With its total assets equaling 27 billion dollars, the Al Rajhi Bank is the third-largest Islamic Bank in the world. It is owned and operated by one of the wealthiest families in Saudi Arabia. The four brothers, Saleh bin Abdul Aziz Al Rajhi, Abdullah bin Abdul Aziz Al Rajhi, Mohammed bin Abdul Aziz Al Rajhi and Sulaiman bin Abdul Aziz Al Rajhi operate the Al Rajhi Bank. In 2007, the Al Rajhi Bank was given the Best Islamic Bank Award by Islamic Financial News (IFN). In Islamic nations, IFN is the leading provider in information, training, seminars, and more. In recognition of Al Rajhi’s development of innovative business policies, the Bank also received three additional awards from the IFN. In comparison, Arcapita, a small bank based in Bahrain, shows strong profitability, satisfactory capitalization, sound liquidity, and a well-diversified portfolio. The CEO of Arcadia, Atif A. Abdulmalik, said in a message to the shareholders that they have been successful in creating strong returns for investors and that the Bank’s net income has grown tremendously in the last several years. Arcapita’s net assets are currently worth 3.6 billion dollars. In 2006 Arcapita’s net assets equaled 2.8 billion dollars. With a growth of just under one billion dollars in 12 months, Arcapita is well on its way to becoming a competitor of the larger banks in the Mid-east.

The Al Rajhi Bank was first developed 50 years ago by the Al Rajhi Family. When the Al Rajhi Family was starting out in business, they owned a trading and exchange company. It expanded when individual establishments merged into the company. Then ten years later, the corporation was converted into a joint-stock company. This joint-stock company was then developed into the Al Rajhi Banking and investment corporation three years later.

Today Abdullah Sulaiman Al Rajhi is the Chief Executive Officer and partial owner of Al Rajhi Banking. He was formerly the Deputy General Manager for Investments & Foreign Relations, and in 1994 he became the First Deputy General Manager. In 1996 Mr. Al Rajhi was given the position of Director & General Manager of the Bank. Finally, in 2005, he took over the position of Director and CEO of Al Rajhi bank. The Deputy CEO is named Saeed Al-Ghamdi and has over 16 years of experience in the banking industry. He has held many important positions within the Bank, including Chief Information Officer, General Manager of IT operations, and Head of Retail Banking. Saeed was also the GM of retail banking; he was responsible for leading projects across the retail business, including major projects in the areas of IT and CRM development, until he became the DCEO of Al Rajhi bank in 2007.

The Board of directors consists of 11 very experienced professionals who make well thought out decisions based on the legislation of Saudi Arabia and the policies of the Bank. The Board of directors includes Abdullah Abdul Azziz Al Rajhi, Mohammed Abdul Aziz Al Rajhi, Ali Ahmed Al Shudy, Saeed Omer Qasim Alesyi, Mohammed Ibrahim Alissa, Salh Ali Aba Al-Khalil, Mohammed Abdullah Al Rajhi, Mohammed Osman Al Bishr, and Sulaiman Saleh Al Rajhi. Further management positions include the GM corporate group, which is headed by Marcus Andrade; the GM Retail Group, which is headed by Anand Dorai; the GM Finance Group &CFO, which is headed by Mohammed Lookman Samsudeen, the GM Strategy Group headed by Constantinos Constantinides, the GM Shariah Group headed by D. Saleh Bin Abdullah Bin Saleh, the GM Administrative Group which is headed by Suliman Al-Obaid, GM Human Resources headed by Saud Al-Roshan and the GM Al Rajhi Bank Financial Services Group headed by Rajkamal Taposeea.

The Al Rajhi Banking and Investment Corporation is a Saudi Joint Stock Company whose objective is to carry out banking and investment activities in compliance with the by-laws of Saudi Arabia. The accounting policies of this Bank are consistent with the Accounting Standards for Financial Institutions put forth by the Saudi Arabian Monetary Agency or the SAMA. The consolidated financial statements are prepared under the historical cost convention and modified for the measurement of fair value. The corporation uses IRFS 7- Financial instruments, which include disclosures and international financial reporting to keep track of their assets and liabilities. Critical accounting, such as estimates, assumptions, and judgments, are made from historical experience and the sound judgment of the management team.

