Introduction

Corporate stakeholders are often faced with the conflict of interest of pursuing personal goals other than the intended objectives of the company. Therefore, there is a need to put in place appropriate mechanisms to effectively deal with the potential conflicting issues in the organisation. For instance, there should be clear policies and management guideline to facilitate running of the corporation. The stipulated management principles will act as a guide to control and monitor the activities of all the stakeholders in the corporation. For example, when a manager engages in some activities that conflict with those of the company, then there is need to put in place stiffer penalties for the offenses and malpractices committed. In certain cases, the management team might reward themselves high amounts of bonuses without necessarily considering the amount of net revenues earned from the operation of the company. In fact, such instances will definitely make the company to incur high expenses, which consequently reduce the net earnings and the profitability of the company (Bodie, Kane & Marcus 2008, p.29). As a result of this, the shareholders would not be entitled to receive some good dividends, as returns on their investments.

Moreover, the conflict of interest among the stakeholders of the company has made the shareholders to pass a vote-of-no-confidence on some of the board members during the annual board meetings. The presidents of the company are awarded bonuses due to their hard work so as to motivate them. However, when the performance is dwindling as witnessed in the China’s publicly listed companies, the stakeholders can be forced to terminate the contracts of the top management team of the corporation.

Literature Review

Corporate Performance

According to Wittner it is important to study the way corporations are structured and governed to avoid possible cases of capital mismanagement (Wittner 2003, p.66). A poorly defined capital structure of a company makes it impossible to maximise revenue that can facilitate the declaration of dividends. It is possible to note that even in a country; there are many differences in terms of the corporate performance and management. There is a hierarchical difference in various corporations that exist in China’s publicly listed companies. Therefore, it is prudent to justify that corporate structure differs from one organisation to another. However, arrangement and organisations in various corporations are ways through which different structures are formed to achieve a common goal, that is, the managerial accountability (Peteraf 1993, p.189).

In the pre-bureaucratic corporate structure, there is a centralised structure with the role of strategic decision making left to the top management leaders, which is the best for solving very simple problems. This system is very common among the small corporations and mostly communication is done on one-on-one basis. Though, it lacks a fundamental role, that is, standardisation of roles and responsibility, the consequences of this structure on managerial accountability is that it helps the strategic director to influence and control development /growth of the corporate organisation (Peteraf 1993, p.188).

Timmer revealed that there are some effects of corporate governance towards a company’s performance. As a result, the structure and arrangement are clearly defined, thus there is a more efficient way of supervising how roles, responsibilities and duties are carried out while at the same time ensuring performance (Timmer 2011, p.67). Without proper corporate structure and governance arrangement the organisations tend to be weaker and at the same time inefficient. It is agreeable that only when all the corporate stakeholders are working together that they can be able to predict changes in the market. Therefore, the company should be prepared to meet these challenges. In addition, it acknowledges the difficulty that can be faced in putting the control management and leadership of a corporate. Therefore, the manner in which it defines the powers, roles and responsibilities of the board of directors makes it easy to manage and oversee the company’s operations (Timmer 2011, p.73).

Weygandt recorded that corporate performance facilitates the access to capital, which is as a result of good governance. This puts a company at a better position to outsource funds easily (Weygandt 2008, p.51). This in turn enables a company to fund its projects easily, and even earn some surplus revenue. The shareholders are always linked to the business through the corporate governance structural arrangement, and in that case they are able to build more trust and confidence in the business. The trust also enables the shareholders to use their contact to their financial organisations and individuals to support the corporation financially. As a result strong corporate system finance in the form of capital becomes very easy to fund (Weygandt 2008, p.54).

Managerial Accountability forms the main merit of the corporate performance/governance since the system provides a structure and arrangement that foresee the accountability checks and balances and integrity. The different branches that are delegated with various roles are held to account for any mistake made. The accountability of the managers met through the audited financial reports and subjecting the auditors to period performance evaluation and re-election processes give the company a good image. The good image would attract investors and encourage the shareholders to contribute more capital through the purchase of shares. Indeed, corporate performance/governance expands the role of directors from the legal responsibility and loyalty to the shareholders and corporations (Weygandt 2008, p.53).

Corporate performance and governance is also considered as one of the most efficient element in improving economic efficiency. This is because the development of the capital markets are directly affected by the corporate governance since it influences the market very strongly and at the same time affects the resource allocation through what is considered as its impact on a company’s behaviour, innovation activity, development of an active small market economy, and entrepreneurship (Weygandt 2008, p.56). Therefore, it can be argued that the presence of a good corporate governance system is manifested through the enhanced performance by a corporation, especially in China, and enhances a steady high growth in the economy.

Capital Structure

Capital structure theories have several uses that facilitate the understanding of the capital structure of various companies, as outlined in the following discussion. According to Abusabha and Woelfel capital structure is the way corporations finances its own assets through combining equity, debt, or through hybrid securities (Abusabha & Woelfel 2003, p.568). For instance, an organisation can sell 300 million in equity and a debt of $700 million. This implies that it is financed by 30% and 70% equity and debt respectively. The company debt ratio total financing, 70% in this case, is described to as the company’s gearing (leverage) level (Abusabha & Woelfel 2003, p.566). In this regard, The Cost of debt calculation is easier than cost of equity calculation. This is often the same as the cost of current interest on borrowings. In addition, the current rate of interest is derived from the prevailing financial market rates. Moreover, the market is capable of adjusting the fixed rates of debt interest according to the prevailing rate by fixing debt prices on discounts (Abusabha & Woelfel 2003, p.566).

