The process of designing an automated system project is associated with a number of risks, starting from the basic probability of equipment failure to more complex issues including the threat of the wrong choice of information management strategy, which might lead to confusion in the data and the ultimate failure of the venture. However, with the introduction of an efficient risk management plan, one will be able to coordinate the situation and solve the related issues as they emerge.

To start with, it is necessary to introduce the concept of the so-called risk register. By arranging the existing threats into a list and creating a specific classification of the threats in question, one will be able to not only come prepared when the necessity to face risks arrives, but also to adopt a flexible approach towards the risk management strategy design, since using a combination of strategies will be available. The key threats are listed below:

Table 1. Risk Register: Automated Accounting System Risks

As the chart shows, the key risks associated with the given change within the company settings that have truly drastic effects on the company’s operations and the production process concern the issue of rivalry, information exchange and the manager – employee relationships, as well as the employee – employee relationships.

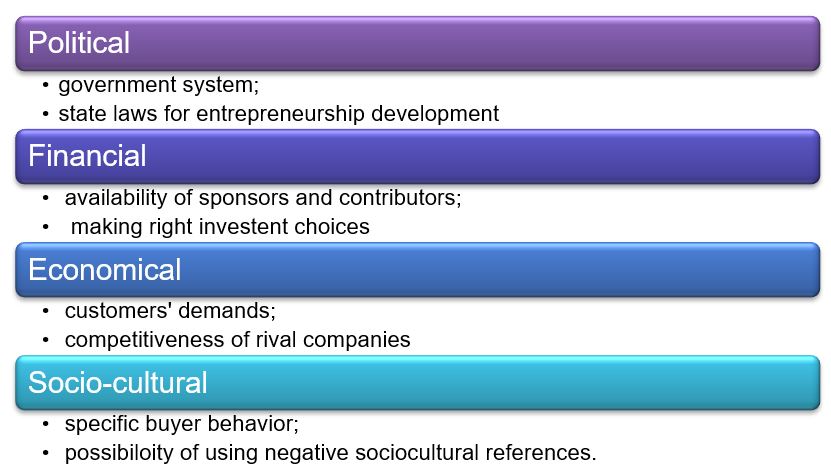

However, knowing the risks that the organization may be afflicted by is only the first step towards designing the strategies to fight these risks efficiently. It is also crucial to define the key factors that shape the environment within which the organization in question works. Therefore, the array of factors affecting the organization has to be viewed. The entire range of factors that shape the company’s production process and even the relationships within the firm can be split into four major categories:

According to the chart, the socio-cultural factors seem to be the ones of the greatest impact on a company’s organizational processes. Apart from shaping the relationships within the company and defining the corporate morals that the firm follows, they contribute to shaping the company’s strategies of building relationships with its partners. More to the point, socio-cultural factors predispose the company’s strategy regarding competition and a possible failure. However, the importance of economical and financial factors is also not to be underestimated; unless a company evolves in a traditional competitive environment, and every company in the vicinity equal chances of succeeding in the specified field, the company in question will never be able to progress until it meets the international standards of the globalized market. Likewise, political factors play a major part in the evolution of a company; there is no secret that democracy and the availability of numerous options predisposes the progress of an entrepreneurship.

Sensitivity Analysis

Table 2. Best Case Scenario

Table 3. Worst Case Scenario

Another important stage of designing a risk management strategy, the risk response plan includes the following recommendations:

Table 4. Responding to Risks

Because of the challenges related to the necessity to embrace information technologies and financial strategy, as well as develop a coherent leadership strategy that will allow for holding the two together, designing a perfect accounting system project seems hardly possible; however, a well thought out risk management plan may help avoid the basic problems and teach to face more complicated ones. Once an adequate risk management strategy is introduced, the company will be able to handle any situation and define the best avenues to improve its position.