Executive Summary

Apple Inc is an American company that designs and sells personal computers, home and office electronics, mobile phones, music gadgets and computer and phone software. The company’s most popular products include the Mackintosh series of personal computers, the iPhone, the iPad, and the iPod. Software products include the Mac OS X line of operating systems, the iTunes digital media player, the iLife media management and creation software, the Safari web browser, and the iOS, iPhone’s operating system.

Apple Inc currently runs more than 301 retail stores around the world and an online store (Apple Store), that sells hardware and software components. A study conducted in May 2010 revealed that Apple Inc is among the largest corporations globally and the largest and best performing technology company in the world, having beaten Microsoft Corp.

Abstract

Since its formation in 1976, and the subsequent listing in the NASDAQ stock exchange, Apple Inc. has gone on to register unparalleled growth over the years, becoming one of the most amazing comebacks in the corporate world for a company that has been written off. The firm has been a trendsetter in most fronts and is a market leader in technology.

The aim of this report is to analyze the viability of an acquisition of Apple Inc. by Embry Investment Group (EIG). The report concluded that the acquisition should proceed due to the following reasons:

- Apple Inc. has a strong clientele spanning more than 30 years;

- The company’s share prices have been stable over the last six years and have registered great gains, currently selling at $337.37. The trend is expected to continue.

- Financial performance has been positive in the recent years too, the first quarter of the financial year 2011 registered a record profit of $6 billion up from $3.38 billion the previous quarter;

- Apple Inc. has diversified its products, most of which are bringing in substantial revenue;

- Apple Inc. has embraced innovation in all of its products and is never afraid to take risks in designing new products; and

- The corporation also enjoys high sales of its desktop computers and laptops line, with demand for MacBook Air increasing by over 300% in Q1 of 2011.

These are only a section of the reasons why an acquisition of Apple Inc. is highly approved. However, should the acquisition proceed as planned, the management to device way of countering competition faced by he iPhone due to the emergence of the Android operating system.

Background

The company was founded in April 1, 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne to market the Apple 1 set. Apple II was released on April 1977 without one of the co-founders, Ronald Wayne, as he had left the company a few months earlier. Apple II was a step ahead of its competitors, hence its popularity and increase in sales volume.

By the time the first Mackintosh machine was being launched in 1984, Apple Inc was a public company and was competing industry heavyweights such as IBM and Microsoft. However, internal wrangles led Steve Jobs to quit his job at Apple in 1985 and formed a media company, NeXT Inc. Job’s departure spelt doom for the company as the Macintosh Portable, launched in 1989, recorded low sales (Linzmayer, 1999).

The company gained its foot with the introduction of the PowerBook, among other products. Apple continued to perform poorly and the trend only changed when Jobs returned to the firm as an advisor, and later as a CEO in July 1997 (Deutschman, 2000).

The company also announced that it would collaborate with Microsoft to design a Microsoft Office version for their Mac platform, Apple Store was created a few months later. The iMac, launched in August 1998, returned the company to profitability as it sold close to 800,000 units in the first five months of its release.

Mac OS X was launched on March 2001 and was targeted at home users and professionals alike. The iPod was introduced a few months later. The product was extraordinarily successful as it sold million of pieces. This phenomenal success prompted Apple Inc to create the iTunes Store, an online music download site (Linzmayer, 1999). ITunes quickly became the market leader in music download services, with more than 5 billion downloads by June 2008. Share prices increased from $6 to more than $80.

From 2005, Apple began producing computers based on the Intel platform, further expanding its market share. The company also introduced a Boot Camp to enable users install the Windows OS on their Macintosh machines. Apple Computer, Inc. changed its name to Apple Inc. as the firm was expanding into other product lines.

This was followed with the announcement of the iPhone and Apple TV. This announcement brought further growth as Apple share prices jumped to more than $100 in May 2007. The App Store was launched in July 2008 and was highly profitable in its first month, bringing in more than $1 million. Three months later, Apple Inc became the third largest mobile handset manufacturer after selling millions of units of the iPhone.

