Introduction

On 17th March 1929, Bank Pekao S. A. was established in Poland, and its headquarters is located in Poland’s capital Warsaw (Bank Pekao, 2022). From 1929 to 1939, Bank Pekao established various offices in countries such as Palestine, the United States of America, Argentina, and Germany to launch branches. In other countries, such as Brazil, the war outbreak brought a halt to further development (Global Data, 2022). However, Bank Pekao S. A. is still ranked second among national banks. The bank offers various services, including account banking services, insurance, mortgage, card, and services to businesses and investors (Bank Pekao, n.d.). Some direct competitors to Bank Pekao S. A. include mBank SA, Bank Millenium SA, ING Bank Slaski SA, and PKO Bank Polski. The process of acquiring Bank Pekao S.A shares was completed on 7th June 2017 by Owszechny Zaklad and the Polish Development Fund.

Performance Analysis

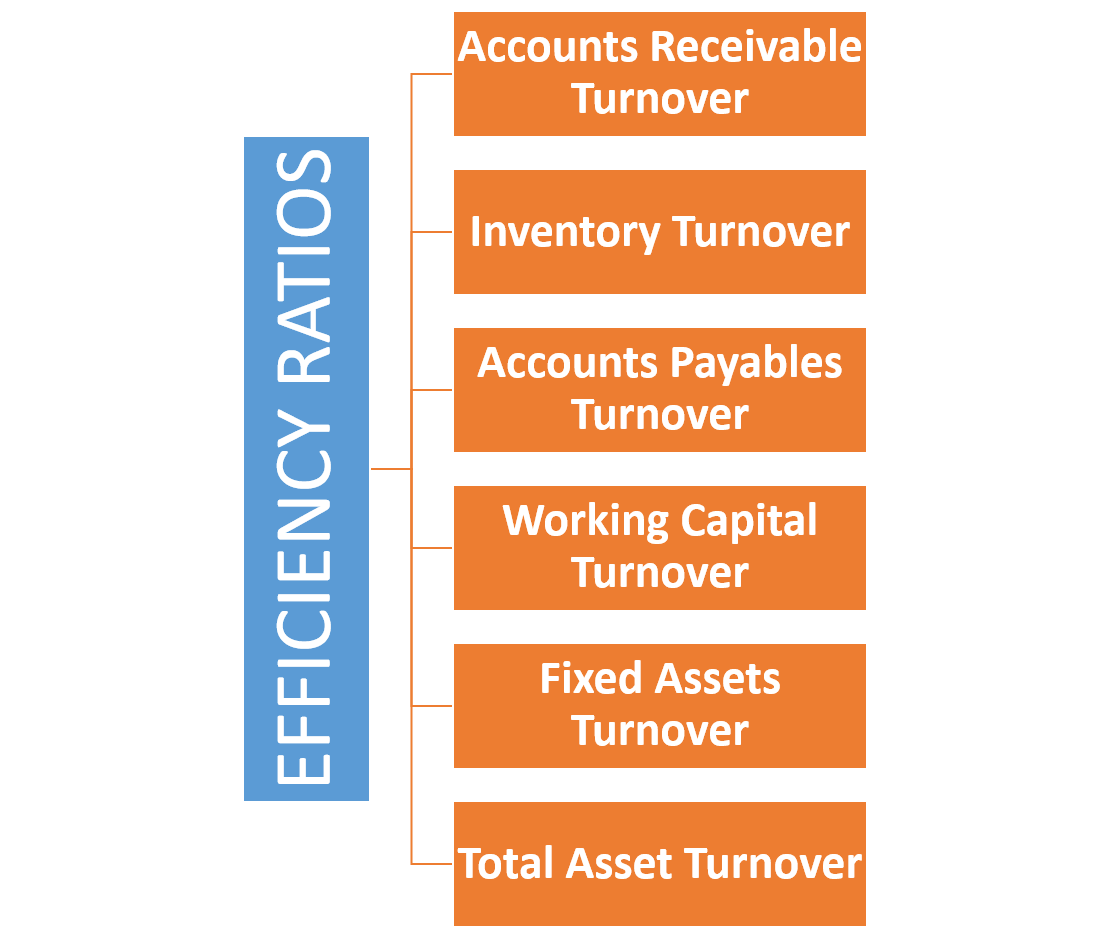

A Uniform Financial Institution Rating system, also known as CAMEL (Capital Adequacy, Assets, Management, Earnings, Liquidity, Sensitivity) rating system, is one of the best tools to identify the financial strengths and weaknesses of a bank (Gołosz, 2022). As mentioned earlier, the bank’s principal purpose after being started was to provide financial support to emigrants (Bank Pekao, n.d.). Through the bank’s help, its customers have had access to foreign currency accounts since 1971, indicating earnings stability and return on assets. The management’s capability has been demonstrated by the bank’s ability to the management team to identify financial stress since 1929. Bank Pekao SA has always stood as a pioneer in modern banking as it was the first bank to launch ATM banking systems, therefore, being the first bank to issue credit cards to its customers in Poland (Global Data, 2022). This has increased the bank’s capital adequacy by continually meeting the minimum capital reserve amount. Compared to its peers in Poland, Bank Pekao is uniquely placed as it launched a brokerage house and made practical biometrics technology in the banking industry, contributing heavily to the bank’s assets quality and investment policies. With Bank Pekao’s strategic plan to offer cross-border solutions to its clients, it has set up International Clients Office that helps provide these services, acting as one of its strengths in delivering liquid capital to meet the present and future cash flow. This indicates that the bank is not sensitive to market risks (Global Data, 2022). Another Strength the bank has majored in is its diversification of currencies, whereby the foreign transfers can be executed in twenty different currencies, thus increasing market scope. Whereas some of its weaknesses include the state being biased, whereby it supported ING Bank Slaski, Bank Pekao’s competitor, by offering it pension assets (Kozar, Ł.J., 2022, p.338). Therefore, Bank Pekao S.A., on the CAMELS rating analysis, can be scaled at two, which means that it is financially sound and has moderate weaknesses. Efficiency Ratios indicate the bank’s internal resources performance. Bank Pakeo S.A. uses this to analyze how well its operations costs generate revenue. Most big banks have a low-efficiency ratio because they generate more non-interest income.

Banking Risk Analysis

As of September 2021, Bank Pekao S.A. Viability Rating was affirmed at ‘bbb+’which is highly attributed to downside risk, contributing to the institution’s overall credit profile (Bank Pekao, n.d.). With the pandemic, there has been a high level of uncertainty which has very little effect on the bank’s overall risk as it has strategically implemented the digitalization process. The bank is required to maintain the “P-1” short-term deposit rating and “A2” on the long-term one, as well as a stable outlook on the long-term deposits (Bank Pekao, 2022). The Bank’s Baseline Credit Assessment was also downgraded while the Adjusted Baseline Credit Assessment from “baa1” to “baa2” and the Bank’s Counterparty Risk Assessment was downgraded from “A1(cr)” to “A2(cr)”.

