Fund Management

Before undertaking any type of investment in a portfolio, an investor must formulate a formal document which is used to guide the investment process (Toolsformoney.com, 2010). Therefore, this document must evidently describe the investor constraints and objectives within a clearly defined time frame; in this case for instance Foreign & Colonial has an investment horizon of one year, three years, five years or ten years. The investor’s investment policy assists the investment manager to balance the return seeking against risk taking; this result to increased likelihood of success in attaining the long-range investment objectives during the portfolio design. The portfolio construction is influenced by several factors, some of which are expressed in the investment policy (Toolsformoney.com, 2010).

Thus, Foreign & Colonial investment must align with the investors’ individual investments policy in regard to the type of portfolio, the benchmark, duration, asset allocation, the risk appetite and the rate of return (Toolsformoney.com, 2010). The investment constraints and objectives deemed in the investment market anticipation will state the suitable investment strategies that the firm should follow including stock selection, asset allocation, investment style and suitable methods in which the portfolio performance can be monitored and assessed (Toolsformoney.com, 2010).

The Foreign & Colonial firm has three main elements in its investment strategy; that is gearing, stock selection and asset allocation (Fundnets.net, 2011).

Asset allocation is the main returns driver; in the past ten years, the company has performed well in all the developing nations. The most excellent performance from the emerging nations has been achieved and thus the firm’s placement in these nations will create a less significant affirmative involvement in future.

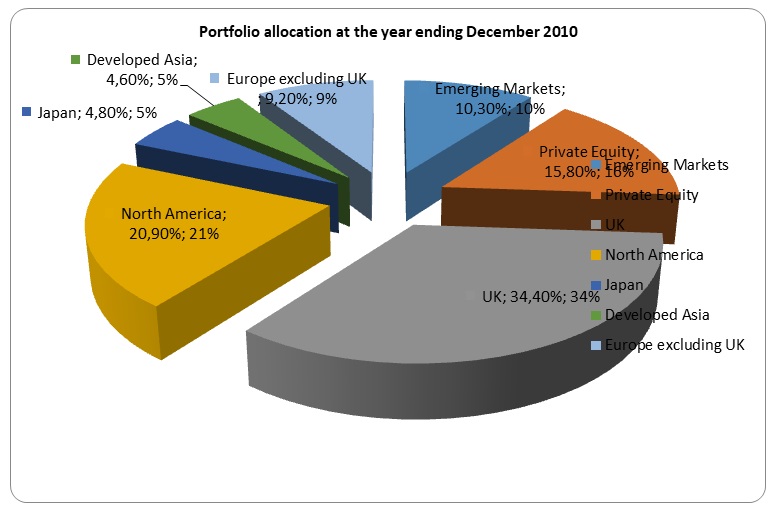

By 2010, the firm had distributed its assets to seven different portfolios in the world which include; “emerging markets, private equity, UK, North America, Japan, developed Asia and Europe excluding UK according to various proportion” (Fundnets.net, 2011) as shown by the pie chart below.

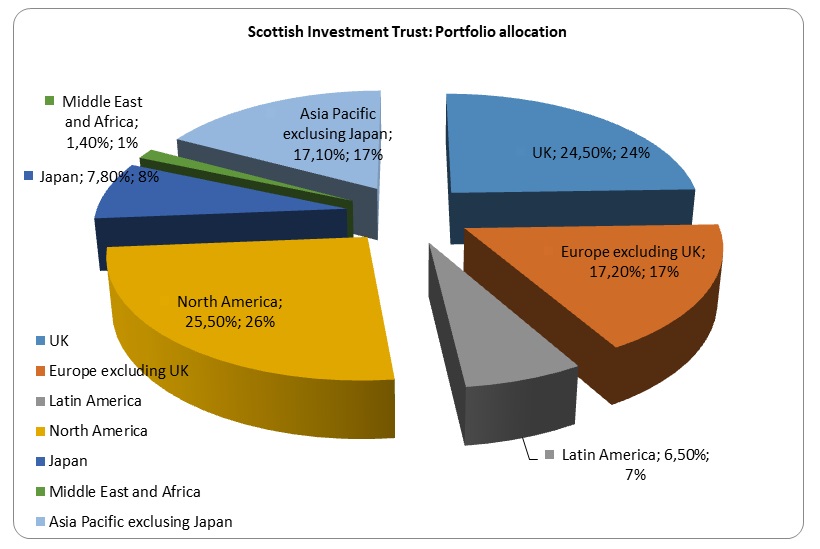

When you compare this to Scottish Investment Trust PLC also allocate its portfolio geographically into seven different portfolio that is “UK, Europe excluding UK, Latin America, North America, Japan, Middle East and Africa and Asia Pacific excluding Japan” (Sit.co.uk., 2011). This implies that the trust or funds uses almost the same strategies of asset allocation but which differs due to the the firms type of portfolios and other factors (Sit.co.uk., 2011). For instance, the Scottish Investment Trust does not have an emerging market portfolio, instead it generally groups its investment portfolio into a general class such as Middle East and Africa or Latin America (Sit.co.uk., 2011). It also does not have private equity as a portfolio (Sit.co.uk., 2011) as shown by the pie chart below.

The second strategy is gearing which uses borrowed funds to improve returns and it has been Foreign & Colonial’s traditional approach. Gearing has attached value for a long period of time although the two stern bear markets have an intention of gearing to have a negative performance. Funders.net (2011) articulates that, the company’s borrowings amounting to £110m are predetermined at a rate of 11.25% as interest until the year 2014, and the early cost of recovery is unaffordable. Many countries in the world are faced with low rate of interest, which implies that in many nations, the firm can purchase shares that have superior dividend yields than the extra cost of borrowings. The firm has actively been transferring borrowings among currencies, in order to locate the lowest rate of interest, which will continue in the near future (Fundnets.net, 2011).

