Executive Summary

Issue of shares through IPO involves Offer by prospectus that is shares are offered to the public at a fixed price to subscribe. The prospectus gives information relating to the company performance for present and prospective performance in future. The other methods of issuing shares to the public are placing where shares are given to specific institutions to sell or buy them. If the members of the public wishes to own shares of the public they will be purchased from those institutions.

Offer for sale, is an invitation of the public to apply for the shares of the company, based on the information contained in the prospectus. There is another source of raising equity capital for companies not listed in any stock exchange called private negotiations. Private negotiations is for those companies that are not quoted, but they are rich or well performing companies therefore venture capitalist moves in to buy those shares of that company when the company requires that money.

This process operates under a management system approach in service provision, which begins with the definition of the particular characteristics of the process that has an embedded value in the actual delivery of service, as well as employing certain metrics, management tools, and strategy selection for interdisciplinary collaboration. This service and the process utilized to manage it has been widely critiqued both for poor service quality in the past which might be attributable to overcrowding or under-staffing, as well as admirable demonstration of massive improvements within a short period of time, making this process a dynamic and engaging topic for examination in this particular project. The IPO’s ongoing service process provides challenges, which can be identified and benchmarked against improved models and therefore highlight the processes’ potential for process improvement.

The quality of services increases customer satisfaction, which is of primary importance in IPO processes that entails relational activities where optimization of individual functions takes dominance. As such, the value of process management in an IPO process cannot be stressed enough in how numerous salient elements of the multiple interdisciplinary services must connect successfully to bring on an effective system that provides a positive impact on customer satisfaction. The dynamic improvement of quality of services will further bring on realignment and improvement, if instituted and managed well with proper control measures to bring on an effective operation of the redesigned system.

Case Introduction

IPO Summary

Coca Cola fortunes remain strong and the 200-2009 economic crisis created a turnaround in the franchise’s profitability. However, the franchise has remained relatively profitable, Coca Cola’s interest in buyout small with fortune in the debt market. Coca Cola considered floating its shares indicatively at between $8 and $10 per share. It listed on 2009 for the IPO and targeted a market capitalization of between $6 and $ Coca Cola 8 billion.

Coca Cola continues to be so even after the former floated its shares in an IPO in November 2009.

Statement

Before a company can issue an IPO, it needs first to be registered with the Securities and Exchange Commission. This process of registration is at times very difficult because it requires a statement stating the purpose of the issue, the history of the company and the plans. This IPO needs to be planned well for it to be successful.

Modeling System

The challenges of the corporate business environment are increasing by the day. These days, firms have to deal with several bottlenecks such as outdate technology, underdeveloped infrastructure, out of place payment systems, and futile scheduling and control systems, which have in an inferior position their progress. Many organizations today have started recognizing the significance of automation, optimization of scheduling and a proper management system, and are incorporating total quality management and total quality control in their operations.

The fundamental objective of any business is to make money. While this could be the end, the major means to reach this end is to achieve optimized productivity. Making money may be translated to increased net profits in synchronization with increasing returns on investment and cash flows. One of the key objectives of any business organization is to reach a position where it is able to attract more customers than its competitors. In order to achieve such a competitive advantage, businesses try to recognize their discrete competencies. The distinctiveness of an organization’s operations function is significant in shaping its choice of various types of products and markets, and the rudiments of its competitive potency. A variety of operational and strategic decisions is taken in this process(Schonberger, 74).

Operations research is a very recent discipline that is gaining recognition in the recent past. The workers in the field of Operations research during the initial days of its evolution came from a variety of disciplines like physicists, physiologists, mathematicians, surveyors etc. All these intellectuals from different fields put together ‘technically trained minds’ in exploring various expects of the study like logic, devising experiments, data collection, numerical analysis, hypotheses exploration etc. One interesting point to be noted is that, all the intellectual teams of Operations Research are of extremely high caliber (ICFAI Center for Management Research, 39).

This method used by most companies in resource allocation, scheduling and analysis of some problem. Today, technologies exist driven by a combination of databases, active RFID devices, bar-coding etc, to make sure that customer’s shopping is validated and billed in real time.

