Introduction

Adidas is an internationally recognized company that has major operations in Asia, Latin America, North America, and Europe. Its major sales have been from the European market with sales of over 51%. However, the overall market share of Adidas is 13% which makes it the second largest manufacturer (Bloomberg Business Week 2010).

Adidas AG is a German-based company involved in the manufacture of sports apparel. Other than sports footwear, Adidas AG is also involved in the manufacture of shirts, bags, eyewear, watches, and other clothing-and sports-related products. The company is the leading manufacturer of sportswear in Europe. Globally, it comes second after Nike, the American-based rival company (Bloomberg 2008). Adolf “Adi” Dassler founded the company in 1948 and registered in 1949 (Runau. 2011, p.3).

Based on the 2010, Adidas Group reordered revenues of €11.990billion in 2010 compared to €10.381 billion of the previous year 2009 (Adidas Group 2010, p.134)

The paper analyses market environment, strategy, and strategic position of Adidas so as to establish the best strategic plan that can be adopted to gain more competitive advantage.

Market Environment Analysis

This section identifies the competitive advantage of Adidas AG, its successes and its market share position.

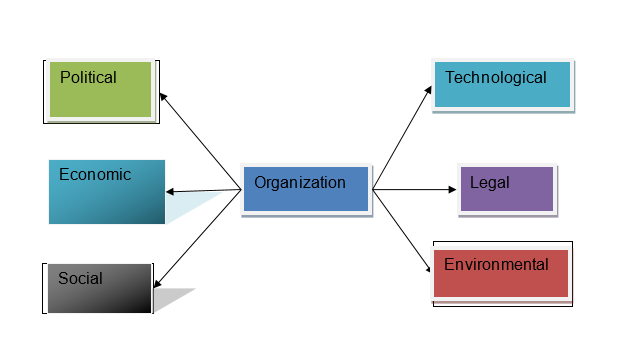

PESTEL Analysis

Political factors

Like any other company with product manufacturing and production in a foreign country, Adidas is prone to political threats like insecurity and some regulations which are politically instigated. Adidas was accused of paying its employees as low as less than $3 especially in the nations where production is carried (Oxfam Australia 2007). Other political accusation is breaking International Labour Organizations requirements and standards. ILO advocates for the basic working conditions and rights to all employees in a workplace. For example, the company does not allow labor unions participation and strikes as witnessed in one of the factories in Indonesia in 2005 were members were fired after participating in a strike (Oxfam Australia 2007).

Economic

Adidas group margins increased in 2010 from 45.4% in 2009 to 47.8% despite the macroeconomic challenges (Adidas group 2010, p.134). However the consumer spending has been low because of the increased unemployment. Despite the weak economic conditions, Adidas performance was better in 2010 compared to 2009 (Adidas group 2010, p.134).For example, Adidas Group revenues grew to €11.990billion compared to €10.381 billion in 2009 (Adidas Group 2010, p.134) can be attributed to the increase in Adidas product consumption in the emerging markets.

Social cultural

people around the world have become health conscious especially those from the rich families leading to high consumption of sporting equipments. For example, the consumption has increased by 11% in 2010 (Bloomberg Business week 2011). This could have been the reason why the sales in North America have increased by 13% and a market group increase by 12% (Adidas Group 2010). Other Adidas programs like ‘micoach’ which is used for physical fitness program has also attributed to the increase in sales (Borowski 2011, p.3).

Technological

Adidas AG has invested heavily in the latest technology to meet the changing demands of the consumers and clients. For example, Adidas has invested in TaylorMade-adidas Golf which is a innovation based on latest technology (Adidas Group 2010, p.176). The net sales of TaylorMade-adidas Golf in 2010 were at €909 million from the UK, Japan, and North America (Adidas Group 2010, p.102). This means that technology coupled by innovation is playing a great role in the sales of Adidas technologically made products.

Environmental

Every company in the world has become conscious of the environmental risks associated with the use of bio-fuels and other forms of energy. Adidas is aim is to reduce energy use by 20% which will cut carbon emissions by 10% (Adidas Group 2011).Adidas has been in the forefront to sustain the environmental risks associated with the manufacturing sector of the company. For example, the company has embarked in production of more environmentally sustainable products (Adidas Group 2009).

Legal factors: Adidas AG brands are usually based technological design and innovation which is prone to counterfeiting. To avoid and reduce losses associated with counterfeiting, Adidas invests heavily in legal protection (Adidas Group 2010). For example, the company works law enforcement officers and authorities to protect its intellectual and property rights (Adidas Group 2010). This has increased the seizure of counterfeit Adidas sportswear and apparels. For instance, in 2009, more than 8 million Adidas Group counterfeit products were seized all over the world (Adidas Group 2010).

