Introduction

Demand and supply is possibly one of the major economic concepts and the backbone of free market economy. Demand is the quantity of services or products needed by consumers (Mankiw, 2012). The amount of products desired at a particular price is referred as quantity demanded; the relationship between quantity demanded and price is referred as demand relationship (Mankiw, 2012).

On the other hand supply is what the market can provide and quantity supplied by firms is the quantity of particular product manufacturers are ready to supply at a particular price. The connection between quantity supplied and price is referred as supply relationship; thus, price is the expression of demand and supply, which underlies the forces impacting on the distribution of resources (Mankiw, 2012).

Demand and supply

The demand law states that “if all other factors remain equal, the higher the price of a good, the less people will demand that product” (Mankiw, 2012). To be precise, higher price attracts less demand because as the price of the product increases, the opportunity cost increases as well.

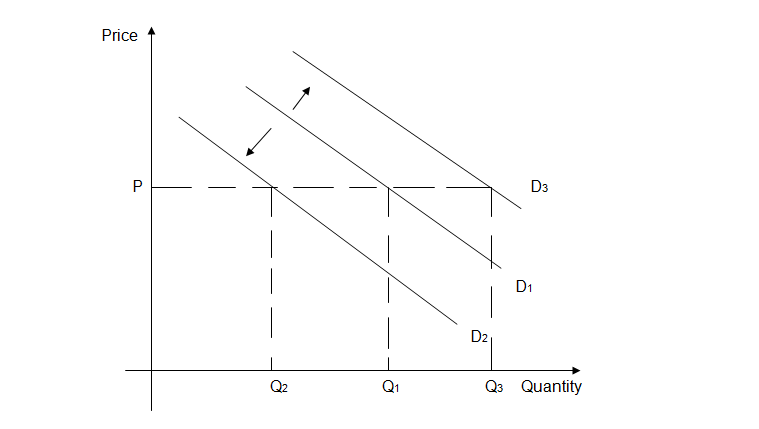

Thus individuals will not acquire goods that will compel them to decline the utilization of anything else that is of significance to them (Netmba.com, 2010). For instance, if the price of oil increases consumers will look for substitutes such as bicycles or bus instead of using their private vehicles to place of work. Therefore, the demand for the cars will reduce and the demand curve will shift from D1 to D2 reducing the quantity demanded to Q2 as shown on the graph below.

Graph 1

Source: Netmba.com, 2010.

The shift in demand can also be caused by change in income, for instance if income increases consumers buy less of inferior good and the demand curve for this goods will shift from D1 to D2. While, if the price of the oil reduces consumers will be induced to purchase more (Q3) cars for instance, this implies that the demand curve will shift from D1 to D3. In the same way if the consumers’ income decreases the consumers will consume more of the inferior r products thus shifting the demand curve from D1 to D3 as shown above.

Conversely, similar to demand law the supply law shows the amount of products that can be put up for sale at a specific price but unlike demand law, supply relationship indicates a positive slope. Therefore, the supplier supplies more products at a high price because trading more products that are priced highly normally raises income (Mankiw, 2012).

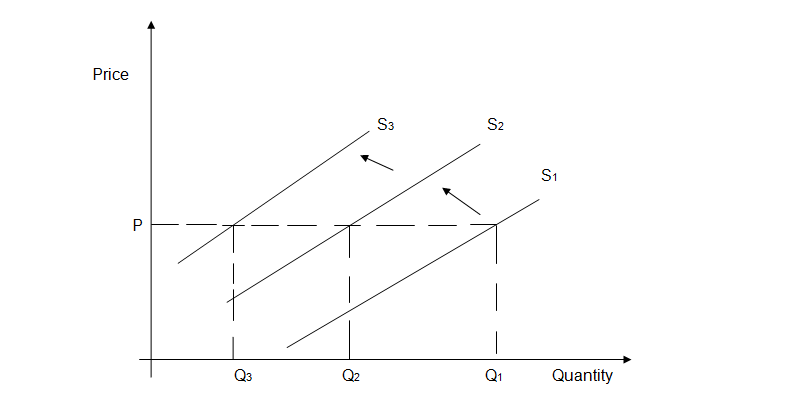

Consider the increase in price of drilling and refining the oil, this makes the suppliers to reduce the amount produced and supplied (Q2), thus the supply curve will shift from S1 to S2. While if the production cost or price reduces the oil producer will produce and supply more oil (Q3) to the market therefore, the supply curve will shift from S1 to S3 as shown below.

Source: Mankiw, 2012.

In conclusion, supply and demand relationship tries to describe macroeconomic variables like price levels and amount of quantity in the economy. It also indicates how various variables like substitute goods, compliments goods, income, consumers’ preferences, advancement in technology and sector growth among others affects the demand and supply of a particular product in the market.

References

Mankiw, N.G. (2012). Principles of macroeconomics. (6th.). Ohio: South-Western, Cengage Learning.

Netmba.com. (2010). Supply and demand. Retrieved from http://www.netmba.com/econ/micro/supply-demand/