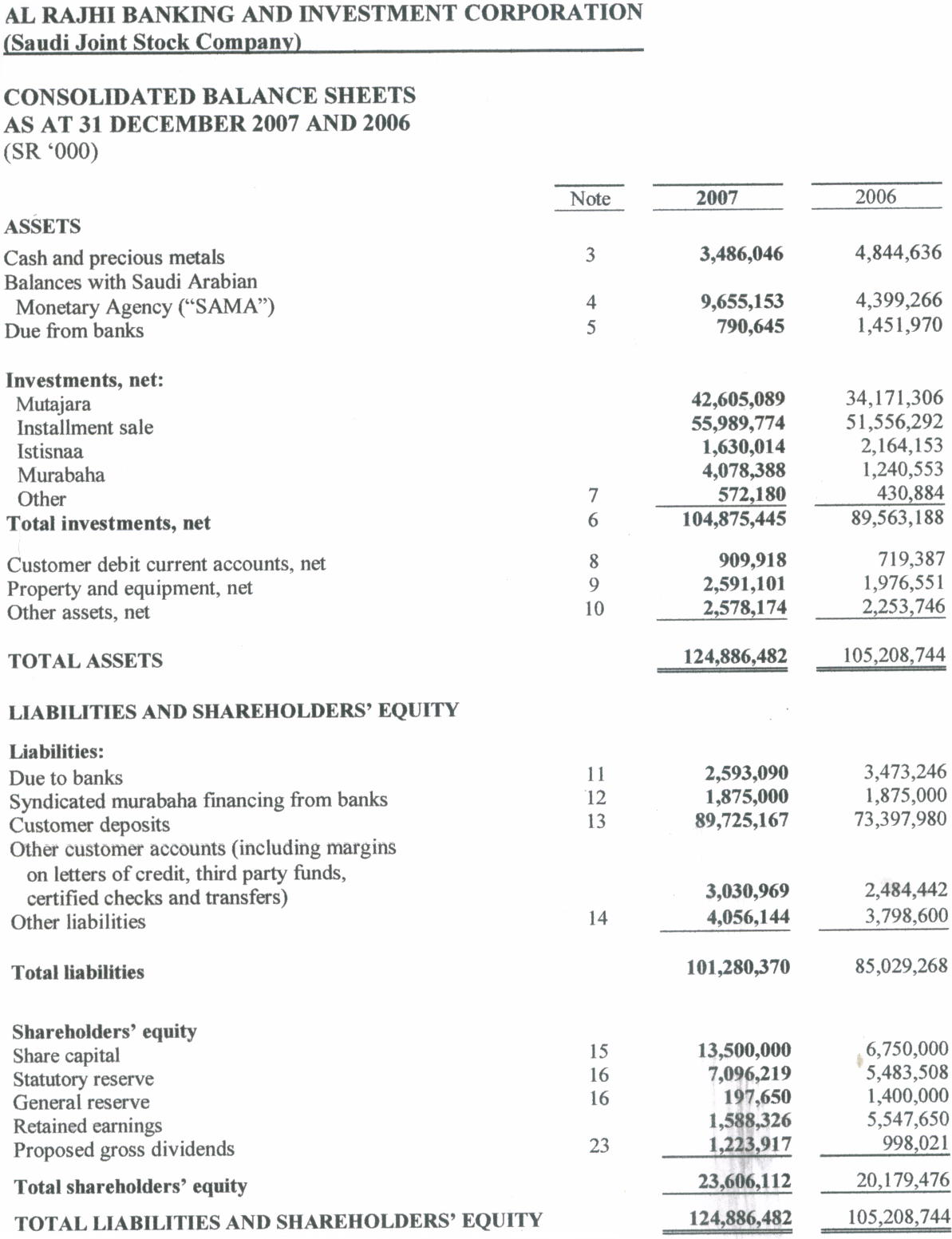

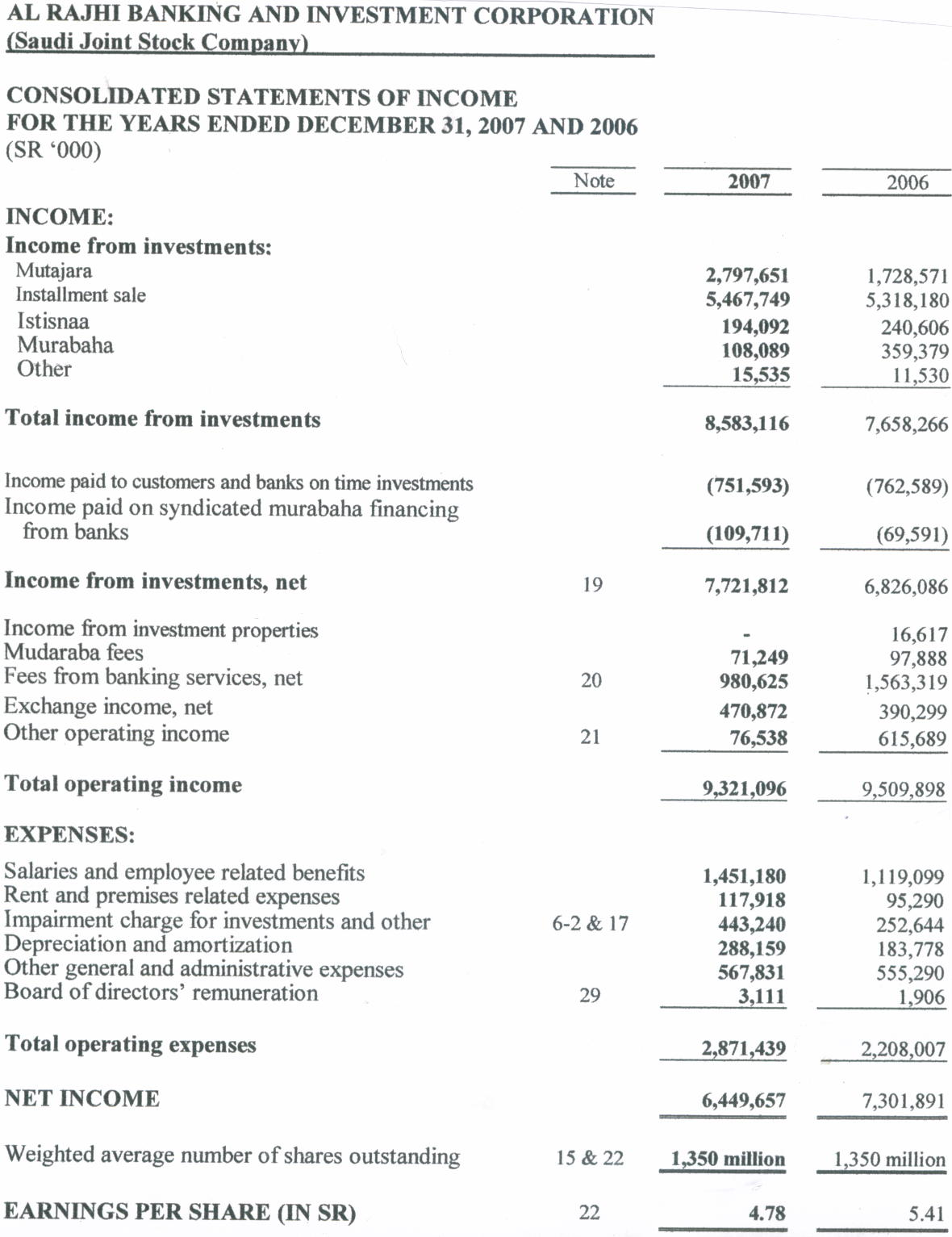

The following charts were taken from the Al Rajhi Bank’s 2007 annual business report. By looking at the charts, one can see that the Al Rajhi Bank is continuing to grow and that the outlook is fairly good. The consolidated charts show losses in some areas since 2006. However, the gains in other areas such as the SAMA and the income from investments are greater than they were in 2006.

