Executive Summary

This report considers the four main sourcing approaches for procurement and supplier appraisal criteria. The example used in the research is the Abu Dhabi National Oil Company (ADNOC), and the analysis is performed using relevant literature and company data. Before choosing the type of sourcing for a particular product, the organization has to consider the state of the market for this good and determine its competitiveness, quality and cost margins, and significant players. Then, the appraisal of internal stakeholders has to be conducted to determine whose input into the discussion and implementation is the most valuable. The four methods of sourcing are single, sole, dual, and multiple, each having their own benefits and drawbacks.

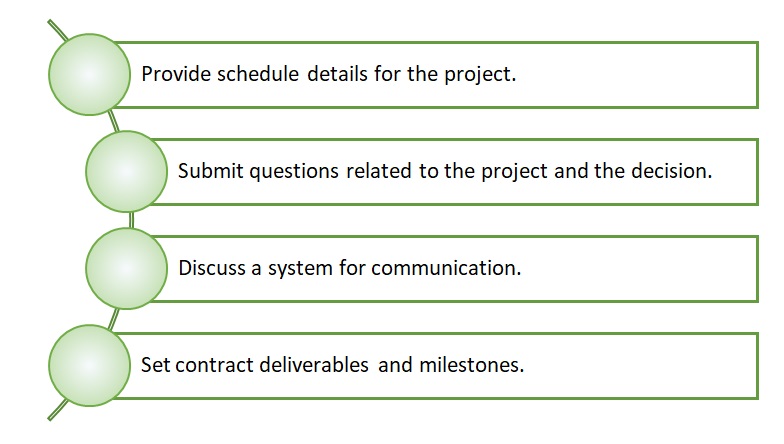

In this case, ADNOC uses multiple sourcing due to its growing demands and high risk of disruptions in production. To select suppliers, ADNOC has to retrieve such information as sellers’ certification, financial statements, environmental policy, experience, and workers’ capabilities. These questions are included in the company’s pre-qualification questionnaire. In post-award discussions, the focus has to be shifted towards deadlines, delivery milestones, and feedback channels. ADNOC should review its system to enhance suppliers’ data security. The main limitation of the project was the lack of available financial information about the company and suppliers.

Introduction

The company under analysis is the Abu Dhabi National Oil Company (ADNOC). According to the latest annual report, the total amount of direct costs in 2018 reached $4,9 billion (Abu Dhabi National Oil Company, 2019). Some typical categories include pipeline equipment and installation, furniture and fixtures, motor vehicles, plant machinery, research and technology, IT services, administrative services, and others, reaching the total number of ten or more. ADNOC works with both local and overseas suppliers, but the full list of suppliers and dollar spend is unavailable. For most needs, ADNOC employs the multiple supplier approach, working simultaneously with several vendors such as Vallourec, Tenaris, Sumitomo, Tianjin Pipe, Hengyang, TMK, JFE, and Voestalpine (McAuleu, 2016). Other methods are not as appropriate for the company’s size and needs.

The oil company conducts the spend analysis using the 7-step strategic sourcing process (Supply Management, 2011). First, ADNOC profiles the category, for example, cleaning services which are employed to maintain the office buildings or development sites. To complete the investigation, the company has to understand the current state of the category’s contents owned by the firm as well as how and for how long the services can be used. Second, the market of potential suppliers is reviewed to locate local vendors that are suitable for the contract. Abu Dhabi and other cities where cleaning services may be needed have a broad selection of cleaning service companies. As a result, the company chooses a sourcing process, typically resorting to large tender projects. Suppliers that applied are appraised and selected according to their experience, quality, bid, and negotiation results. The chosen partners are contacted and implemented into the chain, and the company tracks their progress and ensures that all deals are finalized.

Sourcing Approaches

A vital part of choosing the most suitable suppliers lies in their evaluation. To understand which companies are the most appropriate to work with, ADNOC has to consider significant amounts of information about their financial records, experience, and sustainability. As an initial step, the market (for example, consisting of cleaning companies) is assessed using the PESTLE framework, Porter’s Five Forces, Product Life Cycle, and Competition analysis (CIPS, 2017). These steps show whether the segment is characterized by monopoly, competition, high or low quality, and specific demands to buyers. These criteria also help the firm understand which category should be used to source a particular material or service. If the market segment is monopolized by one company, their quality and pricing make the sole supplier approach the most suitable (CIPS, 2017). In contrast, if there exists healthy competition, the buyer can look and different services and choose a single or multiple supplier strategy. ADNOC utilizes tenders with specific requirements to select from firms that can handle the amount of work necessary for the corporation and its branches.