Probably, yet another off-shoot of the above stated issue would be to look into how well the production process of the organization is designed to retort to any kind of sudden fluctuations/spikes in demand for a specific product or range of products in the market place is addressed. If the responses achieved are smart and reasonable, and are in alignment with the accepted norms of operations management as well as the strategic management; then it can be safely inferred that the firm’s strategy for operations management is quite matured. Operations Managers can no longer continue with a system in which the operations system completely operates in seclusion from other systems.

In this case, of Coca cola IPO first models streamline the administration of the IPO that will be issued. It will give the flow of information. The model will help the management monitor and manage the IPO. The IPO will be issued to the public; the model will show how the IPO will be issued from the initial stages to the final stage.

System model 2 will forecast the performance of the stock after it has been issued. This will inform of the price to charge. Before the IPO is issued to the public, the number of staff that will be required to make it successful will need to be calculated as well as the time required for the IPO. The allocation of funds, which will help in logistics, will be of great importance to the process of issuing the IPO.

System Model One- Inventory Model

Coca- Cola recognizes the significance of automation, optimization of scheduling and a proper inventory management system, and is incorporating total quality management and total quality control in their operations. One of the key objectives of any business organization is to reach a position where it is able to attract more customers than its competitors. In order to achieve such a competitive advantage, businesses try to recognize their discrete competencies. The distinctiveness of an organization’s operations function is significant in shaping its choice of various types of products and markets, and the rudiments of its competitive potency(Myerson, 192).

As already mentioned above, operations research is a very recent discipline that is gaining recognition in the recent past. On the other hand, the workers in the field of Operations research during the initial days of its evolution came from a variety of disciplines like physicists, physiologists, mathematicians, surveyors etc. All these intellectuals from different fields put together ‘technically trained minds’ in exploring various expects of the study like logic, devising experiments, data collection, numerical analysis, hypotheses exploration etc. One interesting point to be noted is that, all the intellectual teams of Operations Research are of extremely high caliber(Gerald and Matthew, 172).

Extended information questioning the above issue would also point out to what level of assimilation of inventory management with the backward supply chains or the dealers has been done to optimize the carrying costs of the inventory. Probably, yet another off-shoot of the above stated issue would be to look into how well the production process of the organization is designed to retort to any kind of sudden fluctuations/spikes in demand for a specific product or range of products in the market place is addressed. If the responses achieved are smart and reasonable, and are in alignment with the accepted norms of operations management as well as the strategic management; then it can be safely inferred that the firm’s strategy for operations management is quite matured. Operations Managers can no longer continue with a system in which the operations system completely operates in seclusion from other systems(Dilworth, 74; Slack, Lewis and Bates, 126).

Constrained optimization models are functional techniques that help operations mangers to compute the amount of resources that need to be allocated to each individual strategic alternative. A model is a representation of the key characteristics of an object, a system, or a problem, organized with finer pieces of information. These constrained optimization mathematical models help the operations manager to arrive at an optimum alternative without much hassle(Gillett, 123).

If a manager wants to identify the optimum blend of concrete that is needed for constructing a building, his fundamental objective is to calculate the accurate blend of concrete with a satisfactory quality level, and to reduce costs. In this case, the manager can look at the problem in two different ways. The first approach to the above problem would be to conduct the manual trial-and-error method. This requires experimenting with a few combinations, and checking whether the quality obtained is up to the industry standard or not, and then computing the cost for each satisfactory combination. However, this approach is time consuming, as it is necessary to work out with numerous combinations for arriving at the optimal solution (Jeston and Nelis, 75).

The second approach to the above problem would be the mathematical one. This requires the use of a constrained optimization model that estimates all the probable combinations of mixtures and arrives at an optimal solution that is acceptable and meets all requirements at the maximum lesser cost. Interestingly, the time required for this approach is much lesser when compared to the first approach. This is the most commonly used approach as it needs lesser time; it is inexpensive and more consistent.

