Under the present system, each office of the company is controlled by a manager who is responsible for all the activities of the respective offices. There are two basic factors which are considered in compensating the managers. The managers are paid a reasonable salary with a bonus based on the net income of the office and a share in the overall profits of the company as a whole. The managers function in a most independent manner and are provided with the necessary authority to make independent decisions for the improvement of the company’s business. However, the managers are made responsible for the decisions they take and are made accountable for the consequences of such decisions.

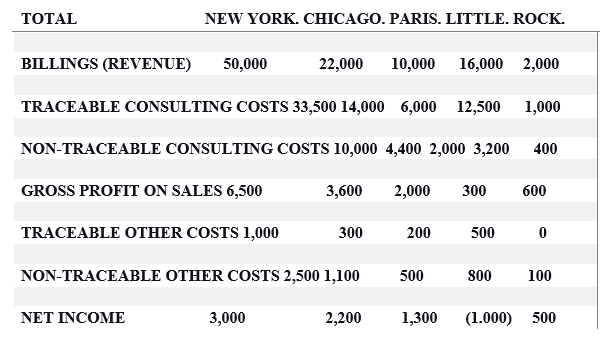

From the cost point of view, each office is allocated a portion of the non-traceable cost which is common to all the offices. The existence of non-traceable costs and their allocation complicates the short-run profit planning (Blocher, Stout and Cokins). These common non-traceable costs are allocated based on the estimated total billings of each individual office for the ensuing year. Presently this allocation is based on gross billings of each office. The following table presents the segment wise operating results for the current year with all numbers in 000’s of $.

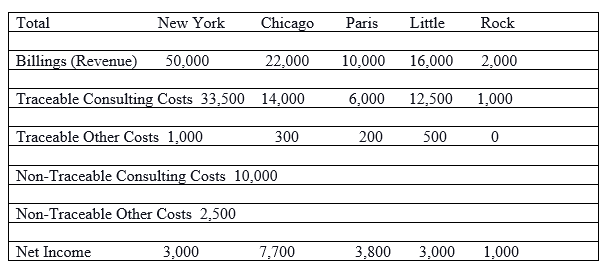

When it is assumed that the non-traceable costs are not allocated office wise income looks as in the following table

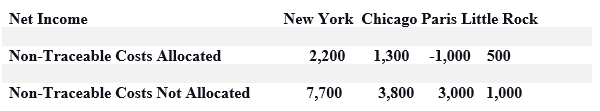

The comparison of the evaluation of the office managers based on the original table and the table with the revised earnings is presented below.

Suitable Method

Non-traceable costs are common costs incurred by a firm which are to be assigned on an arbitrary basis since there are no logical criteria for their assignment (Business Dictionary). From the comparison of the income of the offices as presented in the tables, the second method of not allocating the non-traceable costs appears to be more goal congruence. This view can be supported by:

- Since the non-traceable costs are not incurred by the managers, they cannot be made accountable for such costs. When the non-traceable costs are allocated to the offices, the managers lose their control on the net income of the offices. Still, they would be made accountable for the results, which is not logical.

- The basis of allocation cannot be considered right. When the non-traceable costs are allocated based on gross billings, the office which makes higher billing would get a higher allocation of costs. This amounts to penalizing an office which has done well.

- From the table it can be observed that the Paris office in fact has made some earnings, but becomes negative due to the allocation of the non-traceable costs. Even though it is argued that the non traceable costs have been incurred for the growth of the offices, the method of allocation is fundamentally wrong and is counter productive. A better method of allocation can be arrived based on the actual utilization of resources so that the cost allocation would be meaningful.

Works Cited

Blocher, et al. Cost Management. London: McGraw Hills, 2008.

BusinessDictionary. Non-traceable Common Costs. 2007. Web.