Introduction

Life cycle maintenance approach of transformers in the power transmission system of hydroelectric power plants was reviewed in assignment 1. In this assignment, the life cycle cost of transformers is assessed using life cycle cost (LCC) analysis. The aim of the paper is to explore the application of life cycle cost analysis and its benefit to engineering asset management of Dubai Electricity and Water Authority (DEWA), which is a utility company for supplying electricity and water.

DEWA – Background

DEWA is the sole electricity and water provider in Dubai. It was formed in 1992 after merging the Dubai Electricity Company and Dubai Water Department (DEWA 2016a). The company generates, transmits, and distributes water and electricity across the United Arab Emirates (UAE).

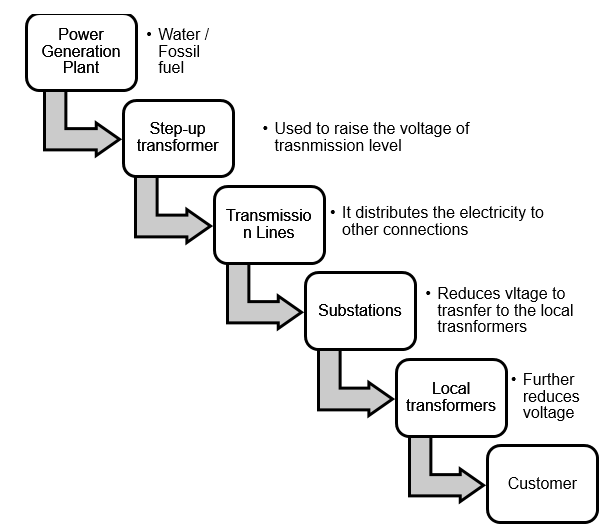

A general flowchart demonstrating the positioning of the asset is shown in figure 1. The flowchart depicts the position of different kinds of transformers used in the power transmitting system in DEWA. The electricity supply voltage for DEWA is 220kV to 400kV (DEWA 2016b). The transformers used are of two types – ground and pole mounted. The company uses latest digital technology for its substation transformers to enhance reliability and efficiency of its operations.

The transformers used are above 2000 megavolt amperes and each substation connects over 1.5 km of overhead lines. According to DEWA power supply guidelines, the company has 110kV distribution network using 400/1332kV and 132/11kV substations (DEWA 2016b). The company uses both underground as well as overhead cables for power transmission.

In this process, the function of the transformer is to convert the alternating current produced at a low voltage in the generator to a higher voltage. The transformers use two coils namely the supply and outlet coil. The former helps the transformers to receive current from the generator and it passes out current through the other coil. The number of turns that the outlet coils has decides the voltage at which the current is passed out.

For instance, if the number of coils in the outlet coil is double of the supply coil, then the voltage that passes out also doubles. The outlet coil of the transformers is connected to the nation grids that distribute the power to the domestic and industrial consumers. Here, it should be noted that the voltage at which various customers require power is different. For instance, an industrial consumer will probably require power at a higher voltage than a domestic user. Hence, the power supplied by DEWA varies from 220V to 400V.

Reason to Review Asset

The asset chosen for this particular paper is the transformer used in power transmitting devices used in DEWA for transmission of electricity. This particular asset has been chosen, as power transformers are crucial to the process of production and distribution of electricity. A life cycle analysis is used as transformers usually have a lifespan of around 40 years. LCC approach entails an analysis of the operation, installation, maintenance, and end-of-life analysis, which is essential to reduce environmental load and to improve the control of accidents and other hazards (Hegedic et al. 2016).

Power transmission system is an essential part of the company’s operations as it helps to transmit power from generation to distribution. A transformer is the most important equipment in the transmission system. The transmission system carries electricity to the consumer units with the help of transformers. It assists the system to lower the voltage while transmitting electricity. This increases efficiency and reliability while reducing power loss (Hegedic et al. 2016). Therefore, proper functioning of the transformers is an essential part to maintain the performance of the power distribution system.

