Introduction

With the company being one of the best-recognized developers and sellers of smartphones, computers, and software, Apple Inc.’s history is closely tied to that of the technology industry. This multinational organization was founded in the US in 1976, and at the present moment, it is considered a major contender in multiple technology markets (Giachetti 2017).

In the smartphone segment, Apple Inc. has introduced many revolutionary ideas, leading trends in innovation and changing the way people perceive handheld devices. Nevertheless, the company’s success does not make it the leader in this segment of the market—Apple’s competitors also display varied strengths as well as opportunities for future growth. This report analyzes Apple’s place in the smartphone market in the UK, using SWOT, PEST, and strategic group mapping analyses to provide a foundation for making recommendations.

Organization and Product Line Description

Apple Inc. is a company that develops manufactures and sells electronics and software. The organization has also branched out into online services, offering subscriptions to its customers. A distinguishing feature of Apple’s products is that the company develops both hardware and software. For example, in the smartphone industry, Apple presents iPhones that are equipped with iOS, a unique operating system available for Apple devices only. The firm also sells a range of accessories for smartphones, designed to complement the features of the devices.

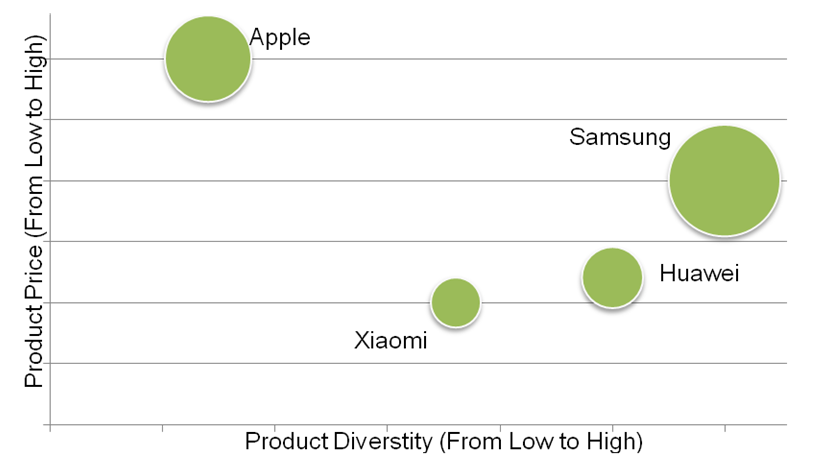

Notably, the range of Apple products is much smaller than that of other companies. Currently, it offers such models as the iPhone Xr, iPhone Xs, and Xs Max, as well as iPhone 8 and iPhone 7. While older models can be found through some retailers, the company’s official website features the line of products listed (iPhone 2019). Clearly, the selection of available Apple smartphones is limited, characteristic of all the product ranges of this company (Payne 2017).

Furthermore, the models do not show evidence of any significant differences. In contrast to other firms’ phones, which often feature a wide variety of designs, colors, screen sizes, and—most importantly—price categories, Apple has introduced a line that is consistent in design while varying in some features. For instance, the only differences between iPhone Xs and iPhone Xs Max are the screen (and device) size and battery capacity. Similarly, other Apple phones have differences in screen size, resolution, battery capacity, and camera capabilities.

Market Condition and Current Competition in the UK Market

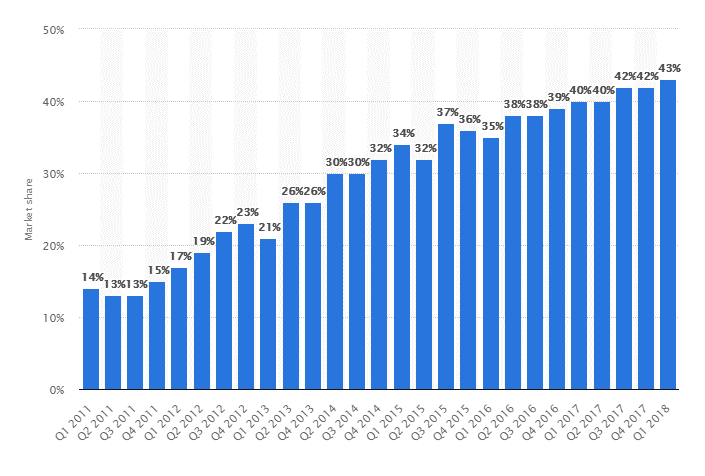

Comparing Apple and other companies in the smartphone industry along with other consumer electronics reveals many differences between the company and its competitors. Apple products are based on iOS, in contrast to smartphones from other companies that feature the Android operating system. In the UK, iPhones dominate the industry: statistics show that more than 40% of the national market share belongs to Apple iPhone (Market share held by Apple iPhone 2019; Moskvitch 2018). The position of Apple products is leading to a steady increase in its influence in the UK electronics business arena (Figure 1).

