Executive Summary

The paper looks at the external business environment situation of five emerging countries from Asia and then picks Thailand to analyze its risk.

Further, the paper analyzes the automobile manufacturing and sales industry in Thailand and the prospects of a new firm introducing a locally manufactured car model in the country for the domestic and export markets.

The analysis makes inferences based on the political and financial risks and offers advice on how such a firm should proceed with its investments.

Firm specific risks

Direct capital investment will increase company costs that are hard to recover in a less promising market. Introduction of non-eco-friendly cars will expose the company to high taxation rates that erode the profit margin.

Country specific risks

Political uncertainty casts shadow on investment decisions by most multinationals, which hurt demand for local business goods and services. The high domestic debt reduces the central bank’s ability to lower interest rates and stimulate domestic consumption to boost GDP growth.

Global specific risks

Global recession can affect the growth of trading partners negatively and lower the exports from Thailand.

PESTEL Analysis of Five Emerging Economies

The following table analyzes Indonesia, Thailand, China, Taiwan, and the Philippines

Why country risk analysis is important

The analysis establishes the relevant influence of each analyzed factor to a business’ success prospects. It also helps investors to avoid making decisions that would lead to losses due to instabilities in the performance of the country in terms of politics and economy.

Political Risk Factors

Attitudes of consumers in host country

In Thailand, consumers show a high propensity to engage in corrupt practices. Their behavior and attitude reflect of the widespread corruption in the country.

Internationally, the Transparency International’s corruption index puts the country at the 85th position, with a score of 38 out of 100. It is an indication of the prevalence of corruption in the country (Bankok Post 2014).

Bangkok is the capital of Thailand and has the highest country’s population of 8.4 million people. Literacy levels of the country’s population are 95 percent for males and 91 percent for females. Unemployment stands at 2.8 percent of the population and ranks as number 144 in the world.

Consumers have the freedom to demonstrate against political, social, and economic issues affecting them. Although citizens of Thailand do not have publicly known consumer activist groups that have countrywide memberships, they remain easy to rally behind causes that affect them on personal levels.

For example, they have in the past demonstrated against policy proposals of the government to the effect of ousting the government from power in a citizen’s coup. Consumers have a large appetite for debt, as demonstrated by the high levels of domestic debt in the country.

Actions of host government

The country faces a political uncertainty over elections of a new government, which deters business investment plans. Thailand has been politically unstable since 2006 when the country underwent a coup.

Nevertheless, the Thai economy has remained robust amid the political tensions because the policy of the government and many of its agencies is to leave the market to determine many affairs of businesses.

The Thailand parliament was dissolved in 2013 and early elections came in 2014. The elections came due to widespread citizen protests against a proposition on amnesty law. The law created tensions between supporters of the Democratic Party factions in the country.

The Democratic Party lost its control of government after a coup in 2006. However, it has been trying to regain its foothold in Thailand politics since. Demonstrations in public places are a common method for citizens to compel the political elite to change government.

Other than the national government, all districts in Thailand have to elect representatives. The effects of the 2014 early elections have been negative on the country’s economy, causing an increase in tensions and forcing many multinationals to halt their expansion programs in the country.

Blockage of fund transfers

Thailand is open to the global economy with no risk of funds transfer, unless companies engage in criminal activities.

Currency inconvertibility

The currency is very flexible and freely convertible to major world currencies.

War

Currently, Thailand is facing no risk of war; thus enjoying good relationships with neighboring countries.

Bureaucracy

Bureaucracy is relative to government activities, with the private sector being independent. Risk is low.

Corruption

Corruption risk is high due to political uncertainty and weak law enforcement.

Financial Risk Factors

Economic growth

Thailand’s economic growth depends on its diversified and efficient agricultural and industrial production capabilities. The country is a regional hub and maintains favorable relationships with its dynamic neighbors, many of them keen on integrating into the global economy.

The country also has strong banking systems that have provided adequate capital and market incentives for local business growth.

