It is assumed that one of the causes of inflation is too much money in an economic system. However, as some economists have discovered, there are other forces that determine inflation and recession in economies especially production oriented economies such as the USA.

This can be best described by the relationship that is exhibited between demand for consumer goods at the household, national and regional level as well as the supply of funding by financial institutions. This relationship is expected to stabilize aggregate demand.

These forces do affect the country’s GDP. Insufficient demand for commodities is created by a number of factors. They include the tendencies of fallacies to adjust their spending in anticipation of tough economic times ahead. In this case the demand of commodities is likely to go down.

Furthermore governments might also fail to issue incentives such at tax cuts to manufacturers to mitigate the reduced demand. Under such circumstances companies are most likely to result to external sources to fund their own operations. In such circumstances it means that most of the companies are operating under loses and will negatively affect the GDP.

In such a case companies are most likely to have an increase of consumer prices as companies try to cushion themselves from the influences of the increased cost of doing business (increase of operational costs results as a result of borrowed funds to meet demand).

Such a scenario is also characterized by the rise of interest rates as a result of increased borrowing for manufacturers. It further leads to an increase in the prices of consumer goods.

This leads the consumers to pressurize manufactures to source for funds from external sources to meet demand. This creates a need for additional funding but does not necessarily mean that supply of funding has gone up.

This might result to a rise in demand but not all demand will be recovered due to the increasing interest rate and consumer prices. As such aggregate demand will continue to fall. With aggregate demand lowered below the GDP, then manufacturers will need to have additional finances to cater for their increased demand.

Such a need for additional funds continues to drive interest rates high, and keeps the aggregate demand of commodities even lower. What does it mean then for such companies? To begin with, employment is affected as there may be lay offs especially for redundant employees (employment is kept down).

Furthermore, the output level is also kept down due to the reductions of the number of employees. This is accompanied by the increase of prices as companies pass on the increased cost of doing business to the consumers.

However companies in this case are likely to borrow more to support production in the hope that this will keep the prices of commodities down. This does increase the demand for goods. This sees an improved GDP which in turn creates a need for additional funding.

To maintain such levels of increase in GDP level financiers need to loosen their lending laws and increase capital especially to producers. When this happen producers will be enabled to go back to their pre-recession production levels.

However, demands must be able to accommodate all commodities produced with the new empowered environment. Otherwise, manufacturers are likely to develop cold feet towards supporting production. This may drive the aggregate demand down.

The most important lesson is that for any economy to sustain growth during troubled economic times it must be able to adjust its monetary policies to support production. Money must be used to bankroll the production function of that economy.

To do this money must been kept liquid and not just limited to fixed assets and as such can allow manufacturers to responded effectively to fluctuation in interest rates.

Classical macroeconomics

Creating such a monetary policy where is a deviation from the microeconomics that existed in the 20th and the turn of 21st century. During this time money was only quantified as physical assets and expressed in such commodities as gold and silver.

Such a monetary policy would not work in the current financial state as it does not guarantee that money is not responsive to inflation in interest rates. Classical manufacturers thought that they would respond to tough economic times by adjusting prices of commodities.

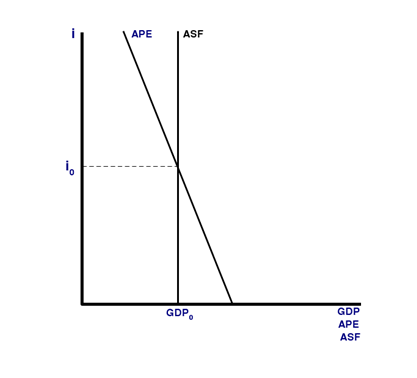

Furthermore such rigidity of supply of funding means that it becomes difficult to finance aggregate demand. The figure below shows the relationship between funding supply, fluctuation in interest rates and aggregate demands.

From the figure above it can be seen that at economic equilibrium, GDP, supply of funding as well as aggregate demand are equalized. But if the demand increases beyond the supply of funding it means that there would not be enough money to meet that demand and as such interest rates will go up.

Classical economics stipulates the need for funding supply would not increase due to the fact that it does not react to any change in interest rate. However, such rises in the rates of interest aggregate demands only affects interest rates due to the fact that manufacturers will be competing for little funding. As such under will offer high interests rates. Prices are not affected in this sense.

However, if the aggregate demand falls then it is automatic that the supply of funding will effectively fall. The reduced supply of funding increases the amount of money available for borrowing and as such interests rates fall.

The rate of interest will lower to such an extent that the aggregate demand will start to rise until it is equalized with the addition supply of funding. Classical economist explained that when such a situation happens, then manufacturers are likely it hike the prices of commodities because manufacture would be interested in attracting as much profit s possible.

Thus any increase in supply of funding only affect the increase in consumer prices but not interest rates. Actually the rate of interest may decrease for time but eventually returns to their original rate. As such employment and levels of output are kept at a constant.

The opposite is true: a fall in supply of funding leads to a fall in consumer prices. Thus the rate level of supply of funding is directly proportional to the level of consumer prices.

Such classical economic theories would only serve during small types of economic turbulence but would be insufficient with large scale economic turbulences such as the great depression of the 1930s America. Such an occurrence as the great depression could not just be dealt with by just adjusting the prices of commodities without affecting employment and output.

This is because lowered prices would also mean a reducing employment as well as production to meet the new level of demand. Such economic processes distribute efforts of harmonizing the economy at various economic functions such as households, government’s economic interventions, market schedules and manufacturers.