In most cases equity is preferred to debt financing as means of raising capital. Therefore, internal financing can be utilised first in the business (Abusabha & Woelfel 2003, p.568).

Cost of equity financing can be calculated using the following formula, derived from a dividend growth model.

P = D / RE – g

Where: P = the price of a security

- D = dividend

- RE = return on equity

- g = rate of growth

Therefore, RE = D / P + g

However, this model is limited in its application since some companies focus on growth, but they fail pay dividends at. Besides, growth rate is not easy to estimate. In addition, the above model fails to incorporate market risk adjustment. Due to the limitations of the dividend growth model, witnessed above, many fund managers tend to opt for the capital asset pricing model or security market line (CAPM/SML) so as to estimate equity cost, as shown below.

RE = Rf + βE x (RM – Rf)

RE = Return on Equity

Rf = Risk free rate

βE x (RM – RF) = (risk factor x risk premium).

SML is advantageous because it facilitates risk evaluation, especially to those companies, which do not pay shareholders’ dividends (Timmer 2011, p.211)

According to Bodie, Kane and Marcus equity not a preferred method of raising capital, this is because when managers who are understood to have a better knowledge of the true condition of the company than investors floats new equity, investors supposedly think that managers are of the opinion the company is overvalued, and that managers are taking benefiting from the of this over-valuation (Bodie, Kane & Marcus 2008, p.31). The study of capital structure is a significant part of a typical introduction to a finance course (Bodie, Kane & Marcus 2008, p.30).

Thompson and Westerfield found that capital structure hypothesis is an organised approach which is known as the “Trade-Off’ form. This implies that it is simply understood under the basic primary perception of optimising worth. Therefore, shareholder wealth is maximised by choosing a capital organisation combination which has the lowest probable cost of capital for the company (Thompson & Westerfield 2004, p. 94). Once the firm finds this best mixture of monetary sources, which is a mix of debt plus equity sources which equates the profit of tax guard provided by debt of bigger expenses produced by company’s financial distress equity holders (Sunder & Myers1999, p.109). The assumption is that new dollars of financing is raised proportion of debt and equity financing.

Separate data analysis of tentative capital structure choices showed similar findings. In each of the surveys, question were put forward to financial managers of two major criteria they used to determine their financing decisions, maintaining a mark capital structure or using a hierarchical of financing (Sunder & Myers1999, p.109). Several industries, especially the most profitable companies habitually have the smallest debt ratios completely to opposite what trade-off model can predict. Huge positive and abnormal returns for a company’s Stockholders are linked with leverage-increasing actions like stock repurchases and debt-for-equity interactions other leverage-decreasing events like issuing stock. Finally, more companies in China issue new stock once in a decade. According to this survey carried out in these multinational companies and industries there is enough evidence to support this rule that industry trends do really exists (Sunder & Myers 1999, p.116).

Pecking order theory of capital structure explains that companies do have a favorite hierarchy for financing decisions (Sunder & Myers 1999, p.117). Failure to give out new securities allows the company to escape the flotation costs linked with external grant and the monitoring and market discipline that happens when accessing capital markets in China Petroleum & Chemical Corporation most of the money is liquidities (Sunder & Myers 1999, p.117). This explains the reason for their continued expansion globally and their financial stability.

Gustavo, Michaely and Swaminathan argued that monetary managers will try to retain financial flexibility while making sure the long-term survival of their companies (Gustavo, Michaely & Swaminathan 2002, p.399). When profitable companies keep their income as equity and build up cash coffers, they can create the financial slack which gives room for financial flexibility and, eventual lasting survival; pecking order theory examines plains these observed and reported managerial dealings, but the trade-off model cannot; it also explains stock market responses to leverage-increasing and leverage-decreasing event, while trade-off model is not able (Gustavo, Michaely & Swaminathan 2002, p.397).

Debt can always be regarded as a cheaper option since the equity is more expensive than it (Gustavo, Michaely & Swaminathan 2002, p.398). This is so because equity involves partnership with the shareholders who share the company’s profitability. However, in case of losses the business bears it alone since the investors are only involved in sharing the returns, which are given in the form of dividends. These groups of the investors do not offer some technical expertise and knowledge in running the business since their work is to contribute capital to the business alone. Therefore, this can be regarded as a cost to the company.

Focusing on the debts, it is evidenced that the interest paid on the money borrowed is always periodic and has a time limit to complete the loan repayments. However, the dividends paid on the equity do not have the time limit since they are paid to the shareholders once the business is still in operation, and making profits. This compels the board of directors to declare dividends to the investors (Gustavo, Michaely & Swaminathan 2002, p.399).

Bankruptcy costs play crucial roles on the firm’s capital structure since they are the basic foundation upon which the financing policies of the firm are based. These bankruptcy costs act as the counterweight to those taxes that have been deducted on the interest payments. Therefore, bankruptcy costs are very relevant in determining the optimal capital structure of the firm. The costs associated with the bankruptcy such as the reorganisation costs, and tax credit losses directly impact on the capital structure of the firm since they are borne by the failing company (Libby & Short 2005, p. 98).

Moreover, Libby and Short studied that the agency cost impacts directly on the optimal debt ratio of the firm since the equity holders often have the incentives that make them to under-invest in those projects that have negative net present value (NPV), in situations whereby the leverage of the company is on the upward trend (Libby & Short 2005, p. 98). This happens due to the fact that the equity holders are mainly interested in the net benefits of the project, when they bear the investment costs. The rests of the cots are passed on to the bond holders. On the other hand, the debt holders are aware of this incentive enjoyed by the equity holders of shifting the risks as well as under-investing. As a result of this, the debt holders price their debts accordingly as well as demanding for the higher rates of return. This agency cost problem puts much pressure on the optimal debt ratio of the firm (Libby & Short 2005, p. 99).

