Introduction

The present report provides a strategic analysis of JPMorgan Chase & Co., the top performer of the US banking and capital market, against Wells Fargo and Company. The new decade is associated with the emergence of a new wave of disruptions related to technological, economic, geopolitical, demographic, and environmental factors (Srinivas et al., 2019). Additionally, the COVID-19 pandemic has increased pressure on all the stakeholders of the industry to utilize the latest innovations to adapt to the rapidly changing reality (Melamedov, 2020). The present report evaluates if Chase Bank is ready to enter the new decade with its challenges and opportunities.

The present report utilizes experts’ opinions, analyses of banks’ executives, and customer reviews to evaluate the strategic performance of JPMorgan Chase & Co. against Wells Fargo and Company. The paper provides an overview of the banking and capital industry and conducts SWOT and Dupont analyses of the organizations. At that, the paper summarizes the findings and offers strategic recommendations for Chase Bank.

Background Information

Industry Overview

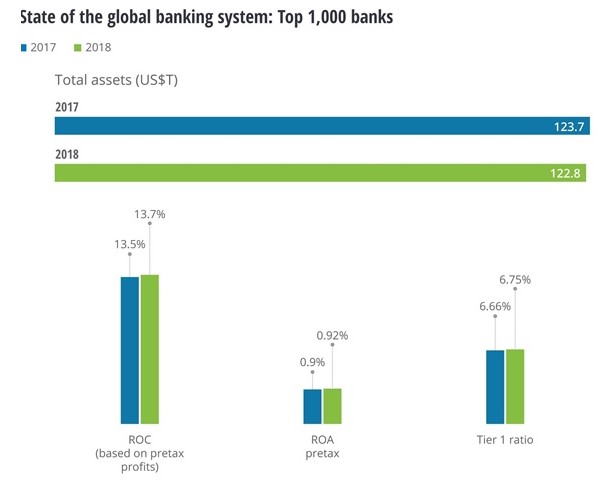

Before the COVID-19 pandemic, the global banking industry was on a positive streak. Figure 1 below demonstrates the state of the global banking industry in 2017 and 2018. The return on capital (ROC) in 2018 was 13.7%, which is 0.2% higher than in 2017 (Srinivas et al., 2019). However, global assets declined to $122.8 trillion, while return on equity (9.6%) was still below the 12%mark associated with banks’ cost of capital (Srinivas et al., 2019). In the US, the banking industry demonstrates a modest improvement and remains strong. The total assets in 2018 were 16.5 trillion showing a 3% increase in comparison with the previous year (Srinivas et al., 2019). The return on assets was 1.5%, with a ROC of 18%, which is significantly higher than the global average. Thus, before the pandemic, the banking sector in the US was on a significant rise, which positively affected both JPMorgan Chase & Co. and Wells Fargo and Company.

In 2020, the US banking sector began to experience a significant recession due to the coronavirus outbreak. The US implemented considerable virus containment measures, which implies that the GDP growth will be negative during Q1 and Q2. The S&P 500 Index has declined 29% from its 2020 peak on March 19 and can drop further down, as the US has become a leader in the number of registered cases of COVID-19 (Russel Investments, 2020). The central risk is that a significant drop in cash flows will cause highly indebted companies to default, triggering a credit crunch in the broader economy (Russel Investments, 2020). However, when the virus disruptions have cleared, the US government is expected to introduce the most robust stimulus measures in more than a decade to start a rebound (Russel Investments, 2020).

The emergence of the new decade is associated with significant pressures and opportunities. Among technological, economic, geopolitical, demographic, and environmental factors affecting the banking industry, the influx of new technology, such as machine learning, blockchain, quantum computing will impact the industry the most (Srinivas et al., 2019). At the same time, banks will need to adopt new technology and embrace the change of traditional banking as a reaction to the COVID-19 pandemic, as coronavirus fuels the movement towards digital banking (Melamedov, 2020). In summary, the challenges before the banking industry calls for considerable adaptation in strategic planning and implementation.

Chase Bank

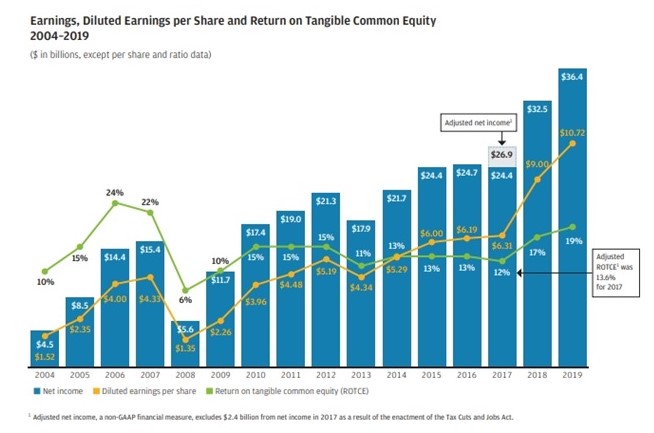

JPMorgan Chase and Co. is the leading consumer bank in the US (JPMorgan Chase & Co., 2020). It serves more than 63 million US households, including 4 million businesses being the #1 family lender in an investment bank (JPMorgan Chase & Co., 2020). The bank is one of the top employers, as it gives jobs to nearly 200,000 employees around the world (JPMorgan Chase & Co., 2020). In 2019, the bank earned $36.4 billion in net income, grew core loans by 2%, increased deposits overall by 5%, and generally broadened market share across our businesses (JPMorgan Chase & Co., 2020). The bank provides an entire spectrum of services with a focus on customer centricity in nearly 4,900 branches (Fralick, 2020). The overview of the financial performance of the bank is provided in Figure 2 below.