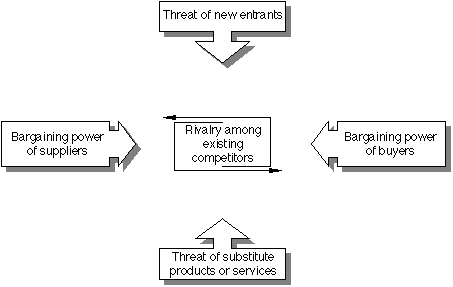

Micro economic factors

Nike is the largest rival of Aidas in both market penetration and market control. According to Doigiamis and Vijayashanker (2009, p.5) Nike has 33% of the market share. Other rivals to Adidas are Puma and Fila. However, despite the huge rivalry in the sportswear and apparel industry, Adidas has been has to retain its second position. Despite the high level of rivalry, Adidas controls the golf industry sportswear through the production of the TaylorMade-adidas Golf (Adidas Group 2010, p.81).

Adidas is faced with threats from perfect substitutes from its rival manufactures like New Balance, Asics, Puma, and Nike (Adidas AG 2010). However, because the companies operate under oligopoly market structure, the prices are not likely to be more from one another. This has ensured consumer loyalty. The substitutes are 78% from the apparel market and 18% from local and small rivals like Li Ning of China (Dogiamis & Vijayashanker 2009, p.6)

Because of the many barriers posed by the industry, Adidas faces low threat from new entrants. This is because of the huge economies of scale required to manufacture, distribute, and research and development among others (Dogiamis & Vijayashanker 2009, p.6). Huge capital is required before entering the apparel industry to establish factories and other infrastructure (Riley 2011). However, new entrants like a Li Ning controls 36% of Chinas market after the leader Nike (Reuters 2011)

A lot of bargaining power is carried out by customers given that they can choose to buy Adidas rival products (Dogiamis & Vijayashanker 2009, p.6). Given that the sports apparel lacks compliments, then the bargaining power of customers is always high. Because of the high customers bargaining power, the sales of Adidas increased by 9% in 2009 (Dogiamis & Vijayashanker 2009, p.6). Adidas is always on its move to make sure it satisfies its consumers through the production of high quality products.

Adidas suppliers bargaining power is very high (Dogiamis & Vijayashanker 2009, p.7). This is because of the sourcing companies are based in Asia and other pacific nations. For example, China is the largest supplier of Adidas with a share of 27% (Adidas Group 2010, p.73). With increase in the number of suppliers from the Asia and other nations it means that their supplier bargaining power has increased.

Market Structure, Strategic Groupings and Market Segmentation

Adidas operates under an oligopoly market structure (Riley 2011). For example, there are few sellers in the sportswear industry like Nike, Puma, Asics, Columbia Sports, Li-Ning, and Under Armour. It is also characterized by barrier entry (Ghai &Gupta 2002, p.40), because of the high capital required at entry level. It entails large economies of scale which is a characteristic of an oligopoly (Ghai & Gupta 2002, p.41). This can be due to the fact that Adidas is the second in terms of market share and sales just behind Nike.

The market of Adidas is segmented based on potential customers, behavioral, demographical, geographical and social economic features (Borowski 2011, p.7). For example, Adidas sells more sportswear in North America region. Adidas has expanded its market share to emerging markets like China, Japan, Latin America, Asia, and India (Adidas AG 2010). It has been operating in these new segments by targeting the wealth families. The major segments of Adidas are the sports style and sports performance (Adidas AG 2010).

Strategic groupings

Adidas operates under several strategic groupings like the premium price strategy which specializes in footwear, apparel, and fashionable items (Adidas Group 2010). Another strategy that has been employed is the Reebok excessive discounting aimed at increasing sales. For example, in 2009 the Reebok had 19.45% net sales, Reebok-CCM Hockey 8% and Rockport 12% worldwide (Adidas 2010). In the emerging markets strategy, the company targets wealthiest segments selling under the premium prices. Other brands used as a strategy include the TaylorMade-adidas Golf which targets the golf markets in North America (Adidas Group 2010, p.176). The satisfaction of its customers and meeting their demands and expectations has been achieved through research and development.

