Specific activities within the company where planning and organizing are performed and how they are interrelated

- Resource allocation;

- Distribution of funds, expertise, labor, and equipment;

- Environmental adaptation;

- To improve the company’s relationship;

- Address problems and opportunities;

- Internal coordination;

- Internal strengths and weaknesses to maximize profitability;

- Organizational strategic awareness;

- Systematic management development systems for evaluating past plans.

Resource allocation includes decision about the distribution of the Bank of America Corporation’s funds, expertise, labor, and equipment (Cherrington, 1994). For instance, the Bank’s CEO or the Board of Directors may decide not to pay dividends as a means to retain earnings for expansion strategies or the Bank may focus on employee redistribution to meet workforce demands in other regions.

The Bank may use environmental adaptation planning activities to enhance external relations with stakeholders such as customers, governments, suppliers and the public. The Bank uses planning activities in this category to address opportunities and challenges emanating from external factors. For instance, the Bank may decide to increase the number of ATMs at various locations to enhance convenience of customers.

Internal coordination activities at the Bank would focus on handling internal affairs. The Bank uses these planning activities to review its strengths and weaknesses in order to maximize profits. These may hiring the best talents to create human resource competitive advantage or introduce new technologies to enhance efficiency.

Finally, strategic awareness activities ensure that the Bank can review its previous plans against performances. This could be quarterly performances.

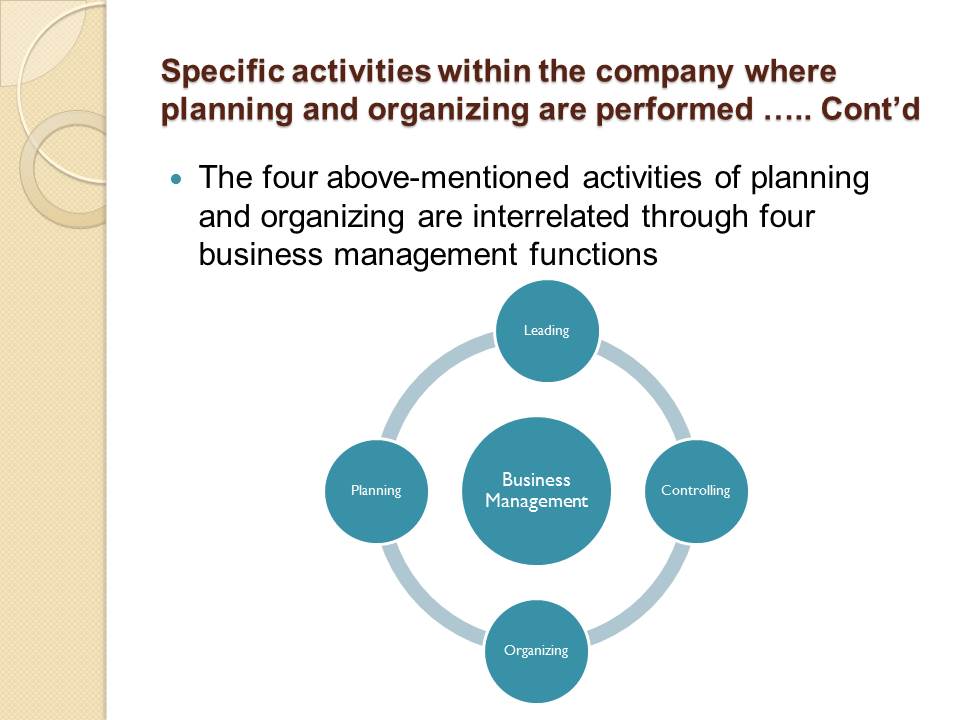

The four above-mentioned activities of planning and organizing are interrelated through four business management functions:

- Business management:

- Planning;

- Leading;

- Organizing;

- Controlling.

Business management involves acquisition, allocation and use of resources through four management functions such as planning, organizing, leading and controlling (Daft, 2014). In this case, the Bank managers must rely on planning to develop effective strategies, policies and various means to achieve organizational objectives. Planning would ensure that possible challenges are identified and solved. Planning ensures that all activities and management functions are interrelated. It offers the direction the Bank may require, set goals for growth and develop a framework for achieving those goals.

During planning and organizing activities, the Bank managers must set goals; evaluate both internal and external environments for challenge and opportunities; assess various options; a chose appropriate plan; implement the plan; and finally control and evaluate outcomes of the plan.

Generally, these processes and activities ideally overlap across management hierarchies and therefore promote organizational unity and coordinated planning.

Two goals for the organization that might be achieved over the next six months

Goal One: To align the segments with how the bank manages the businesses in 2015:

- The Home Loans subsegment;

- Legacy Assets & Servicing;

- A portion of the Business Banking business.

As from January 1, 2015, the Bank decided to realign its various business segments and improve management processes in 2015. These realignment processes should be achieved within six months.

