Description of the Issue

Economic development is the process of accumulation of economic wealth in countries, states, or regions, which is tickled down on the well being of the individuals of the society. From the point of view of public administration, economic development may be defined as the policies and plans undertaken to improve the financial well being of the people of the locality by increasing income and creating jobs.

Why this issue

In the USA, public sector, federal or local, has been engaged in economic development activities. Today, the local governments are so ingrained in the developmental activities it is difficult to imagine any local developmental sector without government participation. The main units of the local governments that are engaged in local economic development are county, city, and state governments.

The aim of the paper is to understand the role of the local and/or regional governments in the process of economic development of the region. This paper will deal with the economic development and the various aspects of economic development that may lead to revenue increase. It will provide an economic explanation of the process and then relate it to the economic conditions of the states and local governments of the USA.

The first step will be to familiarize with a few definitions related to economic development literature. The first definition is that of ‘local government’. The term local government means the smallest level of governing body, which usually is the municipal body of city, town, or county. The definition of local government is less concerned with the political definition of local government and more concerned with the economic definition, which is established through the roles of the government bodies.

Background of Regional/Local Economic Development

The theory on economic development has been based on the substantial attention on the economic growth. For instance, Robert Solow and Edward Denison model has been based on the economic growth of the economy rather than economic development (Lucas Jr, 1988). The early theories of economic development concentrated mostly on understand the accountings of economic growth rather than the core issues of economic development.

However, with the change in the perspectives of the economists in the understanding and treatment of economic development, the new models of economic development emerged (Lucas Jr, 1988). The present day local economic development literature is mostly swarmed with the firm-centered, incentive-based, state-driven Keynesian model based regional developmental programs (Amin, 1999). However, recently, local governing bodies have started to adopt innovative policies to explore the possibilities of development in local areas.

With globalization, the importance of the local actors has increased considerably and their importance as formulators of local economic development has become immense (Ascani, Crescenzi, & Iammarino, 2012). This can be observed mostly in urban areas where the industrial work has been concentrated and thus these areas have become the loci of growth and development.

Due to industrialization in urban areas, improvement in communication, it helps in the Marshallian concept of agglomeration and diffusion of ideas (Ascani et al. 2012). The more recent steps towards economic development by local economies are more complex policies such as shifting the local governments’ dependence on federal state and relying more on their own resources, adopting higher risk-taking policies, and adoptions o a divergent policies that emphasize on indigenous growth (Clarke & Gaile, 1992).

The main centration of the local government has been increasing local area revenue and creating jobs for the local people in the area, and increasing other lifestyle improving facilities to the locality.

