Background

The Unilever Ice Cream division operates in a highly competitive environment. Ice cream is part of the company’s food business that has to compete with other companies in the fast moving consumer goods segment. The company is the biggest maker of ice cream in the world.

Customers are mainly retail buyers who shop from supermarkets and are increasingly taking on ice cream as a snack.

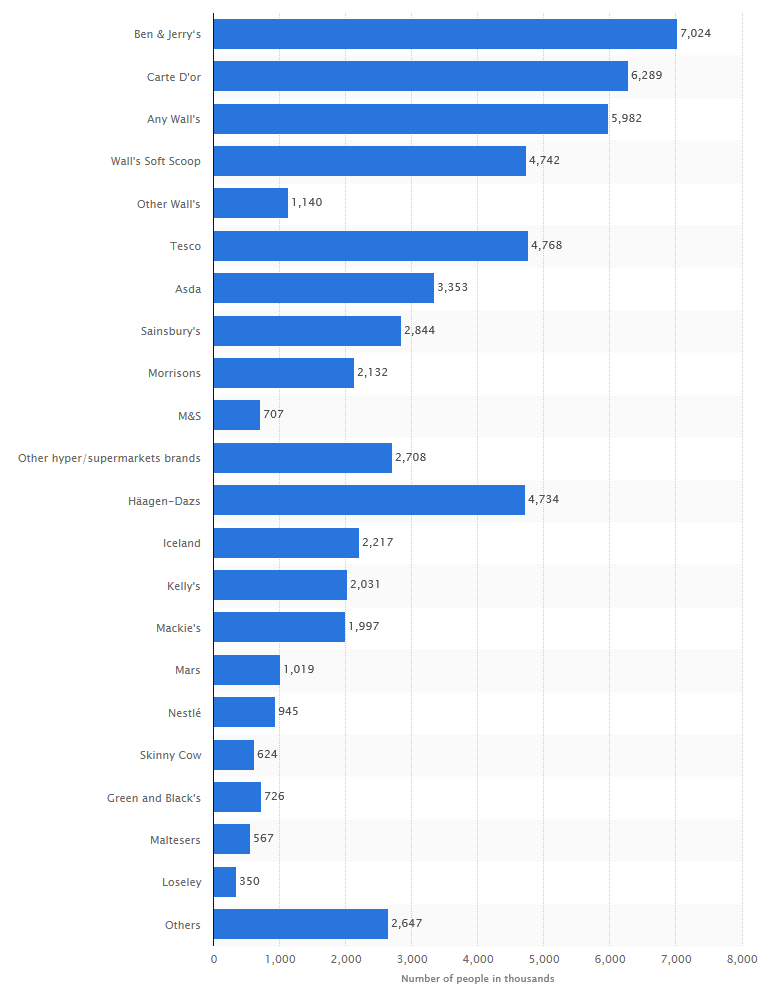

Figure 1: Euromonitor International-Statistics.

The main Unilever ice cream brands in the UK are Ben & Jerrys, Carte D’or, and Walls. The following graph displays the market share of the respective brands in UK in 2013.

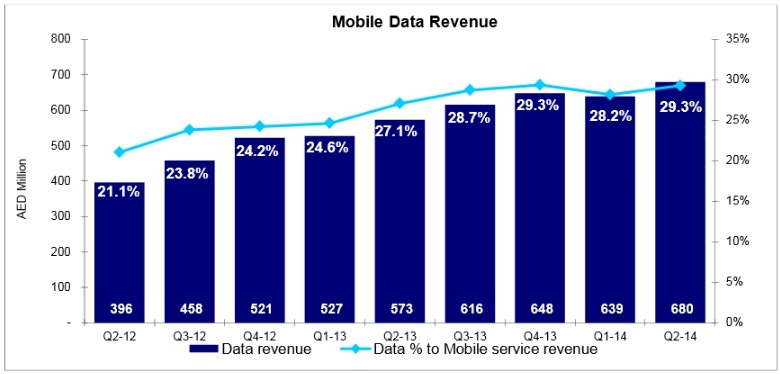

Meanwhile, du telecom operates in a young, growing industry. It also benefits from its association with the United Arab Emirates government by being owned by several state agencies. du is enjoying a persistent increase in mobile data revenues. The business segment contributes about 30% of the total company revenue.

The main challenge for du telecom is sustaining the cable infrastructure to provide 100% uptime on data business. Rivals like Etisalat and YahClick are already opting to use satellite links as backups. du has to keep up with changing technologies to remain relevant in its business (du 2014).

Competitive environment applications

Five Forces du telecom in the UAE

The threat of new entrants in the UAE telecom market remains low because of the low population of the country and the high cost of setting up the required infrastructure. New entrants also try to avoid the associated cost of having to upgrade their networks when new technologies become common.

