Introduction

The Riverview Community Hospital is a not-for-profit organization that serves the Riverview community. The hospital has a strong standing in the community as a health service provider. Consumers consistently give the hospital high ratings in customer satisfaction surveys. The hospital is under the threat of losing its customer share because of the acquisition of a local for-profit competitor by a health service chain known for aggressive competition for market share. This situation makes it necessary for the Riverview Community Hospital to evaluate its competitive position in the healthcare sector in the Riverview community.

An evaluation of the three key financial statements of the Riverview Community Hospital revealed several issues. First, the balance sheet showed that the assets of the hospital grew from $39.627 million to $54.275 million between 2005 and 2009. The increase arose because of the acquisition of new plants and equipment. The liabilities of the hospital also grew prominently in the same period from $1.8 million to $4.4 million. The statement of operations of the hospital showed that the hospital created a surplus in the years reviewed. However, the surplus is on a reducing trend. If the trend persists, the hospital will start experiencing deficits within the next three years. The most worrying element of the cash flow statement is the reduction of the net cash flow of the hospital from 7.192 million in 2005 to $3.481 million in 2009. The hospital may not meet its current liabilities such as the payment of wages and the payment of bills to utility providers if this figure keeps falling.

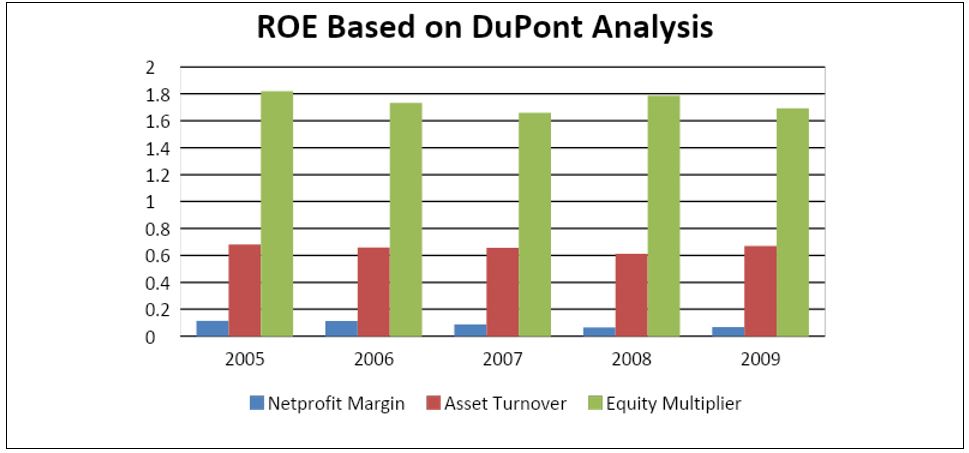

An analysis of the financial performance of the organization using the DuPont Analysis showed that the Return on Equity (ROE) of the hospital comes from the equity multiplier component of the DuPont Equation. This means that the ROE is not sustainable since it is not growing based on sales or increases in the net profit margin (Young, 2009). This means that the hospital is not generating value as an entity. In addition to this analysis, it is important to note that the ROE for the hospital decreased steadily throughout the period under review.