Risk management is of the utmost importance to the Al Rajhi Bank. They take great pains to protect their corporation. While some degree of risk is accepted, risks are continually analyzed and evaluated. The corporation aims to achieve an appropriate balance between risk and return and to minimize poor financial performance. The policies, procedures, and systems that are put in place to identify and analyze these risks are practiced on an ongoing basis. Risk management is performed by the Credit and Risk Management Group (CRMG) under the policies approved by the Board of Directors. The most significant types of financial risks include operational risks, liquidity risks, and market risks. Market risks include currency risk, profit rate risk and other price risks. The CRMG continues to work with other departments in order to control risks.

With Assets equaling 27 billion dollars, the Al Rajhai Bank continues to flourish. Although the balance sheets reflect losses in some areas, the only significant losses were the earnings per share. In 2006 earnings per share were equal to 5.41% and in 2007 these earnings dropped to 4.78 %. This is an important loss; however, the loss is primarily due to an overall decline in worldwide markets. The economy has slowed and therefore every market is suffering to some degree. Total assets are gaining, however, and the Al Rajhi Bank seems to be holding steady.

Arcapita is a small bank centrally located in Bahrain with branches in Atlanta, London, and Singapore. Arcapita started up in 1997 and has grown annually by 40 %. They are staffed by a world class team of professionals who are dedicated in producing the highest quality performance from such a small bank. Their aim is to eventually be a competitive force with the large world-class banks.

Arcapita is currently worth 3.6 billion dollars. Only one year ago they were worth 2.8 billion dollars. Although the world’s economy has slowed over the last year, Arcapita has managed to increase their assets by 8 billion dollars. This is no small feat because over the last year most markets have experienced significant losses. But, because Arcapita targets economically attractive sectors and regions they have been able to make big profits. Their stratagey is simple, they act as a principle arranger in the acquisition of controlling interests in established companies in the United States and Europe, focusing on growth-oriented corporate acquisitions.

Acapita’s Chief Executive Officer is named Atif A. Abdulmalik and is a leading professional banker with over 20 years experience. Arcapita has a board of directors with includes 9 professionals who make decisions based on the information and advice that the International Advisory Board supplies to them. The International Advisory Board provides advice and consultation to the Bank on Business matters, international relations, legislation, and regulatory and political issues. The Shari’ah Board has a broad geographical mix and a proven track record in the practical implementation of the regions laws. According to Atif A. Abdulalik (CEO):

The backbone of the business is supported by a carefully cultivated corporate culture that encourages teamwork, innovative thinking and integrated decision making. We have continuously emphasized a focused strategy, recruiting and retaining the best people, a flat and participatory management structure, maintaining a solid capital base and effectively managing the risk to our business. The alignment of the interests of employees, shareholders and our investors has also been of great importance. We believe that these factors have driven our success, and will continue to do so in the future (Atif A. Abdulmalik, 1).