Overall, the latest figures show a decline in smartphone sales for all companies in the face of rising prices for devices (Field 2018). It is possible that Apple’s discontinuing its open sharing of sales numbers can be connected to market difficulties (Rotstein 2018; Titcomb 2018). While Android is a major iOS competitor, Android-based models come from different companies, allowing Apple to assume a position of power in the market.

One of Apple’s major competitors, both locally and internationally, is Samsung, a South Korean company offering a wide variety of consumer electronics. Samsung develops smartphones that use Android OS; the firm’s wide range of models includes products from multiple price segments (Lovejoy 2017). For example, Samsung’s Galaxy product line offers smartphones that are very similar to iPhones in the features they provide.

On the other hand, some of the phones the South Korean company produces are significantly cheaper, smaller, less powerful, or less equipped than iPhones. This allows Samsung to attract a wider variety of buyers, reaching audiences that Apple does not target (Gardere, Sharir & Maman 2018). Moreover, another recent competitor is continuing to gain international recognition. Huawei is a Chinese developer of consumer electronics that also offers products in low-, middle-, and high-price categories (Gibbs 2018).

According to Sharma (2017), UK shares of Samsung and Apple were almost equal, each company accounting for around 34% of all smartphone sales in 2017. Huawei came in third with 13% of the smartphones bought by UK customers (Sharma 2017). While not as popular as the two other brands, Huawei’s standing in the global market continues to strengthen.

Analyses

PEST

- Political: The ongoing political discussion regarding Brexit continues to affect all companies that are actively participating in UK markets. The fluctuation of the British pound is a politically influenced aspect that lowers Apple’s stability in the UK. The current uncertainty regarding the Brexit deal means that Apple and other smartphone companies are facing instability in product pricing.

- Economic: The abovementioned political change is affecting the national economy, challenging many local and international companies. Apple may need to review its pricing, affecting future buyers. Moreover, the laws and regulations that may potentially be accepted following changes to the relationship between other European countries and the UK may also affect Apple’s expenses and revenues.

- Social: Throughout the years, Apple has created a strong network of supporters and has increased brand loyalty, benefiting sales. However, reliance on customer choice may produce adverse effects in the future if customers should turn their attention to another brand or alter their values. Increasing societal interest in environmental conservation may also influence Apple’s advertising and manufacturing.

- Technological: Apple’s products are considered unique, innovative, and simple to use, all characteristics that have contributed to raising the company’s status. Nevertheless, reviewers have criticized Apple’s latest products for their lack of new substantial changes (Berendt, Uhrich & Thompson 2018; Bradshaw 2018). At the same time, the number of competitors whose products offer a similar set of characteristics and features continues to expand.

The results of the PEST analysis demonstrate how the current political and economic landscape of the UK has the potential to endanger Apple’s revenue growth. It is vital to note that a change in consumer preferences regarding retaining phones for longer periods of time along with their concern for the environment may also decrease sales numbers. Finally, the current staggering rate of innovation is another threat to the company’s profitability as Apple’s range of products remains highly limited.

SWOT

The SWOT analysis reveals an unstable position for Apple in the face of increasing recognition for other brands. While the current reliance on brand loyalty and iPhone’s compatibility with other Apple products tend to support sales, the changing environment may quickly shift the focus of Apple’s platform to image and quality (Appiah, Ozuem & Howell 2017).

Although competitors have begun to equip their smartphones with similar features at a lower price, Apple has continued to base its high prices on customer experience (Liu, Zhai & Chen 2018). The threat of high competitors’ saturation may increase as younger generations enter the market.

Strategic Group Mapping

Core Strategy Statement and Optimal Strategic Option

The provided analyses show that Apple is positioning its products differently from other companies’ approach, focusing on exclusivity, quality, a unique customer experience, and a network of products. The challenge facing Apple lies in the downturn in the smartphone market characterized by saturation and high competitiveness (Ahmed, Gull & Rafiq 2015; Field 2018). The company’s strategy should be aimed at achieving further growth and support of brand recognition and loyalty in the next five years (Lamberson & Page 2018).

Apple should use their current place in the market while recognizing the new needs and concerns of customers by addressing the rising opportunities for ethical consumption and environmental protection. Here, the goal is growth; neither retrenchment (scaling down the scope of the company’s reach) nor consolidation (use of current resources) is necessary for Apple to survive (Bassell & Lambert 2018).

In contrast, by reaching additional markets and modifying its message to accommodate younger current consumers, Apple will be able to grow through partnerships and acquisition of new software. iPhones appeal to the younger generation; thus, it is vital for the company to engage in further analysis of emerging trends. Apple is relying on a competitive stance of differentiation, increasing competition between Samsung and Huawei without taking a direct role (Gibbs 2018). As a result, while its current strategic group should remain the basis, the company can add new customers and engage them in the process of transitioning from Android to iOS products.

