People’s Republic of China (PRC) has increased government spending exponentially on areas such as up-gradation of the internet infrastructure, new rail line construction, housing schemes, etc. to launch the government’s pro-growth and reform measures (Chang par. 2). The government introduced an increase of 29 percent of fiscal spending as compared to 2014 accounts (Sweeney par. 1). The increase in government spending has spread evenly across various sectors. For instance, there has been an increase of expenditure in 2015 compared to 2014 towards energy conservation and clean technology by 22.7 percent, social security by 21.7 percent, and employment spending by 15.8 percent (Scutt par. 4). The reason for such an exponential increase in government spending is to boost economic growth and achieve 7 percent growth that has been predicted to be a difficult target to achieve, given the evident signs of economic slowdown (Scutt par. 8).

Therefore, this increase in expenditure is observed as China’s strategic move towards fundamental reconstruction while others believe that increase in government spending was a countermeasure to compensate for the huge public debt accumulated due to the inefficient use of capitalism during the reign of Premier Wen Jiabao in 2008 (Chang par. 7). Given this increase in government spending, it will not only have an impact on the internal socio-economic structure but also on the international economy and socio-political structure. This paper analyses the effect of this increase in government spending by China in the US. The paper first looks into the different sectors where the Chinese government has increased it’s spending to the greatest extent and how the increase in Chinese government spending affect the US economy, business, and political relations. The paper will first analyze the areas where China has increased its government spending and why. Further, the paper will then see how these changes in the public spending of china affect the United States of America and why.

Increase in Chinese Government Spending

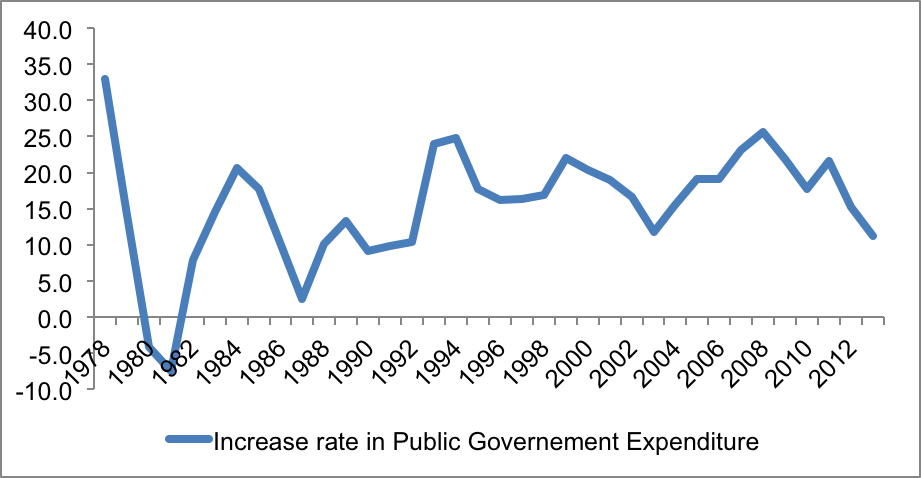

A glance into the historical increase rate of public government expenditure of China since the late seventies demonstrates that the highest increase in Chinese government expenditure was made in 1978 when the rate increased by 33 percent (National Bureau of Statistics of China). After 1978, the highest increase in government spending occurred in 2008 by 25.7% and then again in 2015.

In 2014, the annual data presented by the National Bureau of Statistics China on government expenditures showed the main items in government expenditure are presented in the table below. The table shows that the maximum share of the total expenditure of the Chinese government went towards education than to social safety net and employment effort in 2013 (National Bureau of Statistics of China). The major increase in the government expenditure has been in education and social development sector. Therefore, the aim of the government is to provide a stimulus to economic growth the benefits of which are expected to trickle down as social reforms.

Table 1: Main Items of Public Government Expenditure for Chinese government for 2013, Source: National Bureau of Statistics of China

The possible aim of the Chinese government is to increase fiscal stimulus to boost both short-term growth and reduce the impact of the rising deflation (Sweeney par. 6). In 2015, China has allotted 15.8 percent of its spending on education, 22.7 percent on energy conversion, 21.7 percent on social security and employment, and 19.5 percent on healthcare (Sweeney par. 8). Clearly, Chinese spending has shifted its focus from education in 2013 to energy conversion, social security and employment, and healthcare.