Dividend Policy

Baker and Jeffrey revealed that dividend policy of any firm can be regarded as irrelevant owing to the fact that corporations that often pay a lot of dividends to the shareholders give little price appreciation (Baker & Jeffrey 2002, p. 23). However, the firms must offer the same sum of revenue returns to the investors, depending on their risk characteristics as well as the cash-flows generated from the investment ventures. In fact, since there are lack of taxes, but, if there is any, both the capital gains as well as the dividends are often taxed under a similar rate. Therefore, the investors ought to be indifferent to get their expected returns in both the price appreciation as well as in dividends, under such circumstances. Importantly, some assumptions must be incorporated in this argument for it to be true. First, it must be assumed that the transaction costs are lacking, thus making it impossible to convert price appreciation into some cash. Therefore, it is not easy for the investors who might need cash urgently to receive their sum of dividends (Baker & Jeffrey 2002, p. 25).

Second, it has been assumed that companies, which offer a lot of dividends, are capable of issuing their stock, without both the transaction costs and the floatation costs (Myers & Majluf 1984, p. 189). As a result, this implies that the stocks are priced fairly. Finally, it has been assumed that the management members of the company just pay few dividends, and do not waste the free cash-flows allocated to them so as to pursue their own personal interests and gains (Baker & Jeffrey 2002, p.32).

Baker and Jeffrey found out that Contrary to past statements, dividend policy may matter in the real word owing to several imperfections that are eminent (Baker & Jeffrey 2002, p.29). Some of these imperfections can be attributed to conflict of interests among the stakeholders, information asymmetries, and taxes levied. Under these circumstances, the dividend policy matters. For instance, when the corporation’s management team members tend to waste the resources of the company, then the shareholders would prefer to have large sums of dividends, though this will eventually raise the taxes to be paid by the company.

According to Levich the information and signaling content in dividend announcements can be defined as the way the dividend announcements present information to the investors/shareholders about the future prospects of the company (Levich 2001, p.115). The empirical validity of this concept can be ascertained under the fact that stock prices often increase when there is some increase announced on the dividends or when the dividends. On the contrary, the stock prices often fluctuate when there is decrease in the prices of dividends announced or when no dividend has been declared. As a result, many investors will shy away from investing in such companies. In fact, this is cause by the dividends information content.

In situation whereby the cost of new equity capital is more than the retained earnings it would mean that the company lacked sufficient funds to compensate its shareholders. Abusabha and Woelfel studied that the firm might be forced to source for more equity funds (Abusabha & Woelfel 2003, p.568). However, when many new investors are brought on board the company’s ownership and control might be diluted in the process, as a result of the new investors. On the other hand, it is not a worthy venture for the company to issue new stocks so as to pay dividends in the same financial year or accounting period (Sercu & Uppal 1995, p.142). This is quite irrational in the sense that the new stocks are floated in the market at some costs. Besides, it takes time before all the stock is sold in the market so as to raise the required amount of capital. Therefore, it would not be easy to pay dividends using the expected funds during that same year. In addition, the performance of the stock market is not accurately predictable in the sense that it is pegged on so many factors such as history of the firm, the management of the firm, its liquidity, and credit worthiness among other factors. Therefore, before the company declares and pays dividends to the investors, it is not likely to sell many of its stock in the market. Therefore, the decision to pay dividends using the new issue of stocks during the same year is not a rational one (Abusabha & Woelfel 2003, p.567).

According to Brealey and Myers free cash flow hypothesis ascertains that the financial performance of a company is always calculated on its operating cash flow, once the capital expenditures have been subtracted (Brealey & Myers 2008, p.77). Therefore, the free cash flow is the amount of money that the company is left with after putting aside the money required for the maintenance and expansion of assets. This is important for both the company and the investors since it is able to pursue its goals as well as to enhance the shareholder value. Therefore, the free cash flow theory makes it possible for the company to pay its debts, pay dividends, make acquisitions, and to develop new products (Brealey & Myers 2008, p.78).

According to Davies the free cash flow can help in understanding, for instance, the motives behind mergers and acquisition by availing the sufficient amount of cash to carry out such business transactions (Davies 2007, p. 54). This will be important for the company in the sense that it does not necessarily need to source for capital from the outsiders since there is sufficient funds for expansion. These activities are aimed at strengthening the performance of the company as well as expanding to other geographical areas, and this will help in acquiring more customers (Davies 2007, p.56).

Das, Markowitz and Scheid postulated that the cash flow hypothesis helps in understanding the leverage buy-outs, because those companies that do not have sufficient funds are likely to be sold out to other investor companies (Das, Markowitz & Scheid 2010, 321). The leverage buy-outs will make the firms, which are in big debts to have sufficient funds for settling their outstanding debts. Under the leverage buy out arrangement, the acquiring company would use collateral from the company that it is intending to purchase so as to secure loan. Though, this often comes with some interests, it is beneficial in the sense that the company is able to get cash from the secured loans so as to carry out some of its intended activities (Das, Markowitz & Scheid 2010, p332).

