Introduction

Stock exchanges form part of the critical aspects of an economy. The two main sections of the stock exchange market include the primary and secondary market segments. The primary market segment provides public and private entities with an opportunity to raise financial capital by issuing securities. Buyers have the discretion to sell their securities to other investors. The securities traded within the stock market can be debt or equity based securities. Stock exchanges are a critical component of the private sector. According to Glynn, the World Bank has continuously been involved in advocating for the formation of stock exchanges.

The emergence of stock markets in most economies requires the firms to be effective and efficient in order to enhance the attainment of national objectives such as improvement in levels of competitiveness, productivity, and stimulate investment. Prevalence of uncertainties in the global stock market is a major issue facing stock exchange firms. Market uncertainties may lead to capital flight due to a decline in the level of investor confidence, which presents a major challenge for stock exchange firms. Consequently, it is fundamental for stock exchange firms such as Abu Dhabi Securities Exchange and London Stock market to appreciate the role of strategic management. Strategic management enables stock exchange companies to deal with changes in the external environment, which entails a comparative analysis of Abu Dhabi Securities market and London Stock Exchange.

Companies Background

Abu Dhabi Securities Exchange [denoted as ADX] was founded in 2000 through enactment of the Local Law Act No. 3. The Abu Dhabi government has provided ADX with autonomy of operation hence increasing its ability to implement the necessary executive and supervisory roles. The firm started its operations in November 2000 and it is charged with the responsibility of providing individuals and institutions with the chance to invest their funds in various stocks/securities hence promoting growth and development of the national economy. In the course of its operation, ADX intends to promote to enhance accuracy and soundness of transactions. ADX aspires to position itself as the exchange choice in the Gulf region. Additionally, ADX is also focused towards development of a capital environment that is characterized by a high level of integrity, transparency, and disclosure.

London Stock Exchange (LSE)

The firm is ranked as one of the oldest stock exchange firms in the world. In the course of its operation, the firm has undergone significant growth and has managed to position itself at the heart of the world’s financial community with regard to the provision of fixed income, cash equities and other post trade service. Since its inception, the firm has undergone significant growth due to effective implementation of business and corporate level strategies. One of the corporate strategies that the firm has focused at entails formation of mergers.

Organization and operations of Abu Dhabi Securities market and London Stock Exchange

Abu Dhabi Stock Exchange market (ADX)

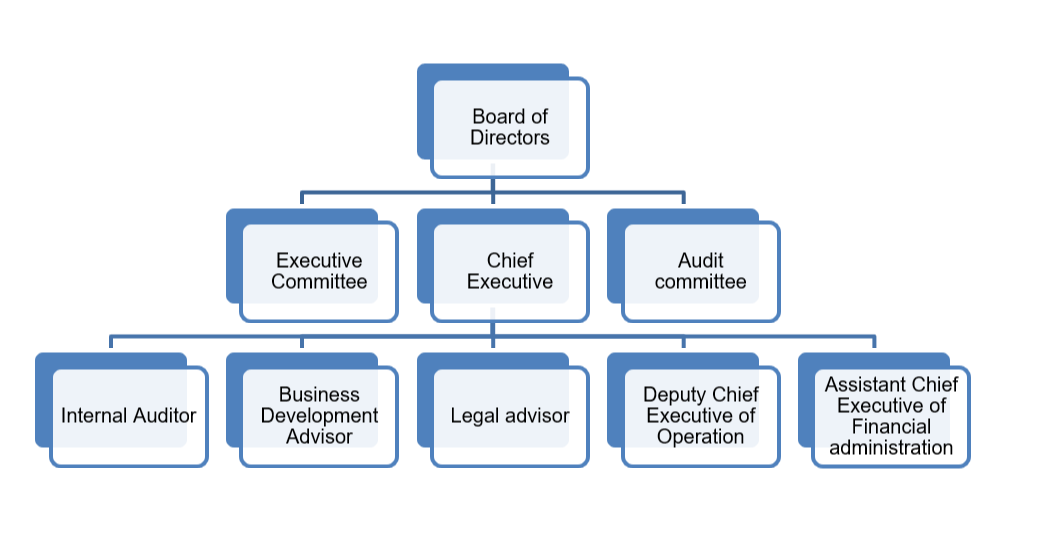

In the course of its operation, ADX controls brokerage firms in Abu Dhabi through a well-designed regulatory framework, which outlines the market regulations and rules. The Securities and Commodities Authority (SCA) issues the rules. The chart below illustrates ADX’s organization chart.