The threats to economic growth include the recurrent political instability highlighted in this report, which began with the 2006 coup. The external trade of the country depends on the performance of the Chinese economy, given that Thailand is a second-tier outsourcing destination for many companies established in China.

The business environment is not detached from the political environment and the tensions in politics can sometimes spill over to the country’s business climate (Asian Development Bank 2015).

The country’s banking system is healthy. Nevertheless, the country has accumulated a high amount of fiscal deficits in recent years. The country’s banking sector has assets that are roughly twice the country’s GDP (The Economist 2014). The primary economic goal of the government is to make Thailand an economic welfare state by 2016.

The intention of the policy further escalates the deficit problem for the budget and affects its currency value negatively (National Economic and Social Development Board 2012).

In addition to social security, Thailand has an increasing middle class population and demonstrates tendencies of economic development disparity. The development of its main cities continues to overshadow that of the rural areas in Thailand. Consequently, the population is increasingly becoming centered in the urban areas.

Exports from Thailand are equivalent to 73.57 percent of its GDP, while imports are equivalent to 70.28 percent of its GDP (Global Edge 2015). The main trade partners, according to scale, are China, Japan, the United States, Hong Kong, Malaysia, Indonesia, Singapore, Australia, and Vietnam.

Thailand trades mostly with other Asian countries because of its position as an outsourcing center. Trade involves components in the supply chain of various finished products. Industrial machinery and electrical machinery are the main goods exported from Thailand.

Others include motor vehicle parts, rubber, oil and mineral fuels, precious stones and metal, as well as plastics. Thailand is also an exporter of food, mainly prepared meat and cereals. The country imports oil and mineral fuels.

Other imports are the same as the export category because Thailand import goods to process and export again. Most companies trading within and with the country rely on its affordable labor and have joint ventures and subsidiaries in Thailand to manage supply chain needs.

A close association with the global economy put Thailand’s economy at the influence of the American monetary policy, which tightened in the past year.

Thus, the available liquidity in Thailand will be low. In addition, the prevailing fragile political stability makes the country have a high-risk profile, which makes investors unwilling to make long-term commitments.

Foreign Exchange

Thailand is a recipient of volatile capital flows, which cause difficulties in maintaining economic stability. Since the Asian financial crisis, Thailand has emerged as a growth model that relies on export-led growth and small and medium enterprises.

It has limited knowledge and capacity of protecting itself against exchange rate fluctuations. As the economy moves to a growth model that relies on value-added production, it also faces opportunities for reconfiguring exchange rates.

Currently, the country seeks a flexible exchange rate that allows it to promote industrial policy, financial development, and macroeconomic stability that responds to the world economy.

Thus, Thailand’s foreign exchange market continually benefits from policies aimed at increasing market reliance and efficiency as determinants of the country’s currency value. With a flexible exchange rate, the country is able to withstand external adjustments and make sure they do not affect the economy (CIA World Factbook 2015).

In 2014, Thailand maintained 7.5 months’ worth of imports as foreign exchange reserves to ensure that the fluctuations of the country’s currency did not succumb to deep dives and spikes that could hurt local business and international trade.

Assessment of Risk Factors

Macro-assessment of country risk

Most households in Thailand are in debt. Cumulatively, the domestic debt level is about 80 percent of the country’s GDP. Therefore, it is almost impossible for households to increase their consumption. Consequently, the central bank cannot effectively cut interest rates to increase the uptake of loans and spur economic activities.

The state is also not going to renew rice subsidies in rural areas. The action will hurt farmers who depend on rice farming for their economic survival.

The lack of a stable government also limits public expenditure to the bare minimum, which hurts the robust plan for economic resurgence that was part of the Thailand 2020 Vision (The World Bank 2014).

Political tensions cause the country to lose its attractiveness as a tourist destination, thereby affecting the government’s realization of goals to make Thailand a cuisine capital of the world. Reduced tourism numbers hurt local business sales and jeopardize economic growth.

However, Thailand continues to maintain a stable level of foreign trade due to its attraction as a major outsourcing location. As advanced economies recover, they increase the amount of outsourcing-related trade with Thailand and keep its economy growing.