System Model 2: Forecasting Model

This will evaluate the stock market volatility where the stock will be sold. A basic problem associated with conducting such forecasts is that the volatility process has the inherent nature of being unobservable. This problem is surmounted by making use of an alternative for the monthly volatility that is ascertained by utilizing the day-to-day data. The importance of stock market volatility arises since it is one of the most significant parameter for forecasting future risk, which is a basic element in investor’s portfolio construction. Financial market price volatility has a notable characteristic that is changing with time. This phenomena that is quite strong in holding that a financial variable varies when the market undulates, is quite common in financial time-series (Monks, 239).

Most traditional analysis such as multiple linear regression model assume the residual error has expectation zero as well as independent covariance, which cannot be objective and clearly describe the behavior and characteristics of how market price and return vary with time. Despite this difficulty, it is important to estimate and forecast the market volatility for investors and arbitrageurs; individual stock forecasting is also very important to personal investors. By assuming the existence of multivariate auto-regressive procedures that control the three factors and having obtained poor outcomes after their implementation and testing, the three factors demonstrate outcomes that have very low mean coefficients that do not allow further exploitation of forecasting and testing issues in such settings (Peters, 78).

In modeling the variation of the term structures, assumptions have been made about the three factors being heteroskedastic and therefore have been modeled through a multivariate GARCH specification. An interesting aspect of asset returns is the non-symmetric manner in which they are impacted by shocks. It has been proved through empirical research that returns are not positively related with variation in the unpredictability of returns whereby instability appears to increase during the phase of bad performance and decrease with good news and results in what has come to be considered as leveraging impact.

To depict the possible correlation in conditional variances, ARCH model is set on a basic assumption that the there is serial correlation in the conditional variances. It is required to make the conditional variance of the time t prediction error a function of time, system parameters, exogenous and lagged endogenous variables, and past prediction errors. For each integer t, let εt be a model’s (scalar) prediction error (white noise), b a vector of parameters, xt a vector of predetermined variables, and σ²t the variance of εtgiven information at time t. An univariate ARCH model equation 1-5 sets (Peters, 88).

(1)![]() ,

,

(2) zt~ i.i.d. with

(3)![]()

The system (1)-(3) can easily be given a multivariate interpretation, in which case zt is an n by one vector and σ²t is an n-by-n matrix. Form (1)-(3), whether univariate or multivariate, is referred to as an ARCH model.

The most widely used specifications for σ²t are the linear ARCH and GARCH models introduced, which make σ²t

linear in lagged values of![]() by defining

by defining

(4)![]() ,

,

(5)![]() ,

,

Respectively, where ω, αj , and the βj are nonnegative. Since form (4) is a special case of form (5), (4) and (5) are both referred to as GARCH models, to distinguish them as special cases of (3).

(6)![]() ,

,

In which σ²t, the conditional variance of Rt , enters the conditional mean of Rt as well. For example if Rt is the return on a portfolio at time t, its required rate of return may be linear in its risk as measured by σ²t.Substituting recursively for the βiσ²t-i terms, (5) can be rewritten as

(7)![]() .

.

It is readily verified that if ω, the αj, and the βj are nonnegative, ω* and the φk are also nonnegative. By setting conditional variance equal to a constant plus a weighted average (with positive weights) of past squared residuals, GARCH models elegantly capture the volatility clustering in asset returns aforementioned(Peters, 78).

To meet these objections, Nelson presents an alternative to GARCH, which is the exponential GARCH model. If σ²t is to be the conditional variance of εt given information at time t, it clearly must be nonnegative with probability one. GARCH models ensure this by making σ²t a linear combination (with positive weights) of positive random variables. Then by making logarithm of σ²t linear in some function of time and lagged zt’s, σ²tcould remain nonnegative, the suitable function should be

(8)![]() , β1=1,

, β1=1,

(9)![]() .

.