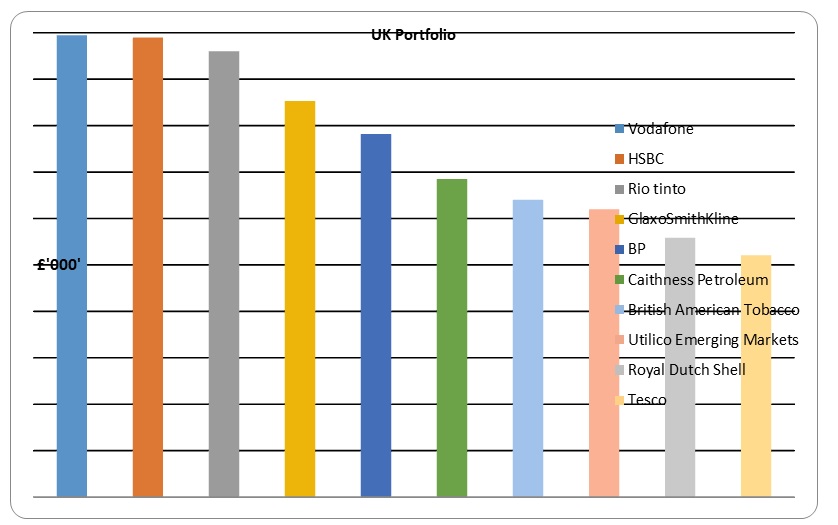

The third strategy is stock selection which has not made net involvement for the past five years and it was negative in the year 2010. Thus the firm has to centre on corporations with strong statement of financial position and growing dividends that is vital, if the fund dividends are going to grow though, there are times when this particular strategy generates capital proceeds lower than the market. For instance, the UK portfolio focuses on firms that have strong statement of financial position and attractive dividends with growth projection that is believed will indicate superior returns in 2011 than the general market (Fundnets.net, 2011) as shown below;

The above graph is a representation of the UK portfolio; 34.4% of the overall portfolio allocated based on the investment region. Each of the portfolio is made up of ten companies, which have the largest holdings in each region except the private equity (Fundnets.net, 2011). The portfolio of the private equity consist of 16 funds of other funds that invest in more than 10,000 firms. Generally speaking, these firms have performed reasonably well in the past three years, regardless of the number of them having superior debt levels.

Indeed, many firms in this category are prized with reference to share prices of listed firms, thus the strong upturn in the stock markets ever since 2009, has progressively been replicated in their assessment (Fundnets.net, 2011). The valution is expected to increase in 2011 after the rise in price of shares in the last quarter of the year ended 2010. If the portfolio produces considerable amounts of money as proceeds surpass investments, the firm will have attained its target level of 10% of the overall portfolio in the private equity (Fundnets.net, 2011). Among the company’s 2011 priority is superior stock selection while the next main major task is making a decision on the long-range gearing strategy since the firm will be more flexible after 2014 (Fundnets.net, 2011). The other strategy for the firm is establishment of a private equity assortment, primarily aiming at 10% of total portfolio, to over-weight in the emerging nations in relation to the yardstick weighting, AND for Foreign & Colonial to utilize the exterior sub-managers, if this is possible it will lead to superior performance (Fundnets.net, 2011).

The firm’s buyback policy makes up the company’s wider strategy in which the board may attain less volatile markdown with ceiling, in the usual market settings, of 10% and developing the Net Asset Value per Share (Fundnets.net, 2011). The firm’s investment objective attempts to secure long-range development in income and capital by use of investment policy chiefly in a globally branched out portfolio of listed public equities, in addition to unlisted securities and private equity, through the utilization of gearing (Fundnets.net, 2011).

Diversification of risk is attained by geographically allocating assets, Inclusion of the sector and selecting stock across an extensive market range. In the wide-ranging policy of upholding a portfolio which is diversified, there exist no particular geographic or sector disclosure restrictions for the listed public equities. A 5% of total portfolio value has been placed by the board on the unlisted securities, during the purchase period and keeping out investment on private equity as well as several unlisted investment needs with specific approval from the board (Fundnets.net, 2011). However, the borrowings are expected to fall within 0% to 20% range of the owners’ funds according to market value of the firm’s debentures.

The firm will naturally remain completely devoted to equities, though it is not banned from putting in money in other forms of assets or securities. Derivatives should be utilized in risk control and in return improvement for the portfolio as well as, if suitable, securing against risks arising from currencies (Fundnets.net, 2011).

This type of fund is appropriate and can be recommended to all investors ranging from individual to institutions, as the investors’ are required to state or write down their own investment constraints and objectives in the investment policy. Therefore, each and every investor has their own unique investment objectives and thus it is for the fund manager to determine which strategy or approach to use in order to achieve the investor specific investment constraints and objectives.

In the year 2010, the firm made two main strategic decisions. First, the share prices were expected to fall following the strong rally, which started in 2009. Due to expectations, the firm made a number of sales from the emerging nations’ portfolio and it repaid the entire short-range borrowings at the year ended 2009 (Fundnets.net, 2011). Markets turned out to be on the edge at the start of the year 2010, since Greece was facing a budget deficit and fear also mounted slowing the growth of the economy internationally.

