Coffee Manufacturing Company (CMC) needs to consider several factors before accepting or declining the acquisition and expansion proposal presented by the head of marketing. This is one of the most crucial roles of a finance officer or advisor since a single decision may plunge the company in a financial crisis or boost its financial position (Lyndon 2008, p. 65).

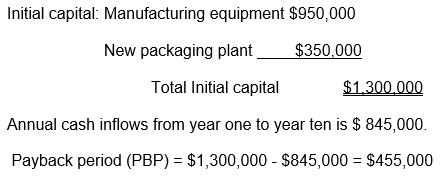

The management needs to consider the payback period of the proposed project. Payback period is the amount of time an investment takes to repay back the initial capital invested in the project. Payback period is calculated from the cash inflows and outflows generated by the company for estimated life of the project (Hunt 2009, p. 34). CMC should not accept a project with a long payback period or a project where the cash inflows cannot cover the initial invested capital. Coffee Manufacturing Company payback period can be calculated using the following formula: Initial Capital (Io) – Annual Cash inflows and its unit of measurement are years.

The CMC project will not recover the initial investment considering the annual cash inflows for ten years cannot cover the cost of purchasing the new machine and in 10 years, there will be a cost balance of $455,000. The operating cost, repairs and maintenance cost are not included in the calculations.

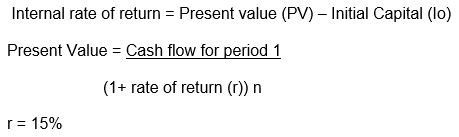

The management needs to analyze the internal rate of return for the machine, which this can be used as a tool of determining whether the new production machine should be acquired or declined for the project. Internal Rate of Return (IRR) is used to determine the productivity of a project by converting the estimated future cash inflows into present value and equating them to zero. The size of the internal rate of return is not of concern provided the project produces positive or greater than zero internal rate of return. For CMC’s project to be approved, the present value cash inflows must be positive or greater than zero; a contrary result should not be approved (Kimmel, Weygandt & Kieso 2011, p. 56).

Calculation of PV

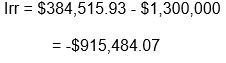

The project’s internal rate of return is a negative value meaning that if CMC management approves the purchase of the machines, then the project will never recover its initial investment cost. Therefore, the management should not approve the project.

References

Hunt, P 2009, Structuring mergers and acquisitions: a guide to creating shareholder value, Wolters Kluwer, Austin.

Kimmel, P, Weygandt, J & Kieso, D 2011, Financial accounting: tools for business decision making, John Willey, Hoboken.

Lyndon, B 2008, Market research and analysis, Wildside Press LLC, Maryland.