Chinese cosmetic and skin care industry is on the growth path. The industry experienced a growth of 13 percent between 2009 and 2010. It is worth RMB 64.2 billion. In terms of products, China’s cosmetic and skin care industry derives growth phenomena from gene-repair products.

These are mainly anti-aging and premium skin nourishers. Chinese consumers prefer products that claim to enhance skin elasticity through repairing the DNA in the damaged skin, leading to few wrinkles.

Chinese cosmetic and skin care industry also experiences stiff competition among major players. For instance, in 2009, Lancôme Genefique was the first product that claimed gene-repair capabilities. A year later in 2010, Christian Dior introduced a Dior One Essential serum to target women with mature skin.

Mid-high income consumers characterize Chinese cosmetic industry. This is the fastest growing consumer segment of Chinese cosmetic and skin care consumers. These women are in their 40s and 50s years of age and mainly in major Chinese cities like Beijing and Shanghai.

These segments of consumers want to maintain youthful skin, and are willing to spend money to do so. They are responsible for escalating sales of skin care products for body, face, hand, and lips.

Chinese consumers have increased trends in consumption of personal care products. This is mainly in the area of skin care among women. The niche market is on anti-aging products.

As a result, demands and strong market among premium and mass market consumers have emerged. On the contrary, hand and body creams have experienced slow growth, but they have not reached points of decline.

China also has women consumers aged between 20s and 30s who are conscious of their skins. According a market research of 2010, these age groups prefer anti-aging products. The report indicated that this segment of consumers accounted for 18 percent of the Chinese skin care market. This segment of the market grew by 14 percent in the year 2009.

In 2010, Chinese consumers became price sensitive for the first time. Price sensitive consumers have increased consumption and market penetration of skin care products. However, price sensitive consumers of Chinese market are reluctant to purchase premium and mass market brands as companies are yet to find products that can appeal to them.

Category of Lancôme’s major competitors

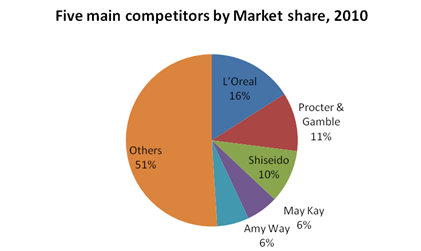

Lancôme has major competitors in the Chinese cosmetic and skin care industry. These competitors include L’Oreal, Procter & Gamble, and Shiseido among other local players.

L’Oreal is the market leader in Chinese cosmetic and skin care industry. The company commands 16 percent of the total market share.

The company has strong and stable international brands. It also has high-end brands such as Biotherm. The company targets mass market consumers who prefer fair prices. At the same time, it also serves low-end consumers with products like Garnier and Garnier Mininurse.

L’Oreal has at least 10 skin care brands. This is a strategy of providing for different needs of consumers and increasing command of the market share. The company has a growth strategy that aims at capturing the second and third tiers cities. The company relies on a management system known as Charm Alliance for distribution its products direct to resellers.

Through the system, the company creates customer loyalty and repeat distributions through provisions of substantial discounts and store membership. L’Oreal has been able to grow its core brands namely Maybelline, New York, Garnier, Yue Sai, and L’Oreal. Since the launch of Charm Alliance, the company has received more than 1,000 applications from retailers who want membership.

L’Oreal is also aggressively expanding online using Taobao, an equivalent of e-bay. This strategy has enhanced sales and increased the company presence.

Procter & Gamble is the second competitor after L’Oreal. Procter & Gamble cannot match extensive marketing strategy and strong brands of L’Oreal. During the period of 2009 and 2010, Procter & Gamble lost market shares to 11 percent. Unlike L’Oreal, the company has only two brands, SK-II and Olay.

Olay brand experienced a slip in market shares. However, it remains the most popular brand in the mass market with wide distribution and strong customers’ loyalty. The company increased advertisement activities of its premium brand, SK-II and recorded increased sales.

Another strong competitor is Shiseido. This is a Japanese high-end skin care company. The company positions its brands as detoxification products in Chinese markets. The company launched a new product, Cle de Peau that claims to reduce stress from the environment on the skin and enhances the skin radiance.