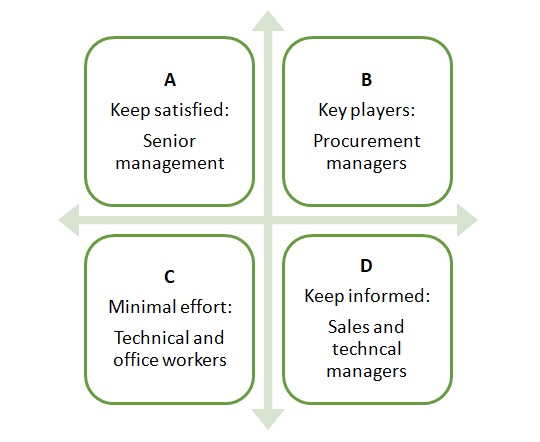

In procurement, key internal stakeholders are procurement managers, senior management, as well as managers and workers of units that interact with the acquired materials or services. These employees may include storage and distribution operators, sales and technical unit members. According to Mendelow’s Matrix, all stakeholders can be separated into four categories, depending on their level of power and interest (Figure 1). Senior management is in Category 1 since its members possess significant control over operations, but the amount of their duty does not allow them to pay much attention to each process. Procurement managers are in Category B because tenders are one of their primary responsibilities. Sales and technical managers need to be informed about all operations because they can contribute to supplier assessment. Finally, mechanical and office workers are Category C stakeholders since their input is minimal – they deal with the implementation and distribution of new materials, but their autonomy is limited to managers’ requests.

The procurement process in ADNOC follows multiple steps to select options and regulate operations. First, the need is identified by reviewing benchmarks of current performance and materials’ availability. This responsibility falls on the procurement unit, and such procedures are performed regularly. Next, the contract terms are developed using the standards outlined by the company. The market is searched using ADNOC’s new Internet database – ADNOC Commercial Directory system. It invites potential suppliers to register and undergo a pre-qualification process to enter the database for future products and receive notice of new tenders. The appraisal of suppliers during bids’ placement is also completed using this system as it compiles all data in one place and uses standardization to guarantee that all valuable information is entered and considered. This database allows the company to instantly see what selection of supplier is available and make a decision regarding the sourcing approach.

A team consisting of sales, technical, and procurement managers defines specifications, sources the market, and appraises suppliers. All negotiations and awarding are performed by the procurement board. For most resources, competition is advantageous to keep the prices stable and enhance the quality of the services or goods. ADNOC does not choose single or sole sourcing in most cases since the number of its offices and development sites is high. The involvement of stakeholders is essential because their contribution increases the transparency of the company’s needs. For instance, technical and sales managers value different information about the supplier – quality of the services and cost. Their collaboration is necessary to pick firms with good offers while keeping the prices low.

The four sourcing approaches are single, sole, dual, and multiple. The first two, sole and single, refer to cases where a company established a relationship with one supplier for a type of goods or services. A major difference between these methods is that sole sourcing implies that the buyer does not have a choice of suppliers and has to pick the organization due to the lack of options. This situation may arise if the market is monopolized by a large company that offers the best products and price. Alternatively, sole sourcing is possible in niche market segments that do not have strong or stable competition. Single sourcing, on the other hand, is the company choosing a supplier from a range of firms based on their specifications and bids.

The primary benefit of the sole sourcing approach is that the choice of the supplier is easy to make, thus saving time on company appraisal and market analysis. Negotiations may also be simple and quick, although their results are not always positive for the buyer. In sole sourcing, the supplier possesses an unbalanced level of authority over the discussion and can demand a high price for its services, putting a financial strain on the company. The lack of choice also does not guarantee that the supplied goods will be of good quality or be delivered on time since the seller will not be encouraged to compete with others. In this case, the market of cleaning services is full of companies competing for corporate contracts, thus eliminating the option of sole sourcing and increasing the benefits of multiple sourcing.

