. Further, the construction spending also has reduced by 0.9 percent from April 2009 to May 2009 and by 11.6 percent from May 2008 to May 2009 (U.S. Census Bureau, 2009 ). This shows a deceleration in the real estate industry and construction industry in the US.

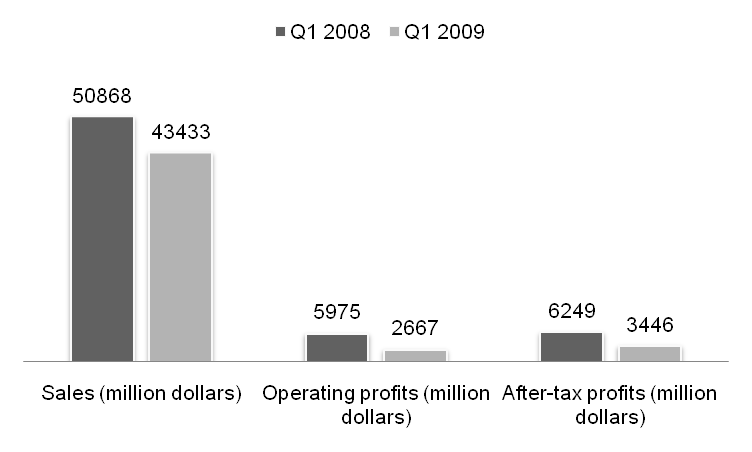

The figure below demonstrates that the sales in the electrical equipments manufacturing sector in the US suffered a declining sales in first quarter of 2009 as compared to the sales of the same quarter in 2008. The operating profit as well as the after-tax profit has declined in case of electric equipment components industry.

Now considering the machine tool industry in the US, which comprises the power tool market, is stated to be in depression (Manufacturing & Technology News, 2009). The report states that sales in the tool industry fell by 41.5 percent in May 2009 from April 2009 and 78 percent from May 2008. The consumption of tools was the lowest in the industry in this period. The industry is supposed to have been affected due to the economic slowdown. However, a deeper analysis shows that the industry had been undergoing a declining growth since 2000 (Datamonitor, 2002).

An industry profile of the US construction and engineering industry to which Able Corporation supplies its products is analyzed in this section. The industry report shows that the non-residential building segment is the most lucrative market for the U construction and engineering industry in 2008. This segment generated 55 percent of the total revenue for the industry. The construction and engineering industry comprise of the civil engineering companies and large-scale contractors who are not involved in home building ( this definition is in accordance with the Datamonitor report). These are the B-2-B connections of Able Corporation.

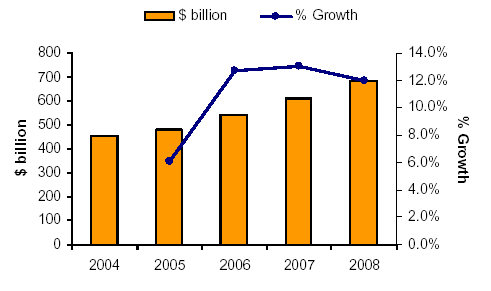

Figure 3 shows the growth of the US construction and engineering industry. The industry has posted a growth of 6 percent in 2004 to 12 percent in 2008. Thus, the industry’s growth is an important indicator for the company as it is expected that this boost will drive demand for electric power driven tools in the industry. The homebuilding industry in the US has experienced both boom and bust, while the growth in the non-residential construction industry has experienced a more steady growth.

The study of the external environment shows that the industry of tools manufacturing has been undergoing serious external pressure due to dwindling demand. As the demand from the manufacturing sector in the US fell, portal electronic power tool producers concentrated on domestic market which itself was small. Able Corporation falls in the 2 percent of the industry, which produces other tools.

After doing the internal and external environmental analysis of the company, we can do a SWOT analysis of the company. The strengths of the company are:

- innovation of the cordless tools, and

- demand for circular saws.

The weaknesses are:

- excessive cost of production,

- age old manufacturing system,

- no investment in product development and marketing, and

- lack of strategic direction.

An analysis of the external environment of Able Corporation shows that the company has to look for opportunity in the non-residential construction industry. In the recessionary phase, it is the only sector, which has registered steady growth. Demand from the household sector is expected to decline further due to the slowdown in the real estate market. The threats to the company are the economic recession, which has reduced demand and driven down corporate profits. The main points regarding the industry that need to be kept in mind are –

- specialist form of the industry nurturing brand loyalty,

- distribution channel, and

- innovation.

From the SWOT analysis, the strategies that can be derived are

- innovating products,

- innovative marketing strategy, and

- a strategic direction to the company.

In the next one year, the strategies of the company would be to retain existing customers and increasing the marketing and brand awareness of the innovative products. As circular saws are already a market leader with a market share of 40 percent, the company must concentrate to retain its existing sales. As the US economy is in recession, it will not be advisable to embark on a complete re-imaging of the company with is costly. Rather, the company must stress on cutting down its costs in order to become more competitive. The mission statement of the company should be to drive down cost and become more competitive in the portable power tools industry.

The next five year, Able Corporation must invest more in its research and development and bring about changes in their products as per the market demand. They must try to reduce their production cost further so that they can compete with competitors over price. As brand loyalty is the key in business-to-business markets, the company must develop relationships with their client companies in order to retain customers. The construction industry in the US is expected to growth at a CAGR of 0.9 percent until 2013 (Datamonitor, 2009). In the next five years, Able Corporation must try to capture the market in the construction industry so that they can growth with the growth of the construction industry.

The strategy that Able Corporation need to concentrate on is to change the corporate structure and culture of the company. The distribution and the sales channels have to be expanded. The manufacturing side of the company has to be restructured in order to reduce manufacturing cost. The problems with the unions and the suppliers have to be solved in order to remain competitive. Another aspect that the company must attain is flexibility. The company must become flexible with the changing external demands and conditions. Therefore, in the end the company needs to address the following issues:

- corporate culture and structure,

- bottom line of production, and

- flexible organization.

Following these strategies will help the company become competitive in the long-run.

References

Datamonitor. (2009). Pharmaceutical market assessments without the guesswork. Web.

Manufacturing & Technology News. (2009). U.S. machine tool industry reaches a nadir; monthly sales dip to lowest level ever. Web.

U.S. Census Bureau. (2009). FIRST QUARTER 2009 DATA FROM THE QUARTERLY FINANCIAL REPORT: U.S. MANUFACTURING, MINING, AND WHOLESALE TRADE CORPORATIONS.

U.S. Census Bureau. (2009). United States Census Bureau. Web.