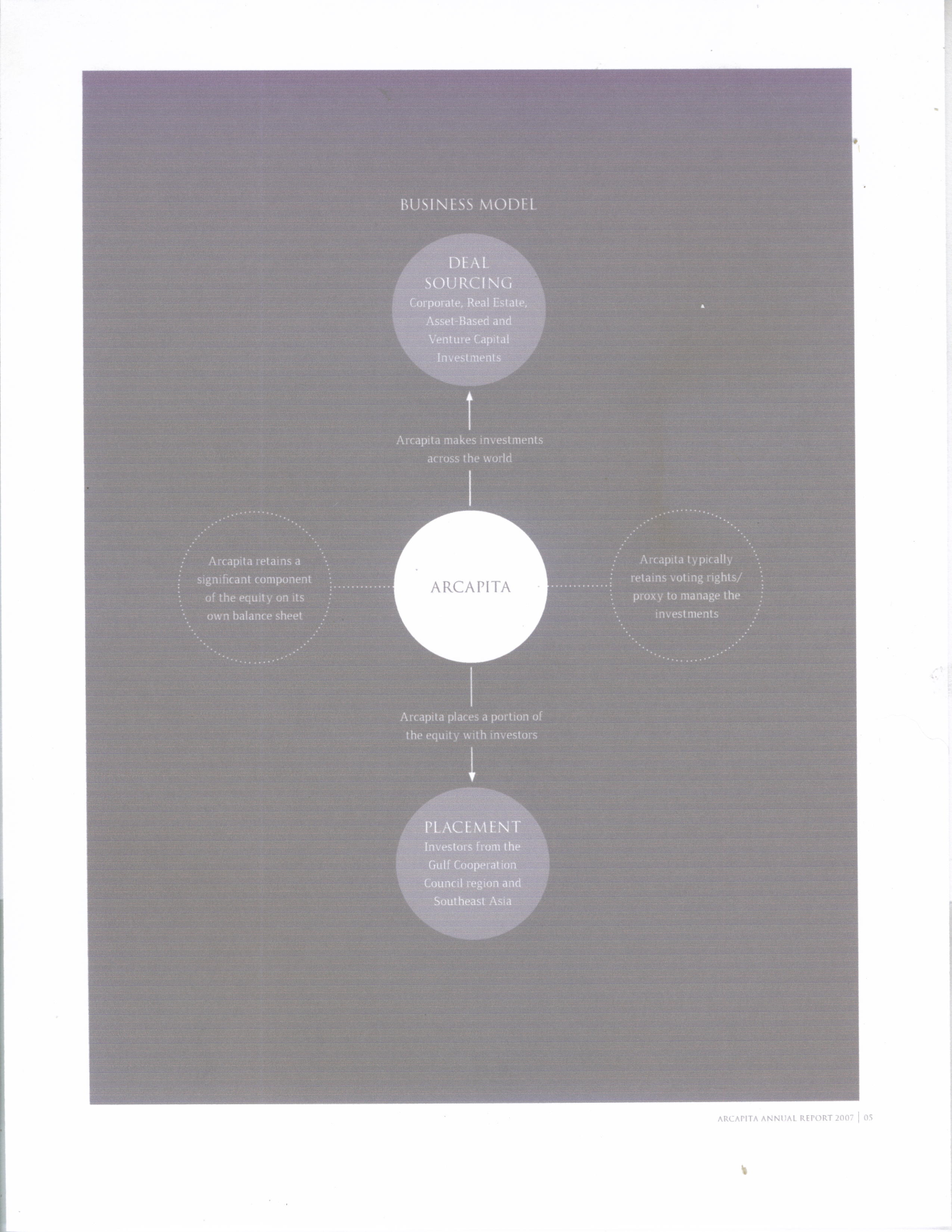

The team at Arcapita searches for companies that have innovative products and services, leading market positions and strong managerial teams who are capable of building assets.

The companies that are targeted by Arcapita should have a strong value proposition and product line, technology, distribution, manufacture brand and a clear business strategy. In addition Arcapita only invests in businesses where they believe that they have a secure business plan. While Arcapita considers almost any profitable business for investment, they especially invest in consumer, healthcare, energy, technology and specialized manufacturing sectors. Corporate acquisitions are funded through Islamic financing and equity through the company

Arcapita underwrites the equity portion of every acquisition and uses its own financial resources where the target company’s capital structure allows. Then the equity in each investment is put into the Bank’s investor base.

2007 was the most successful year to date financially. The bank’s proven business model generated significant growth and net income from an increasingly diversified portfolio of investments. There were 13 transactions with a total value of over $8.1 billion and the aggregated transaction value was approximately $1.1 billion. 83% was added to the overall transaction value which now amounts to approximately $19 billion and Arcapita transaction stands at $60 billion. During the last year Arcapita completed its largest transaction with the acquisition of Viridian and they completed their largest U.S. corporate transaction to date, the $460.7 million acquisition of FORBA as well as their largest European transaction in real estate ($779.4 million).

