Introduction

With the recession and global downsizing across the world, the issue of compensation paid to the Chief Executive Officer – CEO has received widespread condemnation. Public view and the media outcry against the exorbitant compensation given to CEOs had received much criticism, especially for failed banking and financial institutions where the top executives received millions of dollars even when the organizations failed miserably. While such a criticism is expected in these hard times, the paper examines different aspects of the issue and presents a ‘for and counter’ argument on the issue of CEO pay.

How much are CEOs paid

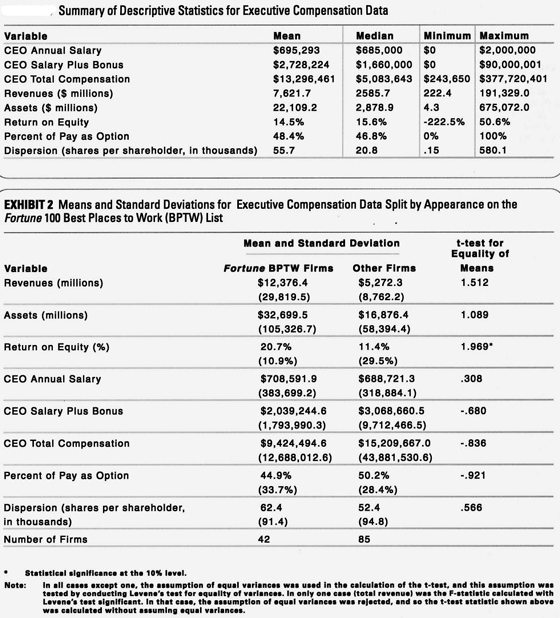

Gropper (2005) points out that the pay of CEOS in Fortune 100 companies CEOs of US-based companies have relatively much higher salaries when compared to CEOs of other companies. The compensation for CEOs has risen by about 106 % over the last five years, while wages for other employees across different levels have risen at an average of 32 %. The author reports that considering the financial returns of skilled and unskilled labor, the amount of money paid to a CEO in a year is much more than what an average US worker would earn in his whole working life. The following table gives a brief snapshot of compensation paid to US CEOs.

As seen in the above figure, CEO annual compensation means salary was about 695,293 thousand USD, and the mean CEO salary plus bonus was about 2.72 million USD. Considering the other options that were paid to the CEOs, the mean CEO total compensation was around 13.29 million USD. The figure also shows the minimum and the maximum values, and it can be seen that the maximum CEO total compensation was in the range of 37.7 million USD. The figure also gives values for the revenues for the company, and while the mean values for 22, 109.2 million USD, the maximum revenues was 191.329 million USD. As seen in the above figure, the compensation given to CEOs is very high when one considers the number of wages for workers and other employees who receive wages ranging from 35 to 50 USD per hour.

Criticism against the high pay and Golden Parachutes

Duprey (October 8, 2008) has come down heavily in the often-exorbitant pay given out to CEOs and top executives of a number of failed organizations. He argues that due to the skillful laws and covenants that the intelligent CEOs build into their contracts, people such as Daniel Mudd, who was the CEO of the failed bank Fannie Mae, and Richard Syron, who managed Freddie Mac, would have a severance pay of 25 million dollars even though the banks they have managed have crashed. The author mentions that the CEO of the failed Washington Mutual bank got a golden parachute compensation of 44 million USD, and the failed banks such as Lehman Brothers and AIG have paid about 1.4 billion USD as compensation. The author also notes that companies such as Merrill Lynch, Bear Sterns, and Morgan Stanley paid 613 million USD last year to its top executives while Lehman Brothers paid 23 million USD to three top officials just a few days before the bank collapsed. Shareholders and organizations continue to pay its executives who clearly fail in their primary duty of protecting assets and making them grow, and the company called Regions Financial ensured that their CEO got a rise of 46% while the stocks fell by 34 %, and the American Express CEO Ken Chenault got a raise of 124% even though the stocks fell by 13%.