Basing the arguments on the empirical evidence, the acquiring group of company is likely to benefit more than the acquired group in the mergers and acquisition arrangements. This is because the assets of the company, including its customers and the goodwill are transferred to the acquiring company. Under many arrangements, the debts of the company are just partially settled by the acquiring firm, thus much of the profitability and gains are transferred to the firm that acquiring the other (Bennett 2010, p.147).

Methodology and Data

The purpose of this study was to explore the corporate performance, capital structure and dividend policy of China’s publicly listed companies. The search focused on China’s publicly listed companies’ capital structure. Moreover, the study focuses on these companies’ dividend policy. To this end, the relationship between these companies’ capital structure and dividend policy is ascertained (Glautier, Underdown & Morris 2010, p.176). Finally, a dividend pay out predicting model is developed.

The following sections contain a summary of the methodology of the study that was deemed appropriate for the quest for information. Quantitative data were gathered from the companies’ financial statements for this study. It also includes summaries of the population selected for the study, data collection procedures, validity and reliability, trustworthiness, assumptions, scope and limitations, explanation of research bias, and the manner of analysis of recovered data.

Under the positivist approach, a quantitative approach was employed in analysing the data gathered during the study. The reason for this was to qualify or disqualify certain assumptions in research. Therefore, it would be ascertained whether dividend policy and capital structure were correlated. The association between the dividend policy and capital structure variables was assessed through statistical methods (Libby & Short 2005, p. 98).

Research Method and Design Appropriateness

The selection of a quantitative approach was deemed appropriate because the method is an inquiry approach useful for exploring and understanding the central phenomenon. The chosen inquiry process was designed to study corporate performance, capital structure and dividend policy in detail, which is typical of a qualitative approach. Quantitative research method focuses on finance problems through testable predictions based on variables. On the contrary, a qualitative approach provides data through descriptions, analysis, and observation of financial indicators (Libby & Short 2005, p. 99).

A quantitative research design will be used to gather financial data on China’s publicly listed companies. The present study was focused on an approach with which understand an approach with which to test a hypothesis with a numerical construct (Solnik 2000, p.72).

Population and Sampling

A sample of 258 companies was drawn from 2585 China’s publicly listed companies for this analysis. The sample drawn from the population being studied was selected to be representative of the entire population so any data recovered from secondary data was a true reflection of the population.

Sampling Method

As mentioned, sampling is the process by which the researcher chooses a representative sample from an entire population. The number of China’s publicly listed companies currently runs up to 2585. Therefore, it would have been impractical to send out questionnaires or to conduct interviews with all the stakeholders of these companies. The best way to choose participants was through the extraction of a sample that was representative of the entire population (Markowitz 1952, p.90).

Identification of participants is essential to ensure that the most qualified respondents are selected to take part in the interviewing process. Special care was taken to ensure that all participants are stakeholders of the companies involved. In special situations, the use of a purposive sample is chosen as the form of data collection (Porter 1980, p.204). Through sampling, data were gathered through the content analysis of the companies’ financial statements.

Instrumentation

The respective companies’ financial statements were downloaded from websites. This took place after authority was received from the management of these companies. The analysis of the data was carried out in spread sheets. Besides, graphs and data tables were used. As a result, the observation of data trends was made easier.

Procedure and Timeframe

For the success and viability of the coverage of the entire research, it was important that timelines be created for the activities to be undertaken. It identified potential bottlenecks and points of failure for the research and took positive counter-measures well in advance. From the data gatherings of the information required, the most time-consuming and critical were the samplings of the individuals in the sample. As per the scope of the research, it was imperative to allocate sufficient resources and time for the financial reports analysis and, simultaneously, to strictly adhere to the designated timeframe during the interview period. The procedures chronologically followed the path specified by the research plan, which included the selection of an appropriate sample (Abusabha & Woelfel 2003, p.568). During the interview period, the confidentiality of the data collected to each participant was explained. Thereafter, the background of the research and its significance explanation; each question was well spaced so that each consecutive question led to the cumulative questions within the research topic. The greatest hurdle in the research was to implement the collected data findings to the chosen sample within the period provided.

Analysis Plan

For this research, the analysis could also involve coding and verification. Coding refers to sort and organising collected data and identifying recurring themes, facts, or ideas. It involves describing the responses to the interview questions in a few words or even letters that are typical for each response.

In this research, collected data were coded to integrate all descriptions into specific key terms that could be represented in a database. Common themes were identified that dealt with the barriers to and prospects of Web-based environments, which in the determination of how these key patterns (or lack of patterns) would address the research problem (Porter 1990, p.74). Finally, the analysis looked for similarities with other quantitative studies in the field of finance.

The use of coding for analysis assisted in standardising the answers gained from the data collected and in finding possible relationships and trends in the responses collected from the sample population (Pandey 2008, p.123). After the coding process, where textural descriptions were given to the data collected, the material was recorded into a database system. For this research, spreads sheets and multiple regression analysis software were the appropriate analytical tools utilised throughout the analysis process because of the complex formulas that could be flexibly manipulated data.

The analysis identified trends in responses; after incorporating these data into the software, and checked for patterns and common themes that dealt with Web-based environments in relation to the research questions (Oster 1994, p.87). The experiences management of China’s publicly listed companies some similarities. These similarities or differences either formed or did not form patterns. Therefore, it can be suggested that analysis should also draw many explanations from the broad perspective of experiences as demanded by the research.

The analysis involved the use of statistical tools to set up the appropriate attributes that can have relationships to nodes and cases, and the attributes had defined values (as a tool for quantitative analysis, statistical tools are very versatile in the creation of trees and nodes for numerical data to match up with similar responses. Additionally, relationships and links between the quantitative data can be created to show the trends within the data collected from the population sample. For example, multiple regression statistical software then allows for building graphical presentations of the data distribution and comparing attributes, as seen in the results section.

