Introduction

Government institutions prepare their statement following the direction provided by the Government Accounting Standard Board (GASB) and not the Generally Accepted Accounting Principles. This work reviews the financial statements of the University of Alabama System. The paper discusses the employee pension disclosures in the financial statement of the institution. It also discusses the impact of the recent changes on the financial reporting of liabilities on the profitability of the institution. Further, it highlights some of the social and economic factors that may hinder the future success of the University.

Employee pension plan disclosures

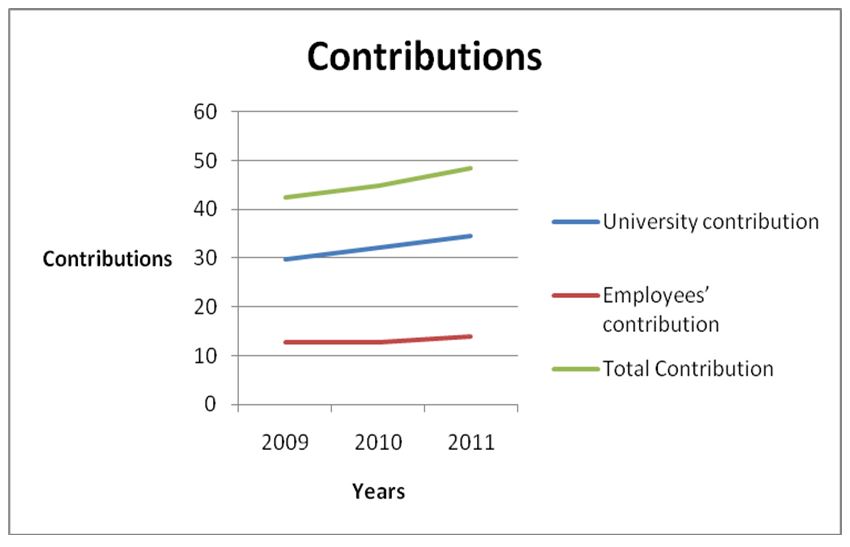

Employees of the University of Alabama System take part in the Teachers Retirement System of Alabama. Covered employees contribute 5% of their earned compensation to the pension plan. The University also contributes to the plan (The University of Alabama, 2012). The total contribution to the plan for the past three years is summarized in the table below.

Source of data – The University of Alabama, 2012

From the table, it is evident that there was an increase in total contribution to the fund. For the three years, the employer’s contribution was greater than employees’ contribution for the three years. Apart from the Teachers Retirement system, some employees take part in the TIAA-CREF and VALIC programs. These are optional contributions. In these programs, the employer also contributes up to 5%. The trend of the contributions is shown in the graph below.

Teachers Retirement System of Alabama does not make separate measurements of assets and the actuarial accrued liabilities for individual employers. The actuarial accrued liabilities amounted to $28.3 billion while the actuarial valuation of assets amounted to $20.1 billion as of 30th September 2010. The net effect is an underfunded actuarial accrued liability of $8.2 million (The University of Alabama, 2012).

The GASB proposed changes in accounting and financial reporting and not how the government approaches pension funding. As proposed, “Governments would recognize a pension liability on the face of their financial statement”. Currently, the unfunded liability appears as notes to the financial statements. The proposed changes in reporting of pension liability will increase the long-term obligations of the University since they will be included alongside other long-term liabilities (Governmental Accounting Standards Board, 2011; Guardian News and Media Limited, 2011).

Economic conditions that will affect the future growth and success of the institution

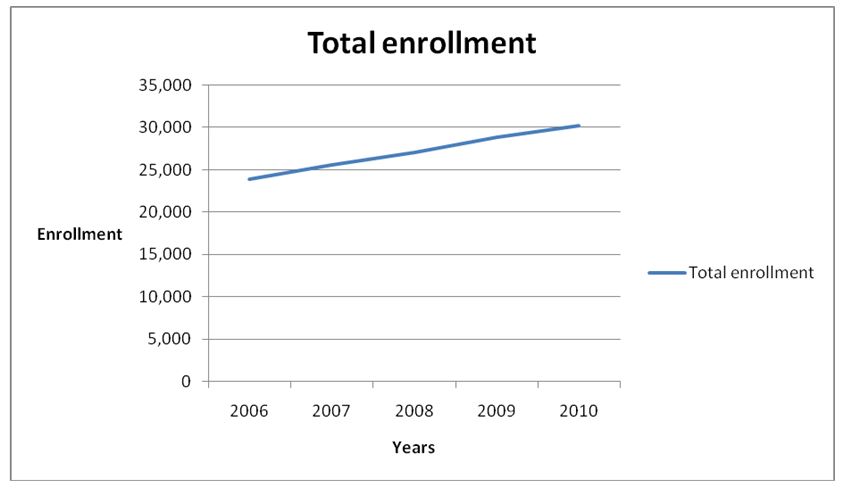

The increasing number of enrollment is a threat to the future growth and success of the institution. The table below shows the number of enrollments over the past five years.

Source of data – The University of Alabama, 2012

From the table, the total enrollment has been on an upward trend since 2006. This shows increased demand for education. The increase leads to overstretching and the dilapidation of available resources at a high rate.

Apart from increased enrollment, uncertain State appropriations affect tuition levels. For instance, in 2011, the appropriations were reduced by 3%. The University budget is likely to be bloated with increased tuition, increased enrollment, and internal services thus hindering growth. The same volatility can be extrapolated to the future and it hinders the University from planning for the future. A combination of increased demand for education as a result of population growth and reduced State appropriations poses a threat to the future success of the University (The University of Alabama, 2012; Granof & Wardlow, 2011).

Treatment of federal grants in the financial statement of the institution

From the financial statements of the institution, the federal, state, and local grants and contracts were treated as operating revenue. However, the Federal Pell grants were reported under non-operating revenues in the financial statements (The University of Alabama, 2012). Further, the University did not receive a supplemental grant within the period under review. Work-study was treated as a scholarship allowance. These were deducted from revenue from tuition and fees. They are classified under operating revenues.

Treatment of endowments, earnings on endowments, and restricted funds

Endowments and life income investments are treated as noncurrent assets in the financial statement of the University. Further, the University treated restricted funds as current assets. According to GASB statement number 35, the net assets should be classified into three categories these are, assets invested in capital items restricted net assets (consisting of assets and liabilities), and unrestricted assets. Both permanent and term endowment falls under restricted net assets. Further, earnings on the endowment are included in the restricted earnings. All three items should be treated as noncurrent items in the balance sheet. However, the University recognized only endowments as noncurrent assets. Restricted funds and earnings on endowment were treated as current assets. This contravenes GASB requirements (Governmental Accounting Standards Board, 2011).

Conclusion

The paper reviewed certain aspects of financial statements of the University of Alabama System. From the discussion, changes in reporting of pension liability increase the long-term liabilities of the institution. Further, an increase in enrollment and uncertain State appropriations cast doubt on the future success of the business. Finally, the University did not report restricted funds and earnings on endowment as per the GASB requirements.

References

Governmental Accounting Standards Board. (2011). GASB proposed to significantly improve pension reporting. Web.

Granof, M., & Wardlow, P. (2011). Core concepts of government and not-for-profit accounting. Hoboken, New Jersey: John Wiley & Sons

Guardian News and Media Limited. (2011). Public sector pension changes: How will they affect you. Web.

The University of Alabama. (2012). 2010 – 2011 financial report. Web.