Additionally, the oil spill at the Gulf of Mexico resulted to a quick fall in the BP’s price of shares and dividends suspension. As a result, foreign & Colonial took its second main decision for the mid-year 2010 and raised the effective gearing by 63% to 12.4% as a short-range debt attained £81m (Fundnets.net, 2011). All markets increased strongly in the remaining half of the year 2010. The fear on the recession was relieved by normally good growth in the economic statistics. Investors stopped to be concerned with growth as their concern switched to inflation, in Europe the prices of shares rose in spite of the requirements of another bailout.

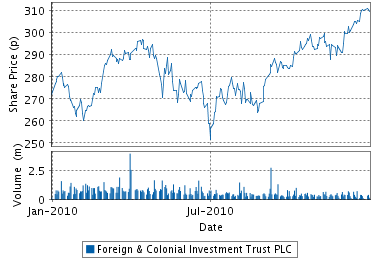

There was superior appreciation on the firm’s good performance as they accounted superior results than forecasts (Fundnets.net, 2011) and the chart below indicates the share price movements in the year 2010;

At the end of the year 2010, the short-range debt had increased by 112% to £172m, resulting to an effective gearing increase of 6.5% to 13.2% compared to the mid-year values.

The firm strategic decisions on gearing were totally accurate, though selecting the currency to have a loan of, was difficult since there was fine rationale as to why every currency must be weak. Thus, the company is able to time the market effectively through superior asset allocation approaches (Fundnets.net, 2011).

As discussed above the firm usually allocates or distributes it portfolios into seven geographic locations with each portfolio being made up of 10 companies. These portfolios are then benchmarked with an index which also contributes to the firm’s total return (Fundnets.net, 2011).

The firm also has a superior stock selection as it has identified 20 largest holdings within it portfolio which represent 30.4% of the firm’s overall investments and it has also selected the right asset to take in a portfolio (Fundnets.net, 2011).

Therefore, Foreign & Colonial Investment Trust PLC has applied the two portfolio management approaches namely; passive portfolio management and active portfolio management approaches. The objective of the fund manager using passive portfolio approach is not really to register superior performance but to replicate the performance of a benchmark. Thus each investor or fund manager must identify a benchmark upon which to measure performance. Passive strategies are normally two; indexing, and buy and hold (Investment.rusell.com, 2010). Indexing – A fund manager, who follows this approach, identifies a certain benchmark, which closely represents his or her own investment desires. For instance, Foreign & Colonial has a composite benchmark against which it measures it performance that is 60% FTSE WI World ex UK/40% FTSE All-Share (Fundnets.net, 2011).

Investment.rusell.com (2010) argues that, once the benchmark is recognized the fund manager will try to replicate both particular assets in the benchmark portfolio in addition to asset allocation strategies of that particular benchmark. These strategies are then implemented as for every change in the benchmark (Investment.rusell.com, 2010). The fund manager can decide to follow the benchmark in two ways; full replication, where the fund manager attempts to reproduce the benchmark as per the proportion in the benchmark although it is sometimes hard to implement because the fund manager will always be operating on stale information and not all assets in the benchmark might be available in the market for sale and the lack of resources (Comprehensivepensiongovernancegwahl.word.com, 2011).

Under partial replication, the investor acknowledges the challenges of full replication and therefore decides to take a representative sample of the asset in the benchmark and invest in them. Thus the firm, take a representative sample from the benchmark for the seven portfolios except private equity, which is not measured against any benchmark, thus private equity uses active fund management (Investment.rusell.com, 2010).

Conversely, active fund management emphasizes on maximization of risk-adjusted returns for every level of risk taken and such a strategy requires the fund manager to make superior returns in the market by capitalizing on mispricing existing in the market (Investment.rusell.com, 2010). Thus, the investor must be able to select the right asset to include in a portfolio and must be able to time the market effectively through good asset allocation. Thus the investment in private equity are worth investing in, since the fund manager constantly identify the undervalued stocks in the market to include in the portfolio at the same time overvalued stocks present in the portfolio are also identified and disposed off to obtain capital gains (Investment.rusell.com, 2010).

The fund manager is also able to identify stocks with superior dividends yields in order to maximize returns from the stocks as well as those with the highest returns potential through the earnings per share for long-range investment. Active management ensures that the portfolio is properly diversified in order to eliminate unsystematic risks. This includes private equity through active management, which does not require many resources except a small amount of fee, is charged for management (Investment.rusell.com, 2010).

The firm’s allocation strategies can be explained by 85% of the benchmark, this is because the benchmark and the firm’s portfolio have a strong positive relationship meaning both shows increase in returns and vice versa (Fundnets.net, 2011). But the firm was not efficient in tracking the benchmark due to the presence of a standard error of 6.13%

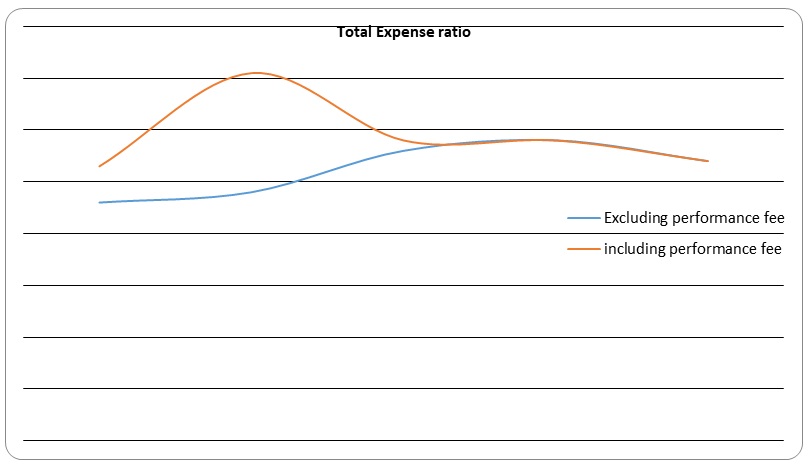

The firm uses eight indicators to measure its performance, these include; expense ratio, performance attribution, share price return, annual growth in dividend, savings plans, discount to the net asset value, investment flows, and net asset value return (Fundnets.net, 2011).