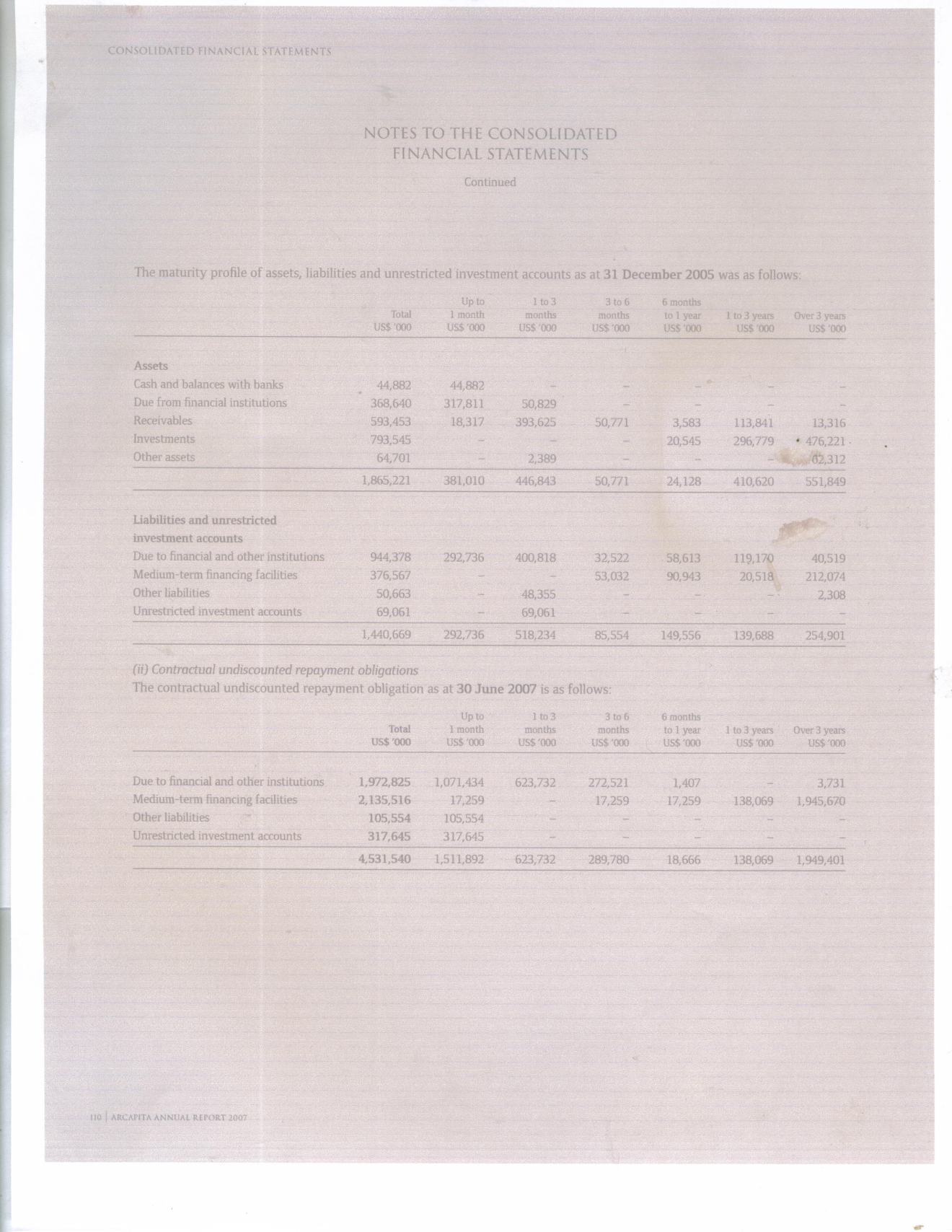

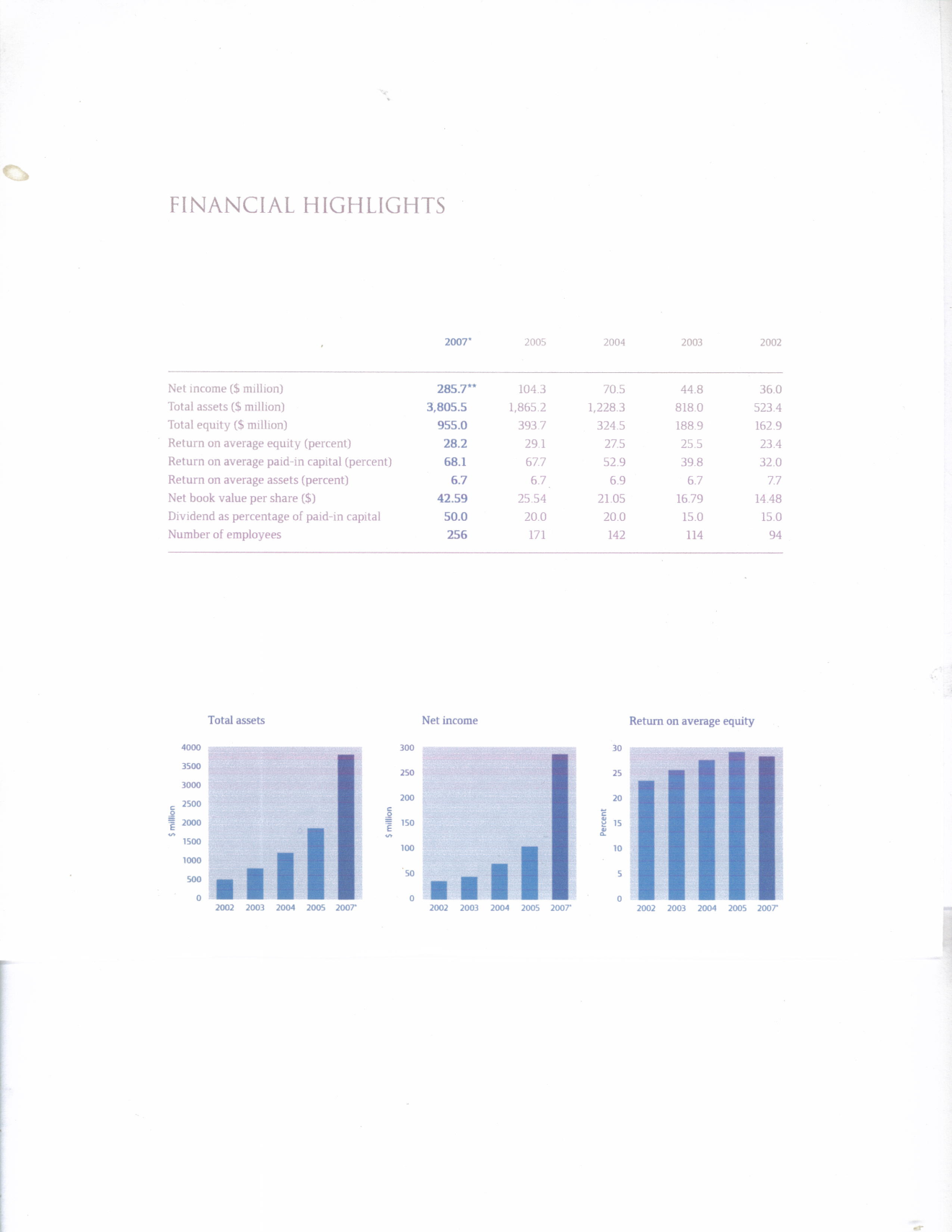

The financial outlook for Arcapita is promising. In Table 5 Arcapita’s financial hightlights are outlined. As one can clearly see Arcapita is in a growth spurt and may soon catch up with their larger competitors such as the Al Rajhi Bank. Arcapita’s total assets and net income sored this year. Arcapita’s total assets and net income reached 3.6 billion up from 2.8 billion in 2006. Because of Arcapita’s sound business ventures they have profited well.