Validity and Reliability

The interview method for data collection could be carefully designed to focus on interview questions that addressed the research questions. The main idea was to gain information on corporate performance as well as the relationship between capital structure and dividend policy (Fama 1970, p.412). For maximum validity, the questions could be designed to request in-depth information about the main research areas. This aided in sensing and understanding current information about the occurrences that are unique to this field of study.

Validity is measured to determine the reliability of the data collected for analysis. It can be measured during the analysis period when the data are tested to determine statistical trends. Regression analysis interactively takes up qualitative data in the form of codes (where necessary), and the trends, plus similarities and differences, are depicted graphically. During the data gathering sessions, a content validity test was done by checking whether the data presented by the respondents were in line with the research topic requirements. In this regard, it can be suggested that content validity increases the logic of the answers as they build toward the research objectives (Bennett 2010, p.95). From the validity checks done during the interview process, it appeared that the data were highly reliable for measuring the experiences that finance managers gain while assessing corporate performance based on capital structure and dividend policy.

The reliability of regression/correlation as an appropriate tool for qualitative analysis can be tested by inserting test data and comparing them to the presentations made concerning the attributes to the corresponding cases (Liu & Wang 2010, p.68). With such tests, it becomes clear that the system is accurate in the presentation, and if manipulated, can weed out values that should not be presented in charts and graphs.

Trustworthiness

The concept of “trustworthiness” is included to demonstrate the way in which the researcher claims that the work is plausible or credible (Reilly & Brown 2007, p.127). In order to ensure credibility of the data, member checks, peer review, and external audit should be performed.

Researchers’ checks and process permit the respondents to check that the language used by the researcher represents what they reported. Throughout the data collection process, it is advisable to periodically send interview transcripts to participants to verify the accuracy of the document. In addition, peer reviews were conducted to aid with verification of confirming and/or disconfirming themes in the data collection process. For the peer review process, experts in quantitative research from the University can be invited. This was essential to help verify the emerging themes in the data record and for the quality of the study. Finally, an external auditor could review the entire project during the analysis phases in order to provide an objective assessment of the project (Elton, Gruber & Brown 2006, p.47). The external auditor for this study can be the student’s dissertation supervisor. All these procedures helped in ensuring the reliability and trustworthiness of the study.

Assumptions

The most salient assumption was that all participants in this study cooperated fully and honestly when offering information. Regarding the information gleaned from unstructured questions (e.g., the last interview question that requires additional information from the respondent), such assumptions were later being checked against the data to ensure maximum consistency between the numbers presented and the representation of the analysis through graphs and other tools (Marshall 2010, p.123).

Data description

The financial data used for this study were gathered from ‘Orbis’, and a sample of 258 companies was drawn and exported to an excel spread sheet. This represented 10% of the 2585 China’s publicly listed companies. The data included total assets, cash dividend paid, gearing ratio, price earning ratio, earning yield ratio, cash/cash equivalent, return on assets (ROA), return on equity (ROE), and solvency ratio. In this regard, the data on the sampled 258 China’s publicly listed companies were used in the analysis.

This is carried out to break up and locate subsets, which are linked to the main data set. For instance, properties/elements of price earning ratio can be traced from the cash dividend paid. Such groups/data sub-sets help in calculating the relationship between two financial variables (Dobbs, Huyett & Koller 2009, p.39).

For sufficiency to be attained in the financial analysis of the companies, the evaluator must establish the capability of the firms to pay their debt. The creditors and suppliers are significantly concerned with the debt-paying ability of the companies under consideration. As such, the short-term creditors of the companies will be concerned with the following gearing ratios in their bid to establish the firms’ past and current debt-paying abilities (Dobbs, Huyett & Koller 2009, p.52).

Correlation analysis

Correlation analysis is presented in the appendix 1. Financial data for 258 China’s publicly listed companies have been used in the analysis. As represented by the correlation analysis (shown) there was some level of relationship between the price earning ratio and cash dividend paid by these companies.

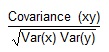

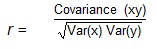

The correlation co-efficient (r) is a clear indicator of both strength and direction between the price earning ratio and the cash dividends paid. In the analysis of these two statistical variables, the cash dividend paid is the dependent variable (y). On the other hand, the price earning ratio has been assumed as the independent variable (x). The outcome of the financial data analysis indicated a 0.4% positive correlation co-efficient. Therefore, a 0.16% co-efficient of determination (r) could be derived from the analysis. Based on the analysis, it is possible to conclude that 0.16% of the changes in the cash divided paid by the 258 China’s publicly listed companies can be elucidated by the changing trends in the price earning levels. Therefore, 99.84% moving trends in the cash dividend paid can be elucidated by errors/factors, which are not analysed in the study.

Moreover, correlation analysis can be performed to determine the relationship between the cash dividend paid and the cash/cash equivalent at the end of last year. The data on the cash and cash equivalent ratios have been provided in the appendix 4. Therefore, the following results can be obtained from the correlation analysis/report.

Xi = Cash and cash equivalent at the end of the year.

Yi = Cash dividend paid

N =258

Note: See detailed excel workings (attached)

Even though, there was a linear relationship between the cash/cash equivalent and cash dividend paid, the correlation showed a negative relationship. This implies that the companies did not use the cash and cash equivalent balances to settle cash dividend, but they paid their shareholders from revenue earnings reserves (Firzli 2011, p.64).