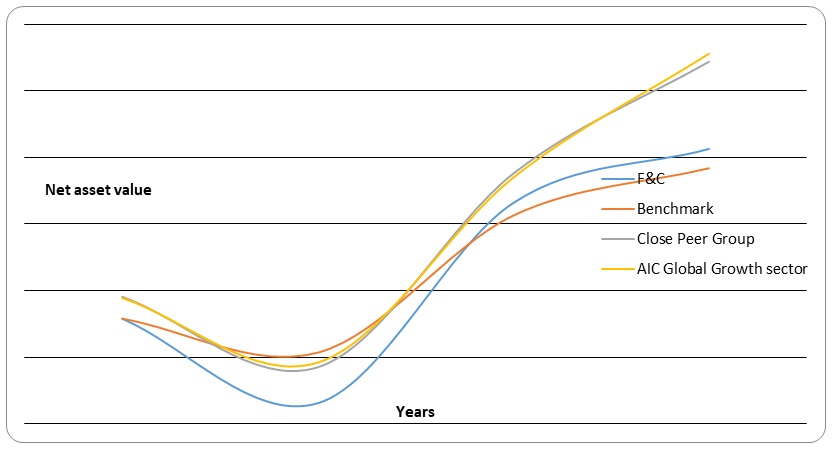

The graph above shows that the firm was underperforming compared to the benchmark, AIC global and the close peers in terms of net asset value during the first three years but its performance improved in the fifth year; the rising trend continued to the tenth year (Foreignandcolonial.com, 2011).

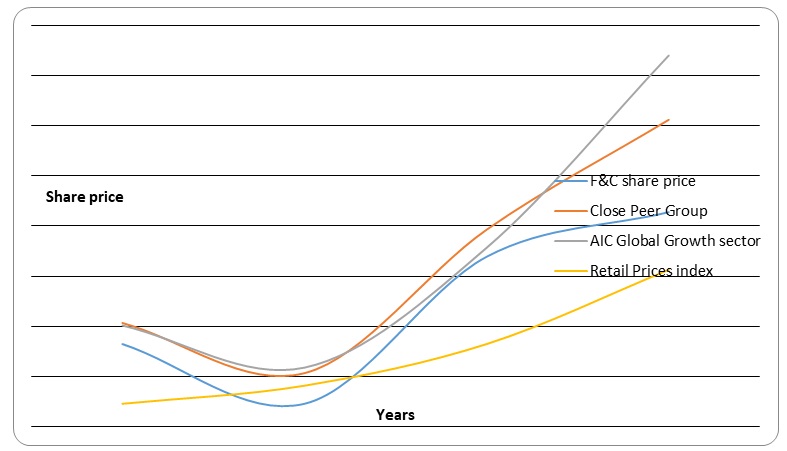

The firm share price was low in the 3rd year, but the trend changed and the price increased tremendously from the fourth to the fifth year. Following that, was a slow increase in share price as shown by the graph above.

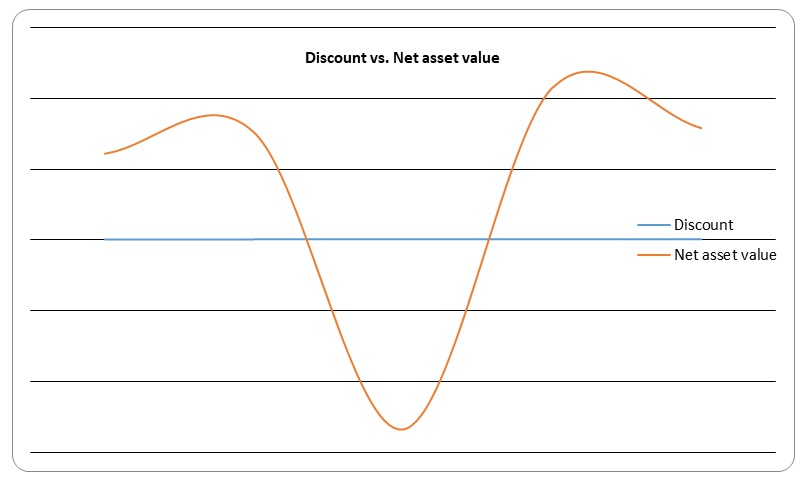

The discount does not have much effect on the net asset value as the discount is almost constant while the net asset shows a wide variation with a negative value in 2008, which then increased tremendously in 2009 (Foreignandcolonial.com, 2011) as shown by the above graph.