Vision Statement: “At JPMorgan Chase, we want to be the best financial services company in the world. Because of our great heritage and excellent platform, we believe this is within our reach” (Comparably, 2020a, para. 3).

Mission Statement: “Our mission is to enable more people to contribute to and share in the rewards of a growing economy. We believe that reducing inequality and creating widely-shared prosperity requires the collaboration of business, government, nonprofit and other civic organizations, particularly in the cities and metropolitan regions that power economic growth” (Comparably, 2020a, para. 2).

Wells Fargo Bank

Wells Fargo and Company is a well-known diversified financial service company with offices in 42 countries (Wells Fargo, 2020). It employs 268,000 people in more than 7,400 locations worldwide (Wells Fargo, 2020). The company prioritizes social responsibility, diversity, and accessibility (Wells Fargo, 2020). In 2019, Wells Fargo generated $19.5 billion of net income, which is a considerable decline compared to $22.4 billion of net income in 2018. The company acknowledges the need for change; therefore, a new CEO, Charlie Scharf, was selected in 2019. The hope is that the new CEO will align strategic planning with the challenges posed by the new wave of disruption described by Srinivas et al. (2019).

Vision Statement: “We want to satisfy our customers’ financial needs and help them succeed financially. This unites us around a simple premise: Customers can be better served when they have a relationship with a trusted provider that knows them well, provides reliable guidance, and can serve their full range of financial needs” (Comparably, 2020b, para.3).

Mission Statement: “The reason we wake up in the morning is to help our customers succeed financially and to satisfy their financial needs, and the result is that we make money. It’s never the other way around” (Comparably, 2020b, para. 2).

Analyses

SWOT Analysis

SWOT analysis is a framework that helps to analyze internal and external environments (Dess et al., 2019). The general idea behind SWOT analysis is that every company should build on its strengths, remedy or workaround weaknesses, take advantage of the opportunities, and protect from threats (Dess et al., 2019). Tables 1 and 2 below provide SWOT analyses of JPMorgan Chase and Wells Fargo banks correspondingly.

Table 1. Chase Bank SWOT analysis:

Table 2. Wells Fargo SWOT analysis:

DuPont Analysis

DuPont analysis is a crucial framework that helps to decompose return on equity (ROE) (Hargrave, 2019). The decomposition of ROE helps to understand the weaknesses hidden behind the numbers of annual reports. Tables 3 and 4 provide DuPont analyses of JPMorgan Chase and Wells Fargo banks correspondingly.

Table 3. Chase Bank DuPont Analysis:

Table 4. Wells Fargo DuPont Analysis:

Findings and Recommendations

The present report demonstrates that JPMorgan Chase Bank outperforms Wells Fargo for a variety of strategic reasons. First, Chase Bank acts consistently with its mission and vision statements, which help to align operations worldwide. Wells Fargo often contradicts its vision and mission: it advocates for transparency but is caught in fraudulent activities. Second, JPMorgan Chase reacts to outside threats and grasps opportunities. Unlike Wells Fargo, it took use of the increasing demand for credit cards and became the leader in credit card sales. Third, Chase Bank is a stable financial performer and gradually increases its DuPont index, while lowering financial leverage to decrease risks. Wells Fargo is an inconsistent performer in terms of DuPont analysis, which is a sign of strategic issues.

To sustain the current performance, JPMorgan and Co. are recommended to pay close attention to the changing environment. First, it needs to improve the security of online banking and increase its usability. Second, it needs to implement the latest technologies, including blockchain and machine learning. Third, the company needs to stay transparent and avoid scandals, as in the case with Wells Fargo. Finally, JPMorgan and Co. should continue to decrease the dependence on debt to diminish risks.

References

Bhasin, H. (2019). SWOT analysis of Wells Fargo. Marketing91. Web.

Comparably. (2020a). JPMorgan Chase & Co. Web.

Comparably. (2020b). Wells Fargo. Web.

David, J. (2019). SWOT analysis of JPMorgan Chase. How and What. Web.

Dess, G., McNamara, G., Eisner, A., & Lee, S.-H. (2019). Strategic management: Text and Cases (9th ed.). McGrawHill Education.

Fralick, K. (2020). Chase bank review. The Simple Dollar. Web.

Hargrave, M. (2019). DuPont analysis. Investopedia. Web.

JPMorgan Chase & Co. (2020). Annual report 2019. Web.

Melamedov, L. (2020). Coronavirus (COVID-19) and the Banking Industry: Impact and solutions. Lightico. Web.

Russel Investments. (2020). Global Market Outlook – Q2 update. Web.

Srinivas, V., Shoeps, J.-T., Tabsay, T., Wadwani, R., Hazuria, S. & Jain, A. (2019). 2020 banking and capital markets outlook. Deloitte Insights. Web.

Wells Fargo. (2020). Annual report 2019. Web.