Scannell (October 2008) speaks at length about the high wages given to some of the CEOs. The authors point out that Dick Grasso was removed from the NYSE when it was found that he would be entitled to 140 million USD as severance pay and an extra 48 million USD in deferred pay. Arthur Levinson of Genetech and O Neal of Merril Lynch, both of them CEOs in 2005, got severance payout of 69 million USD and 35.5 million USD. The author points out that as per the SEC rules, the pay given to high officials has to be mentioned in the balance sheets. But the problem is that SEC only asks for disclosures and does not have the power to question the high package or attempt to put a cap on the salary. SEC rules also do not require an organization to mention the severance packages that have to be paid, and this issue comes up only after the CEO is asked to go. Pointing out the injustice for the inequalities, the author points out that in 2007 when Goodyear workers were on strike since they were asked to give up benefits and job protections in the effort to turn around the company but the Robert Keegan, the CEO, got a rise of 1 million USD and a bonus of 3 million USD and a few million dollars worth more in stock options. The author contends that the average compensation of CEOs as listed in the S&P 500 had a salary in excess of 14.5 million USD in 2005, and this represented a rise of 16.4 % over the previous year.

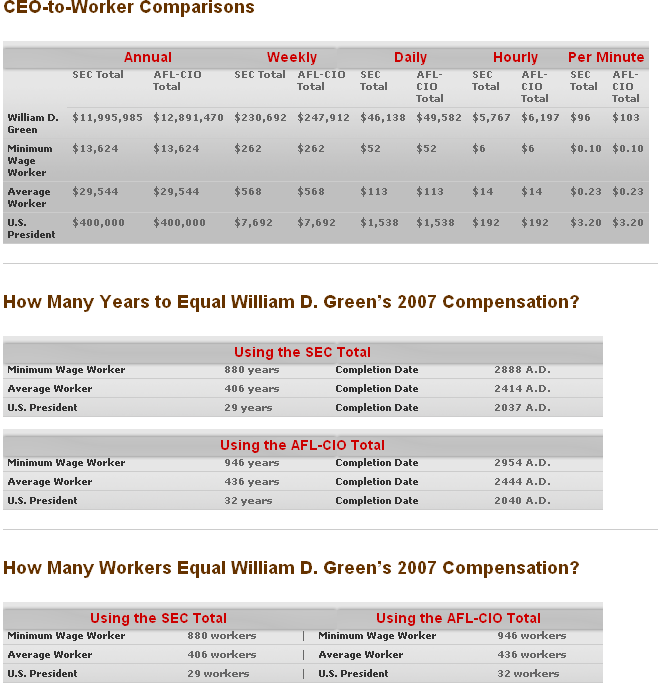

AFL-CIO maintains a database of the packages given to CEOs of a number of publicly-traded companies. The website allows compensation for CEOs to be viewed as per the company name, and along with details of the wages, a comparison of the salary with other workers is also made on the same screen. As an example, the salary paid to the CEO of Accenture has been accessed and compared with other workers, and the results are shown in the following figure (AFL-CIO, 2008).

As per the claims made by the website, the CEO of Accenture received a salary of 11.99 million USD in 2007, and the daily wages were 49 582 USD, while an average worker was paid about 29544 USD, and the daily wage was around 113 USD. Comparison has also been made to the wages of the US President and a minimum wage earner, as seen in the above figure. It is interesting to see that a minimum wage earner will have to work for 946 years to equal the compensation received by the CEO in 2007, while the average worker would take 436 years and the US President would take 32 years.

The section has shown how much injustice exists in the form of excess wages paid to CEOs and the disparity between what a CEO receives and what an average worker earns. It could be argued that while CEOs are expected to get higher wages, the disparity should not be so excessive.

Argument for the high CEO pay

Pornsit (2008) points out that the extraordinary compensation given to CEOs should be seen in the light of the success and creative ability that these people bring to companies. Pointing out that these groups of people help to devise and implement strategies that make companies earn billions in revenues and also increase the shareholder values. When the market performs well and stock markets are healthy, no one questions the pay of the CEOs, and in fact, much praise is extended to them, but it is only during bad times that the issue gets highlighted and blown out of proportion.

Pointing out that the pay of CEOs is linked to the market forces and the general pay rise, the author comments that in hostile markets with takeovers and mergers happening every instant, the CEO is the first person to lose the job, and it is most difficult for them to find suitable openings and another job (Nelson, 1998). Therefore, when a person is entrusted with looking after a company that earns billions and has thousands of employees demands a sensible severance pay in case of a job loss due to reasons beyond his control, there is nothing wrong (Finkelstein, 1989).