(10)![]()

System Model Three: Transport Model

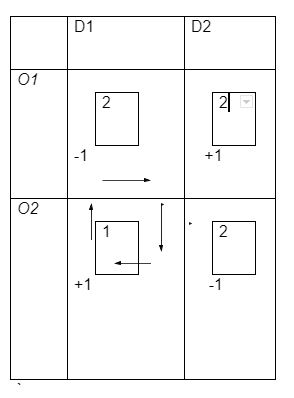

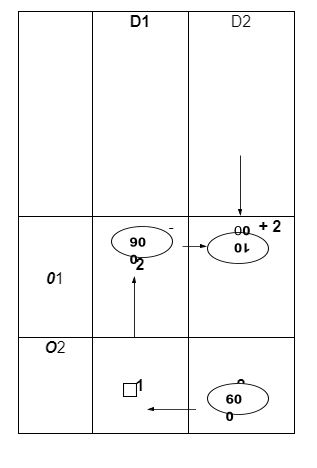

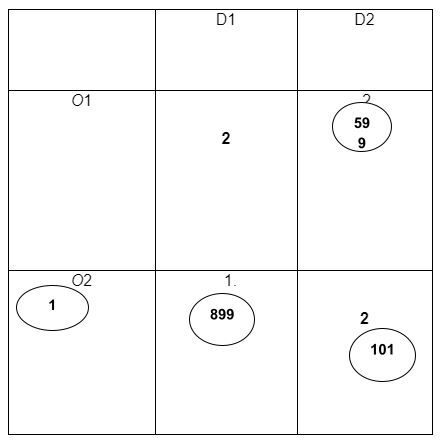

Transportation model involves decision making under certainty. It specifies how to use limited resources to meet a particular objective such as profit maximization or cost minimization, when there are alternative uses for the available resources. As the operations manager already knows the output per unit of resource and the return per unit of output, it is easier for him to determine the combination of resources, which would optimize the objectives of the organization. It is extensively used by coca-cola in their operations. In this case, they will use linear programming techniques for a selection of a particular allotment criteria. The constrains, in such circumstances will be the limitations on the type of investors, organizational policy, maximum acceptable risk, government regulations, etc. The advent of high-speed computers and data-processing systems has made this mathematical technique increasingly easy to utilize(Giovannini, and Uysal, 15).

Optimal solution must not incur any positive opportunity cost. To determine whether any positive opportunity cost is associated with the given program, by testing the empty cells [cells represent roots not used in a given program] of the transportation matrix for the presence or absence of opportunity cost. Absence of positive opportunity cost in all empty cells will indicate that an optimal solution has been obtained. If on the other hand a single empty cell has, positive opportunity cost then the given program is not optimal program.

Since cell 02D1 in this program is empty, we wish to determine whether there is an opportunity cost associated with it. This is accomplished by shifting one unit of goods to cell 02D1 making other shifts satisfy the rim requirement, then finding the cost consequence of these changes. by shifting one unit from cell 02D2 to cell 02D1 will shift the necessitate change that keep the rim requirement satisfied. The changes associated with the following cost consequence -2+1-2+2=-1

Since the shifting of one unit to 02D 1 yield a negative cost change, it is obviously a desirable shift. this results of cost consequence of -1 indicates that the opportunity cost of not including sale 02D1 in the first program is a +pound/unit of shipment.

The empty cell 02d1 must be included in a new and improved program. The opportunity cost of the empty cell 02D1 is +.we must obtain a new basic feasible solution by designing the new improved program in which cell 02D1 will be included.]

Situation can be remedied by shifting one unit from cell 01D1 to cell 01D2 a change that will satisfy the raw and column requirement.We can make the Improvement by shifting one unit from cell 02d2 to cell 02D1. this means that we are left with 599 units in cell 02D2.this change has not violated the capacity constraints of either row 1 or row 2.this affects the requirement constraints of column 1 and 2 because we have1 unit in 02D1, 900 units in 01d1, 599 units in 02D2, and 100 units in 02D2. Hence column 1 has 901 units (one more unit than the requirement constraint), and column 2hads 699 units (one less unit than the requirement of column 2) this

If one unit shifts to cell, 02D1 a change in the program affected by one unit to cell 02d1 established earlier reduces the shipping costs by 1 pound. As we gain the advantage each time a unit is shifted to cell, 02D1 we must shift to cell 02D1 as many units as possible. as the closed loop(+and- signs connected by arrows) shows that we cannot shift more than 600 unit to 02D1 for allocation of more than 600 units to 021 would certainly violate the capacity constraint of row O2.