Falling prices of raw materials continue to affect the growth of the economy negatively. Unless the prices change, the country will still be at the risk of running into a recession.

Micro-assessment of country risk

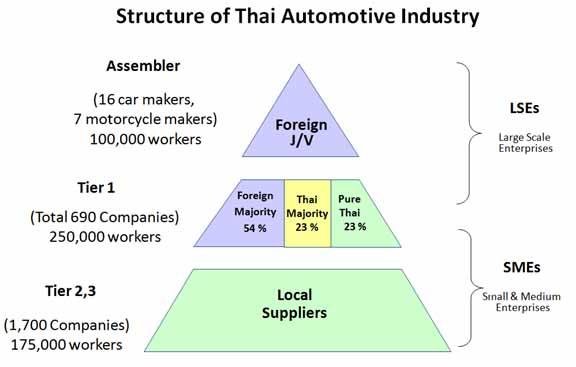

The automobile industry in Thailand has grown considerably since its birth about half a century ago. The country is a hub for the Southeast Asian countries. The country has about 701 Tier 1 auto part suppliers serving the demand from other Asian countries like China and Japan.

Half of the top car manufacturers in the world have factories in Thailand for the production of complete cars or various components of vehicles. Thailand has capacity for developing all components of automobiles, including interiors, engines, and body parts.

The main automobiles players are Suzuki, Toyota, Mercedes-Benz, and Tata Motors (Thailand Board of Investment 2014).

Assembler companies are foreign owned, while Tier-1 companies are mostly joint ventures; only a few are purely owned by the Thais. All Tier 2 and 3 companies are locally owned and they are mainly small and medium enterprises (Tractus (Thailand) Co., Ltd 2014).

The Thai government has been promoting the adoption of green technology in its automotive industry, seeking to make the country a hub. The Thai automotive industry has not been performing very well in the last few years due to the overall economic pressures highlighted in this report.

However, it expects to recover with the introduction of eco-cars that fit into the emerging consumer demand for environmentally friendly technologies and vehicles.

Manufacturers are in the second phase of the eco-car scheme, where they enjoy a new excise tax policy geared towards making the new technology cars affordable in the local and export markets (Thai PBS 2014).

The industry also expects a rebound because the government has been keen to take corrective measures of giving farmers subsidies to avoid political fallout.

Other factors that will contribute to the recovery of the automobile sector include mega project spending by government and multinationals that will increase demand for new cars in the Thailand market, as well as the demand for associated components.

The industry is also a great beneficiary of lower fuel prices globally and improved economic performance of major trading partners.

Cars with reduced CO2 emissions will attract a lower tax penalty in the new taxation plan for the industry. The plan favors the production of eco-friendly cars, rather than hybrids, whose taxation bracket remains unchanged. The industry expects to sell 2.1 million vehicles in 2015 among the domestic and export sluggish business prospects.

Achieving the objective is possible, but past indications show that the industry experienced a year-on-year domestic sales drop of 36 percent with an export drop in sales of 1.25 percent (Thai PBS 2014).

Toyota is one of the biggest automobile companies in Thailand. Its projected sales in 2015 will reflect an increase of 0.9% from the previous year as a result of the rising demand for commercial automobiles.

In 2014, the company’s sales shrunk by 27 percent due to political unrests, which affected purchase decisions of consumers (Reuters 2015).

Elections are unlikely in Thailand before 2016, as the military exerts its control after the impeachment of the country’s Prime Minister; therefore, the present year will provide a stable business environment to facilitate growth in the industry.

Approaches of Assessing a Country’s Risk

The checklist strategy

It entails obtaining a wholesome assessment by examining and rating individual factors that contribute to a country’s risk profile.

The Delphi approach

The Delphi approach involves the collection of independent opinions and then averaging the opinions and finding out the dispersion in the measured opinions about Thailand (Madura 2015).