Single sourcing has similar risks, although the ability of the buyer to choose another option increases the responsibility of both parties. Here, the relationship between the supplier and the procuring side can be based on mutual trust and respect, thus affording both companies an ability to make bold decisions or ask for favors that would otherwise be impossible. Working with one supplier, the company may also reduce administrative costs and maximize system integration and delivery size control. Nonetheless, any problems with the supplied goods or their manufacturer will cause the buying firm to stop or delay its operations. Therefore, in times of crisis, the company will have no protection or a second option that would let it maintain the same level of productivity. Such lack of security is a major drawback of both sole and single sourcing options. In the discussed company, these methods are avoided due to the size of the firm.

The two other options – dual and multiple sourcing – refer to cases where the relationship is established between a company and several suppliers (two and more than two, respectfully). Within the organization, these strategies, especially multiple sourcing, are used for the majority of categories of spend. In the mentioned above example, cleaning services are asked to work in different buildings, depending on the offices’ location and size. Here, the benefits depend on the market’s characteristics – if the market has several businesses with similar products, a professional relationship with multiple suppliers can help the buyer to take advantage of the competition. Moreover, as cleaning services are often tied to one place (city or neighborhood), multiple sourcing is vital for large firms such as ADNOC (Jensen, 2017).

If the procuring firm has a significant influence in the industry or can offer much to the bidders, it possesses a substantial chance of assuming some degree of control overpricing. Moreover, multiple sourcing provides security for the buyer in emergencies where one of the suppliers is unable to deliver the goods on time. Demand fluctuations are also easier to manage with several suppliers that can adjust their volumes according to negotiations. Natural events, financial issues, and other problems of suppliers become less damaging in multiple sourcing in comparison to single sourcing.

Nonetheless, some drawbacks of using these strategies exist as well. While it may be easy to share information and negotiate new deals with one supplier, it is challenging to preserve straightforward relationships with a number of firms. Furthermore, if selling companies do not feel responsible for their share of the service, they may not be as strict in following the standards of quality. Small order volumes also lower the bargaining power of the buyer and limit the chances for beneficial deals and cost-saving. In emergencies, less involved suppliers may not respond to the buyer’s request. Finally, with the increase in information sharing, negotiations, meetings, and quality checks, the company also needs to invest more in the management of these processes. This means that more resources (human and financial) are required to maintain a system of relations with several suppliers.