London Stock Exchange (LSE)

London Stock Exchange market is organized into two main market segments, which include the alternative investment market (AIM) and the main market. Firms on the main market segment are fully listed on the stock market and are subject to adhere to the formulated rules and regulation. In order to be listed on the main market segment, a firm is required to have been in operation for approximately 3 years and maintained its financial records. On the other hand, operations of the AIM segment deals with trading in stocks of smaller and newly listed companies. One of the main limitations of trading in shares of firms in the AIM segment is that in most cases they are illiquid and characterized by a high degree of inherent risk.

Approximately 2000 UK companies are listed in the London Stock Exchange. Additionally, foreign companies are also listed on the LSE. New companies continuously join the LSE at an average rate of 200 to 300 annually. The prices of shares in the market fluctuate in accordance with the performance of the firm and the external forces such as bad news, which may affect the demand and supply.

Operations in the LSE market are subject to regulation through the Companies Act. The Act stipulates a wide range of issues such as appointment and remuneration of the directors and the stock market’s internal constitutional arrangements. The market’s operations are also guided by the Accounting Standards. The Financial Services Authority (FSA) also controls the operation of the LSE.

Corporate governance

Corporate governance entails the various set of processes, principles and systems that are implemented within a firm in order to promote attainment of organizational goals and objectives. In the course of their operation, LSE and ADX have effectively implemented the concept of corporate governance. The two entities ensure that their operations and transactions are fair and transparent. Additionally, they have integrated mechanisms, which ensure that full disclosure of information is provided to various stakeholders. The two firms have designed a Corporate Governance Code that guides operations within the firm. The code requires all listed firms in the AIM and main market segments to operate professionally.

Analysis of London and Abu Dhabi performance

LSE and ADX have managed to maintain a positive performance over the past few years. The chart below illustrates the performance of LSE over the two years. From the chart, it is evident that the firm’s performance has been on an upward trend. For example, the firm’s total income include increased from £ 674.9 million in 2011 to £ 814.9 million in 2011, which represents a 21% increase.

Despite being a relatively young market, ADX’s performance has been appealing as underscored by the positive contribution by the entity towards the country’s economic growth. ADX has provided investors in diverse economic sectors with an opportunity to access financial capital, which has led to a significant improvement in the country’s market capitalization. The chart below illustrates ADX sector performance in 2012.

Strategic analysis of LSE and ADX

Strategy is a fundamental component of firms’ effort to survive in a very dynamic business environment. Rao et al. assert that the strategy formulated by a business entity outlines what the management team’s decision with regard to scope and direction of the firm. Alternatively, the strategy formulated outlines the firm’s decision with regard to competition, and change in customers’ product and services needs. Businesses face a wide range of options when selecting corporate level strategies. Some of these strategies include formation of mergers and acquisitions, joint ventures and strategic alliances.

In the course of its operation, London Stock Exchange has adopted merger and acquisition as one of its main cooperative strategies, as evidenced by the fact that the firm has entered into a number of cooperation with other firms through the formation of mergers. Over the past few years, the firm has been involved in a number of mergers and acquisitions. In 2007, LSE merged with Borsa Italiana S.P.A. The objective of the merger was to ensure that the firm positioned itself as a diversified exchange market in the European region. The firm also acquired Mecarto del Titoli di Stato (MTS) and Turquoise in 2009.

On 9 February 2011, LSE announced its merger proposal with TMX Group, which operates in Toronto. LSE’s focus in cooperating with other firms in the market illustrates its commitment to attain a high level of consolidation. According to Hill and Gareth (), formation of mergers and acquisitions stimulate firm’s effort to consolidate their operations. The LSE Board of Directors is of the opinion that the merger will stimulate the firm’s effort to reach high levels of efficiency, attain greater scope and scale of operation. Consequently, the firm will be able to serve its stakeholders optimally.

Similarly, ADX has also appreciated the importance of merger and acquisition in enhancing its liquidity. On 26 March 2012, ADX committee announced the completion of its possible merger with Dubai Financial Market (DFM). Upon its initiation, the merger was expected to improve ADX’s liquidity platform. Consequently, ADX would be in a position to address the growing United Arab’s Emirate economy.