The Bank changed its Home Loans subsegment within Consumer Real Estate Services (CRES) and moved it to Consumer & Business Banking (CBB). At the same time, the Bank created a new segment for Legacy Assets & Servicing (Bank of America Corporation, 2015).

In addition, the Bank reviewed a portion of its Business Banking business depending on the size of the client relationship. This portion was transferred to from CBB to Global Banking. The management will evaluate these changes to ensure conformity with the new segment alignment.

Business Segment Operations Realignment

Home Loans subsegment:

- Moved Home Loans subsegment from Consumer Real Estate Services (CRES) to Consumer & Business Banking (CBB).

Business Banking business:

- Moved Business Banking business from CBB to Global Banking depending on the size of the client relationship.

Legacy Assets & Servicing:

- A new segment.

Studies have shown that strategic planning is imperative for all organizations – large or small (Cordeiro, 2013).

The Bank’s decision to review its business segments and realignment them according to emerging needs, challenges and opportunities reflects planning processes that involved the allocation of resources with regard to personnel and time.

Business realignment is a strategic planning decision that requires a well-formulated plan based on internal and external environments. Without effective strategic planning of business segments and creation of new ones, the Bank may fail in its attempts. Hence, the Bank managers must formulate and implement strategic decisions to achieve organizational business objectives.

Goal Two: To achieve cost savings in certain noninterest expense categories:

- Under the Project New BAC, first announced in the third quarter of 2011;

- Based on streamlined workflows, simplified processes and aligned expenses;

- Achieve $2 billion per quarter by mid-2015 in cost savings.

A part of overall strategic plan and operating principles.

To improve its processes, operational efficiency and realize cost savings, the Bank management introduced the Project New BAC, which was first announced in the third quarter of 2011. Under the Project, the Bank expected to realize cost savings in specific “noninterest expense categories as it streamlined workflows, simplified processes and aligned expenses with our overall strategic plan and operating principles” (Bank of America Corporation, 2015).

This is a part of the overall strategic plan and operating principles of the Bank. Strategic planning, therefore, is crucial for any organization that wants improve its processes and realize cost advantages.

The Bank planned to realize annual savings of $2 billion per quarter, by mid-2015 or $8 billion every fiscal year. It is expected that the Bank will achieve this goal as planned.

The elements of organization and how they are interrelated within the structure of the company

Human resource:

- Layers of management.

Geographical divisions:

- North America;

- Europe; and

- The Asia Pacific region.

Product and service development:

- Evolving services and products.

The size of the workforce, which is more than 220,000 employees, influences the structure of the Bank. The large number of employees requires several administrative levels for effective operations (Brews & Tucci, 2004). As the Bank grows, the structure will also expand accordingly.

The Bank must account for several corporate locations in its strategic plans. It has North America, Europe and the Asia Pacific region among others affiliates. The Bank may create autonomous levels at some regions to enhance efficiency.

Over the years, the Bank has increased its portfolio of services and products to cater for diverse needs of the market. Moreover, as it continues to grow, the Bank has created specialized departments for Home Loans, Consumer and Business Banking, Legacy Assets and Servicing.

Control:

- Control over the quality.

Distribution of Authority:

- Centralized management or Decentralized Management.

Marketplace:

- Distribution channels e.g. ATMs, branches, agents etc.

- Marketing and sales teams.

Elements interrelate during planning to create future growth strategies and objectives.

The Bank wants to create excellent customer experiences and therefore it has focused on providing quality products and services. Control is therefore strict and enforced with internal controls and rules. Although it deals with mass customers and engages in millions of complex transactions, they must adhere to monetary regulations. Hence, various organizational structures exist to ensure compliance and efficiency.

The Bank may decentralize some operations to enhance efficient management. Therefore, new structures must be created to accommodate communication lines and interactions.

The marketplace has also influenced the Bank’s structure. The Bank relies on branches, ATMs, agents, online platforms, mobile banking and affiliates to provide its products and services. Various structures are required to manage these marketplace constituents.

These elements interrelate during planning to create future growth strategies and objectives for the Bank. Further, the elements interact to develop the blueprint for structure of the Bank and provide managerial staff levels for effecting strategies.

