Data gathering

Data gathering on ATM services will apply a qualitative research design. This is the most appropriate method for the report. It will involve collection of data from various users and ATM service providers.

The data gathering technique will involve collecting information from various countries and preparing semi-structured questionnaires. The this method is applicable because it yields many results.

It will also provide essential data for analysis on ways of improving ATM services as well as ways of reducing security risks. The other sample for data collection will include interviewing various banks that provide ATM services to their customers.

The interview will involve bank managers to give information about the methods they are applying in order to reduce the increasing ATM risks.

Most of the questions will need customers to give details about the problems they face when using an ATM and ways that they would improve. The aim of carrying out interviews is to assist in data analysis. This will help in improving ATM services for all users worldwide.

The data analysis method will assist in understanding the various techniques proposed for ATM services improvement. This information will assist banks and other ATM service providers to analyze certain initiatives for management of risks involved.

The qualitative study will require effective data interpretation according to information gathered from interviews and questionnaires. This will also require an objective position in the analysis of the issue. Effective analysis will ensure the provision of viable and valid results from data collected.

Data analysis

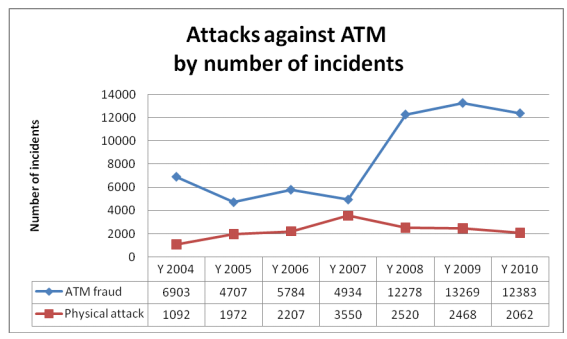

The above diagram shows the related ATM attacks.

The research found that 20 percent of survey participants had been victims of crime within the past five years. Over 10 percent of bank managers interviewed admitted having lost thousands of dollars over ATM crimes.

Among the victims of ATM crime, 70 percent claimed they lost their money through the skimming method. Other ways included card trapping, data attack and hacking. A research carried out by CPP in 2011 found that 28 percent of adults in UK are victims of ATM fraud (Snellman & Viren, 2009).

The recent research indicates the crime is high in Russia, Africa and Euro-America. In UK, ram raiders stole an ATM from a convenience shop by driving a car into the closed space and causing a damage of 30,000 pounds.

In lower Austria, criminals destroyed an ATM using certain tools and this led to huge losses. In December 2010, robbers swiped over 25 cards at the Winnetka Bank through card skimming.

Research participants show that, in February 2013, a team of eight men scattered to over 2,900 ATMs in New York and made away over 2.4 million dollars in 10 hours. The analysis of the issues found that ATM crimes have caused over 45 million dollars globally in losses.

The case in New York indicated first case hackers into Indian credit card vendor system making the cards unlimited.

A Police officer indicated having imprisoned a Romanian man who was involved in skimming and had stolen thousands of dollars. A twenty eight year old man in Newark court stated he installed a skimming device in order to steal from ATMs in Valley National Bank, in Belleville and Nutley.

He said that he made off with over 278,000 dollars from various customers’ accounts. Some customers reported cash trapping using a device that look like a Lebanese loop.

A case about a programmer working on the bank’s ATM system showed he created access to customers’ accounts through a malicious computer code. The sophistication of software and network attacks introduced both malicious and Trojan.

These attacks lead to major losses to banks once they are undetected. Criminals use strong software engineering devices and the issue lies with lack of detection tools for most banks. It is necessary for the government to place heavy penalties for such cases to reduce the number of robbers.

Results

To reduce the major risks facing ATM users, manufacturers have introduced various technologies. The technologies include the use of biometrics in order to improve security purposes.

This method involves authorizing the transaction after scanning the fingerprints, face and eyes of the user (Snellman & Viren, 2009). The other technology includes being able to print valuable items, for example, traveler’s cheques.

The final technology includes customers being capable of advertising on the ATM. These technologies may be the way forward for modern use of ATMs. However, banks and other services providing ATMs have yet to analyze whether the above technologies are feasible.

They need to analyze the financial benefits and costs incurred after the implementation as well as a reaction from customers. With many problems facing the interface design of the ATM, the service providers will need to sort various issues currently facing ATM services.

Earlier, the security for ATM focused on avoiding physical attacks and fitted with dispenser mechanisms (Snellman & Viren, 2009).

Today, there are reports that robbers steal the whole ATM with its housing in order to steal the cash inside. However, the modern measures for improving the physical security for ATMs focus on avoiding criminals from getting cash from the machine.

An introduced technique involves dying the money stolen to make it invalid. The technique also dye the thieves thus increases the possibility of catching them. Other developments include encrypting the data given during transactions.

The security problems related to ATM transactions include phantom withdrawals. This occurs when a withdrawal occur from an ATM without the customer’s consent. This is challenging since the bank and the customer do not admit liability for the loss of money (Snellman & Viren, 2009).