Comparison of Chinese and US Government Spending

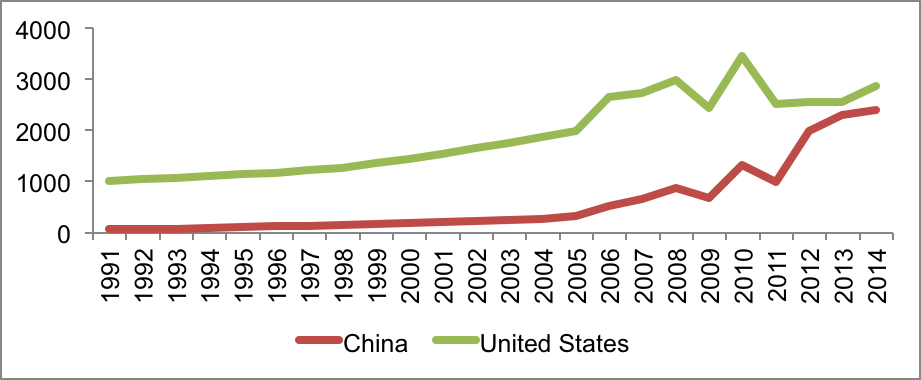

A comparison with the total expenditures of US and China shown in figure 2 demonstrates that China’s government spending over the years has increased considerably, coming closer to the US government spending. The major sectors where US government spending is diverted are healthcare, pension, defense, welfare, and interest payment. However, the lion’s share of Chinese government spending went to education and social welfare, which has now been diverted to social security and employment, energy conversion, healthcare, and education. Clearly, there is a considerable difference in the government-spending pattern in both the countries.

Impact of Chinese Government Spending on US

Private consumption in china has undergone a steady decline. Historically, private consumption has been low in China due to higher inclination towards saving, primarily by precautionary instincts of the larger Chinese populace (Fardoust, Lin and Luo par. 10). The reason behind higher savings is underdeveloped government healthcare support, education, and pensions systems that induce individuals to share a larger part of the cost in these areas. Thus, one obvious way to boost consumption is to reduce the precautionary savings that will automatically boost growth. Therefore, higher government spending on social security and employment, education, and healthcare will reduce precautionary savings and hence, increase private consumption and therefore, growth.

On the other hand, US economy has undergone a severe damage due to the economic slowdown in 2008. However, China has remained unscathed from the global recession as its financial system is not exposed to the global economic vagaries and its growth is driven by domestic activities (Altman 2). China has a reserve of $2 trillion making it the strongest country in terms of liquidity (Altman 2). Thus, if China maintains its projected growth of 7 percent through fiscal stimulus, it will solidify its economic position and gain strategic advantage over US when the latter struggles to recover from economic slowdown. Due to China’s strong financial position, it can invest in key natural resources and other technological investments, as it has already done by increasing its spending on energy conversion, putting US in a strategically disadvantageous position. The current trends in Chinese government spending indicate a greater move towards fiscal decentralization and stimulus towards economic growth. This fiscal spending strategy will definitely boost the economic growth of China when the US economy tries to recover from economic slowdown due to the massive crash of tis financial market. Presently, the US economy is in no position to respond to fiscal or monetary stimulus, therefore, making it even more difficult for the country to recover from recession.

Employment boost is an essential area that Chinese government has diverted its attention. Increase in employment will increase better social and living condition and higher consumption expenditure. This will increase growth possibilities. On the other hand, higher unemployment will induce greater pressure on government liability and reduce government revenue. Therefore, boosting employment will help increase government revenue, national production, and private consumption that will directly help in increasing growth.

China has always followed a fiscal stimulus package to drive growth. The Keynesian growth model shows that China has experienced a larger multiplier effect of fiscal stimulus, which is due to two basic reasons: (a) higher marginal effect of government spending and (b) higher marginal effect of local government spending on national output (Fardoust et al. par. 11). The reason for such high marginal effect of fiscal stimulus on China’s growth is due to the investment-centered program of growth. The main reasons for the higher growth are greater investment on infrastructure, environment, technology innovation, and transportation. Further, the high marginal effect of local government spending is high in China because the difference in the nature of the political system in the country, which is largely different from the federal political system of US. Further fiscal decentralization in China has helped in fiscal stimulus induced growth. Therefore, the current increase in fiscal expenditure, with the intention to boost growth, may become successful in China because the political system of China supports such growth.

Works Cited

Altman, Roger C. “The Great Crash, 2008.” Foreign Affairs (2009): 2-14. Print.

Chang, Gordon C. Did China Just Launch World’s Biggest Spending Plan? 2015. Web.

China Government Spending. 2015. Web.

Fardoust, Shahrokh, Justin Y. Lin and Xubei Luo. “Demystifying China’s fiscal stimulus.” 2012. World Bank policy research. Web.

Government expenditure (Total) – Comparison between China and United States. 2014. Web.

National Bureau of Statistics of China. Public Government Revenue and Expenditure and Their Increase Rates. 2014. Web.

—. Main Items of Public Government Expenditure of Central and Local Governments (2013). 2014. Web.

Scutt, David. The increase in Chinese government spending is mind-blowing. 2015. Web.

Sweeney, Pete. REFILE-UPDATE 2-China steps on the gas to spark economy, Aug fiscal spending jumps 26 pct. 2015. Web.