A better basic feasible solution for the optimal allocation of the opportunity cost of cell 02D2 which Is now the only empty cell will give affirmative answer since the opportunity cost of sale 02D2 is not +.this is verified by shifting one unit to cell 02D2 and noting that the net cost consequence of such a shift is

+1 (+2-2+2-1) the opportunity cost being negative of the corresponding net cost change, is therefore a negative. After ascertaining that the opportunity cost of the empty cell was positive, we changed the initial program by filling the empty cell02D1 as much as possible in view of the rim requirements. This revision program is guided by the plus and minus signs of the closed loop.

Combination of 3-Model System

One of the key components of model system implementation is the Design of Experimentation. Doe ensures the process implementations are effectively planned and put into practice within the organization. In order to make the process of implementation smoother and effective, various teams will be created within the coca-cola for reviewing and analyzing discrete sub-processes concerning the overall IPO. The teams thus created within the company comprised of staffs and outside experts. The most promising ideas required detailed investigation because of the intrinsic risk that is associated with IPO issue. These ideas became replication scenarios. The simulation offers the teams with irrefutable performance data that in turn offered the needed input to executive decision-making(Shim and Siegel, 383)

One of the key objectives of IPO is to reach a position where it is able to attract more investors. In order to achieve such a competitive advantage, businesses try to recognize their discrete competencies. The distinctiveness of IPO’s function is significant in shaping its choice of various types of model, and the rudiments of its competitive potency. A variety of operational and strategic decisions is taken in this process.

The Learning curve, according to the author is that in any organizations, processes result in performance improvement consequently leading to reduction of the processing time. Learning is considered very important because it helps in lowering costs. The knowledge that an individual gets from learning can be used in the improvements, procedures that increase the utilization of resources to the process (Stuart, 150).

The secret behind the Coca Cola’s consistent progress with regard to the IPO issue is the lessons that the company takes seriously by combining the feedback it gets from its stakeholders with the day-to-day advancement of technology. The same has allowed the company to enhance its initial quality and the reliability in the end. Modeling and simulation in the process of 3 systems implementation enabled the management to better understand the experience of the issuing an IPO, performances of the process, and staffing inter-relationships for the proposed IPO. The three models will help the company issue the IPO successfully in the market. Coca-cola will successfully issue the IPO to the public without much hustle because the first model will assist in the administration while the second model will assist in the allocation of resources and the final model will help the company in issuing the shares among the successful investors. The three models are important in changing the strategy of the company in issuing the IPOs.

Overall Company Strategy

In order to implement this IPO, the company will need to recruit various stockbrokers who will help in the issue of IPO. The IPO is important and will need the management to understand the whole process including the cost associated with it. The stockbrokers will act as underwriters of the IPOs. Model’s focus is how to align every move in IPO to be synchronized with the requirements of its particular company. This is the primary reason why clear communication of targets must be strictly enforced to keep the guide-light on, and keep the process on track and dynamic so that targets may be attained. This is slightly more defined than the very basic skill of assessment, planning and intervention but it follows the same concept of identification of goals by defining the project or the problem and within this analysis, the targeted improvement and measurement there off is identified, followed by the actual intervention.

Immature processes stop at this point and it will take much focus to go beyond the initial celebration of success, and to actually measure the success using the initial measurement criteria set, reporting this and using the positive and negative results as a springboard for a revised plan for the next process improvement (Becker, Kugeler and Rosemann, 78).

Measurement and reporting serve very important features in attaining effective and efficient process improvement projects that eventually result in increased customer satisfaction, across any organization and across any time. This governance task forces teams to take necessary steps to ensure that processes are managed, kept under control and properly administered. It is further outlined that this further ensures that exceptions, non-compliance and undesirable outcomes are identified and dealt with appropriately so that risks and weak points are kept to a minimum. However, what will be the single, crucial step in measuring the success and effectiveness of the intervention will be the audit of actions taken and the response to these (Suzuki, 1-10).