Strategic Analysis

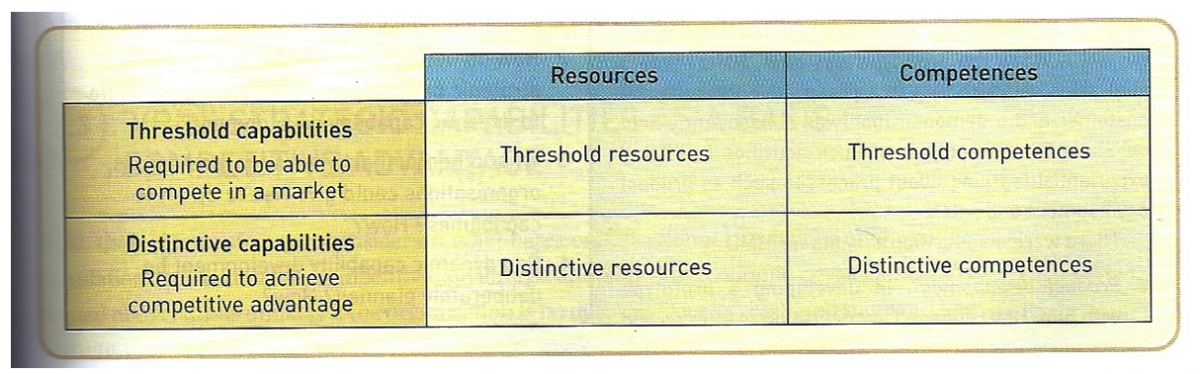

Figure3: Threshold resources and core competences. Source: Kotler, Berger and Bickhoff (2010).

Threshold and distinctive resources

.Adidas depends heavily on outsourcing for its manufacturing and production lines. This is because the Asian countries are low wage production economies which are cost effective compared to home production and manufacturing.. For example, 67% of the plants are located in Asia where 90% of the production process is done manually (Borowski 2011, p.3). This has assisted Adidas in making numerous profits because of the low production costs incurred by having its production in Asia. The production and the manufacturing facilities are also located near raw materials (Adidas 2010, p.113). This acts as a competitive advantage to the company as the company is able to maintain its production levels.

On the other hand, Adidas distinctive resource has been being an active player in the sponsorship of games in North America, Europe, and other countries. For example, it has partnered with Chelsea FC, LA Lakers, and Liverpool FC among others (Dogiamis & Vijayashanker 2009, p.7). The sponsorship of games in the emerging nations by Adidas in Asia has led to an increase in sales by 24% (Adidas AG 2010). Acquisition of Reebok in 2006 by Adidas (Runau. 2011, p.21), can be categorised as a threshold resource. This is because the company had net sales of 12% in 2010 Reebok sales (Adidas Group 2010, p15) which was an increase.

Competences

The core competences of Adidas are technological competence and being a competent service provider of sportswear and apparels to athletes (Maler 2010, p.3). For instance, Adidas is ranked as the second largest manufacturer and distributor of sportswear and athletes shoes after Nike. This implies that it has the capability to manufacture athletes’ footwear depending on the changes in tastes and demands of the consumers (Adidas Group 2010, p.114). It also manufacturers’ customized footwear for some of its clients (Adidas Group 2010, p.114). This has been achieved through the great emphasize in innovative technology and workforce.

The Adidas brand is driven by the heavy investment in technology (Maler 2010, p.3). This has led to the creation of innovative products that can meet the “changing needs of athletes and consumers” (Adidas Group 2010, p.114). This has been realised through heavy investment in research and development as well as in skilled human capital. Research and development allows inception of new ideas which are able to strengthen the company’s brand name and image (Adidas Group 2010, p.114). For example, the Taylormade-adidas Golf has been one of the successful inventions and innovations of Adidas developed by skilled and competent team using the latest technology (Adidas 2010, p.114). Adidas is always placing new brands in the market that have undergone thorough scrutiny (Adidas Group 2010).

Value chain analysis

Adidas has a diverse value chain which includes innovation, design, marketing, development, sourcing, operations, sales and the use & end value. The inbounds involves the product production and manufacturing which is primarily carried in Vietnam, Thailand, Indonesia, and China (Adidas Group 2010). Adidas has more than 1230 factories which manufacture products in 69 countries (Adidas Group 2011). More than 50% of the manufacturing is carried in China and Asia and the products sold in Europe, Asia, US, and Latin America. Outbound logistics are carried through a well developed distribution and dispatch network (Adidas Group 2010, p.130). It also involves warehousing and transport mechanism that ships the end products from the factories to the ready market in Europe, US, and Latin America.