The industry in a duopoly served by Etisalat and du. However, there are smaller companies offering hybrid services in some specific telecom segments, such as data. Rivalry is very high as du tries to increase its market share to reach at least 50% of the market.

Currently, it has about 30% control of the market. In the industry, buyers can shift their service providers quickly, but du is doing all it can to sustain consumer loyalty by providing long-term contracts and increasing switching costs. Therefore, the bargaining power of buyers remains moderate.

Meanwhile, the bargaining power of the suppliers is low because there are many global and national companies competing for contracts and tenders to supply equipment and services to the UAE telecom industry.

In the UAE, telecom companies provide the same services, but they differentiate the services through customer care and market campaign presentations. Any changes in pricing by a rival will directly affect du telecom. Therefore, the threat of substitute products remains high.

Mapping strategic groups, Unilever in the UK

When mapping, Unilever uses demographics to divide markets and then follows through with the expectations of the particular age group segment. Ice cream flavours are made with the needs of the diverse customers in mind. Each company brand is for a specific market segment.

For example, the Calippo, an ‘ice lolly’, is for children.

Brands sold in the UK do not have to be launched in the country. In segmentation, Unilever also follows customer traits, where 29% are quality driven, 24% are individualistic, 19% are habitual shoppers, 14% are shelf stalkers, and 14% are conformists brand loyalists (Unilever 2013).

The performance of different brands in the UK follows consumer income levels, with Magnum as the best-selling brand because it targets adults.

The marketing and sales strategy for Unilever UK is defined clearly. The company concentrates on its biggest brands, but it also ensures small ice cream brands have the required presence in retail stores.

Packaging differs for all brands and the targeted price segment in the market. Brands focusing on impulse customers are mainly premium and mixed-priced. Those focusing on the take home market are available in all price variations, leading to the brand positioning structure displayed below.

Company strategy applications

Objective of du Telecom

The company aims to maintain a progressive dividend policy for the shareholders. The objective provides a reference point, which also serves as the main unit of performance measurement. The other objective is to provide consumers with the best offerings in the world in terms of handsets, network technologies, and overall consumer experience.

The company measures its commitment to this objective by evaluating the available choices offered to customers, the quality of its network compared to the rivals and industry standards, the innovativeness of its products and services measured by the frequency of upgrades, and the pricing of its products to reflect profit margins and market competitiveness.

One minor objective of the company is to comply with the Emiratisation programs of the UAE government. It involves the hiring of many UAE nationals as workers. The company judges its performance towards this objective by the number of job applicants who are Emiratis and the turnover of Emirati employees annually.

Objectives apply differently to functions and business units; the voice market segment pursues the call quality objective, while the customer care area aims to satisfy a higher number of customers (du 2015).

Unilever Mergers and Acquisitions

Unilever embraces mergers and acquisitions to take advantage of the emerging trends in the ice cream industry (Unilever 2013). It also does so to consolidate market share, reduce costs, and increase its economies of scale. The table below presents a summary of the company’s activities from 1959 to 1980 (Reinders 1999).

The motive was to improve its access to relevant resources, which were critical to its business expansion. Therefore, the choice of target depended on freezer cabinets, cold stores, and transportation demands (Jones 2002).

In 2014, the company finalized the acquisition of Talenti Gelato & Sorbetto in a move that would enable Unilever increase its offerings for the ice cream market (Boyle 2014).

Acquisitions have happened within and outside Europe to make the company truly global and to enable it develop elaborate supply chains for the main ingredients of its ice cream brands. There are no notable mergers in the company’s history, which could be due to the company’s need to retain absolute control of its business.

Acquisitions are helpful in reducing the costs of operation. They also help Unilever to become diverse. The company targets small firms that are operating in single national markets, where it can easily dominate after acquisition (Jones & Miskell 2007).

Reference List

Boyle, M. 2014, ‘Unilever buys Talenti Gelato & Sorbetto to bolster ice cream business’, Bloomberg Business. Web.

du 2014, Q3 2014 year-on-year revenues exceed AED 3 billion for the second consecutive quarter. Web.

du 2015, Company overview. Web.

Jones, G. & Miskell, P. 2007, ‘Acquisitions and firm growth: Creating Unilever’s ice cream and tea business‘, Business History, vol. 49, no. 1, pp. 8-28. Web.

Jones, G. 2002, ‘Unilever- A case study‘, Harvard Business School Working Knowledge. Web.

Reinders, P. 1999, Licks, sticks and bricks: A world history of ice cream, Unilever, London.

Statista 2015, Brands of ice cream in tubs and blocks ranked by number of users in the United Kingdom (UK) in 2013 (in 1,000 people). Web.

Unilever 2013, 2013 annual report and accounts: Making sustainable living commonplace. Web.