Introduction

Crude oil optimization is considered one basic function in the extraction of oil because it has a significant impact on the cost of oil production, as well the volume of oil output (Alborzi and Hargreave 2010, p. 76). Refinery activities are normally comprised of several processes, including distillation, refinery and the likes.

The process of oil optimization is normally characterized with pressures of operational flexibilities as well as constraints, which can be varied by changing the intensity of the refinery process (and through the update of several products in the same process). In this regard, Fiorenzani (2006) notes that “According to this vision, it is natural to presume that crack spreads, for each product, represent the refiner’s Margins best indicator and crack swaps or options represent the natural instruments to hedge the refiner’s market risk exposure” (p. 63).

The process of oil optimization is therefore not only dependant on the forces prevailing in the market but also the efficiency of the refinery plant. From this analysis, we can see that management policies can be used to mitigate the effects of market pressures on oil production (Alborzi and Hargreave 2010, p. 76).

Planning the optimization of crude oil is normally a complex issue and several companies use certain tools such as linear programming, real-time-optimizers (and the likes), to make the process, a success. However, other companies use design modifications to optimize their production capacities (Alborzi and Hargreave 2010, p. 76).Nonetheless, there are two commonly known methods for crude oil optimization: discrete time formulation and continual time formulation (Fiorenzani 2006).

This study will focus on the main features that make oil optimization possible. However, to gain a complete understanding of this process, this study will explain the technical processes that are normally used in oil optimization. These processes include: Stochastic Dynamic Programming, Linear Programming, and Real-Options technique.

Stochastic Dynamic Programming

The stochastic dynamic programming technique normally factors in the flexibility and capacity for refinery plants to optimize the production of crude oil. The technique is normally applied when the conditions prevailing in the market are unknown (Fiorenzani 2006).

The technique however, uses several control variables to optimize crude oil production. Such variables are normally manipulated in the program and they may include aspects of production, such as storage capacity, minimum or maximum production capacity, oil prices, product prices and the likes (Fiorenzani 2006). Therefore, the biggest task in using the stochastic programming technique is to identify stochastic variables which have the highest significance in maximizing production.

The stochastic dynamic programming technique has been identified to be of benefit to managers because it optimizes the best sequence of decisions. Fiorenzani (2006) acknowledges that “this attribute maximizes the economic margin, facing market price uncertainty, exactly as the refinery manager tries to do in his day-to-day activity” (p. 67). Many researchers therefore note that the stochastic dynamic programming model is not only a mathematical tool used in crude oil optimization but also a high value tool used in the decisions making process.

Linear Programming Technique

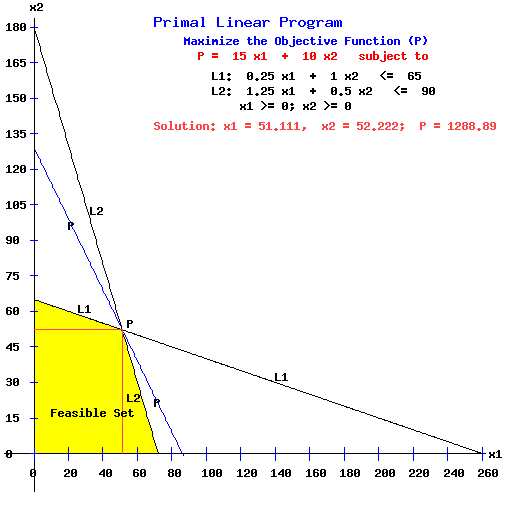

The Linear programming technique is a mathematical tool used to find the best solution for maximum oil production, subject to given constraints and variables. This technique has been used since the 1940s and its main focus is on two aspects: proportionality and additivity (Karuppiah et al. 2007). In making the technique a success, relevant variables and flexibilities need to be factored in, to realize the optimum plan of production. Assuming two unknown variables L1 and L2, the linear programming technique would work as follows:

Many petroleum companies use the technique to increase their oil revenues. The technique normally uses softwares to develop optimum plans. Some major types of softwares used are, the RPMS (Refinery & Petrochemical Modeling System); PIMS (Process Industry Modeling System) and GRMPTS (Karuppiah, Furman and Grossmann 2007).

However, the use of this software is not an easy process as is affirmed by Karuppiah, Furman and Grossmann (2007) who note that: “Development of a refinery LP model is an arduous task that demands sound, accurate and complete understanding of the refining process and planning functions. It requires compilation of enormous plant data and meticulous documentation of the same” (p. 74).