Quantitative analysis

Quantitative analysis techniques use regression analyses or any other statistical method to evaluate the sensitivity of a business to risk factors, based on historical data of Thailand (Madura 2015).

Inspection visits

Inspection visits involve travelling to Thailand and then meeting with state officials and executives to understand the main risk factors affecting the country (Madura 2015).

A combination of techniques

Measuring a country’s risk can require a number of techniques to provide different dimensions of the country’s position (Madura 2015).

Disparities in approaches of determining a country’s risk

Assessors apply varying procedures in evaluating different countries’ risks. The disparities arise due to the factors being evaluated, but all assessments entail apportioning weights and rating the factors. Disparities also depend on the corporate activities planned to necessitate the risk rating (Madura 2015).

Rating numerous countries’ risks

Rating more than two countries requires the use of a matrix to determine the economic risk of each country against the political situation in each country. The results are presented in the form a graph that compares each country against the other to guide foreign investors in decision-making.

Actual country-risk ratings across countries

The comparison will yield relative scoring for the risk rating, with some countries weighting higher than others. The actual risk changes over time. In the case of Thailand, the automotive industry attracts lower risk rating overall.

Capital Budgeting Guided by Country Risk Assessment

Varying the discount rate

There is a direct relationship between the projected risk and the discount rate for capital budgeting. It implies that if the risk is projected to be high, then the discount rate will equally skyrocket.

Varying the projected cash flows

An international company can rely on the cash flow and its weakness before making the decision to invest in different units of its business.

Assessing the risk of existing projects

How important is the country risk of the product that the firm wishes to introduce?

Thailand’s risk profile is very important for an automotive company seeking to introduce new vehicle models to the country. The political risks directly affect consumer-purchasing decisions and the volume of sales that the company can forecast and achieve.

In addition, political uncertainty also influences government spending, which is a strong indicator of overall economic performance. Thailand relies on government stimulus packages to stimulate economic activities and growth.

The financial risks of the country affect the actual demand for new cars. A high financial risk profile implies that it will be difficult for the business to access capital. Consumers will also find difficulties in accessing funds to finance their car purchases; thus leading to low sales volumes for the new car introduced in the market.

Manufacturing of new vehicles relies on the Tier 1 and Tier 2 or Tier 3 companies that provide the required components. Favorable economic conditions and less risk increase the attractiveness of Thailand as a foreign direct investment destination, which attracts more firms in the respective business sectors.

An increase in competition and concentration encourages economies of scale and improves access to the latest technologies to improve the competitiveness of a given firm’s new car sales.

What measures can be taken by the firm to minimize the country risk?

The carmaker must reduce its investment in long-term projects and limit its focus to the medium term, where economic conditions are predictable.

With the fragile political situation in Thailand, the best strategy is to commit more to the export market, but still have considerable marketing operations in the local market to take advantage of any change in the domestic credit situation and political conditions.

With top manufacturers expecting a mild growth in sales, such as Toyota’s 0.9 percent growth, the production of new cars should be moderated to avoid too much inventory at the end of the financial year.

The company should work closely with the locals and employ many of them so that it is protected against any citizen protests that can arise against the government or businesses. It must cultivate favorable relationships with local partners and labor representatives to sustain a positive reputation and the “preferred employer” status.

At the same time, it should detach itself from any political sides by maintaining a neutral political position so that it does not become a victim of the ongoing Thailand political tensions.

How does the risk affect the profitability or the Net Present Value (NVP)?

High political risk and moderate financial risk can lower profitability of the company, unless sales come from the export market and the risks do not affect the current industry policy.

What steps have been taken by the government to protect industry?

The Thai government has revised its taxation on emissions to encourage the production of eco-friendly cars. It also detached political activities from daily functioning of government to cushion the industry. The state also continues to implement the World Bank projects to increase the ease of doing business (The World Bank 2014).

Conclusion

Thailand has a high political risk and a moderate financial risk of a company seeking to introduce new car models, locally manufactured and sold in both domestic and export markets.

