Introduction

Cigarette smoking and other forms of tobacco use are directly responsible for at least one-third of all cancer deaths annually. One reason why smoking has endured, in spite of its dreadful death statistics, is that cigarette is highly addictive and comparatively not expensive to buy. It is vital to fight this trend to ensure that the deaths emanating from smoking are reduced drastically.

Contextually, the dangers posed by smoking are numerous. Not only are the smokers at risk but also non-smokers. This is a considerable provision in the realms of health; hence, the efforts created by the government to curb this trend should be supported fully. Smoking kills, both directly and indirectly.

Canada, as a country, is no exception in this trend following the massive deaths it registers annually due to cancer and other related diseases (The Lung Association, 2012). In this regard, there is need to reduce the mentioned deaths for the benefit of the nation. Most families have been rendered hopeless due to cancerous attacks.

In addition, most children have been orphaned due to deaths caused by smoking, and societies are losing lots of funds on tobacco-related problems. Despite the economic gains registered from tobacco, its health concerns are devastating. Hence, it is vital to agree that there is need to reduce the smoking rates within the society. There are 2 different types of policies in the Canadian context.

This incorporates taxation policies and education policies. In fact, the government should impose high taxation provisions on cigarette manufacturers. This will eventually hike the prices of cigarette sticks in the market hence discouraging smokers.

Education, on the other hand, tends to sensitise the public against smoking (CBC News, 2011). The government, policy makers, and people in general are the concerned stakeholders in the fight against smoking. This paper seeks to reveal how the smoking phenomenon can be combated through “Taxation Policies” as well as “Education Policies”.

What the Theory Says

There are credible theories on how the two policies can be enhanced to help in the fight against smoking. This is a considerable provision when scrutinised critically. By applying the concept of elasticity of demand and supply to discuss (theoretically) how each type of policy (taxation and education) impact cigarette smoking, several ideologies emerge that indicate the possibility of attaining success in the fight against smoking.

First, high taxation provisions will force the cigarette manufacturers to increase the prices of their commodities due to increased operational and business costs. Consequently, the prices of cigarettes will increase forcing smokers to cut down on their demands for cigarettes. Eventually, there will be reduced smoking trends in the country.

Additionally, by increasing the taxation provisions, the supply of cigarettes will reduce (since most manufacturers might quit the industry) while the demand will increase. Consequently, the prices of cigarettes will also increase due to high demands.

Nonetheless, due to “demand, supply, and price” elasticity, high prices will discourage buyers who will consequently reduce their smoking rates following the high cost of cigarettes imposed on smokers indirectly by the government. The desires of those with purchasing power in regard to cigarette business will drastically reduce due to high taxation provisions.

Hence, high taxation quest will help in reducing the aspects of smoking within the Canada and beyond (CBC News, 2011). Only the few individuals who will be able to afford the prospected high costs of cigarette will smoke. Nonetheless, the majority will reduce their smoking trends. Educational programs executed to sensitise the youth and other vulnerable groups have also been put in place by the Health Canada.

Canadian Examples

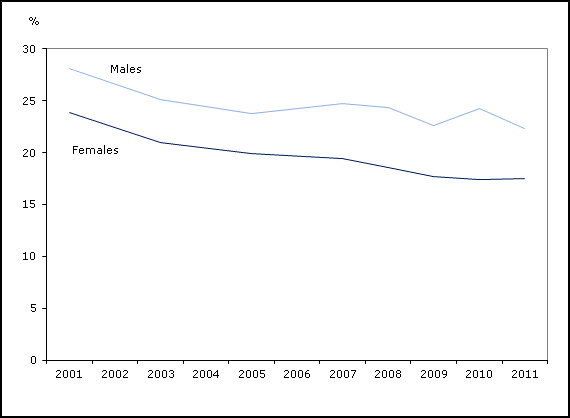

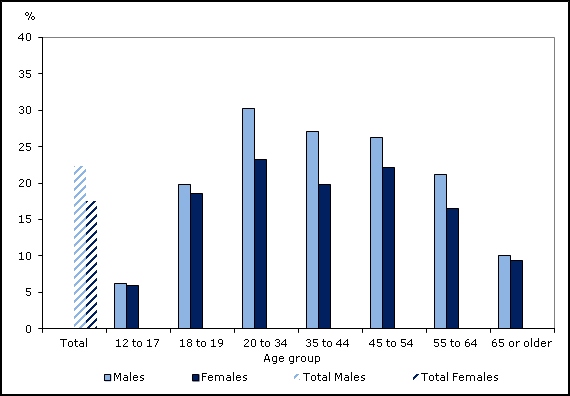

In the last decade, smoking rates in Canada reduced drastically from 25% to 22%. The Canadian Health has forced cigarette manufacturers to put graphic health warnings on cigarette packaging. This is meant to draw the Canadians’ attention to the devastating health repercussions of using tobacco products. This has been done to complement the high taxation provisions set for the cigarette manufacturers.

Additionally, most states in Canada have adopted smoke free by-laws to help in curbing the menace (Health Canada, 2002). Additionally, the Health Canada’s legislative, regulatory, as well as policy efforts regarding the tobacco control have been promoted by the Tobacco Act (1997).

Other new regulations enacted as at June 2000 have also been operational. Such legal Acts have been staged to control manufacture, trade, tagging, and advertising of tobacco merchandise in Canada. They also promote the education of the youths on the health consequences of smoking. Educational programs executed to sensitise the youth and other vulnerable groups have also been put in place by the Health Canada.

Conclusion

The Canadian government fights to reduce the rates of smoking within the country. The government proposes to enact high taxation policies and educational policies to help in curbing this menace. Health Canada has managed to involve the public in the fight against smoking. Youths are under educational programs to ensure proper knowledge regarding the dangers of Smoking.

References

CBC News. (2011). Anti-smoking efforts in Canada and abroad. Web.

Health Canada. (2002). A Framework for Action. Web.

The Lung Association. (2012). Smoking & tobacco – Quitting smoking. Web.