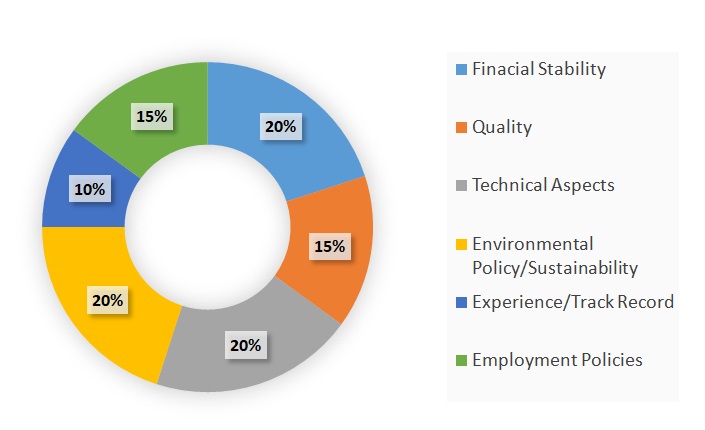

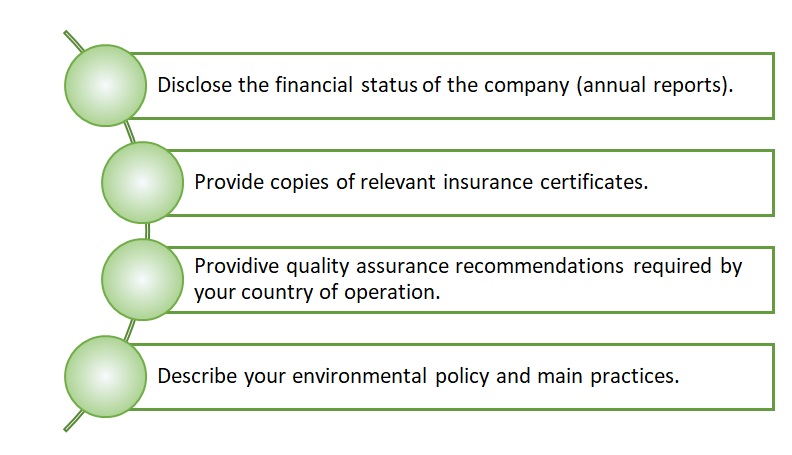

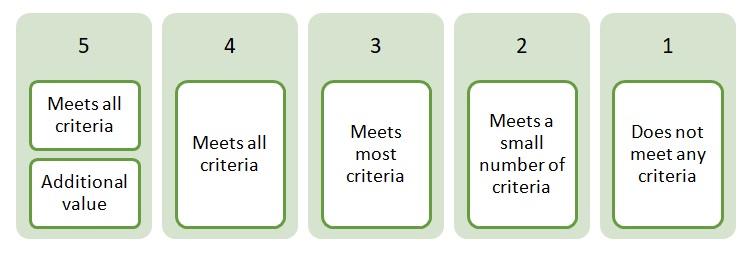

Using a database for supplier selection and appraisal, ADNOC also gains the advantage of developing effective ITTs. All tenderers receive the same document and are offered similar opportunities, timescale, and pricing. The base increases the confidentiality of bidders and ensures that all enlisted companies agree with the terms of the contract. Firms complete a pre-qualification procedure – all businesses that do not have the necessary characteristics are excluded automatically. These qualities make the digital system reliable, safe, and easy to use for both parties. The evaluation of suppliers follows the scale shown in Figure 2. The Pre-Qualification Questionnaire (PQQ) is a tool that is embedded in the ADNOC Commercial Directory system. The provided examples show which areas of inquiry can be addressed in the PQQ, but this list of questions is not exhaustive (Figure 3).

The commercial evaluation of the involved supplies is completed automatically in the installed system. Its award criteria calculate the quality of goods, cost presented in the bid, as well as a range of characteristics derived from the PQQ. A simplified version of the algorithm is shown in Table 1. Since the company primarily employs the multiple sourcing approach, this framework is used to choose a number of firms with the best characteristics, including the most balanced price-quality ratio. If the table were used for dual sourcing, then companies A and B would be chosen. In cases of single sourcing, company A would present the best coordination of costs and quality.

Table 1: Award Criteria for Suppliers.

E-catalogs can be used in all four sourcing approaches – using them, suppliers show their qualification and service types – carpet cleaning, window washing, and other examples. They are especially advantageous for single, dual, and multiple sourcing since a buyer can quickly find all necessary information about the market segment. On the other hand, potential purchasers lack authority over choices which may be detrimental in sole sourcing or significantly damage the efficiency of multiple sourcing. Supplier portals and market exchanges are beneficial for single and sole sourcing because they are easier to use for one-on-one trades than complex connections between several suppliers and buyers. Online supplier evaluation data is helpful for all approaches- it simplifies market assessment. E-Auctions may be used for all strategies, and their competitive nature is useful for all but sole sourcing types. Finally, E-Tendering provides the buyer with the highest level of authority, which can help in multiple sourcing but is unnecessary in sole sourcing.

Supplier Appraisal Checklist

The process of supplier appraisal is vital to the establishment of long-lasting and trustworthy relationships between the supplier and the purchaser. It assists the company interested in acquiring goods and services in understanding the market, including the established standards of quality and average prices. Moreover, supplier appraisal eliminates or lowers risks related to fraud, corruption, unfair competition, and poor working conditions. The steps of this procedure are to evaluate the suppliers’ stability, experience with similar products, comments from customers, and required certifications.

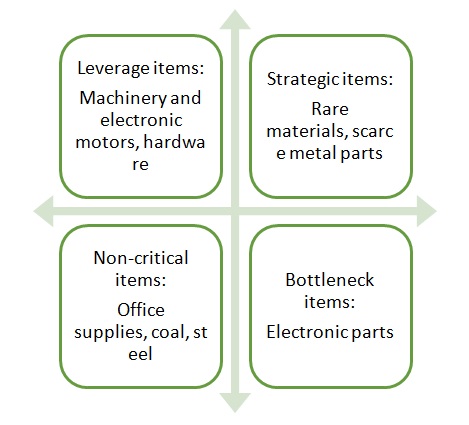

The products are categorized depending on the impact that they have on profit and the supply risk. The Kralkic matrix demonstrates which items require a more attentive approach to supplier selection – strategic items, for instance, determine the success of the company and are difficult to acquire (Figure 4; CIPS, 2017). Leverage items are similarly important to the firm’s operations, but their abundance makes all transactions less challenging. Non-critical items are both easy to acquire and substitute – the market is usually full of competitors that have low prices and a large selection of goods. Finally, Bottleneck items are difficult to find and purchase but are not as essential to the company’s performance.