Regression results

A regression analysis was conducted on the financial statement data for the 258 China’s publicly listed companies to ascertain the relationship between the gearing ratio and cash dividend paid (see appendix 2).

See the excel workings for detailed calculations.

Regression analysis helped in deriving a linear association that existed between the gearing ratio and the cash dividend paid. In this regard, the equation derived as Yi = 0+-1,752.36xi + e (see appendix 2). This shows that if the cash gearing ratio is zero, then the cash dividend paid will be nil (Gardener 2011, p.254). This implies that an increase in the gearing level means that the cash dividend paid increases proportionately. In the regression model, an error factor (e) has been included.

Given that every shareholder seeks to put his/her funds into an organisation that will in turn invest the funds in various assets aimed at generation of sales and profits, the better the companies manage these assets, the higher and larger the size and amount of sales the assets will generate and the more satisfied the investor will be. Therefore, many investors employ the use of efficiency ratios to determine the level of efficiency within the organisation and how the organisation manages their assets (Kuwamori & Kuroiwa 2011, p.18). For China’s publicly listed companies, the efficiency ratios are relevant for the above evaluation. In this regard, the return on assets (ROA) for these companies stood at an average of 6.12% during the last financial year. Even though the ratio is significantly low, it is necessary to realise that it is positive to conclude the companies’ managements are efficient in managing the financial performance of these firms (Pang & Lui 2011, p.34).

Simple linear regression analysis can also be employed in deriving the relationship between the cash/cash equivalent and the amount of cash dividend paid by the companies.

Xi = Cash and cash equivalent at the end of the year.

Yi = Cash dividend paid

Sample size (n) =258

Generally, sample regression equation is given by, Yi(hat) = bo + b1Xi

Ordinary Least Square helps in getting bo and b1.

Therefore, bo = 0

Therefore, b1 = -193.23

yi (hat) = 0+-193.23xi

The above regression analysis equation can be used to derive the relationship between the cash/cash equivalent and cash dividend paid.

01.61% of the change in Cash dividend paid (Yi) can be explained by the change in the two independent variables. Adjusted for Sample Size bias to +/- on result of Regression Equation. Therefore, analysis is NOT significant.

Further analysis

Based on appendix 3, the other analysis performed on the data revealed a negative correlation between the earning yield ratio and the cash dividend paid. A low correlation of determination (r²) of 0.068% was established. This is a clear indication of a low relationship between the two variables (Lyandres & Zhdanov 2007, p.37). The co-efficient of determination (r²) of 0.068% reveals that 0.00068 of the movement trends in the cash dividend paid may be elucidated by the changes in the earnings yield.

Moreover, solvency ratios/liquidity ratios are current ratio and quick ratio. These two ratios are regarded as the short term solvency ratios. Current ratio is calculated as a ratio of total current assets to current liabilities.

It is evident from the data report that there are sufficient ratios for China’s publicly listed companies, because they are greater than1.Quick ratio enables these companies to rely on their most liquid assets to meet their operational costs and as such to deduct the effects of inventories, which are more liquid current assets. The ratios can be interpreted to mean that in the last year, China’s publicly listed companies had at least 0.314 to service their $1 current liability.

Generally, the equity ratios for China’s publicly listed companies portray a very stable financial situation for these firms since the current liabilities can be readily offset by the current liability and so do not require more external sources of finances. Together with the aspect of returns on the assets, the shareholders of these companies should not have concerns if the following better and improving circumstances are maintained. This implies that the companies are generating enough returns from the investments. Therefore, the shareholders are assured of security in their investment while the managements do not have to explore, with urgency, funding options since the companies have proven to be self-sustaining as indicated by the liquidity ratios. Therefore, the financial model of China’s publicly listed companies is a more secure one, which does not cause lots of uncertainty.

The other important ratios are the debt management ratios also known as the long term solvency ratios and include debt ratio, debt equity ratio and the equity multiplier. The ratios help these firms to gauge the returns from borrowed sources and help them manage their financial sources without burden. The data on the solvency ratios have an approximate average of 0.314 or 31.4%, which is interpreted to mean that, despite the companies acquiring more funding in terms of debt, the returns due to such funding are not totally hundred percent, but are lucrative for the businesses. The capital borrowed almost gave a return of about 19.21 percent (0.1921) during the past year investment period, as evidenced from the average return on equity ratio for these 258 China’s publicly listed companies. Therefore, such investments are worth taking the investment risks.

If there were to occur the unimaginable position for China’s publicly listed companies. to opt for insolvency, it is true that the shareholders equity in the business will be able to offset the company’s debt by up to five times which is a very sufficient position for the firm and the shareholders are assured of the limited nature of their investment into the companies (Song 2012, p. 57).

The figures for the debt management ratios for China’s publicly listed companies outline the firms’ financial position. The debts of the companies are slightly more than the shareholders equity into the firms. Therefore, it can be ascertained that the shareholders are in a position where they contribute effectively in offsetting the company debts although the debts can be settled from profits as indicated by the profitability ratios, especially when the ratio is approaching one.

China’s publicly listed companies are growing firms. For example, when a growth rate of an average of 6 times had been attained from the last year performance, this meant that these companies managed to acquire assets, which are approximately six times the shareholders equity. This shows that there is an aspect of growth in investment. At this average growth rate, it is only in order to use forecasting to determine what to expect of it in the future stability, profitability and sustainable growth.