The political risk highlighted in this paper becomes mild when considering the separation of government, political, and business activities, as well as market independence of the banking sector and a robust foreign exchange policy of the central bank.

A firm introducing a new car model in the market should not expect to perform exceptionally in the current year, unless the new model is an eco-friendly variety that will allow the firm to make significant cost savings on the final product.

Nevertheless, the available support in the car-industry supply chain remains attractive to keep Thailand as a top choice for car manufacturing.

Suggestions

New investments in the car industry should follow a conservative forecast, with overall new car sales for the industry increasing by less than 2 percent in the domestic market. A conservative approach will ensure that the firm limits capital expenditure and focuses on short term results.

Outsourcing to the widely available Tier 1, 2, and 3 companies is preferred as a means of reducing the exposure of a company’s capital to the uncertain political environment.

Appendices

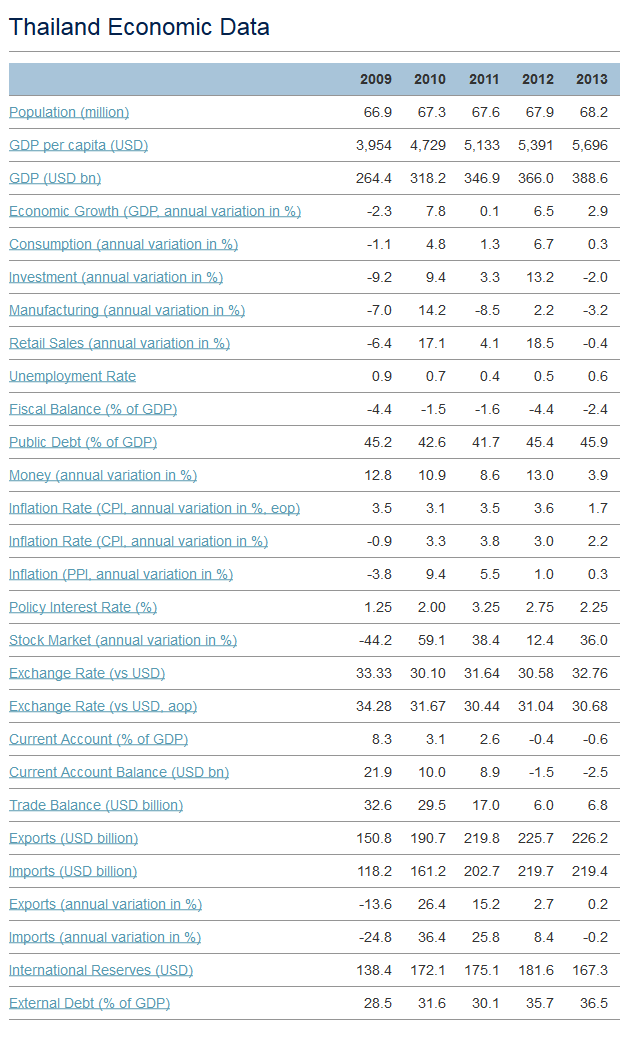

Appendix 1: Thailand Economic Data

Appendix 2: Thai automotive industry structure

Reference List

Asian Development Bank 2015. Web.

Bankok Post 2014, Thailand improves in corruption index. Web.

CIA World Factbook 2015, Thailand. Web.

Global Edge 2015, Thailand trade statistics. Web.

Madura, J. 2015, International financial management, 12th edn, Cengage Learning, Stamford, CT.

National Economic and Social Development Board 2012, The Eleventh National Economic and Social Development Plan 2012-2016. Web.

Reuters 2015, Toyota flags its first drop in vehicle sales in at least 15 years. Web.

Thai PBS 2014, Auto industry to recover next year with cheaper eco-cars in the car market. Web.

Thailand Board of Investment 2014, Thailand Automotive Industry. Web.

The Economist 2014, Thailand’s economy: The high cost of stability. Web.

The World Bank 2014, Thailand further improves the ease of doing business. Web.

Tractus (Thailand) Co., Ltd 2014, Overview of automotive industry sector and route to market. Web.