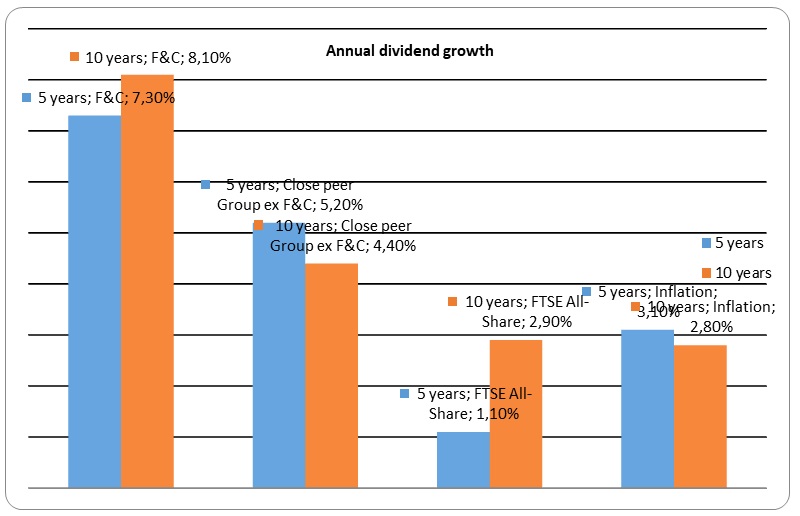

For the past 10 years, the dividends had increased by 11% to 8.1% based on the 5 years data compared to peers who had a decrease in growth by 15% as shown by the above graph.

The performance trend may be as a result of the regulatory response to financial crisis caused by several factors such as increase in oil prices in the North Africa and Middle East as well as increase in commodity and food prices leading to share price fall in emerging nations’ share prices (Foreignandcolonial.com, 2011). In UK inflation is compounding the problem as it is continuing to increase the cost of borrowing funds for investment (Foreignandcolonial.com, 2011).

In conclusion, retail investor may utilize the services of a fund manager since they have the experience on how to manage funds and they are able to diversify risks due to investment in several portfolios, but they have to part with some pounds as management fees.

A pension fund is established by the employer to organize and facilitate employees to invest their retirement funds that are contributed by both the employees and the employer (Inderst, 2009). It is a common pool of asset intended to produce a steady growth for a long period of time, and it offers pensions to the employees after retirement (Inderst, 2009). The fund is mainly managed by a number of financial intermediaries on behalf of the employees and the firm, but larger companies usually manage their own pension fund. The fund actually controls huge amounts of assets in many countries and has as a result become the biggest institutional investor (Inderst, 2009).

A pension fund can be classified into two classifications; that is “private vs. public and closed vs. open pension funds” (Inderst, 2009). Public fund is regulated by the public law whilst private fund is controlled by private law; on the other hand, open funds maintain more pension plans without any limitation on the membership while closed funds maintain only those pension plans that have limited membership (Inderst, 2009). Over the past few years pension fund has changed in order to provide the best pension to the retired persons for a better future; these changes are as follows;

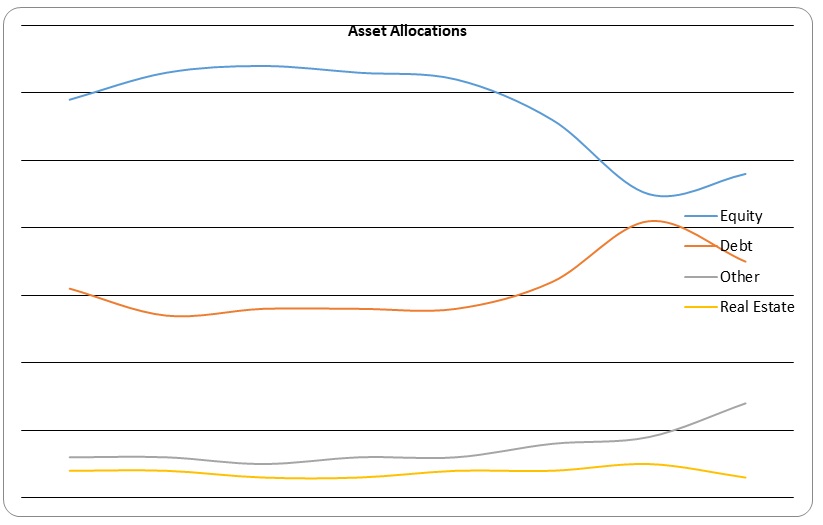

Asset Allocation

Infrastructure investment is the new trend for the pension funds in the past few years (Inderst, 2009). Recently investors are attempting to diversify their investments in wider range of investments compared to the past, in search for better diversification to mitigate risk and other return sources. Thus, they are exploring beyond the conventional asset classes such as bonds, real estate, equities and cash (Inderst, 2009).

The strong market for stocks in 1990 supported funded pension development and distributions of equities in many nations which were raised by the pension funds. However, TMT-bubble burst in the first years of 2000s and the succeeding recession resulted to significant funding and problems of solvency for the pension funds which then affected both balance sheet sides (Underhill, 2007). The prices of assets and pension liabilities fell because of low rate of interest and improved longevity. This resulted to rethinking of the pension funds’ asset allocation after realizing there was no protection against the inflation, risks arising from the interest rate and market volatility (Underhill, 2007). To correct this, the investment experts decreased the long-range return predictions for typical government bonds and equities; as a consequence, most pension funds begun to search for alternative investment opportunities (Bis.org, 2006).

The investment environment was expanded to embrace corporate bonds with high yields and was also now invested more globally, especially in the emerging markets. Additionally, the investment sector begun to provide optional asset classes such as commodities, commercial loans, hedge funds, private equity, forestry products, currency and microfinance among others (Bis.org, 2006).

Infrastructure investment ideas appear to harmonize most pension plan members and directors. This is because infrastructures are tangible and are designed for a long duration of time which naturally fit the long-range liabilities of numerous pension plans. This type of investment is sustainable and it is becoming more and more popular especially for the industry-wide and public pension plans (Inderst, 2009).