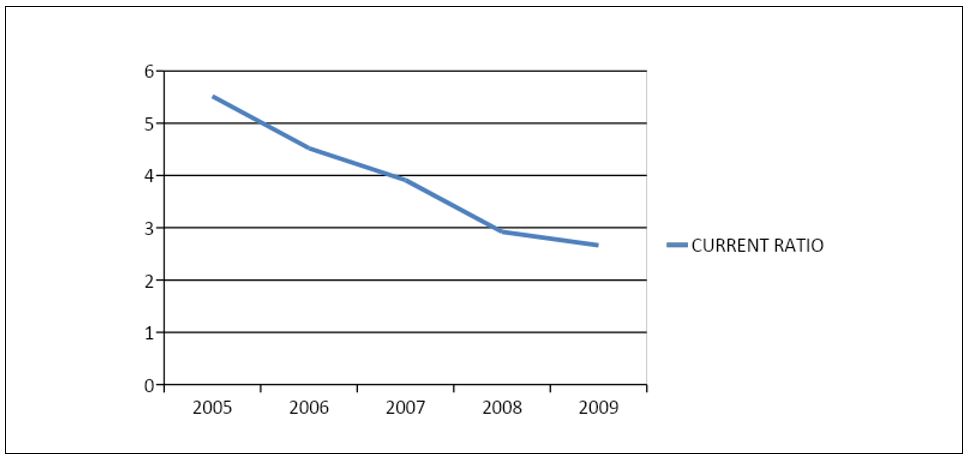

The ratio analysis of the hospital led to several findings. The most significant findings included the steady reduction of the current ratio from 5.5 in 2005 to 2.7 in 2009. The reduction in the value of the current ratio suggests that the hospital may not meet its current liabilities in the coming years. Similarly, the profit margin ratio stood at 14.2 in 2009, up from 8.4 in 2005. This ratio shows that the organization is deploying more resources to raise an ever-reducing surplus. This is not sustainable.

The key recommendations that can help the hospital in its efforts to strengthen its financial management practices include freezing hiring until the hospital can meet its future obligations. In addition, the hospital must freeze all expansion supported by debt financing to reduce its exposure to debtors. Thirdly, the hospital needs to increase its revenues to boost its financial efficiency. Reducing revenues for a self-financing not-for-profit organization is not good for long-term growth.

Background

The Riverview Community Hospital boasts a long history of high-quality medical services to the Riverview community. The hospital holds the pride of place among other healthcare institutions serving the Riverview community. The hospital is in a dilemma currently caused by the recent acquisition of a for-profit competitor by a very aggressive health service chain. The new chain holds the reputation of being an aggressive pursuer of market share in all the locations in which they operate. This means that the Riverview Community Hospital needs to develop strategic measures to deal with the emerging threat. In order to develop sound strategic responses, the hospital must undertake several baseline studies of the current services it offers in addition to looking at its internal and external operating conditions (Goldman & Nieuwenhuizen, 2006). Part of the analysis needed is a financial analysis to determine whether the fiscal ratios undergirding the operations of the hospital are healthy and whether they can support a range of strategic initiatives.

The competitive environment in the healthcare sector in the Riverview community consists of four hospitals. Three of these hospitals, including the Riverview Community Hospital operate as not-for-profit entities. One hospital operates as a for-profit concern. This hospital is the one that the health service chain acquired recently. The not-for-profit hospitals in the Riverview community feel threatened by the new entrant. The aggressive tactics usually employed by the new health service chain can lead to the closure of the other hospitals if they are unable to compete favorably with it.

The Riverview Community Hospital is the smallest player in the medical services sector in the Riverview community. The hospital is, however, the best facility in the area based on customer reviews. The hospital continues to receive the highest customer satisfaction ratings in the area. This notwithstanding, the long-term survival of the hospital in the region depends on its financial performance. If the hospital cannot meet its financial obligations, then it will collapse. This reason explains the interest of the hospital’s board in the financial analysis of the performance of the hospital. The result of the analysis will enable the board to make strategic decisions with confidence in order to guarantee the long-term existence of the facility.

Analysis

Interpretation of Key Financial Statements of Riverview Community Hospital

The three key financial statements of any organization are its balance sheet, the cash flow statement, and the statement of operations (Lee, Roberts, & Sweeting, 2012). The balance sheet shows the current state of the assets and the liabilities of an organization (Lee, Roberts, & Sweeting, 2012). As its name suggests, the balance sheet shows the equilibrium between the organization’s assets and liabilities. The assets of the Riverview Community Hospital have grown from $39.627 million in 2005 to $54.275 million in 2009. The significant trends in the balance sheet of the Riverview Community Hospital include the increase in the value of new plants and equipment, which created a significant increase in the value of the balance sheet. On the other hand, the liabilities of the hospital have also increased from $1.8 million to $4.4 million. This increase is significant because the growth in liabilities is not proportional to the growth in assets. This means that the hospital’s revenue collection mechanisms need review to reduce the current liabilities in the balance sheet. A huge amount of current liabilities can lead to losses in the medium term if these liabilities become bad debts.