Identification of issues/ problems faced by Abu Dhabi and London Stock exchanges.

In the course of their operation, LSE and ADX are faced by one major risk, which relates to liquidity risk. Considering the volatile nature of financial markets, loss of liquidity can adversely affect the performance of a stock market. Shams et al. are of the opinion that lack of liquidity in the stock market can adversely affect shareholder value. By investing in the stock market, investors’ intent is to maximize the value of their investment. Loss of liquidity in the stock market leads to a decline in share prices. The 2007/2008 financial crisis adversely affected LSE and ADX level of liquidity, which arose from the fact that most investors liquidated their investments to invest in other securities that they considered less susceptible to economic recessions.

In addition to the recent financial crisis, LSE is also facing a major liquidity risk emanating from the sovereign debt crisis being experienced in the Euro Zone. The sovereign debt crisis might result in a decline in the level of confidence amongst investors. This aspect will worsen the liquidity risk faced by the firm. According to Shams et al., investors prefer investing in capital markets that have a substantial level of liquidity.

Discussion and analysis of issues identified

The analysis conducted illustrates that the two securities markets are faced by a major challenge that might adversely affect their operation. To sustain their operation, it is paramount for the firm’s management team to ensure that they institute effective strategies that will enhance their capability to deal with changes in the external business environment. Occurrence of liquidity crisis can result in the level of confidence bestowed on a particular stock market be eroded. Shams et al. are of the opinion that a direct relationship exists between stock price and illiquidity. When investors face the possibility of an economic recession, they are forced to liquidate their assets in order to cater for their investment. Thus, it is important for the two stock markets to ensure that they have sufficient financial capital. Stock markets should develop effective models to determine the market risks faced.

One of the aspects that they should take into account relates to liquidity. The two firms should consider incorporating Liquidity-Adjusted Capital Asset Pricing Model, which will enable them to determine the liquidity risk faced effectively.23 The two stock markets cannot shield themselves from changes in the external business environment. However, their management teams should consider implementing strategies that enhance their survival. One of the ways through which the two firms can achieve this goal is by formulating effective corporate, operational, functional, and business level strategies. This move will enable the firm’s shift from mergers and acquisition as their main source of competitiveness.

Conclusion

ADX and LSE have undergone significant growth over the past few years as illustrated by improvement in their financial performance and contribution to their economy. Despite ADX being in the market for a relatively short duration, the firm has managed to attract local and international investors as illustrated by the growth in the increase in the number of listed companies. The firm’s successes have originated from effective corporate governance and institution of regulatory frameworks. However, the two firms are facing a liquidity risk emanating from economic recession. Occurrence of such an event can adversely affect their long-term survival.

Recommendation

ADX and LSE should consider implementing the following strategies in order to cope with changes occurring in the external business environment.

- The firms should incorporate the concept of product and market development in order to address the changes in customer product needs. The financial products developed should have the capability of being less susceptible to changes in the external business environment such as economic recessions, which will aid in changing the investors perception with regard to safety of their investment.

- In an effort to improve their liquidity platform through implementation of cooperative strategies, it is paramount for ADX and LSE to ensure that effective integrations are attained. A comprehensive cultural analysis should be conducted prior to acquisition to determine the feasibility of the merger succeeding, which will minimize the probability of failure.

Reference List

Abu Dhabi Securities Exchange: Standard operating procedure for broker operations 2008, Web.

Glynn, J 2008, Accounting for managers, Cengage Learning, London.

KAMCO: Abu Dhabi Securities Exchange review 2012, Web.

Kerr, S 2010, Dubai talks to Abu Dhabi over bourse merger, Web.

London Stock Exchange: Getting in shape; leveraging our assets developing opportunities 2012, Web.

Omet, G 2011, Stock market liquidity: comparative analysis of Abu Dhabi Stock Exchange and Dubai Financial Market, University of Jordan, Jordan.

Rao, C, Rao, P & Sivaramakrishna, K 2008, Strategic management and business policy: texts and cases, Excel Books, New Delhi.

Shams, M, Zamanian, G, Kahreh, Z & Kahreh, M 2011, ‘The relationship between liquidity risk and stock price: an empirical investigation of the Tehran Stock Exchange’, European Journal of Economics, Finance and Administrative Sciences, vol. 2 no. 30, pp. 7-19.