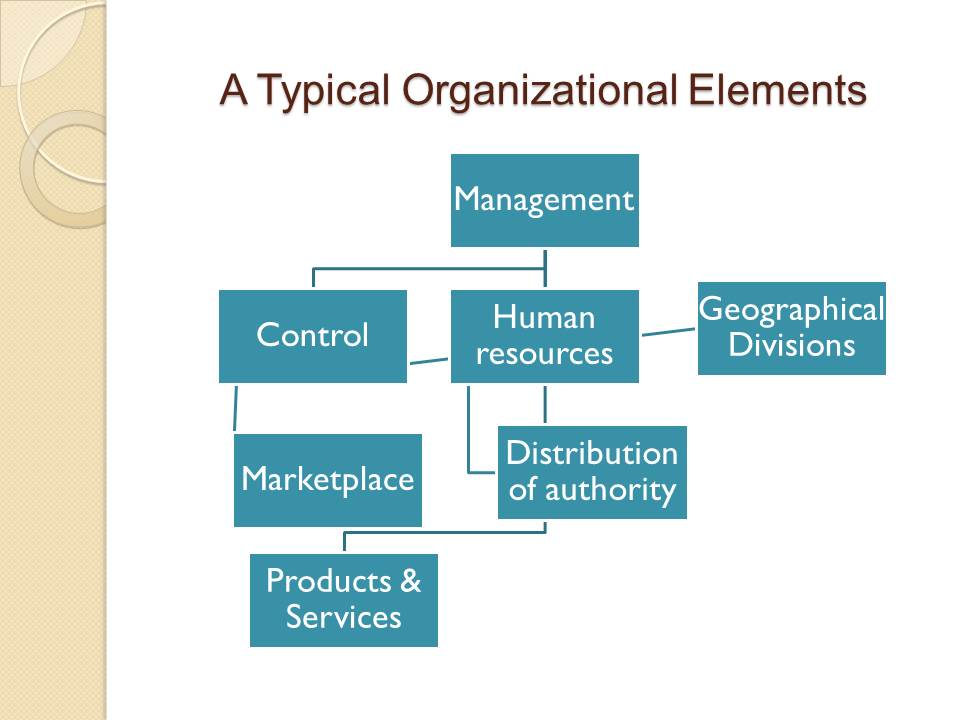

A Typical Organizational Elements

Management:

- Control;

- Geographical Divisions;

- Marketplace;

- Human resources;

- Distribution of authority;

- Products & Services.

As noted previously, these elements interrelate during planning to create future growth strategies and objectives for the Bank and further, they interact to develop the blueprint for structure of the Bank and provide managerial staff levels for effecting strategies.

If and how planning takes place in the organization

- Setting objectives;

- Determining a course of action for achieving those objectives;

- Evaluating environmental conditions;

- Forecasting future conditions;

- Decision-making.

Planning involves management roles that focus on setting objectives and identifying a course of action to attain the set objectives. Managers must evaluate both internal and external conditions and forecast potential future situations.

The Bank requires effective planning during decision-making.

There are several planning processes. The fundamental step involves evaluating operating conditions of the business. As a result, the Bank managers may be able to identify vital contingencies that affect their operations based on competitive advantage, economic conditions, competition and customers. Based on the outcomes, the management should strive to predict future business environment and base their planning strategies on the forecast.

Strategic planning:

- Analyzing competitive opportunities and threats, strengths and weaknesses;

- Positioning for competition.

Tactical planning:

- A concrete and specific means to execute strategic plan.

Operational planning:

- Organization-wide or subunit goals and objectives and implementation processes.

Types of Plans and Planning

Planning:

- Strategic planning;

- Tactical planning;

- Operational planning.

Strategic planning entails assessing competitive environments, opportunities, threats, strengths and weaknesses and then formulating strategies to compete effectively in the prevailing banking environment.

This is a long-term plan, involves the entire bank and focuses on formulation of strategic objectives.

The Bank must base its strategic objectives on its mission and explain its reason for existence. Senior executives of the Bank must engage in strategic planning.

Tactical planning is an intermediate range planning formulated on a clear, concrete and specific plan to execute the strategic plan. At this stage, the Bank’s middle-level managers must in the process.

Operational planning focuses on the entire organization or its strategic business units’ goals and objectives and specific methods to attain them. In this phase, the Bank must focus on short-term planning to support its tactical and strategic plans.

Recommend an organization strategy to reach two goals in order to improve planning and organizing processes

Expand franchises to serve:

- Consumers;

- Businesses; and

- Institutional investors.

The Bank believes its current franchise network is broad enough to serve its clients. The retail distribution has expanded through acquisitions, which has led to increased ATMs and branches for clients. The Bank also increased the number of its employees after acquisition of Merrill Lynch and Countrywide Financial. The employees are specialized in mortgage and financial advice.

Further expansion would ensure that the Bank could develop multiple product lines, create a vast network and develop competitive advantages to serve consumers, businesses and institutional investors (Hansen & Nohria, 2004).

Increased resources would facilitate planning and organizing processes, promote customer focus, and retain for revenue generation for longer periods.

References

Bank of America Corporation. (2015). 2014 Annual Report.

Brews, P. J., & Tucci, C. L. (2004). Exploring the Structural Effects of Internetworking. Strategic Management Journal, 25(5), 429–452.

Cherrington, D. J. (1994). Organizational Behavior: The Management of Individual and Organizational Performance (2nd ed.). Boston: Allyn and Bacon.

Cordeiro, W. P. (2013). Small Businesses Ignore Strategic Planning at their Peril. Academy of Business Research Journal, 3, 22-30.

Daft, R. L. (2014). Management (11th ed.). Mason, OH: South-Western, Cengage Learning.

Hansen, M. T., & Nohria, N. (2004). How to Build Collaborative Advantage. MIT Sloan Management Review, 46(1), 22–31.