The second financial statement is the statement of operations. The statement of operations displays the overall performance of an organization with an emphasis on whether the organization created a surplus or a deficit in a specific period (Lee, Roberts, & Sweeting, 2012). This statement determines whether shareholders can expect dividends or otherwise. The statement of operations of the hospital showed strong growth in the overall revenues of the hospital. In 2005, the revenue of the hospital was $26.996 million. The figure grew steadily over five years to reach $36.416 million in 2009. This growth in total revenues did not inspire growth in the surplus of revenues over expenses. The main explanation for this situation is the increase in the expenses of salaries and wages in the same period. In 2005, the hospital spent $10.829 million on salaries, while in 2009 the amount was $13,994 million. Undisclosed expenses in the same period grew from $7.9 million to $11.8 million. The fact that the hospital is a not-for-profit institution may explain the slow growth in its surplus. However, the increase in expenditure on unspecified expenses and salaries is a long-term threat if the facility does not generate surplus revenue. It exposes the hospital to serious financial risks if there is a drop in the revenues raised by the hospital.

The third statement is the cash flow statement. The cash flow statement gives a clear picture of the intensity of revenue generation and spending in an organization (Lee, Roberts, & Sweeting, 2012). This statement demonstrates how active an organization is in its area of operation. Usually, an active cash flow for an organization is a good sign of stability and growth (Young, 2009). A loss-making organization has many opportunities to turn around if it has a strong cash flow statement. On the other hand, an organization with a poor cash floor can collapse despite being profitable (Young, 2009). The income from operations of the Riverview Community Hospital rose to $2.458 million in 2009 from $2.102 in 2008. These figures are lower than the income raised in 2006, which was $3.214 million. The net cash flow from operations kept falling from $7.192 million to $3.481 million in 2009. Another important ratio to contemplate in the investment activities of the company is the drop in the amount of cash and investments from $5.799 million in 2007 to $2.795 million in 2009. These indicators show that the hospital is becoming cash-strapped over time. It is eating into reserves and will soon run out of its financial buffer.

Overview of the Hospital’s Financial Position using the DuPont Equation

A second way of analyzing the financial performance of the hospital is by the use of the DuPont analysis. The DuPont analysis provides a very useful means of analyzing the Return on Investment (ROE) (Young, 2009). This is because looking at the value of ROE in isolation can be misleading. It is important to determine the source of the ROE in order to tell whether the organization is in good strategic standing. ROE is the ratio of net income to shareholders’ equity (Lee, Roberts, & Sweeting, 2012). It provides shareholders with a means of knowing whether the company is increasing the value of its investments. Usually, a high ROE is a good sign of progress. However, there is a need to know the source of the ROE. The ratio presented above does not answer this important question. The DuPont analysis calculates ROE based on three aspects. According to DuPont, ROE is the product of the company’s net profit margin, asset turnover and equity multiplier (Lee, Roberts, & Sweeting, 2012). Each of these measures is a ratio. Net profit margin is the ratio of net income to sales (Lee, Roberts, & Sweeting, 2012). Asset turnover is the ratio of sales to total assets, while the equity multiplier is the ratio of total assets to shareholders’ equity (Young, 2009). The strength of the DuPont analysis is in its ability to determine whether ROE comes from the net profit margin, the asset turnover, or the equity multiplier. Good ROE comes from increasing the net profit margin or the asset turnover, or both. However, increasing ROE based on equity multiplier is a sign of weak ROE, no matter how impressive the value of the ROE is (Lee, Roberts, & Sweeting, 2012).

The calculation of the ROE based on the three-point version of the DuPont Analysis shows that the bigger portion of the ROE for the hospital comes from the equity multiplier. This component consistently contributed over sixty-nine percent of the value of ROE in the period under review. This reliance on the equity multiplier to achieve the organizations’ ROE is consistent throughout the years under review.