The other security problem includes card cloning, for example, through installation of a magnetic card reader device over the ATM slot. Card cloning gets the information about the customer and clone the card forming another card.

The criminal observes the user and takes note of the PIN number. Others put a video camera that records PIN entry. Banks and other ATM services have implemented various methods to avoid the issue of card cloning.

This includes using smart cards that are difficult to copy through un-authenticated devices. The other method is by making the outer part of the cards difficult to be tampered (Snellman & Viren, 2009).

Discussions

There are various ways for reducing the risks associated with ATM services. One of the ways include ensuring banks deploy effective security rules. This will assist in protecting ATM physical structure as well as its software. Security shields assist in the provision of safety environment for users.

Banks need to create consumer awareness about the existence of a mirror for consumers to view the environment before transacting from an ATM (GRG Banking.com, 2011). The other devices that assist in providing a scanning function include anti-skimming solution.

Once they attach it, it assists in detecting a foreign object. To reduce the number of ATM crime victims, customers need to be aware about the safest environment to carry out their transactions.

This will be through the help of bank management in educating them in various ways, for example, they need to check the physical environment before transacting and check the machine in case of a suspicious event.

Customers need advice on planning their needs as a way of avoiding frequent transactions. Signing up for alerts about account changes is also beneficial to customers in detecting suspicious transactions.

The other management aspect for reducing the crime rate involves having a security checklist. This will assist in scheduling frequent checks at ATM branches and the environment around.

To protect customers from physical attacks, one of the physical measures involves installation of audible alarm that will dissuade a criminal (GRG Banking.com, 2011). The banking systems should also implement intruder system that will detect various suspicious events.

Other implementations to assist cardholders from physical protection include having sensors and explosive detectors. Banks should install a monitoring system capable of detecting certain events. This assists in improving remote monitoring.

Banks should also choose a safe place to install their ATM, for example, a place near the road. Banks need to ensure the presence of a well-developed environment to improve physical ATM security.

They should construct barriers such as kerbs, anti-ram bollards or other similar infrastructure in order to make lifting the machine difficult for thieves.

Banks need to realize that the risk is evolving and should consider applying improved methods of protecting their money as well as their customers.

For example, European banks, have implemented an extra layer on bankcards. This layer comprises of chip security and reduces ATM frauds. Some banks resist this system due to cost incurred in the implementation.

According to GRG Banking.com (2011), another method for improving security measures involves installation of a degradation system. This system works by dying notes once criminals move the ATMs. This method help in deterring cash theft and providing improved security.

To improve ATM security, service providers need to deploy various security policies, for example, managing USB ports, using complex passwords, installing Anti-virus software, as well as installing patches from vendors.

Bank management should also ensure effective employee education on the use of ATM network security to avoid any errors. Some recommendations for manufacturers will assist in controlling risks involved when using an ATM.

First, manufacturers need to pay much attention on security measures. This involves ensuring that they meet various security standards when designing new machines (GRG Banking.com, 2011).

ATM manufacturers should also ensure that the machines have various security features to prevent crime and protect their users. New designs are acceptable but may become confusing for users.

It is necessary for ATM manufacturers to develop a security solution, for example, by introducing detective software as a way of reducing risks involved.

Second, the manufacturers should work closely with banks and other service providers on ways of putting countermeasures to prevent theft (Snellman & Viren, 2009).

Manufacturers have implemented other countermeasures that identify customer integrity to prevent threats. The machine has a palm scanner that identifies the finger vein patterns as well as recognizing the iris and face of the customer.

Manufacturers have also developed cheaper equipment to detect foreign object and the tests indicated over 99 percent success in detection, for example, against card skimming devices. Those machines openly exposed to the outside environment should have weather resistant materials.

The design operation integrity for ATM machines is also necessary for protecting the machine from unauthorized people.

In most countries, security guards and cameras include the common aspect found around ATMs. In New York, the department of banking carried out frequent inspections especially in areas that report high crime rates.

Conclusion

ATMs are now part of the modern world, and their infrastructure will improve with the rapidly changing technologies. ATMs are beneficial due to their convenience. However, since the first installation of the machines in the world until now, they have been a major target to criminals.

This is because of its convenient property to provide money to users in a safe way. The rapid development of crimes has facilitated the ATM industry to pay much attention on improving safety measures for cardholders as well as physical ATMs.

With the joint and sustained effort from banks, ATM manufacturers and other technological organizations, a safe and convenient method of the transaction will eventually come up. The use of ATMs is now an irreplaceable service channel between cardholders and banks.

This is due to the convenience, fast services and savings on human resources. They are also easily available in branches, airports, convenience stores as well as shopping malls.

To ensure safe widespread use of ATMs, banks should maintain their brand image and ensure they protect their assets. Other involved organizations, manufacturers and institutions, should also research on measures for meeting the challenges, such as crimes, faced by cardholders.

References

GRG Banking.com. (2011). Best Practice for ATM Security. Overview of ATM security situation, forecast, and best practices. Web.

Snellman, H., & Viren, M. (2009). ATM networks and cash usage. Applied Financial Economics, 19(1), 841-851.