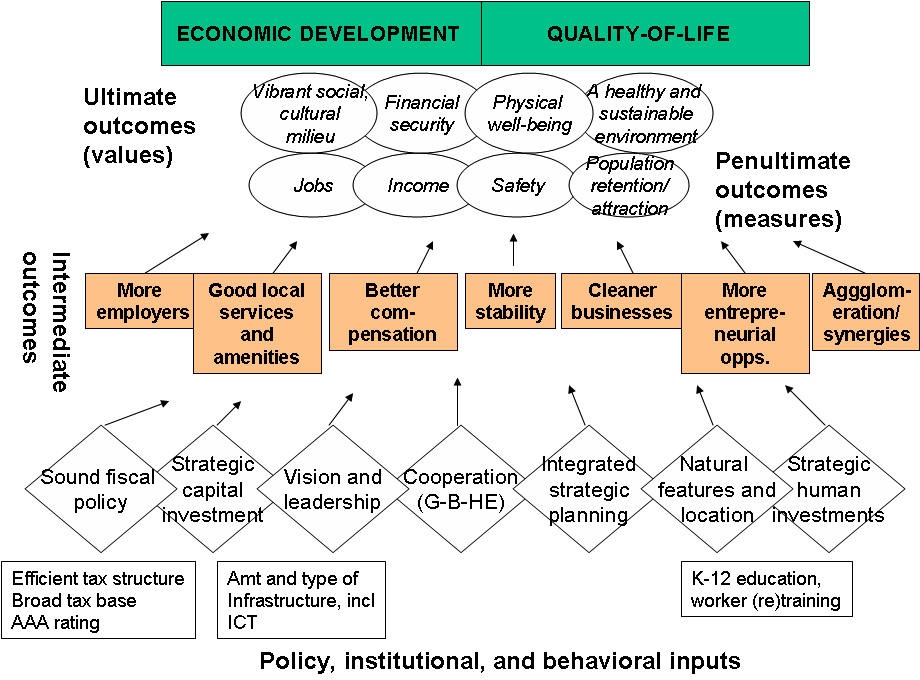

The developmental activity that local actors aim to provide to the community is demonstrated in the picture presented in figure 1 above (Luger, 2007). The pictorial depiction demonstrates the primary initiatives by the local bodies and their intermediate and ultimate outcomes. Here the aim of the local governments is two-fold: first is to achieve better quality of life and the other is the process by which it can be achieved which are providing more jobs, creating income opportunities for citizens, etc.

Is the issue a regional, city, or state problem?

In the USA, federal involvement in developmental activity has been high with federal involvement in infrastructure building projects such as transportation, railways, roadways, airports, etc. these have had a great impact on the regional and local development. However, once these developmental activities were over, the development required more localized attention, catering to the community requirements in towns and cities. The importance of advancement of communication primed the chart of economic development (Luger, 2007).

One of the main areas where the local governments have concentrated their attention is in alleviation of poverty. Lugar (2007) points out to the various local body initiatives in the USA:

Many New Deal programs were directed where unemployment was highest or where infrastructure needs were greatest, for example the Works Projects Administration (WPA), Tennessee Valley Authority (TVA), the Appalachian Regional Commission (ARC), and Rural Electrification Administration (REA) were targeted to laggard regions. (p. 5)

However, it should be noted that the initial regional development programs were mostly federal funded programs, which were directed towards local areas. However, the local economic activity has become the pet of the local governments. The aim of the local governments has been mostly to improve industries, provide tax incentives and increasing employment in the local areas. The local governments have developed groups and committees for economic development in local level such as NGOs, education sector, banks, state legislatures, etc.

Another local initiative has been tax incentives given by local bodies for the growth of the local economy. The incentive is usually given to business taxes. Lugor (2007) points out that in the state business taxes are substantial in amount:

… in California, the estimated loss of revenue from business tax incentives was approximately $15 billion in 2001-2002. New York forewent approximately $2 billion in 2002. And North Carolina spent some $74 million on business tax incentive programs in 1997-1999. (p. 7).

Further, other estimates in tax subsidies given by local governments show that the local corporate subsidy in the US has been as high as $48.8 billion in 1997-99 (Luger, 2007).

Current Policies

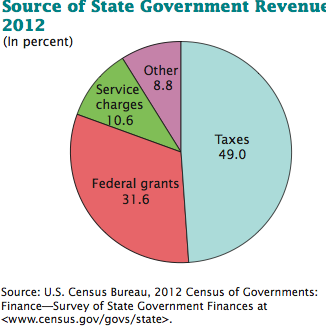

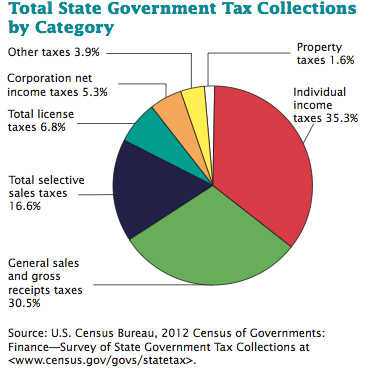

The sources of revenue for the state and local governments and the segregation of the weightage of each source are presented in the pie chart below (figure 2) (Lee, Willhide, & Pome, 2014). Figure 3 demonstrates the division of the taxes collected by the state government.

The US census bureau data shows that there is nine states where tax collection has increased more than 10 percent for 2012 financial year (O’Sullivan et al. 2013). The largest increase in the state tax has been accounted by North Dakota, which has demonstrated an increase in tax by 47 percent in 2012 from previous year.