Secondly, the actual value of ROE declined throughout the period reviewed. In 2005, the hospital’s ROE was 14%. This value fell steadily to 7.6% in 2009. While this is not very surprising for a not-for-profit organization, it is not an ideal situation for any organization (Deloitte, 2011). It shows that the hospital is very vulnerable to changes in its revenue streams. Any reductions in its revenues can lead to losses (Ulmer, 2010).

Ratio Analysis

Ratio analysis covers several aspects of the financial performance of any organization. In this brief analysis, the ratios covered are the liquidity measurement ratios, profitability measurement ratios and debt ratios (Young, 2009).

The fundamental ratio under that can help determine the liquidity of an organization is the current ratio. The current ratio compares the current assets of an organization to its current liabilities (Lee, Roberts, & Sweeting, 2012). The current ratio fell steadily from 5.5 in 2005 to 2.7 in 2009. The steady fall shows that the ratio of the current assets to the current liabilities is falling with time. If the trend continues, the organization will not meet its current liabilities. This can happen within the next three years.

The profit margin ratio compares the net income to net sales (Ulmer, 2010). A not-for-profit entity renders the net income as net revenue (WHO, 2007). The net income increased steadily throughout the period under review while the net profit decreased steadily in the period under review. The result is that the profit margin ratio increased from 8.4 to 14.1 between 2005 and 2009. This means that the hospital deployed increasing resources to generate a reducing surplus over the period under review.

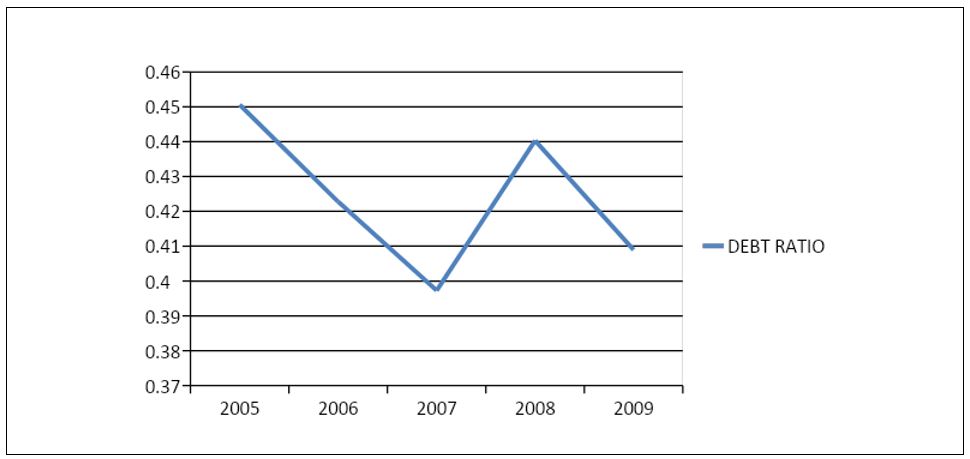

The debt-equity ratio of the organization compares the ratio of total liabilities to total assets (Young, 2009). The debt ratio of the hospital is unstable. The ratio kept changing direction in the period under review. In 2005, the debt ratio was 0.45, close to the value in 2008 that was 0.44. The lowest debt ratio on record was in 2007 when it hit 0.40. The industry median debt ratio in 2009 was 0.48. This means that the hospital had a lower debt burden than most hospitals in the region. While this is a good sign, debt management is a critical component of sound financial management.

Summary of the Hospital’s Financial Condition

Compared to the overall performance of the industry, the hospital is doing relatively well. However, the hospital’s financial situation will worsen in the next three years if the management does not implement measures to control some key indices. The most significant trend that needs the attention of the management is the reducing rate of surplus generation against a backdrop of increasing labor costs. The hospital is running the risk of operating at a loss in the next three years if it does not find more ways of tackling the existing debt burden. It is possible to justify the increase in debt by initiatives such as the expansion of facilities and the increase in the number of patients served in the hospital. While this is indeed the mission of the hospital, financial sustainability must form a key aspect of the financial management of the hospital. The reducing profit margin for the hospital puts it in a precarious situation. The surplus margin will disappear in the next three years if existing trends continue.