Shiseido had 10 percent of the market share in 2010. The company’s strategy for new products involves focusing on additional value to consumers. For instance, Shiseido launched DQ and positioned it as a pharmaceutical product that is only available in pharmacies.

Shiseido uses high-end retailers through counter and beautician system to distribute its products. It targets urban, high-income earners in the first tier cities of China.

The company also diversified its products to include new brands like pre-make up and cosmetic products. At the same time, the company also has mass market products like Za and Urara. However, these products are not under premium brands marketing.

In terms of premium brands, companies have mixed results. However, international brands dominate the Chinese cosmetic and skincare industry. This segment is approaching its maturity stage as there are minimal changes in market shares among competitors.

Critical issues Lancôme faced in 2010

In 2010, a new segment of consumer emerged in Chinese cosmetic and skin care industry. Chinese consumers became price sensitive for the first time. Price sensitive consumers have increased consumption and market penetration of skin care products.

However, this segment of consumers is reluctant to purchase premium brands. As a result, companies like Lancôme and other competitors have not developed products that match price preferences among this segment of consumers.

There were stiff competitions from Christian Dior, L’Oreal, Procter & Gamble, and Shiseido among others. Some of these companies launched new products and increased their marketing and advertisement strategies.

Chinese market is also haven for counterfeit brands and imitation of premium products for low quality. For instance, there were counterfeit brands of SK-II that contained carcinogenic as an ingredient. As a result, there are also unscrupulous dealers in the industry. Lancôme shall contend with the existence of unscrupulous dealers and counterfeit products for many years.

China’s skin care and cosmetics industry’s key success factors

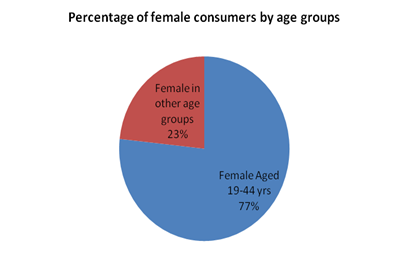

The success of cosmetic and skin care products companies depends on women consumers. A survey in Shanghai revealed that 87.3% of these products consumers were women. Still, 76.7% were women aged between 19 to 44 years.

There is an emerging segment of price sensitive consumers who drive mass market growth and wide distribution of cosmetic products. However, this market is still new as companies are yet to produce brands that match such consumers’ price needs.

Chinese society is also social sensitive as well as price sensitive. Consumers in first and second tiers are willing to spend much on cosmetic products. On the other hand, third tier and rural consumers are not willing to spend much on cosmetic products.

Recommendations based on the four Ps to Lancôme executives covering 2011-14

Products

Chinese economy is among the fastest growing in the world. According to results on the future of Chinese skincare industry, there is huge potential for growth with an average rate of 23.8% annually. However, the industry has concentrated on women products and neglected male consumers. Thus, Lancôme should develop products that also appeal to male consumers.

Most players in the industry continue to launch new products to attract new markets. Lancôme should also adopt the same strategy and focus on skincare for all segments of consumers. Chinese mass market consumers look for tailored products. They have shifted their attentions to toner for skin whitening.

The company can exploit the large market of nourishers, anti-aging, and masks. This area has potential of 10 percent growth among both female and male consumers. At the same time, the company should introduce brands with functional benefits such as anti-cellulite and body firming creams.

Distribution

The company can exploit the large market of nourishers, anti-aging, and masks. This area has potential of 10 percent growth among both female and male consumers. At the same time, the company should introduce brands with functional benefits such as anti-cellulite and body firming creams.

Price

Chinese consumers are becoming price sensitive. This implies that companies that sale premium brands alone shall have reduced market share. Lancôme should introduce brands that appeal to all segments of the market in terms of prices in order to enhance its market share among its main rivals.

Promotion

Procter and Gamble increased its sales of the premium product, SK-II due to aggressive promotional strategies. Lancôme should target Chinese popular media and adopt promotional strategies that enhance customers’ loyalty and repeat purchases. For instance, L’Oreal has membership programme for its retailers. The company experienced increased demands among retailers willing for membership.