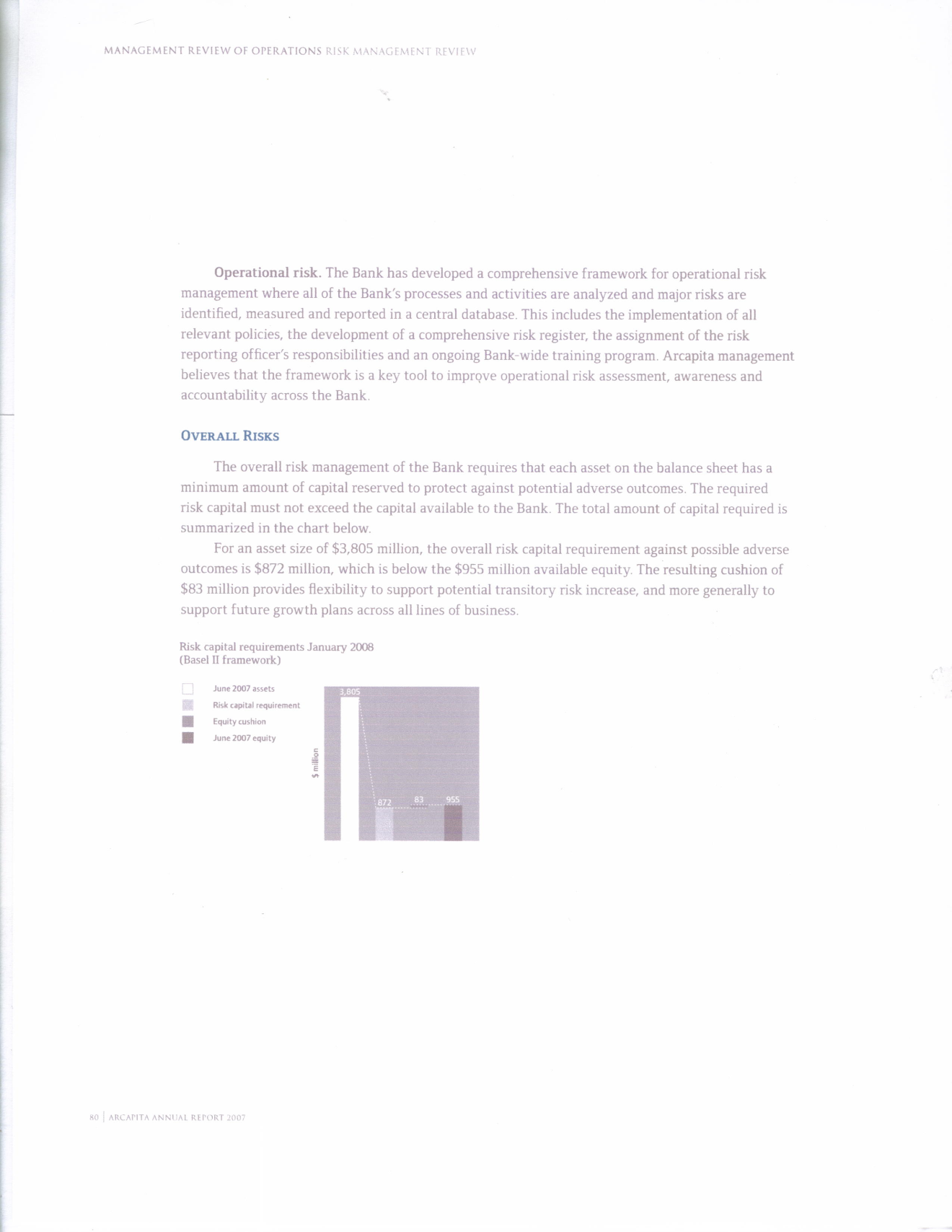

Arcatipa takes an enterprise-wide approach to risk management. They are proactive in the mitigation of risks. The role of the Risk Management Committee is to oversee the management of risks that are not acceptable. The bank manages investment risk throughout the investment process including deal sourcing, acquisitions, and the investment holding period. The day-to-day management of risks is overseen by deal teams and the portfolio management group. Arcapita also uses a portfolio management approach to managing investments across business lines. They attempt to control investment risk as well as all other risks including currency risks, liquidity risks, and operational risks.

The Al Rajhai Bank is a large corporate bank based in Saudi Arabia. It has made some gains in net worth this year, but seems to be lagging some. On the other hand, Arcapita is a small bank based in Bahrain that seems to be experiencing a growth spurt. Both Banks are very important to the banking world. If Arcapita keeps growing in the next ten years they might be one of the largest banks in the world. The Al Rajhi Bank will need to work hard to keep up with the pace of Arcapita. Today Arcapita is worth 3.6 billion dollars if they continue to grow as fast as they did this year they will be worth 40 billion dollars within the next ten years. They will exceed the Al Rajahi Bank to become a world leader in the banking industry.

Works Cited

Al Rajhi Bank Homepage. Al Rajhi Bank 2007 Annual Report. 2008. Web.

Arcapita Bank Homepage. Arcapita Bank 2007 Annual Report. 2008. Web.