Abstract

This analytical report compares and contrasts Citibank and the Bank of America. The comparison is based on several factors — the companies’ product lines, marketing strategies, and other factors beneficial for understanding how to devise a successful corporate strategy and position a successful business competitively.

The comparisons as well as the contrast between the two companies have been done by first looking at Citibank and later on looking at The Bank of America. The paper has established that Citibank is by far ahead of the Bank of America in several major metrics. However, the paper also noted that the Bank of America is generally holding more cash, and besides, its dividends pays and yields more as compared to that of Citibank.

The paper has also provided graphical analysis of the total assets and liabilities of the two firms as well their net income from the year 2000 to the year 2008.This has greatly simplified the comparison as well as the contrast between the two firms.

Citibank

According to its long and rich history, Citibank was established in 1812. As you can see it nowadays, the bank has grown to become the third biggest banking institution within the U. S. as it was recorded in March 2010 as far as total assets were concerned. It followed such leading banking institutions as the Bank of America as well as JP Morgan Chase. According to Weinberg, 2003 the bank has retail banking activities in numerous countries as well as territories globally.

Besides the ordinary banking transactions, the bank offers credit cards, insurance, as well as investment products. Weinberg, 2003 notes that the bank offers a number of products. The major products, however, are commercial as well as consumer lending and banking, insurance, investment advisory, investment banking, as well as clearing services.

Citigroup has greatly developed its customer finance business by acquiring Associates First Capital. The company has also developed due to international banking and also with the acquisition of Banamex. The assets of the bank were estimated at $1.14 trillion in the year 2002, while its sales volume was estimated at $72 billion (Weinberg, 2003).

Bank of America

Within the U.S., the Bank of America comes as the second largest banking institution by assets. It however, comes fourth when rankings are done by market capitalization. It has its headquarters in Charlotte. It should be noted that the bank serves customers who come from about 150 countries.

In the year 2010, the Bank was ranked fifth among the largest firms within the U.S. when the ranking was based on total revenue. It was also the second biggest non-oil firm within the United States. In the year 2010, the bank was stated by Forbes to be the third largest firm globally (Reynolds, n.d.). As at August 2009, the firm held about 12.2% of every bank deposit within the U. S. Alongside Citibank, it was ranked among the top four banks within the United States. The bank’s annual report of the year 2010 stated that the bank operated within the fifty states within the U. S. and also in more than forty non-U.S. nations (Weinberg, 2003).

The bank also offers a number of products such as commercial and Consumer banking. It should be noted that the bank is looking for ways on how it can improve on its investment banking activities and, similar to Citigroup, it has set its sights on Mexico. As at 2002, the bank had assets totaling $680 billion (Nicole, 2007).

Besides, on the basis of their market value, they are among the top three biggest financial institutions in the U.S. The effective as well as the efficient leadership of their management has resulted into the growth and development of the two financial institutions (Dash, 2007).

According to Nicole, K. (2007Citibank is by far ahead of the Bank of America in several major metrics. However, it should be noted that the Bank of America is generally holding more cash, and besides, its dividends pays and yields more as compared to that of Citibank.

One of the recent marketing strategies the ban is using social network. This targets small business so that they can be part of a business community where they have the opportunity to share stories as well as find experts on various topics who can help business people get ideas. Information sharing about such things as business locations, websites among others is made available through this kind of networking. The approach used by the company is summarized in the vision statement.

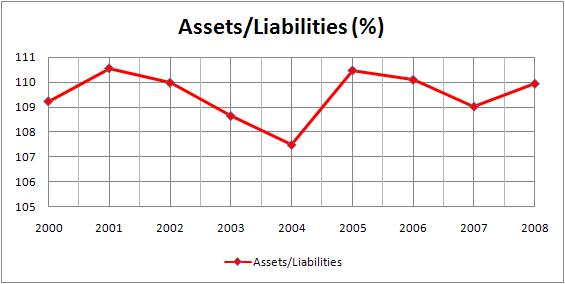

Citibank

The year 2004 is when the bank experienced the lowest assets and liabilities ratio.