All these functionalities only deal with the harmonization of economic inefficiencies for their own benefits and at the levels within which they can. Such processes create an uncoordinated economic harmonization.

Policy interventions

Decentralized economic harmonization efforts do mean that government interventions are key to trying to control economic inefficiencies. As such a number of policy interventions have been generated.

The federal reserve has develop a three step monetary policy that is aimed at creating the desire control the output level, interest rates, jobs and productions levels. Unlike the decentralized economic policies the Federal Reserve’s monetary policy stipulates closer goals regarding job security the rates of interest as well as commodity prices.

Search efforts however do create business cycles that are provoked by monetary based policies. Creating this type of cycles has a number of problematic issues. There has been a noted, unfortunately that such efforts lead to an unstable employment pricing as well as output, which is the opposite of the expectation.

Thus is so because in some cases when household adjust their spending in anticipations of an economic occurrence. This definitely has an effect of demand and as such affects pricing output.

As such it creates a see saw scenario ( tightening and loosening) of monetary control policies that are intended to influence employment, pricing and commodity output in hope that such controls will have an positive effect in controlling interest rates.

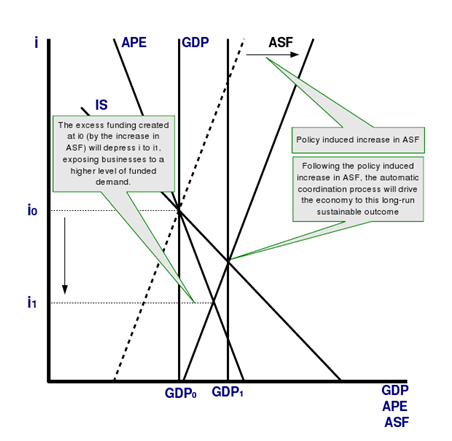

The Federal Reserve can however opt for alternative and effective policies such as inducing an artificial supply of funding by lowering the discount rates. This would effectively have an effect in the employee level as well as output levels which would be stopped from falling.

This is achieved by ensuring that there is an assured amount of necessary financial capital for sales activities needed to boast profits that would enable companies to keep employment levels high. Thus enhanced supply of money lead to enhanced supply of funding that is essential for assured growth in output. This is described in the figure below.

This shows that if the supply of money (note: not supply of funding) can artificially induce several economic shocks such as demand as well as money and credit oriented recessions by ensuring that there is enough capital to support such activities as improved output that do have a positive effect on the GDP. This can only occur if interest rates are lowered to such an extent that it generates desired responses from demand.

The situation is however different in mega economic crises such as the great depression as money is not liquid enough as it is trapped in loans. Increased monetary supply can however create and actually have created mammoth inflations such as the German Hyper Inflation that did occur o in the 1923.

This is due to the fact that monetary polices that induces demand supported policies cannot keep employment high and prices low at the same time. As witnessed in the US, government need to employee different tactics to curb prices and unemployment, other than increased-money-supply tactic.

Such polices include taxing wages in such a way that wage targets are set from tax as well as setting price limits beyond which tax penalties would be awarded. When that idea is implemented not only will employment be kept high but also prices controlled.

International issues

Despite the numerous bottlenecks, monetary authorities have strengthened the monetary policy which has in turn given them humble time to concentrate on domestic policy aspirations for a number of reasons: the balance of payments record comprising the current and the financial accounts.

The current account monitors cross-boarder exchange of goods and services and even gifts while the financial account keeps track of all foreign acquisition of America’s real and financial assets.

The pegged rates domestic policy on the other hand refers to international agreements obligating governments undertaking multilateral transactions to maintain a constant supply of their currency at the foreign exchange market so as to stabilize it at an agreed-upon standard.

At the moment, however, the relative values of the dollar and the euro are allowed to vary. Under the pegged rate system, sustained by the demand and supply a currency, other factors, say a growth in the GPD may come to play and affect the demand-supply equilibrium at the international markets consequently impacting on the exchange rates of the dollar.

To curb this, a domestic policy to increase the interest rates in the US will stabilize the dollar, discourage investment in Europe and attract more foreign investors. That is, a policy manipulating the interest rates in the US keeps the dollar at the official pegged value against the euro, encourages domestic investment, hence its value is kept constant.

As such, there is a variety of GPD and interest rates for the market-manipulated value of the dollar. This establishes a balance of payments (BP) on which the value of the dollar is kept constant despite the foreign exchange market dynamics which bring about huge demand and supply changes for the dollar.

Pegged interest rates does mean that there is negligible bots to foreign trade due to the nature if its rigidity. As such the US government should consider moving from such rigid policies to more liberal polices that guarantee enough space for maneuver in any economic situation.

The move towards flexible monetary policies is encouraged as it will see powerful domestic monetary based policies. Such polices will also see an improved supply of funding that in effect positively lead to an improved GDP.

However, flexibility in decision the prevailing interest rates do have a negative effect on the country’s fiscal policies. This means that if the US government has to realize the assured economic control it has to carefully balance the employment of both fiscal and domestic monetary policies.

This means that the Federal Reserve with which domestic monetary based policy falls under and the congress which handles matters of implementing the fiscal policies must closely work together.

However due to the fact the legislation process within which the congress takes to have fiscal polices take a very long time, then congress might need to consider ceding some of the fiscal possibilities to professionals (Federal Reserve) who are more oriented with economic matters.

The effect is that economic polices will be implemented faster from the same central locations, the federal reserve a opposed to the long tedious procedure that would involve endless and sometimes fruitless communications between congress and federal reserve.