In mid-1990s, the Australia set up its first infrastructure funds where the local U.S. superannuation plans were the first investors to invest in them (Antolin, 2008). The financial institutions in Australia begun to encourage such type of funds extensively for the pension funds and ever since 2005 some pension plans particularly from U.S. and European have completed their first real actions whilst others appear to be considering them (Antolin, 2008).

For the past two to three years, the pension funds financial products have increased rapidly through linked research and marketing reports and the media interest on the whole has followed. Unfortunately, there is significant misunderstanding in this particular area such as the description of the infrastructure assets and that’s why the pension funds have different labels such as real estate, alternatives and listed equity among others (Antolin, 2008). The diagram below shows that asset allocation started to shift in the year 2007 between various assets classes (Antolin, 2008).

Accounting standards

The management of the pension fund has significantly changed over the past years and the increasing orientation of the accounting standards on liabilities and assets market values are emphasizing on new solutions that will overcome the disadvantages of the traditional asset-driven investment approaches (Actuariesindia.org, 2007). Many firms are utilizing the FRS 17 when accounting for pensions; companies that used IFRS, are currently using IAS 19 to report the employee benefit plans (Yermo, 2008). The aged SSAP 24 standard was merely an actuary’s suggestion for the funding rate of the pension scheme that turned out to be an income statement expense. Any extra unique contributions to the pension were capitalized and spread over the useful life of the pension plan to the retirement.

In the recent development, the unfinanced pension benefits under the defined benefit scheme must be accounted for as liability in the firm’s statement of financial position. The rate of discount to the value liabilities must be in accordance with high quality yields corporate bonds at the end of the financial year (Actuariesindia.org, 2007).

Also, pension plans in the past few years were in arrears particularly in UK while the charges arising from benefit provisions were increasing from the employer’s perspective. In many situations, extra contributions from employers were not likely to bridge the gap exclusive of any assistance from returns being generated from investments (Actuariesindia.org, 2007).

Cost

In the UK, the tax relief cost on the pensions has increased by “100% in the past few years to approximately £19,000 million in the financial year 2008-09” (Insley, 2010). The government prior to this change had planned to decrease the tax relief on the pension by approximately £4,000 million every year, though these changes were complicated especially to those earning in excess of £150,000 (Insley, 2010). It would also have resulted to a negative impact on the management of the end-salary pension plans that is still in existence. Currently, these transformations aim to offer similar savings though with less damage to the UK firms pension plans (Insley, 2010).

Most developed nations are attempting to lift their economies from the recession and are therefore reducing their expenditure while the Australian superannuation sector continues to forge ahead. Although, insecurity is one of the features in Australia just like any other country, with the current legal framework this is anticipated to change after the superannuation sector review by the government. The review focused on improving the administration efficiencies and also on defaulting investment alternatives for building up the funds (Towerswatson.com, 2011). There is more effort being put to lower the costs which are beneficial and there are more concerns that several attributes will complicate the ways in which the funds and the trustees will help majority of the members through several levels of investing for the retirement (Towerswatson.com, 2011).

Australia is considering another review on the tax system which will modify the way in which superannuation will be taxed but not yet signaled. Although, due to its commitment to election, the government has shown the intention of raising the amount contributed by the employer from the present 9% to 12% before 2019, implying that cash inflows to the pension industry will probably increase in the future (Towerswatson.com, 2011). In Canada, a pension debate is in progress, with the participant examining whether there is need to extend the coverage to reach a wider population since the current year will be a transitional year for the employers’ pension schemes. Numerous schemes will have changed to the new accounting standards with expectation that the sponsors for the defined benefit (DB) scheme will continue to provide the accruals of the pension to the existing and future employees.

The DB scheme benefited from superior equity markets in the year 2010 but the anticipated funded ratio growth did not succeed for some as the longer-ranged bonds rallied leading to more increase in the liabilities solvency than the assets growth. As a result of inflation-related methods of numerous DB schemes, there is rising concern in the infrastructure and real estate products (Towerswatson.com, 2011).

The financial crisis had a considerable effect on the risk profile and risk perception for many Germany’s firms that have changed their way of managing their pension schemes. Approximately 74% of the firms believe the difference between liabilities and assets is the major pension funds risk aspects and as a consequence, new funds are assuming Asset-Liabilities-Modeling driven strategies to plan their allocation strategies for the assets, whilst shortfall risk and stress test measures have become popular (Towerswatson.com, 2011). Thus, hedging the rate of interest and risk arising from inflation has significantly increased.

Some of the German firms hedge the risk arising from the interest rate in their funds by utilizing the Interest Rate Swap or the long-range bonds (Projectm-online.com, 2009). The rise in the risk aversion is supported by a decrease in the mean exposure to the equities from the 22% to the current 16%; bond investments have risen considerably and most interesting is that active management has become more popular, especially with the fixed income (Projectm-online.com, 2009).

The rules have changed in the UK as a result of the financial crisis in the year 2010, these rules include; first, a number of schemes now requires to utilize the consumer prices instead of the retail prices as a way of up rating most of the benefits. Since the retail prices have developed more than the consumer prices by approximately 0.7% per year, which may decrease the pension liabilities significantly (Projectm-online.com, 2009). Second, the new regulation will only be applicable to the alternative asset managers from outside and within the EU that intend to promote their schemes to the investors in the EU (Projectm-online.com, 2009). Lastly, the law-makers proposed new regulations for transforming the clearing procedure in certain derivatives. If the rules are implemented in their present form, they may result to higher costs for the pension plans during the time of hedging the risks (Projectm-online.com, 2009). The UK pension schemes are showing some signs of change in behavior, possibly as a result of the rise in the investment and rules complexity. Several plans, currently seek a superior stages of allocation than before (Projectm-online.com, 2009).