A positive response from the customers, coupled with positive measurement results brought on by the particular campaign can only be identified when process managers are able to properly record achievement against initial targets or criteria. Ensuring that the expected goals specified at project onset are addressed, progress is measured and evaluation of outcome achievement is a primary task. Achievement measurement takes on most value when management learns from it, and uses it to learn more in the future ensuring that roles and tasks of personnel involved are properly allocated to apply these lessons (Greasley, 122).

Conclusion

During the IPO process, the company is required to circulate a prospectus, which has the whole company profile, and future strategies defined in it. Such a profile in its summarized form is also required by law to be published in the newspapers and circulated widely increasing the customer awareness. This initial listing process gain a lot of media coverage as well without any extra advertising cost. It is always believed that a company that takes the step towards getting listed makes a large leap towards expansion and is a success milestone. This publicity does not stop with the IPO, it increases manifold if the securities being listed do better than expected on the stock exchange and that leads their share prices to rise up.

Lastly, the company seeking improvement in its corporate profile can take a big step towards by increasing their capital structure, creating capital in a better way, making people more aware about the organization and enhancing the company’s profile. All this will eventually lead to enhancing the investors, customers and the supplier’s confidence and increasing the negotiating abilities of the company. Moreover, an IPO helps companies raise capital for expansion and remove the need for loans.

The company’s market value can be evaluated fairly and the shares can be used for acquisitions and mergers without involving cash. Employee retention will be improved and the publicity during the IPO process lead to more customers. In order to get all these benefits there are many stock exchanges options available to decide upon. The purpose behind creating such a market is to provide the investors with enough liquidity, which they seek from any good investment option, helps in mobilizing the savings from around the country and help in economic development of the country.

References

Becker, Jorg, Kugeler, Martin & Rosemann Michael. Process Management: A Guide for the Design of Business Processes. New York: Springer, Inc, 2003.

Dilworth, James. Operations Management: Design & Planning. London: McGraw Hill, 1992.

Gerald, Brown & Matthew Carlyle. “Optimizing the US Navy’s Combat Logistics Force.” Journal of Management Science , 2008.

Gillett, Billy. Introduction to operations research: a computer-oriented algorithmic approach. New York: Tata McGraw Hill, 2008.

Giovannini, Enrico & Uysal Ayhan. Statistics, Knowledge and Policy: What do we know What People Know. 2006. Web.

Greasley, Andrew. Operations management in business. Cheltenham: Stanley Thomas, 1999

ICFAI Center for Management Research. Operations Management. Hyderabad: ICFAI Center for Management Research (ICMR), 2003.

Jeston, John & Nelis, Johan. Business Process Management: Practical Guidelines to Successful Implementations. New York: Butterworth-Heinemann, Inc, 2006.

Myerson, Rogers. Game theory: analysis of conflict. New Jersey: Harvard University press, 1991

Monks, Joseph. Operations Management. New York: McGraw Hill Inc., 1996.

Peters, Jeane Philip. Estimating and forecasting volatility of stock indices using asymmetric GARCH models and (Skewed) Student-t densities, Ecole d’Administration des Affaires, University of Liege, Belgium, 2001.

Schonberger, Richard. Operations Management – Customer Focused Principles. New Jersey: Irwin publications, 1997.

Shim, Jae. & Siegel, Joel. Operations Management. New York: Barrons, 1999

Slack, Nigel., Lewis, Michael. & Bates, Hillary. “The two worlds of operations management research and practice: Can they meet, should they meet?” International Journal of Operations and Production Management, 2004, vol. 24, no. 4, pp. 372-387.

Stuart,Ian. 2006. ‘Designing and executing memorable service experiences: Lights, camera, experiment, integrate, action.’ Business Horizons, vol. 49, pp. 149-159.

Suzuki, Yoshinori. “A Generic Model of Motor-Carrier Fuel Optimization.” Journal of Management Science, 2008: 1-10.