Marketing and sales activities are carried out depending on the market segmentation to meet the consumers’ needs and expectations. For example, some of the channels used to advertise Adidas products are through the use of stores, internet websites, television channels, and through sponsorships (Adidas Group 2010). The developed products are then positioned in the various strategic positions targeting the readily available markets.

Some of the areas where the products are positions include the retail and the wholesale stores. This two are strategically positioned to attract the maximum number of customers based on the demand in the markets. Some of the stars used include Lionel Messi and David Villa (Adidas 2010) who promote the consumers. Through the sponsorship, consumers can watch up to the players and be interested in the brand.

Other than the major technical activities, the value chain is also characterized by administrative activities like financing, information management, retail and wholesale back office activities, and foreign operations financing among other supportive activities (Adidas Group 2010). More than 42,541employees are managed by the human resource department and offering any support to the employees to ensure effective and efficient production process (Adidas Group 2010, p.92). The major focus of the production and development is to ensure that competitive products are produced which include customized footwear and designers (Adidas 2010, p.114). The whole value chain plays a great role in the success of Adidas products.

VRIN framework

Through production and manufacturing operations outsourcing from Asia, Adidas has achieved an added value of its brand because of the low input costs involved. For example, 67% of production is carried Asia (Borowski 2011, p.3). 17% are found in America, 14% in Europe, Middle East and Africa (EME A) (Adidas 2010, p.77). However, 27% of the factories are found in China because of the improved supply chain and raw materials (adidas 2010, p.77)

The powerful brand of Adidas offers the company rare capabilities which act as a competitive advantage. This has seen the company sales in North America be 24% in 2010 (Adidas AG 2010).most of the consumers have remained loyal to the brand.

All the products development and manufacturing is carried by the company management with the aim of increasing its imitable capabilities. The employees of Adidas carry out the research and development process. Based on the annual report of 2010, Adidas spent €102 million for product research and € 86 million on development (Adidas 2010, p197).This is aimed at protecting its products from any closer imitations. The uniqueness in Adidas products has made it possible for the company to remain the second largest manufacturer.

Although there have been some incidents of counterfeiting Adidas products, they cannot purely substitute the Adidas products. Its brand and quality products have ensured the company remains competitive although the resources are not non-substitutable. For example, more of the raw materials are found in the sourcing countries like China and Indonesia (Adidas 2010, p.113).

Strategic Fit Analysis

The distinctive resources and the core competences of Adidas form a unique competitive advantage which can be used in the competitive market environment to increase market share. The company can take this advantage and increase its markets to other Asian emerging economies. This can be supported by the competent team of Adidas to increase performance in new markets (Adidas Group 2010, p.115). The political problems like labor laws regulations and working conditions complains can be addressed by the legal experts or avoided through closer adherence to the laws (Adidas Group 2011).

Adidas faces a threat from new entrants in the industry especially the Lu Nings from China which plays a competitive role in the Asian markets. The company needs to double its brand awareness to gain a huge market share (Adidas Group 2010, p.177). This can be achieved sponsorship to create a brand name and improve its image. It can also use its innovative capabilities to develop a more competitive brand. Brand added value can be achieved through the increased much investment and use of research and development capabilities. The application of both the innovative capabilities and the research and development capabilities can lead to the development of quality and competitive products. Lastly, the weakness can be converted into strengths and the threats into opportunities to link the competences and resources for competitive advantage (Adidas Group 2010, p.177). For example, it can streamline its cost structures and replenish its capabilities.

SWOT Analysis

Table 5: SWOT analysis diagram. Source: Murray-Webster (2010).

Strengths

Adidas’ listing as a stock corporation means that the company can benefit from adjusted capital (Borowski 2011, p.2). This has enabled investment of additional capital in effective and innovative technologies. Being the second largest manufacturer of sporting wear after Nike has made it possible to produce highly competitive sporting wear. Through the sponsor of numerous sports in the world, Adidas has been able to improve its brand and image (Borowski 2011, p.2). It has been able to host Paralympics and sports and in 2012 “Adidas will be the official sportswear partner of the Olympic games and the Paralympics in London” (Borowski 2011, p.2). Adidas has 169 subsidiaries in the world which means that it has a diversified market for its products in different segmented markets (Borowski 2011, p.2).

Weaknesses

After the acquisition of Reebok International ltd by Adidas in 2006, the company has not been fairing on well since. During the 2007/2008 financial crisis, the company received low orders (Borowski 20011, p.3). In 2009 Reebok lost 20% of the market share in North America and a two digit deficit in the European and the Asian markets (Borowski 20011, p.3). Adidas has low quality manufacturing facilities. For example, its production is carried out in low wage countries like Asia where it is impossible to manufacture quality products. For example, 67% of the plants are located in Asia where 90% of the production process is done manually (Borowski 2011, p.3). This lowers the degree in which high quality sporting wear can be manufactured because of low mechanical involvement.