The operation of the hospital as a not-for-profit organization gives the hospital a strong competitive edge against the emergence of the for-profit health service chain. The Riverview Community Hospital can offer similar services at a lower cost devoid of margins. This competitive edge will exist for established services and procedures only. In new areas, the for-profit competitor will have an advantage because it can plow back its profits to develop the capacity to offer state-of-the-art medical services and procedures. This does not excuse the Riverview Community Hospital from investing in new facilities. Rather it is the realization that competing with a for-profit facility directly can lead to loss of strategic advantage. The Riverview Community Hospital should use its competitive advantages to retain its market share.

It is clear from the financial statements that the two areas that led to increased operating expenses are an increase in the wage bill and an increase in undisclosed expenses. The rational explanation of the undisclosed expense is the acquisition of new facilities and expansion of existing ones. There is a need to tie the growth of the hospital to its revenue. The fact that the hospital is a not-for-profit organization does not excuse it from planning for sustainable growth (WHO, 2007).

Recommendations

The specific recommendations that can help the hospital to strengthen its financial standing in the context of anticipated competition from the for-profit health service chain that is setting up base in the area are a freeze on employment, pursuing opportunities to increase revenues, and practicing careful debt management techniques.

The wage bill from the hospital went up by approximately 30% between 2005 and 2009. This is not a bad thing in itself. However, this growth in the wage burden did not come with a corresponding increase in the revenue of the hospital. The surplus available to meet these needs kept reducing throughout the period under review. The hospital must do everything in its power to stabilize the wage bill. This can take the form of instituting a moratorium on employing new employees except when replacing workers lost due to natural attrition. This may negatively affect the long-term prospects of the hospital’s human resource outlay. The second option is to tie hiring new workers to the financial performance of the hospital to ensure that the hospital does not invest in an expensive capacity that does not guarantee returns.

Secondly, the hospital needs to work very hard to increase its revenues in order to compete favorably with for-profit institutions. The hospital relies on payments made by patients to generate its revenues. The hospital needs to price its services in a way that allows it to generate enough surpluses to expand. Since the hospital is not working to raise a profit, the costs will remain affordable for all the patients.

Debt management must take center stage in the operations of the hospital. The debt ratio shows that the hospital incurs debt to finance its long-term aspirations. While there is no primary problem with this, debt-inspired growth may lead to very poor financial performance caused by the needs of the creditors if the debt ratios are too high.

Conclusion

The Riverview Community Hospital is at a critical point in its existence. It is facing a very difficult financial future if the current operating trends continue. The hospital has some time to strengthen its financial performance. The fact that it has strong customer service credentials shows that it has a clear competitive advantage within its area of operations. As such, the hospital needs to strengthen its systems to ensure that it takes advantage of its competitive strengths as it prepares for the entry of a new player in the healthcare sector in the Riverview area.

References

Deloitte. (2011). 2011 Survey of the UAE Healthcare Sector Opportunities and Challenges for Private Providers. London: Deloitte.

Goldman, G., & Nieuwenhuizen, C. (2006). Strategy: Sustaining Competitive Advantage in a Globalised Context. Cape Town: Juta and Co Ltd.

Lee, C.-Y., Roberts, J. W., & Sweeting, A. (2012). Competition and Dynamic Pricing in a Perishable Goods Market. Durham, NC: Duke University.

Ulmer, C. (2010). Future Directions for the National Healthcare Quality and Disparities Reports. Washington DC: National Academies Press.

WHO. (2007). Provider Payments and Cost-Containment Lessons from OECD Countries. Technical Briefs for Policy Makers, 2, 1-7.

Young, S. T. (2009). Essentials of Operations Management. London: Sage Publications Inc.

Appendix

Table 1: Table of Financial Analysis.