Pointing out how successful CEOs build brands and companies, Kay (2005) insists that much of the high compensation that CEOs obtain is linked to the performance of the company, and the wages actually have a high variable component that is paid only if the company shows the required performance that is pre-decided by the Board of Directors during their meeting to finalize the annual operating plan. CEOs have to work very hard and show results. Else their variable component is not paid, and they would, in fact, receive as much as any other senior manager would get (Salazar, 2003). Please refer to the following figure.

As seen in the above figure, the CEO pay is compared to the total return in shareholders and the return on equity, and this percentage varies from 8.7% to 13.8%. So it can be seen that the percentage change in earnings varies from 18.8% to 8.2%, and this can be attributed to the performance of the CEO.

Offstein (2005) points out that the pay of CEOs would depend on new hires, on their track record in turning around a company. It requires vision and creativity to manage highly intelligent people, and the CEO must command respect. While the high pay of CEOs is criticized, it must be understood that the pay is often decided by personal abilities, the market price, what the company can afford, and what a company believes a CEO can do. Westphal (1995) points out that the pay of CEO depends on their ability to deliver, just like the compensation paid to film stars and Sports Stars. No one points an accusing finger when a film star is paid millions when one or two films are hit, and there is no guarantee that the film star would produce another hit.

Conclusion

The paper has presented the arguments for and against the high pay given to CEOs, and the evidence presented so far indicates that the present criticism has come about because of the high severance pay to be paid out to CEOs of failed banks. When the banks were performing well, and the stock markets were booming, and everyone was making money, no one criticized the high pay. The paper concludes that the market forces largely govern the CEO pay, the personal ability of the CEO to deliver and enrich the shareholder value and the importance that organizations give to a CEO, and the salary they are willing to give. While there are bad CEOs and bad CEOs, it is not fair to assume that all CEOs are overpaid and cause massive losses. So the final conclusion is that pay for performance that already exists must be more severely enforced, and top executives must not be allowed to negotiate exorbitant severance pay rules in their contracts.

References

AFL-CIO. 2008. 2007 Compensation of Accenture CEO. Web.

Chowdhury Shamsud D. Wang Eric. 2008. CEO compensation: Turning conventional wisdom on its head. Ivey Business Journal Online. pp: D1.

Duprey Rich. 2008. Limits on CEO Pay Have No Bite. Web.

Finkelstein S, D Hambrick. 1989. Chief Executive Compensation: A Study of the Intersection of Markets and Political Processes.” Strategic Management Journal. Volume 10. pp: 121-134.

Gropper Daniel M. Jahera John S. 2005. CEO Compensation and the Fortune 100 Best Places to Work. Corporate Finance Review. Volume 9. Issue 6. pp: 19-27.

Kay Ira T. 2005. CEO Pay for Performance: The Solution to “Managerial Power”. Journal of Corporation Law. Volume 30. Issue 4. pp: 785-790

Offstein Evan H, Gnyawali Devi R. 2005. Firm competitive behavior as a determinant of CEO pay: Empirical evidence from the US pharmaceutical industry. Journal of Managerial Psychology. Volume 20. Isue 5. pp: 335-349.

Nelson J.E. 1998. Linking compensation to business strategy. Journal of Business Strategy. Volume 19. pp. 25-27.

Pornsit Jiraporn, Young Sang Kim. Summer 2008. CEO Compensation, Shareholder Rights and Corporate Governance: An Empirical Investigation. Journal of Economics and Finance. Volume 31. Issue 3. pp: 242-259.

Salazar A. Hackney R. 2003. The strategic impact of internet technology in biotechnology and pharmaceutical firms: insights from a knowledge management perspective. Information Technology and Management. Volume 4. pp. 289-300.

Scannell Nancy J. 2008. Top Dollar to Go. The Business Review, Cambridge. Volume 6. Issue 1. pp: 5-7.

Westphal J.D. 1995. Defections from the inner circle: social exchange, reciprocity and the diffusion of board independence in U.S. corporations. Academy of Management Proceedings. pp. 281-286.