Introduction

Macroeconomics is a variable topic centered on the economy and factors that influence its overall development. Governments and businesses apply the concept of microeconomics to articulate general growth and development of their economy an how to implement policies that would generate maximum returns to support their overall development.

It tracks the behavioral patterns of companies and individuals with their ability to make decisions over the market alterations. The interactions of the traders and consumers in a certain setting and the entities that influence their behavior toward decision-making are analyzed.

Manufacturers and most companies to determine their functionality in profit production and alterations that can be applied to generate maximum returns apply the concepts. Governments need to predict financial and economic sustainability of its nation’s population and the measures to be implemented to elevate living standards.

Macroeconomics in a given setting can be derived from several entities that affect its overall growth. Through analyzing critical issues in overall development like unemployment; inflation; aggregate demand and supply; GDP verses income, the overall growth and influences on macroeconomics may be determined.

GDP Verses Income and Economic Growth

GDP is used to refer to the quantity of the goods and services that is produced in an economy by a country. The prize that a commodity or service is worth in the market is accumulated is summed up to the value of government expenditure and overall consumer expenses and is measured against the income value. The value acquired by the government after deducting all of its expenses from the imports is articulated to be its GDP.

The higher the rate of consumption by the consumer, the higher the rate of GDP improvement. Income of the population leads to a positive shift in the GDP value because more consumers will be in a position to acquire more goods and services permitting the government to import more products.

The government relies on the ability to generate more finance to support its economy and be in a position to generate better services to its population. GDP is quantified in terms of the prices put on goods and services produced which is then articulated to real GDP. This factor may determine the inflation rate as the country strives to put at a level the amount of goods produced with its overall financial stability. Nominal GDP in turn, indicates the various fluctuations in the prices of a commodity.

Higher service prices in the market will influence the government towards minting more money to control the export/import prizes at a manageable level leading to the rise in inflation. The higher inflation rate normally affects slow or no economic growth prompting measure to be taken to regulate the overall government earnings.

Economic growth leads to an increase in the income level of workers making a positive impact on the overall lining standards of the population. The ability to accumulate enough capital to undertake a business task increases the overall returns in a transaction. Economic growth is articulated to better technology and skills applied by the government during production that promotes high-quality goods and the overall increase in export prizes.

In the article, “Jobs, Not the Deficit, Should be Our Most Immediate Concern!” Thoma indicates that the overall sustenance in an economy is affected by the positive advancements in the technology. With individuals sharing various arguments about the attributes that affect development, groups believe that idea generation is quickly spread through various social forums.

Various individuals in the economy share different opinions on wealth creation. The people who earn more income and affect the employment patterns mainly drive the economy. The inability by the majority to afford certain pleasures of the economy leads to a negative impact on the overall economy.

Aggregate Demand and Aggregate Supply

The accumulation of the necessity by individuals to desire the services offered and goods produced is termed as AD. The total amount of purchases the consumer accesses in their desire to achieve satisfaction without considering the costs incurred would be categorized as the AD.

Mostly, consumers acquire goods or some services because they are necessities and a lack in one of the entities would mean a harsh lifestyle that would inhibit individual development. AD is also affected by the income level because there are individuals who determine the overall price of a commodity due to their desire to spend more for these entities.

AD is attributed to the desire for individuals to acquire GDP and it indicates that a low market prize value would significantly boost overall purchases as the demand increases.

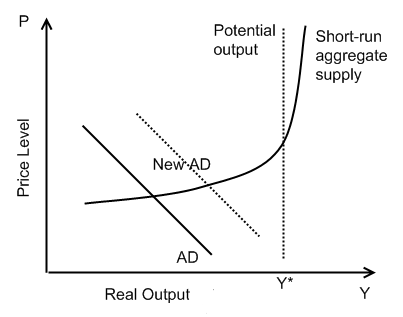

In applying this principle, a country is able to determine it overall GDP and economic growth as it predicts the patterns involved in the overall market and the consumer’s willingness to respond to certain market changes. AS can be useful to determine the impacts of the elevated levels of demand on the real output and the noticed inflation levels. The below diagram indicates the effects of increasing AD on production rate and the prices of the commodity.

The overall demand by consumers towards certain products and services will influence the behavioral patterns of suppliers to make available these desired commodities. Taxes imposed by the authorities and patterns of employment affecting overall consumer expenditure affect the AD and AS process.

As the article indicates, the major decline in the economic condition is because of reduced expenditure among the less fortunate in the economy. Most people predict that the economy would be further affected by the reduced employment rates. The development of inflation rates boosts reluctance by the government to reduce their expenditure, as they desire to deliver more goods to the market improving AS.

The desire possessed by certain individuals in the consumption of these goods boosts the AD/AS relationship with the wealthy dominating the transaction. The ability of individuals to purchase the delivered goods is solely dependent on the employment rate, which determines wealth. AD/AS curve is affected greatly when the market participation of the majority is inhibited.

Unemployment

The unemployment figure is articulated to the population in the productive setting who are required to be participating in work-related activity but have limited access to the entity. Unemployment is mostly affected by the economic development and individual qualifications. Mostly, the economy presents harsh conditions that negatively influence hiring of individuals because of increased inflation rates that lead to scarcity of commodity acquisition.

The unemployment rate reduces when the real GDP elevates, the outputs are adverse therefore prompting increase in labour force to sustain the development. During a recession, however, the unemployment rate increases with most companies seeking to adjust to the economic degradation and maintain their profits. The government during this period is said to increase this trend by encouraging inflation.

Inflation

This entity is affected by the increase in price level as the GDP destabilizing factors are used to acquire the price of a commodity. The article states that with increased recession, the government finds a solution to support its economy by injecting more funds into the economy to support its economy.

Most inflation rates normally lead to a mass population getting unemployed because the prices of the commodities are hiked and the production rate normally drops.

The government that is in control of the policy implementation exerts its dominance in the economy to adjust positively the factors that limit its development by favoring inflation that would sustain the economic challenges affecting financial expansion. The CPI of a particular market is another entity that seeks to measure inflation as it predicts the behavioral patterns of individuals to utilize the commodity under various economic factors.

Conclusion

The economy is normally affected largely by the GDP. The government uses the GDP figures to predict future changes in consumption patterns and overall economic growth. The ability of consumers to utilize the resources available for their satisfaction and complete the supply and demand chain supports the macroeconomic theory.

The activities to purchase and utilize the provided resources and the market activities tell the macroeconomics of the setting. In an economy, the government policies and the availability of technological knowledge help to bolster the development that provides opportunity to the unemployed.

The government shares the responsibility to support the economy by reducing inflation rates and improving the CPI by implementing policies that promote consumer appreciation of the fluctuating prices. Macroeconomics relies on the input by the policymakers and the overall market participants in improving the GDP.

Bibliography

Anne Garnett, Hubbard, Glen, and Phil Lewis. Essentials of Economics. Australia. Pearson Education Press, 2009.

Cencini, Alvaro. Macroeconomic Foundations of Macroeconomics. New York: Routledge Press, 2005

Thoma, Mark. Jobs, Not the Deficit, Should be Our Most Immediate Concern. Economist’s View. January 2012.