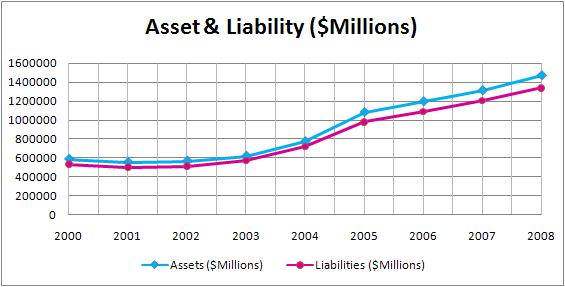

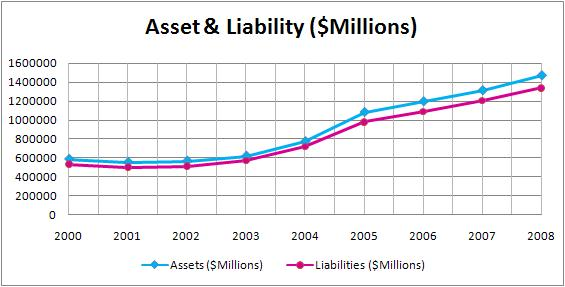

This depicts how the assets and liabilities for Citibanks has been increasing over the years.

Bank of America

Both assets and liabilities for the bank was stable between 2000 and 2004. It then rose tremendously to stand at 1500000 million and 13900000 million for assets and liabilities respectively

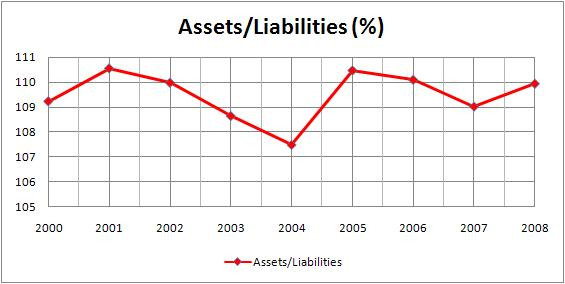

This figure depicts the ratio of assets and liability for the bank

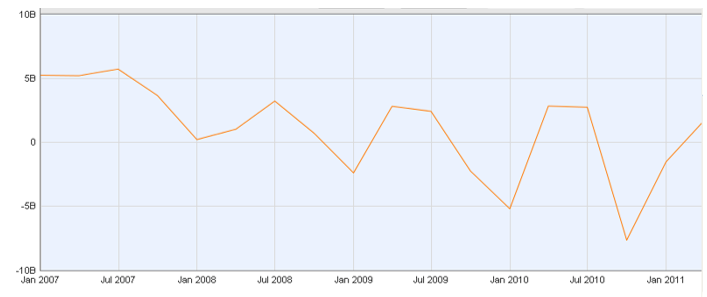

From this graph, it is evident that the net income for the bank started declining from 2007 to 2010 where it hit a record low value of -5 billion due to the financial crises that began late 2007. By mid 2010, the net income started to go up and in the beginning of 2011 it hit a low record of -7.5 billion due to problems in finance in Euro zone.

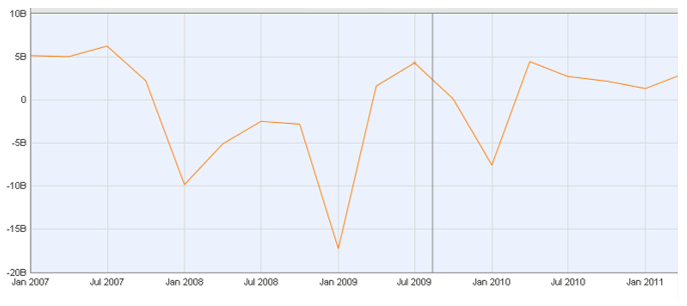

In 2007, the net income was 5 billion; by July 2007 it increased to about 6 billion. By January 2008, the net income stood at -10 billion. It was in 2009 that the bank experienced the highest loss, -17 billion. This is associated with financial crisis of 2008 to 2010. As at January 2011 the bank net income was slightly below the 5 billion mark.

References

Bank of America Corporation. (2011). In Encyclopædia Britannica. Web.

Dash, E. (2007). 4 Major Banks Tap Fed for Financing. The New York Times. Web.

Nicole, K. (2007). Bank of America’s New marketing Strategy. Global Innovation Series. Web.

Reynolds, N. (n.d.). Bank Marketing Strategy + Ideas. Bank Marketing Center. Web.

Weinberg, A. (2003). Citigroup Vs. Bank of America. Forbes. Web.