Introduction

The Back Bay Simulation played an essential role in training me on how to make strategic decisions as a manager. Research and development (R&D) are integral to the growth of any business because it enhances competitiveness and realization of consumer needs. Managers meet numerous challenges while implementing decisions to allocate funds due to the constant need to remain relevant and ensure that R&D aimed at addressing the current market issued does not raise unit costs. The simulation equipped me with a plethora of skills to make tough yet sound decisions on whether to invest in absorbed glass mat (AGM) or a new supercapacitor (SC) battery.

The news channel, consumer desires, potential customers, and the Back Bay Battery revenue furnished me with the relevant information to make informed decisions. UPS makers had realized that adding a supercapacitor’s ability to recharge faster enhanced the capacity of handling surges (Christensen and Shih Par. 2). The rising popularity of start-stop engine technology meant an increased demand from car manufacturers because the AGM battery is well-suited to the increased power demands and frequent cycling. Seemingly, they had a more extensive market demand as compared to the SC type because they could store and deliver power in short surges. They also had twice the lifetime of conventional lead-acid batteries, and they were sealed to prevent any fumes from overcharging, making them preferred for many applications, especially on ships and military equipment and high-end vehicles (Christensen and Shih Par. 3). Since the company has inadequate money for R&D due to market pressures, I decided to improve prices for AGM batteries while ensuring that their technical advantages surpassed those of similar products in the market.

Strategy

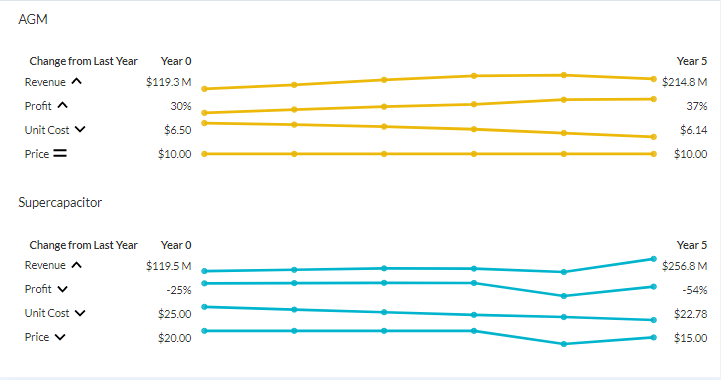

In the first five years after assuming a managerial position in Back Bay Battery, the sales for AGM batteries increased from $119.3 to $214.8 million. I ensured that the price for the product remained $10 and $20 for supercapacitors. This plan played an integral role in increasing the revenues for AGM batteries that were gaining increased popularity in many applications. I kept the price constant for AGM batteries for the next five years. However, since I realized that the company had achieved comparatively lower sales on SC batteries, I reduced their price to $15 in the third year in the notion that I would attract more consumers.

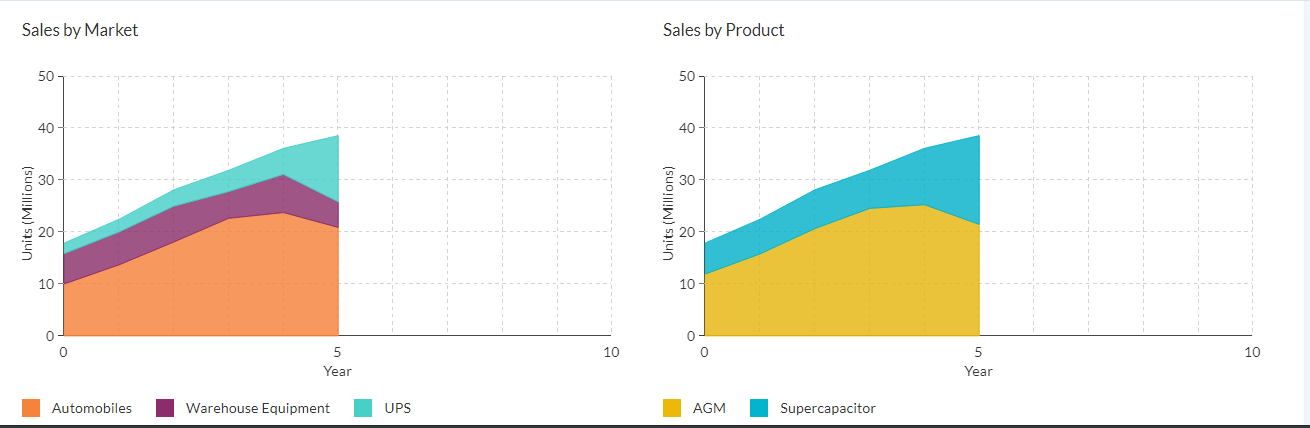

In the first year, the overall sales in automobiles grew by 37%, accounting for 13.7 million units annually. The increased popularity of the SC among UPS makers also boosted sales by 21%, enabling the company to sell 2.5 million units annually. The second year, however, saw a further increase in sales by 32%, boosting the number of units per year to 18.1 million. During the third year, the warehouse equipment makers had increased pressure for improvements in annual production, which implied a need for lowering prices.

However, since Back Bay was offering the best prices for quality products, I overlooked this plea and maintained the same rates as in the previous year. The sales for SCs dropped suddenly while AGM batteries showed a steady increase in profits. In the fourth year, the price of AGM batteries remained the same, but I reduced the price for SCs to $15 while making crucial steps to reduce the unit costs to leverage profits. This decision resulted in a 25% decrease in the overall sales in warehouse equipment. In the fifth year, UPS makers had begun appreciating the power of a supercapacitor to handle surges, which boosted sales by 154% (12.8 million units annually). Throughout the five years, the operating profit for AGM batteries increased from 30% to 37%.

The Rationale for the Strategy

Foremost, I maintained my price at $10, but I invested in the process of improvement to cut the unit cost. As a result, I managed a steady product performance throughout the five years. During the third year, I reduced the prices of supercapacitors from $20 to $15 per unit to boost sales and maintain competitiveness in the market. Even after one of the automakers requested Back Bay to focus on its specific needs for an upcoming SUV line, I still offered the high-power density battery at $10 to prevent intrusion of the market by Asian competitors. The appealing recharge time and competitive price have been critical factors for improved sales, despite the company’s limited R&D resources.

Challenges

While I thought that the strategy for AGM batteries was appropriate, I disregarded various aspects of SCs that would have improved the sale of the products. Although the company has limited resources to conduct R&D for supercapacitors, I did not put any effort into investing in energy density, recharge cycles, and process improvement to make them more marketable. The reduction of the product price only attracted a small amount of profit. I later realized that the best decision was to focus on the improvement of the product specifications rather than dropping the prices in poor market conditions. Asian competitors may have realized this gap and introduced more versatile supercapacitor batteries.

Conclusion

The Back Bay simulation provided a better understanding of the volatility of the market, which does not always align with one’s business goals and strategies. I also learned the importance of investing in R&D to improve product positioning. Lack of this resource can reduce a product’s competitive edge, resulting in low sales. There is a need to ensure excellent timing and efficient allocation of R&D funds to drive promotional campaigns. Lastly, the simulation helped me to understand the link between investment decisions on new disruptive technologies and their contribution to the profitability of a business.

Work Cited

Christensen, Clayton, and Willy Shih. Strategic Innovation Simulation: Back Bay Battery v3. Harvard Business Publishing. Web.