At a glance it can be realised that the debt management ratios for China’s publicly listed companies provide a clear position of the firms and suggest that the corporations have maintained a relatively fair balance between their borrowing and the corresponding rates of return to that effect since the ratios are very sufficient and portray it as businesses that will be able to survive within the market. China’s publicly listed companies are able to service their current liabilities from the current debts, and this assures a financial security to the shareholders (Zhu & Wan 2012, p.86). Based on the profitability of the company within the trading periods analysed, the shareholders are assured of dividend allocation, which according to the capital base of the company is really easy to declare. In addition, the shareholders will be able to focus the financial future of the companies making them to increase their stakes in the firms. Based on such financial stability and security, China’s publicly listed companies can be regarded as to be dominant in the Chinese market (Zou & Lui 2011, p.52). Much of this can only be attributed to the management which they have achieved by ensuring quality production, sufficiency where enough machinery are built to meet the ever increasing customer demands in terms of quality and the numbers as well as extensive marketing, research and development programmes in order to acquire and maintain new markets (Zhan & Zhan 2012, p.84).

Empirical result

It is evident from the observed report that the financial statement data analysis of 258 China’s publicly listed companies indicates significant rising gearing ratio from year 1 to 9. For instance, the gearing ratio of China Petroleum & Chemical Corporation increased from 81.04% in year 8 to 87.54% in year 9. It can be argued that the increasing gearing ratio is as a result of bonds issued (Bebbington, Gray & Laughlin 2001, p.102). It could be possible that last year the companies issued 5 bonds at P60 each. It is possible that 3 of these bonds will be redeemed in year 9, while the remaining 2 are to be redeemed in year 7. Therefore, the gearing ratio jumped from 69.56% in year 1 to 80.61% in year 2.

Coupled with the gearing ratio, the financial position of any organisation, one has to establish the liquidity position of the firm. This involves the use of liquidity ratios. Liquidity ratios enable the companies to measure their ability to sufficiently meet the current obligations by establishing a relationship between cash and other current assets to current obligations. In this regard, liquidity ratios provide reliably quick measure of the companies’ liquidity.

Conclusion

The financial data analysis reveals that the sampled 258 China’s publicy listed companies are better capitalised. This is well supported by the companies’ gearing ratio. Therefore, it is evident that returns on asset (ROA) ratios of the 258 China’s publicly listed companies are better financial indicators of their capital structure. Moreover, the financial indicators showed that these companies paid cash dividends to their shareholders. As a result, a relationship between price earning ratio and cash dividend paid was established from the analysis. This implies that the companies set aside some cash dividend amounts to pay to the investors.

The financial analysis also revealed that there was a positive correlation between the companies’ gearing ratio and the amount of cash dividend paid. The same argument is applicable to the relationship established between the price earning ratio and the cash dividend paid. Even though there had been a positive association between the two variables, the correlation was not a strong one.

On the contrary, the result was different when the correlation between the yield earning ratio and cash dividend paid was analysed. It was established from the findings that a weak negative correlation existed between the two variables.

In view of the above financial data analysis and summary, it is evident that these companies enjoy a strong base of stockholder’s equity over the other elements of their financials. It can be argued that stockholder’s equity constitutes over 100 percent of all the current assets and liabilities. This is a clear indicator of the companies’ with a strong capital base. As such, the current as well as the prospective investors will find additional incentives into placing their financial stakes into the companies. Moreover, the liquidity ratios justify the possibility of any investor putting their monies with these companies. Solvency/current ratios are indicators of the fact that the liquidity of Air Arabia is sufficient. This implies that the companies are significantly capable of sufficiently settling its current liabilities using the current assets. Moreover, solvency/quick ratios also point to the companies’ liquid sufficiency in settling their current liabilities once they fall due without having to sell the current inventory. However, the efficiency ratios together with the profitability ratios reveal a significant need to improve the operational efficiency of the companies’ operations in order to achieve higher percentages of both the gross and the net profit margins.

Focusing on the above research discrepancy it is advisable for the study to use a larger sample size that is more representative, which will help in improving the study.

China’s publicly listed companies are stable and influential players across the regional presence. These companies have several available avenues to ensure that the shareholders’ value improves. By appling simple risk assessment tools, the groups have also established that the companies pride of a very stable financial foundation and a sufficient liquid assets that makes it easier for the firms to operate efficiently. In addition, the companies have substantially relevant divident policy frameworks that ensure that the shareholders receive their share of the gains when realised. The analysed companies’ financial ratios are stable and this corroborates the earlier stand that the firms are healthy in terms of financial position and the related operational capacities.

Following the fact that China’s publicly listed companies’ financial positions are purely inclined on strong capital base at the expense of substantive profit growth that accrue from an operational excellence strategies. This implies that these companies should consider capital restructuring that involves striking a balance between debt and equity so as to achieve higher levels of profitability. In addition, the companies’ financial teams should formulate strategic and managerial competency that are aimed at improving the operational efficiency. This will ensure that these companies achieve growing rates on both the gross and the net profit margins. The increasing profit growth will work to ensure that the companies achieve proficient operational capacity that is pegged on strong technical and technological base. This implies that the companies should significantly invest in technical advancements of the working teams to ensure improved efficiencies of the organisational operations.

Appendix 1 (see excel spread sheet for detailed calculations)

Appendix 2 (see excel attachment for detailed calculations)

Appendix 3

Appendix 4: Data on Cash and Cash equivalent at the end of the last year

References

Abusabha, R., & Woelfel, M. (2003). “Qualitative vs. quantitative methods: Two opposites that make a perfect match”, Journal of the American Dietetic Association, vol.103 no.5, pp.566-569.