The chosen category of services (cleaning) falls under the category of non-critical items – the selection of companies producing these parts is extensive, and the services are not expensive or challenging to perform. Nonetheless, the procurement of these services can be considered a part of supplier management because the quality of cleaning may affect the performance and the status of the company. Moreover, the use of sustainable practices and products during the cleaning process has to align with the company’s goals.

The procurement team has to evaluate the quality of suppliers and monitor their performance to ensure safety and efficiency. The supplier appraisal has to be conducted on both pre- and post-award stages (Rezaei and Fallah Lajimi, 2019). During the first step, ADNOC has to ask potential sellers for necessary certifications as well as their service types and materials used. Cleaning services are needed in all locations that are involved in office work, storage, and development. Thus, a global agreement requires a standard set of KPIs to ensure timely delivery and stable results. Post-award evaluation incorporates onsite checks and discussions about KPIs for different types of facilities.

The appraisal criteria for the pre-award stage is mentioned above – cost-quality balance, annual reports, reviews, previous customer experiences, certification, and environmental policy. Post-award aspects include the time in which the services have be delivered, minor details about specific activities, number of necessary workers, contract requirements, quality checks, and regular reporting. For example, in the case of cleaning services, suppliers such as Spring Cleaning have to be able to work in the location of the office and have enough workers to supply multiple firms under ADNOC (Adma-Opco, Zadco, Adco). Therefore, the workforce capabilities of suppliers are investigated closely to determine the share that they can take out of a tender. Appraisal methods for these criteria combine data acquired through the company’s database and site audits.

The pre-award supplier appraisal checklist includes all mentioned above questions such as the presence of the necessary qualifications and certificates, annual statements, financial information, and environmental policies (Figure 5). It is vital to address the questions presented in Figure 3 and perform ration calculations. If the company meets all criteria, it receives the highest mark, while other companies rank lower. The chosen supplier for ration calculations Is Spring Cleaning (2019) – a Dubai-based company providing cleaning services in multiple locations (Table 2). For a post-award assessment, the purchasing company should focus on planning and process evaluation (Figure 6).

Table 2: Ratio Calculations for a Cleaning Company for 2018.

Conclusion

To sum up, the choice of a sourcing method depends on the size of the purchasing company and its needs. Each approach is also linked to the state of the market since suppliers’ competition determines prices and goods’ abundance. Supplier appraisals help businesses to decide which firms are suitable for a shot- or long-term partnership. They are conducted to see the extent to which competition is present in the industry segment. Moreover, the clarity and transparency of appraisals enhance the standards accepted by both suppliers and buyers. This module helped me understand how to analyze the market with the intention of finding suppliers and which aspects of their performance I should focus on to create strong and reliable connections.

Recommendation

The sourcing process seems to cover all factors that impact further collaboration. The supplier appraisal process at ADNOC is fully automated, with the unified database compiling all essential information into one place and helping the company to make quick decisions. However, the potential risk of information security being compromised still exists for the organization. It is vital to ensure that all data shared through the system is safe and protected by mutual agreements. The improvement of authentication procedures may lower the risk of a data breach.

Reference List

Abu Dhabi National Oil Company (2019). About the New System. Web.

CIPS (2017). Practitioner Programme. PowerPoint slides.

Jensen, P.A. (2017). Strategic sourcing and procurement of facilities management services. Journal of Global Operations and Strategic Sourcing. 10(2), pp. 138-158.

McAuleu, A. (2016). Adnoc plans to extend ‘mega tender’ scheme.The National. Web.

Rezaei, J. and Fallah Lajimi, H. (2019). Segmenting supplies and suppliers: bringing together the purchasing portfolio matrix and the supplier potential matrix. International Journal of Logistics Research and Applications. 22(4), pp. 419-436.

Spring Cleaning (2019). Commercial cleaning. Web.

Supply Management (2011). The seven stages of a sourcing strategy. Web.