Conclusion

Apple is a company that has created a brand image reflecting high quality, uniqueness, excellence, and spirit. People across generations use iPhones, and the products’ high cost does not dissuade returning customers who have shown a willingness to readily exchange older models for new ones.

Apple’s pricing strategy is not based on competition from Samsung, Huawei, or other brands because the company embodies higher quality and a better user experience. This approach may, however, be detrimental to Apple’s future if the next generation of consumers fails to share Apple’s values in the same way as its current loyal customers. Moreover, the UK’s unstable position in the European economy may also lead to additional problems for the company in its attempts to maintain popularity in the market.

Reference List

Ahmed, Z, Gull, M & Rafiq, U 2015, ‘Factors affecting consumer switching behavior: mobile phone market in Manchester-United Kingdom’, International Journal of Scientific and Research Publications, vol. 5, no. 7, pp. 1-7.

Appiah, D, Ozuem, W & Howell, KE 2017, ‘Brand switching in the smartphone industry: a preliminary study’, in Global Business and Technology Association nineteenth annual international conference, Global Business and Technology Association, Vienna, pp. 8-15.

Bassell, M & Lambert, S 2018, ‘Marketing leadership in a knowledge economy’, Atlantic Marketing Journal, vol. 7, no. 1, pp. 33-46.

Berendt, J, Uhrich, S & Thompson, SA 2018, ‘Marketing, get ready to rumble—how rivalry promotes distinctiveness for brands and consumers’, Journal of Business Research, vol. 88, pp. 161-172.

Bradshaw, T 2018, ‘Apple hopes its daring bet on iPhone pricing will still pay off’, Financial Times, Web.

Fawzy, MF& Olson, EW 2018, ‘Total quality management & Apple success’, in Proceedings of the American Society for Engineering Management 2018 international annual conference, American Society for Engineering Management, Philadelphia, PA, pp. 1-7.

Field, M 2018, ‘Smartphone industry falls into ‘recession’ as sales slump 8pc’, The Telegraph, Web.

Gardere, J, Sharir, D & Maman, Y 2018, ‘Consulting and executive coaching on future trends: the need for a long term vision with Apple and Samsung’, International Journal of Business and Social Science, vol. 9, no. 3, pp. 1-7.

Ghosh, S 2017, ‘This chart shows iPhone X adoption has overtaken the iPhone 8 and iPhone 8 Plus’, Business Insider, Web.

Giachetti, C 2017, ‘Explaining Apple’s iPhone success in the mobile phone industry: the creation of a new market space. In C Giachetti, Smartphone Start-ups, Palgrave Macmillan, London, pp. 9-48.

Gibbs, S 2018, ‘Huawei beats Apple to become second-largest smartphone maker’, The Guardian, Web.

Khan, UA, Alam, MN & Alam, S 2015, ‘A critical analysis of internal and external environment of Apple Inc’, International Journal of Economics, Commerce and Management, vol. 3, no. 6, pp. 955-961.

Lamberson, PJ & Page, SE 2018, ‘First mover or higher quality? Optimal product strategy in markets with positive feedbacks’, Journal of Economics & Management Strategy, vol. 27, pp. 40-52.

Lazareska, L & Jakimoski, K 2017, ‘Analysis of the advantages and disadvantages of Android and iOS Systems and converting applications from Android to iOS platform and vice versa’, American Journal of Software Engineering and Applications, vol. 6, no. 5, pp. 116-120.

Liu, J, Zhai, X & Chen, L 2018, ‘The interaction between product rollover strategy and pricing scheme’, International Journal of Production Economics, vol. 201, pp.116-135.

Lovejoy, B 2017, ‘iPhone maintains lead in UK market share, but just 0.4% ahead of Samsung – Counterpoint’, Web.

Market share held by Apple iPhone in Great Britain from 1st quarter 2011 to 4th quarter 2017 2019, Web.

Moskvitch, K 2018, ‘The new iPhones will be way overpriced. It doesn’t matter’, Wired, Web.

Payne, B 2017, Brand positioning and its usefulness for brand management: the case of Apple Inc. Newcastle Business School Student Journal, vol. 1, no. 1, pp. 51-57.

Rotstein, N 2018, ‘iPhone sales statistics’, Finder, Web.

Sharma, P 2017, ‘Apple & Samsung dominate UK smartphone market in 3Q17’, Counterpoint, Web.

Sunnebo, D 2018, ‘Apple OS share drops in UK despite iPhone X release’, Kantar, Web.

Titcomb, J 2018, ‘Apple hiding iPhone figures shows the smartphone market has peaked’, The Telegraph, Web.

White, J & Williams, A 2019, ‘The iPhone’s stratospheric growth is over. Apple’s future is in services’, Wired, Web.

Williams, A 2018, ‘The iPhone’s golden age is over, Apple will only charge fans more’, Wired, Web.