Opportunities

Adidas has collaborated with new techniques such as ‘miCoach’ that is useful training program (Borowski 2011, p.3). This has the capacity of creating a new market share through the program. Through the sponsoring of sports and teams, Adidas will continue to enjoy customer loyalty as many teams will continue to use its products. Because of the changing lifestyles and the health consciousness, many people will adopt healthier lifestyle in the world. This offers perfect market opportunities for Adidas to sell sportswear to many people and sports clubs (Berger 2008, p.39). The adoption of online computer games featuring Adidas (Scherer 2007, 475) will offer new market for Adidas products.

Threats

The financial market crisis has led to increase in oil prices and inflation level which translates into the increase in the costs of raw materials (Adidas Group 2010, p135). Since the raw materials are outsourced from different parts with different exchange rates level, the macro-economic changes are likely to affect the operations of Adidas. These threats have the capacity of reducing the profitability of Adidas (Berger 2008, p.40). The emergence of counterfeit products in the market will affect the sales of the Adidas sporting wears. This has been as result of poor legal policies to regulate the black markets which introduce counterfeit products. However, its fight by Adidas will create more costs to the company (Borowski 2011, p.4). Another risk is the competition and rivalry from other key players like Puma and Nike.

Recommendations

With the increase in competition, Adidas needs to invest in the latest technology to produce more competitive products. It should also increase its sponsorship to increase its brand recognition, public image and loyalty. The company should invest more in legal divisions to ensure closer relationship that would promote liaison to eliminate counterfeit products in the markets. Lastly, the company should change its weaknesses to strengths and turn the threats it faces as opportunities to create a strategic and competitive advantage.

Reference List

Adidas Group. 2011, Environmental Strategy. Web.

Adidas Group. 2011, Supply chain. Web.

Adidas Group. 2011, External and industry risks. Web.

Adidas Group, 2010, Performance. Web.

Adidas Group., 2010. Annual report 2010. Web.

Adidas Group, 2009. Annual report 2009. Web.

Berger, C., 2008. Strategic Sports Marketing – The Impact of Sport Advertising upon consumers: Adidas- A Case Study. Berlin:Grin Verlag. Web.

Bloomberg L.P., 2008. Adidas, Deutsche Telekom, Infineon: German Equity Preview. Web.

Bloomberg Business Week, 2011, Textiles, apparel and luxury goods Adidas AG. Web.

Borowski, A., 2011. Adidas Marketing Strategy – An Overview. Berlin: GRIN Verlag. Web.

Chadwick, S., & Arthur, D., 2007. International cases in the business of sport. Oxford: Butterworth-Heinemann. Web.

Dogiamis, G., & Vijayashanker, N., 2009. Adidas: Sprinting ahead of Nike. Web.

Ghai, P., & Gupta, A., 2002. Microeconomics theory and applications. New Delhi: Sarup & Sons. Web.

Kotler, P., Berger, R. and Bickhoff, N., 2010. The quintessence of strategic management what you really need to know to survive in business. Heidelberg: Springer. Web.

Maler, F. K., 2010. Moving to Large-Scale Demonstrators and European Innovation Partnerships. European Commission Enterprise and Industry, pp.1-3. Web.

Murray-Webster, R. 2010. Management of risk guidance for practitioners. London: TSO (The Stationary Office). Web.

Oxfam Australia, 2007, Adidas: So what’s the problem with adidas?. Web.

Porter, M. E. 1991. Towards a dynamic theory of strategy, Strategic Management Journal (1986-1998), vol.12, pp. 95-117. Web.

Riley, G. 2011, Micro: Oligopoly. Web.

Runau, J., 2011. At A Glance: The Story of the Adidas Group. Web.

Scherer, J. 2007. Globalization, promotional culture and the production/consumption of online games: engaging Adidas’s Beat Rugby’ Campaign. New Media Society, Vol. 9, no. 3, pp. 475–496. Web.

Smith, B., 2007. Pitch Invasion, Adidas, Puma and the making of modern sport. London: Penguin. Web.

Stabell, C. B & Fjeldstad, O. D. 1998. Configuring value for competitive advantage: On chains, shops, and networks, Strategic Management Journal, Vol. 19, pp.413–437. Web.

Teague, S. 2009. The ultimate leadership guide, UK, Simon Teague LLP. Web.