In January 27, 2010, Apple Inc announced a tablet PC device known as the iPad. The gadget runs on the same operating systems as the iPhone. Three months later in April, the iPad was launched in the US and sold millions around the world in the first month of its release. The company also released iPhone 4 that boasted several multimedia and computing abilities as compared to its predecessors. It also launched updated its iPod line of products and unveiled iPod Nano, iPod Touch and iPod Shuffle.

Apple Inc has continued to introduce new product lines and upgrade existing ones, for example, Mac OS X Lion operating systems was launched in October 2010 and is the newest version of its operating. Additionally, Apple Inc has upgraded the MacBook Air laptop, iLife, and created the Mac App Store, a site that deals in software targeted at the users of Apple’s products. The company has also recently released the second line of it s tablet PC, the iPad 2.

In summary, Apple continues to be a leader in personal computers and a trendsetter in the mobile phone devices. It is one of the most successful companies in the world under Steve Jobs and continues to register huge profits.

Assessment of the Company’s Future Performance

In evaluating whether EIG should acquire Apple Inc, it is imperative that the company’s past performance be analyzed keenly for this will give a picture of the future performance. The analysis methodology will therefore involve a scrutiny of Apple’s history, financial performance, competitors, and how it handles competition. All of these factors will be used to determine the company’s future and hence in recommending whether EIG should proceed with the acquisition plans.

Previous Performance

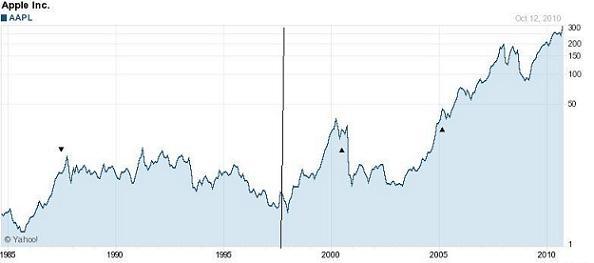

Apple Inc was enlisted in the NASDAQ in 1977 and trades under the mark AAPL, and as APCD in Frankfurt Stock Exchange. In 1980, the company went public and the shares were initially offered at a price of $2.75, the figure has been rising steadily since then and by 2011 April, the shares were trading for $337.40. The rise to the $300 mark has not been a smooth ride, in the 1980s, AAPL shares were traded at a flat gate of $2 and $3, disrupted by a jump in 1983 when the Apple Lisa personal computer was launched.

Share prices gradually rose in double digits in the late 1980s. However, by the mid 90s, Apple Computers Inc began lose its market share to competitors that included Dell and Microsoft. The tech-boom in the late 90s and early 80s led to a rise in share process and AAPL stocks passed the $25 mark. The share prices reached an all time high $200 per share when the company announced and released the iPhone and iPod in 2007.

The gains were reversed by the 2008 global recession, however, phenomenal growth has been made possible by the introduction of its most successful product, the iPad, enabling the shares to trade for more than $300. The current share prices mean that if a person bought Apple shares in 1997 worth $10,000, the shares would be worth $554,000, a good return on investment. The table below Apple share process over the two-year duration.

Financial Analysis

Apple’s financial performance has continued to rise over the recent years, albeit with occasional loses. In its most recent announcement for the financial year 2011 first quarter, the company announced record revenue of $26.74 billion with a profit of $6 billion (Apple Inc, 2011).

The previous quarter had posted revenue of $15.68 billion and a profit of 3.38 billion, hence there was a 77.5% increase in profitability. Profits were driven by an increase in demand for iPhones, iPads and laptops, particularly the MacBook Air during the holiday period (New York Times, 2011). Financial results over the last 3 decades have been majorly positive as shown below.

Table 1: Apple Financial Results from 1982-2010.

Competition

Despite growing phenomenally over the last five years, Apple continues to face stiff competition in the computer, mobile handset, and tablet PC market. Just a few months ago, Apple commanded a majority 95% of the tablet PC market when it introduced the iPad, however, several companies have now designed their own tablets and the Tablet PC market wars have greatly impacted on Apple’s market share.