A report on the state and local government finances presented by the US government census bureau demonstrates that the (Barnett & Vidal, 2013). Revenue and expenditure are first discussed. According to the report, revenues of state and local bodies increased by 8.4 percent from 2010 to 2011. The maximum revenue for the local and state government was derived through taxes that comprised of 51.2 percent of the revenue in 2011 (Barnett & Vidal, 2013).

Desired Policy

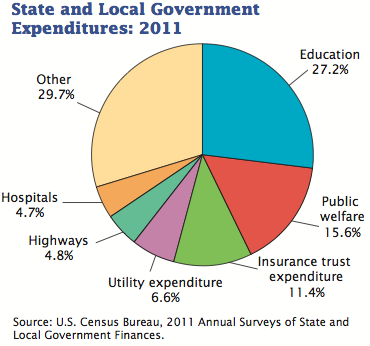

The expenditures of the government of the state and local level included that on education and public welfare (42.8 percent) and accounting comprised of 27.2 percent (Barnett & Vidal, 2013). The expectation of the states and local governments can be to increase this further in future. Another developmental aspect may be the increase in the cash and security holding of the state and local governments.

From the statement, it can be deduced that the increase in revenue there has been induced increased public expenditure and primarily on developmental activities like education, public welfare, infrastructure expenditure etc. (see figure 4). The nature of public welfare activities demonstrate the state and local government’s initiative to invest more on developmental activities in local areas:

Public welfare and education were the largest expenditures for state governments in 2011 at $439.3 billion and $261.9 billion, respectively. Public welfare includes support of and assistance to needy persons and the administration of such assistance. Vendor payments comprised the largest source of state public welfare spending at $378.9 billion, or 86.2 percent of the total. (Barnett & Vidal, 2013, p. 4)

Cost to Finance Desired Policy

The cost that the local governments have to incur to increase their developmental work is high for they have to revamp their expenditure on public finance largely. Further tax initiatives would also reduce net revenue earned by the state, which will be added as cost.

Future Trends relative to Economic Development

Many of the states provide tax incentives to the industries in order to increase revenue as well as employment in the state. For instance, Texas has increased its exemption for manufacturing by $11.7 billion in form of sales tax refunds, and other sales taxes in 2013 in order to increase manufacturing. Similarly, in the agricultural sector, the state has given tax incentives by $2.79 billion in 2013.

Recommendations

With increase in revenue, the local bodies have undertaken the task to develop their area with the primary aim of increasing employment, income, and revenue of the area. One of the strategies adopted is increase in industry and business in order to increase employment and therefore individual income of the area.

For this, the governments have started providing tax incentives to industries. Further other developmental expenditures such as that on education, health and infrastructure development has also been undertaken by the local bodies in order to develop their local areas.

Conclusion

The study of the economic developmental activities of state governments demonstrate that the main developmental impetus has shifted from the federal to the state and local bodies who have taken up the task to develop their local bodies.

Further, a trend towards lesser dependency on the federal fund has been observed, as revenue earned by state and local bodies has become mostly that from state and local body taxes.

References

Amin, A. (1999). An institutionalist perspective on regional economic development. International Journal of Urban and Regional Research, 23 (2), 365-378.

Ascani, A., Crescenzi, R., & Iammarino, S. (2012). Regional Economic Development: A Review. Regional Economic Development: A Review , 1-27.

Barnett, J. L., & Vidal, P. M. (2013). State and Local Government Finances Summary: 2011. Web.

Clarke, S. E., & Gaile, G. E. (1992). The Next Wave: Postfederal Local Economic Development Strategies. Economic Development Quarterly, 6(2) , 187-198.

Lee, C. H., Willhide, R. J., & Pome, E. (2014). State Government Finances Summary Report: 2012. Web.

Lucas Jr, R. E. (1988). On the mechanics of economic development. Journal of monetary economics, 22(1) , 3-42.

Luger, M. I. (2007). The Role of Local Government in Contemporary Economic Development. Web.

O’Sullivan, S., Lumibao, L., Pustejovsky, R., Hill, T., & Willhide, J. (2013). State Government Tax Collections Summary Report: 2012. Web.