The present economic circumstances have positioned the US municipalities in the ever-increasing economic pressure with municipal bonds in a better inspection. One of the common issues is the collapsing tax receipts, whilst the second issue is the superior stage of the under-funding in the pension plans (Projectm-online.com, 2009). Several estimations of the recent amount of the under-funding amounts to millions of dollars (Projectm-online.com, 2009) while the public pension schemes have ended up to be a grouping of governance practices, politics and the accounting regulations. These regulations sustains an insistent investment policy, supporting risky asset investment by recommending that the pension plan liabilities be discounted by use of the anticipated or the required rate of expected return on the assets (Towerswatson.com, 2011). IASB has currently proposed some changes to the pension accounting treatment in the income statement under the IFRS. These changes to the accounting standards may be authorized in the US, irrespective of the SEC permission (Towerswatson.com, 2011).

The funding gaps risk for the defined benefit scheme increased significantly as a result of the global economic crisis; the funding level in many OECD nations fell below 90% (GoldmanSachs.com, 2010). The ratio decreased below 95% in Netherlands, compared to the least ratio which is normally 105%; interest rates also decreased as a result of the international recession and financial crisis (GoldmanSachs.com, 2010). This implies that the generated returns from the issued bonds are decreasing, in addition the fund liability increased because of the decrease in the discounting factor aligned with rate of interest that increased the current amount of liabilities (GoldmanSachs.com, 2010). The reduction in the funding level may result to the transfer of the fund investment approaches, to slices in the pension assurances or to ask for extra contributions. Pension promises cut may include ending the indexation of payment of benefits or partly indexing of payments (Projectm-online.com, 2009).

The ageing population is posing a problem to the pension scheme as the governments are changing from the pay-as-you-go arrangements; the European nations are responding to this problem by transferring the retirement planning liability to the working-age people (GoldmanSachs.com, 2010). Recently, the sector is changing in terms of transition management, some of the reasons for this are due to the superior volatility as well as the consequences of the financial crisis (GoldmanSachs.com, 2010). In addition, there is also an increasing utilization of a broad range of complex and frequently less assets that are liquid which means that trustees may look for expert assistance (Davy, 2011). Next year some larger firms will be obliged to enroll employees to their pension plans except if they decide to leave meaning that many are assessing their pension plans. They are actually asking whether a better deal will be obtained since their schemes are obtaining more cash (Davy, 2011). Thus employers have been woken by these issues and are changing in order to cope with the changing times. These transformations are supported by a development that is also motivating the interest to have transition management especially on the side of the DC pension arrangements (Davy, 2011).

The change to the IASB’s outlook implies that some unstable parts of the pension schemes including liability and asset losses and gains, will not be reflected in the earnings per share and the net income. But the service costs, benefits from the prior service enhancements in addition to the benefits gained by the present employees in the present period would be identified in the operating income (Davy, 2011).

In case the scheme was underfunded or overfunded, this would mean that the interest part would be shown as expense or revenue. It would be determined through multiplying the financed status by rate of discount, equating to interest revenue in case the scheme was overfunded or interest expense for the underfunding situation, reported in the income statement as a financing component (Davy, 2011).

Davy (2011) elaborates that, re-measurements always includes real asset losses or gains plus changes to the current amount of the pension plan liability as a result of changes in the long-range rate of interest will be reported outside the income statement in OCI. Such kind of treatment will imply that the actual losses or gains are presently amortized into the pension cost over duration of time will be transferred to the OCI (Davy, 2011). This implies that the pension expense will be lowered in the present environment since many firms amortize losses, this will only be possible if other factors are held constant (Davy, 2011).

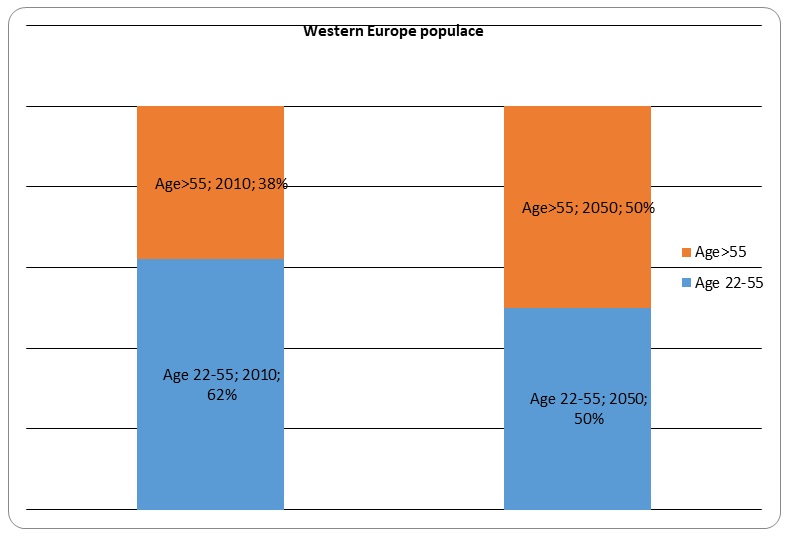

Based on the UN figures, the percentage of the global population with a minimum age of 65 will probably double in the year 2050 from the current proportion of 7.6% to 16.2% (Davy, 2011) and it is more likely that about 1 billion individuals by the year 2050 will be aged 65. To be more specific, in the European region, half of the populace will have reached the age of 55 by 2050 (Davy, 2011) as shown by the graph below.