These include Motorola’s Xoom, Samsung’s Galaxy Pad, Lenovo’s LePad among a host of other companies. Most of these tablets run on the Android operating system, similar to most smartphones, this has caused Apple to lose a substantial share of the market and now controls nearly 70% of the tablet PC market.

To counter competition, Apple Inc. recently introduced the iPad 2, an improvement of the original iPad. The new device boasts of new and improved features such as a thinner shape, faster web browsing and dual cameras for capturing high quality videos and video communication through the web.

Another strategy that the company employed to beat off competition was to introduce the iPad 2 at a price that equals its predecessor, analysts have noted that “…the iPad 2 actually costs less than its comparably equipped Android rivals” (Pogue, 2011).

A similar strategy has been employed at combating competitors in the mobile handset market segment, especially smartphones. Since its inception in 1997, the iPhone has undergone four major upgrades, from the original iPhone, iPhone, iPhone 3GS, and the current iPhone 4G. These upgrades have enabled the iPhone to maintain the position of the most popular smartphone in the market.

Apple faces stiff competition from Google’s Android operating system that is currently the most popular smartphone operating system, having surpassed iPhone and Blackberry’s own operating systems (iOS and RIM respectively). Other mobile phone platforms such as the Windows Mobile and web OS are slowly gaining numbers. However, iPhone is poised to maintain its lead in the smartphone market.

Apple is currently the market leader in the laptop market, especially with the introduction of the ultra-thin and light MacBook Air. Ratner (2011) reports that the second generation MacBook Air has been significant in pushing Apple’s market control of the laptop market. Records show that 420,000 MacBook Air units were sold in the Q4 of 2010, representing an annual growth of 333% (Ratner 2011). The success has been attributed to the low entry price ($999) and the device’s tablet-like abilities.

Product Differentiation and Supply Chain Strategies

As competitors come with new products by the day, Apple has continuously devised new ways of fighting them, under Steve Jobs, Apple is bound to continue with its market dominance of the personal computer market. however, the iPhone is likely to face stiff competition from smartphones operating on the Android platform, which currently commands 50 % of smartphone operating systems. The company is continuously expanding into other products and this has increased its earnings considerably.

These products include the iPod, Apple TV, music through the iTunes Store, iLife, and application software through the App Store. Besides, the company has several retail stores within and outside the US that give it a global presence. Apple Inc. also distributes its products through online stores, cellular network companies, wholesalers, and retailers. It had opened 317 retail stores: 233 in the US and 84 in international markets.

Recommendation

After analyzing major aspects of Apple Inc., the decision arrived at is that EIG should proceed with the takeover. Despite dismal performances in the earlier years, the company has firmly established itself and is on the road to success. Apple has been recording positive growth since 2002, and in the first quarter of the fiscal year 2011, announced a record profit of $6 billion, up from $3.38 billion profitability in the previous quarter.

Profitability has been enhanced partly by the excellent supply chain that enables Apple Inc. to have a global presence, hence increase sales of its products. The future is bright for this company as the excellent financial performance is set to continue. Share prices are also likely to follow the same trend.

Apple Inc. has embraced innovation in all of its products and is a trendsetter, the company is never afraid to venture in new areas, this can be evidenced by products such as the iPad and the iPod. It is constantly providing upgrades of the products with improvements in technology and this has enabled it to stay ahead of at par with the rest.

References

Apple, Inc. (2011). Apple Reports First Quarter Results. Web.

Deutschman A. (2000). The Second Coming of Steve Jobs. New York: Broadway.

Linzmayer, R. W. (1999). Apple Confidential: The Real Story of Apple Computer, Inc. California: No Starch Press.

Pogue, D. (2011). Appeal of iPad 2 is a Matter of Emotions. The New York Times. Web.

Ratner, J. (2011). Apple’s ‘quasi-tablet’ MacBook Air. Financial Post. Web.

The New York Times. (2011). Apple Incorporated. The New York Times. Web.