This rating is mainly formulated due to Bank Pekao’s acquisition of the certain liabilities and assets of Idea Bank S.A, which had a minimal effect on the institution’s credit profile. The acquisition provided a credit risk exposure within acceptable parameters and the organization’s effective asset-liability management, hence liquidity risk (Bank Pekao, n.d.). Due to the rapid increase of off-balance risk, innovation will undoubtedly bring an increment to the banks risk-taking. Therefore, the solution to the rigid payment problem is appropriate to minimize the risk taken by the bank when providing off-balance risk innovation (Bank Pekao, 2022).

The debt-to-equity ratio measures how the bank is financing its operations through debt. An increase in the debt-to-equity ratio is good since it implies the bank can efficiently service its debts. On the other hand, it could be a risk since it implies that the bank is financing a considerable amount of its growth through borrowing. Efficiency ratios analyse the bank’s short-term ability to turn current assets into income. A higher assets ratio rate will indicate that the bank is efficiently making sales from assets, while a comparatively low ratio indicates the opposite.

Bank strategy and Innovations

It is never early for parents to teach their children about financial education, and with this in mind, Bank Pekao S. A., in April 2021, launched the PeoPay KIDS app. This app is described as the perfect tool that enables children to learn the management of money and its fundamentals at a very young age (Bank Pekao, 2022). With regard to Bank Pekao’s performance, this innovation made the bank to be selected as Efma’s April 2021’s Banking Innovation winner. In addition to this innovation, Bank Pekao has also developed virtual coaches intending to provide guided hints, education, and messages on managing finances intelligently (Global Data, 2022). The app’s results have been impressive, with forty thousand users downloading it and rating above 4.7 on App Store and Google Play. According to Bank Pekao S.A.’s 2021-2024 strategic plan, the bank is planning to focus on four primary goals, which include; being a first-choice universal bank for its customers; developing customer service and remote distribution model; making the cost and process efficient; and lastly increasing their market share in the most profitable market share (Bank Pekao, 2022). While doing this, the bank plans to increase the number of mobile banking clients from 2 million to 3.2 million by 2024. Strategically, the bank has put measures to ensure that the customer is at the center of all its activities to develop digital channels that are fast and convenient (Bank Pekao, n.d.). Investment decisions affect ratio analysis. The financial ratios will get better if the company goes through its innovation and investments successfully. It is also important to understand the variables driving ratios as management has the flexibility to, at times, alter its strategy to make the company’s stock and ratios more attractive. Financial ratios reveal how a company is financed, how it uses its resources, its ability to pay its debts and its ability to generate profit (see Table 1).

Table 1. Table of Ratios

Conclusion

With more clients choosing remote channels, digitalization has become a massive priority for Bank Pekao, with the pandemic accelerating this process. This transformation means that there will be a more efficient improvement in the banking sector, hence restoring profitability measured by return on equity.

Reference List

Bank Pekao (2022).

Bank Pekao (n.d.) About the history of Bank Pekao.

Global Data (2022) Bank Pekao SA: Competitors. Web.

Infrontanalytics.com. 2022. Bank Polska Kasa Opieki SA: Stock Performance Benchmark (PEO | POL | Banks) – Infront Analytics. [online]

Kozar, Ł.J., 2022. The Financial Sector and Sustainable Development-A Review of Selected Environmental Practices Implemented in Financial Institutions Operating in Poland Between 2016 and 2020. Finanse i Prawo Finansowe, 1(33), pp.143-157.