Nonetheless, to develop the nest optimum model, using the linear programming model, several processes ought to be sequentially undertaken. They include mapping of the entire production process, developing a future planning processes, using the best practices in the market; completing functional and design specification for the refinery LP model; refinery model building; factory acceptance test of refinery model; tuning of model at site and trial usage for planning; and carrying out a site acceptance test of the refinery LP model (Karuppiah et al. 2007).

In as much as any petroleum company can use the above processes to develop a LP refinery model, it should be understood that the best LP model represents the operational reality of the refinery. Karuppiah, Furman and Grossmann (2007) add that “The addition of variable data, like costs, prices, raw materials availabilities and products requests, process unit’s capacities and product quality specifications enable the model to set up a problem, from which infinite variant cases can be created and run to arrive at the best plan” (p. 76).

Real Options Technique

The real options technique is normally considered an extreme financial technique in developing optimum plans (Alborzi and Hargreave 2010, p. 76). Contrary to other techniques used to determine investment options, in the oil industry, the real options technique is majorly recommended because it factors in, the flexibility of a given project.

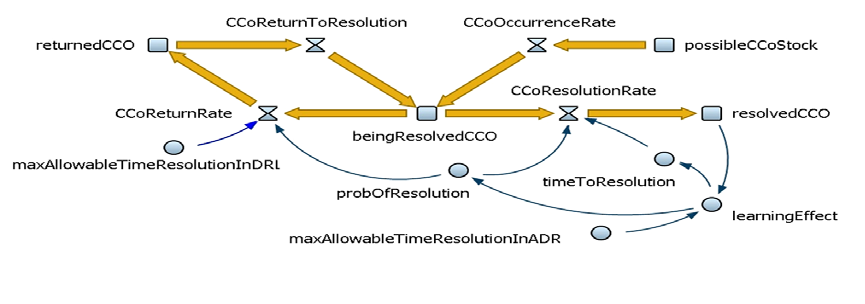

The technique also gets its name from the fact that it acknowledges the fact that, various options normally exist in the oil industry regarding investment options. The following diagram best shows how the technique uses several variables to come up with an optimal plan.

Fiorenzani (2006) explains that “even if the possession of an oil field implies the holding of several options, we only consider the option to delay the exploitation until some useful information arrives and gives the signal to invest” (p. 69). In such a kind of scenario, the uncertainty of a given element in the entire equation is bound to affect the viability of a given option. Such a variable can be the price of crude oil.

Considering the real option technique is normally used by petroleum companies to ascertain future cash flows, it is important to understand that the real option technique uses several methods to come up with future cash flows. This means that the optimum model depends on the method used to come up with the future cash flow (Fiorenzani 2006).

The “two-model approach” is normally considered the most appropriate for the petroleum industry because the approach is considered to give the most accurate price structure for future oil optimization returns. Many economists have compared the future options technique to the net-present value approach used in financial markets. This means that the real options approach can be beneficial in making new investment decisions, making the best decisions in an ever-changing dynamic and deregulated energy market, and determining the best training and commercial activities.

However, the real options method is not easily applied in the petroleum industry, as it is in the financial markets. This is because for the real option technique to be properly applied in the energy industry (or in the context of this study), investment options need to be equated to refinery industrial flexibilities and constraints.

Fiorenzani (2006) affirms that: “Our main purpose was that of demonstrating to refinery managers that real options model is not part of an arcane theory, but an accessible management tool” (p. 70). This technique can therefore be effectively used to develop optimum plans without having to incorporate sophisticated mathematical techniques.

Conclusion

This study notes that crude oil optimization is normally centered on the financial optimization of petroleum companies. To develop the best oil optimization techniques, it is important to acknowledge the role optimization techniques, such as the real options technique, linear programming technique and the stochastic dynamic technique have in influencing the supply chain of typical oil companies (through influencing crude purchase, refining operations, investment decisions).

Through the above technique, petroleum companies can therefore be able to develop effectively an optimum plan by factoring in variables concerning the opportunities and limitations of crude oil production and revenues.

References

Alborzi, S. and Hargreave, J (2010). “Design optimizes sour-crude production facility”, Oil & Gas Journal, 108(28), 76-7.

Fiorenzani, S (2006). “Financial optimization and risk management in refining activities”, Int. J. Global Energy Issues, 26(2), 62-81.

Karuppiah, R., Furman, K. and Grossmann, I (2007). Global Optimization for Scheduling Refinery Crude Oil Operations. Pittsburgh, Carnegie Mellon University (Department of Chemical Engineering).