Baker, M & Jeffrey, W 2002, “Market Timing and Capital Structure”. Journal of Finance, vol. 57 no.1, pp. 1–32.

Bebbington, J, Gray, R & Laughlin, R 2001, Financial accounting: Practice and principles, Thomson Learning, New York.

Bennett, G 2010, Accounting Principles and Practice, BiblioBazaar, Charleston.

Bodie, Z, Kane, A, & Marcus, A 2008, Investments, McGraw-Hill Irwin, New York.

Brealey, A & Myers, C 2008, Corporate finance: capital investment and valuation, McGraw-Hill Publishers, Washington DC.

Das, S, Markowitz, H, & Scheid, J 2010, “Portfolio Optimization with Mental Accounts”, Journal of Financial and Quantitative Analysis, vol. 45 no.1, pp. 311-334.

Davies, M. (2007). Doing a Successful Research Project: Using Qualitative or Quantitative Methods, Palgrave Macmillan, New York.

Dobbs, R, Huyett, B & Koller, T 2009, The CEO’s guide to corporate finance, Havard University Press, NewYork.

Elton, E, Gruber, M, & Brown, S 2006, Modern Portfolio Theory and Investment Analysis, John Wiley, New York.

Fama, E 1970, “Efficient capital markets: A review of theory and empirical work”, Journal of Finance, vol. 25 no.2, pp. 383-417.

Firzli, N 2011, “Forecasting the future: The BRICs and the China Model”, USAK Research Journal, vol. 2 no 1, 60-74.

Gardener, M 2011, Data Collection, Exploration, Analysis and Presentation, Pelagic Publishing, London.

Glautier, M, Underdown, B, & Morris, D 2010, Accounting: Theory and practice, Prentice Hall, New York.

Gustavo, G, Michaely, R & Swaminathan, B 2002, “Are Dividend Changes a Sign of Firm Maturity?” The Journal of Business, Vol. 75 no. 3, pp. 387-424

Kuwamori, H & Kuroiwa, I 2011, “Impact of the US Economic Crisis on East Asian Economies: Production Networks and Triangular Trade through Chinese Mainland”, China & World Economy, vol. 19, no 6, 1–18.

Levich, M 2001, International Financial Market, McGraw-Hill, New York.

Libby, R & Short, D 2005, Financial accounting, McGraw Hill, Sydney.

Liu, Z & Wang, J 2010, “Value, Growth, and Style Rotation strategies in the long- run. Journal of Financial Service Professional”, vol. 4 no. 1, pp. 67-90.

Lyandres, E & Zhdanov A 2007, Investment Opportunities and Bankruptcy Prediction, Harcourt College Publishers, Fort Worth.

Markowitz, H 1952, “Portfolio Selection”, Journal of Finance, vol.7 no.1, pp. 77-91.

Marshall, P 2010, A complete guide to the principles and practice of business accounting, How Books Publishers, London.

Myers, S & Majluf S 1984, “Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have”. Journal of Financial Economics, vol.13 no. 2, pp.187–221.

Oster, S 1994, Modern Competitive Analysis, Oxford University Press, Oxford.

Pandey, I 2008, Financial management, Vikas Publishing House PVT Limited, India.

Pang, C & Lui, J 2011, “Evidence on the Effects of Money Growth on Inflation with Regime Switching”, China & World Economy , Vol. 19, no 6, 19–36.

Peteraf, M 1993, “The Cornerstone of Competitive Advantage: A Resource-Based View”, Strategic Management Journal, vol.14 no.1, pp.179-191.

Porter, M 1980, Competitive Strategy: Techniques for Analyzing Industries and Competitors, The Free Press, London.

Porter, M 1990, The Competitive Advantage of Nations, MacMillan Press, London.

Reilly, K, & Brown, C 2007, Investment Analysis and Portfolio Management, Southwestern Thomson, New York.

Sercu, P, & Uppal, R 1995, International Financial Markets and the Firm, Southwestern, New York.

Solnik, B 2000, International Investments, Longman Publishers, New York.

Song, Y 2012, “Poverty Reduction in China: The Contribution of Popularizing Primary Education” China & World Economy, vol. 20 no 1, 105-122.

Sunder, L & Myers S 1999, “Testing Static Tradeoff Against Pecking Order Models of Capital Structure,” Journal of Financial Economics, pp. 219-244.

Thompson, R & Westerfield C 2004, Fundamentals of Corporate Finance, McGraw-Hill: London.

Timmer, J 2011, Understanding the Fed Model, Capital Structure, and then Some, Harcourt College Publishers, Fort Worth.

Weygandt, J 2008, Accounting principles, John Wiley & Sons, New York.

Wittner, P 2003, The European Generics Outlook: A Country-by-Country Analysis of Developing Market Opportunities and Revenue Defence Strategies, Data-monitor Publishers, London.

Xiaowen, T 2001, Managing international business in China, Cambridge University, Cambridge

Zhan, J & Zhan, Y 2012, “Foreign Value-added in China’s Manufactured Exports: Implications for China’s Trade Imbalance”, China & World Economy, vol. 20 no 1, 27-48.

Zhu, C & Wan, G 2012, “Rising Inequality in China and the Move to a Balanced Economy”, China & World Economy, vol. 20 no 1, 83-104.

Zou, W & Lui, Y 2011, “Rural–urban Migration and Dynamics of Income Distribution in China: A Non–parametric Approach”, China & World Economy, Vol. 19, no 6, 37–55.