As long as most assets being managed are held by the old people, this poses significant assets outflow risk to the fund management sector as a result of decumulation. On the other hand, since the government is gladually changing from pay-as-you-go system and since also decumulation embraces a considerable risk for the accounted figure of potential retirees, fund managers may be posed with new opportunities given that they will be able to provide sufficient long-range pension as well as retirement solutions (Pwc.com, 2011).

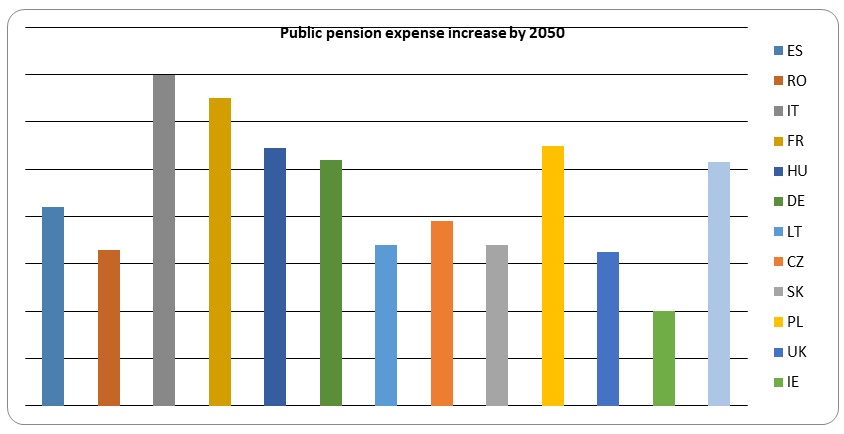

Pwc.com (2011) stipulates that by the year 2050, each retiree in EU will be represented by two workers, which implies that the present ratio of 1:4 will have deteriorated to 1:2. The ageing population will have an impact on the emerging markets in countries such as China; the impact will be that every retiree will be represented by five employees in the year 2020 as compared to the 1990 ratio of 1:10. As a result, public pension expense will increase to 12.4% from the current 10.3% of the country’s GDP by the year 2050 in the European region plus in Spain the percentage will rise to 16% (Pwc, 2011). In the present situation, the expenses for the retired individual will intensely impact on the growth prospects but will also cause a rise of the debt levels. In such a way that an addition of 1% of the GDP of every year for the next 20 years will not completely result to a debt of 60% of the GDP (Pwc.com, 2011) as shown by the graph below.

The transfer of the retirement planning liability to the working-age people will generate new challenges to the people who presently have to decide on the type of the investment they will undertake in the long-term for their financial well-being in the future. Such decisions will have to take into consideration the savings needed to rally the long-term retirement as a result of rise in the life expectancy, in addition to the accountability of the inflation and investment risk (Pwc.com, 2011).

Conclusion

In conclusion, as the governments depart from the pay-as-you-go system, it is necessary that it put into consideration the future risk bearer in the provision of the retirement income if it will not be the one taking that risk. The government must also consider various possibilities like if the risk is borne by the retirees, then who will make sure that the retiree will put adequate savings to be used after retirement, failure to that results to old-age poverty.

Addionally, the government must also consider whether the fund management sector will take that risk, assuming that if the assets being managed fail to generate the expected returns which are required for the gradually huge retiree income outflows, where losses should be covered by the manufacturer of such products. In such a situation, the government must be able to account for the rivalry impact on the asset management sector, bearing in mind that the fund sector is not completely equipped to provide retirement and pension solutions.

References

Actuariesindia.org. 2007. Risk management in occupational pensiosn scheme. Web.

Antolin, P. 2008. Pension Fund Performance, OECD Working Papers on Insurance and Private Pensions, No. 20, OECD publishing,OECD. Web.

Bis.org. 2006. The shift from defined benefit to defined contribution pension plans: Implications for asset allocation and risk management. Web.

Comprehensivepensiongovernancegwahl.word.com. 2011. Target date funds. Web.

Davy, P. 2011. Transitional specialists set their sights on the DC pension funds. Web.

Foreignandcolonial.com. 2011. Investor information. Web.

Fundnets.net. 2011. Foreign & Colonial Investment Trust PLC: Reports and Accounts. Web.

GoldmanSachs.com. 2010. 2010 Pension Preview: Challenges and Changes. Web.

Inderst, G. 2009. Pension Fund Investment in Infrastructure, OECD Working Papers on Insurance and Private Pensions, No. 32, OECD publishing, OECD. Web.

Insley, J. 2010.What are the pension changes and how will they affect savers?Web.

Investment.rusell.com. 2010. Why should investors consider an alternative to passive investment. Web.

Projectm-online.com. 2009. Pension funds and financial crisis. Web.

Pwc.com. 2011. Rethinking distribution: creating competitive advantage in a new fund distribution paradigm. Web.

Sit.co.uk. 2011. Facts and Figures. Web.

Toolsformoney.com. 2010. Investment Policy statement basics. Web.

Towerswatson.com. 2011. Global investment matters. Web.

Underhill, M.D. 2007. Sustainable Infrastructure Investing. in: Responsible Investor, Thematic Investment, Response Global Media Ltd, p. 21-24.

Yermo, J. 2008.Governance and Investment of Public Pension Reserve Funds in Selected OECD Countries. OECD Working Papers on Insurance and Private Pensions, No. 15, OECD Publishing.