Sustainability of eco-friendly transmission system and transformers that ensure this goal is essential for any power supply system. DEWA adheres to these environmental norms and has established energy efficient transmission system that helps in optimization of its environment-friendly power supply. As the UN has passed a resolution to ensure all power supplying companies to reduce its carbon print to reduce greenhouse gas emission, it has become crucial to have a continued life-cycle assessment to phase out the transformers that are no longer economically as well as environmentally viable. Hence, it is imperative to have a life cycle cost analysis in place in order to ascertain the environmental and economic burden of the assets at different stages of their life cycle.

Life Cycle Cost Analysis and Suitability

What is LCC Analysis?

As distribution systems in power plants are one of the most important equipment, LCC analysis is used to estimate the total cost of ownership (Bian et al. 2014). LCC has been used for a very long time. This analysis helps to account for all the manufacturing, operational, and maintenance costs accrued by the company to use a particular asset (Jeromin et al. 2009). This section of the paper tries to answer the question of suitability of a particular life cycle cost model used for determining the feasibility of sustained use of an asset. It will also provide a framework aiding managers and engineers to make informed decisions.

First, it is imperative to understand what is LCC and how it can help to optimize the performance of assets. LCC is the total cost of possession that includes the cost of procurement, operation, upkeep and disposal of the asset (Sinisuka & Nugraha 2013). LCC includes both deterministic as well as the probabilistic cost. The former includes the cost of procurement, upgrading, and discarding while the latter includes costs involving malfunctioning, repair, changing of faulty parts, and other maintenance costs The probabilistic costs, therefore, are related to the maintenance and sustainability of the asset. LCC analysis should be done due to two reasons –

- to understand the sustainability of this particular asset to others;

- to determine the most cost-effective asset.

Understanding the condition of the asset at various stages of its life cycle provides a holistic view of the whole-life asset cost and management implications. Hence, an LCC approach is adopted to ascertain the financial viability and sustainability of transformers in electrical power distribution systems.

According to the IEC 60300-3-3, in order to conduct an LCC analysis, it is necessary to segregate the process into six cost-triggering stages:

- conceptualization and definition,

- designing and development of the asset,

- manufacturing process,

- installation of the asset,

- operational and maintenance process,

- disposal of the asset (Jeromin et al. 2009).

Jeromin et al. (2009) point out that all these six processes can be combined to form three distinct elements of cost analysis namely, investment, operating, and recycling cost. Here, investment costs include the costs incurred at stages of designing, manufacturing and installation of the asset. Operating costs include generation operations and maintenance of the asset (Amoiralis et al. 2007). Recycling cost includes end-of-life disposal of the machine. These are the major cost imperatives for a transformer LCC analysis. Some other data that must be considered while determining LCC are the interest rate, inflation, and lifetime usability of assets (Jeromin et al. 2009).

Suitability of LCC

This approach is a suitable form of cost analysis as it ensures that the asset remains viable. Optimization of life cycle cost helps to utilize the asset helps to cater to the customer needs most effectively. LCC analysis shows the areas where improvement or maintenance is necessary. Further, LCC also includes environmental and social costs along with the financial cost of sustaining an asset. This helps to look into the environmental factors of maintaining a machine.

Further, LCC also ensure that different measures are obtained to guarantee total cost visibility (Blanchard & Blyler 2016). Further, as a model, LCC is more affordable and its emphasis on the design stage of the assets makes it more cost-effective. For systems that have just been installed, a phase-wise analysis is suitable but for assets that are already in use, it is imperative to use a targeted utilization model of analysis of targeted systems. Hence, the IEC approach that does not involve phase-wise analysis and concentrates more on life cycle cost analysis helps to provide a detailed solution to the problem.

The literature on LCC analysis is varied. A few are discussed in this section to assess the reliability and usability of the method. A holistic life cycle cost analysis is conducted on the energy efficiency of EAF transformers was conducted by Marchi et al. (2016). The study points out that particularly for EAF transformers, it is essential to include the cost of purchase, losses, cooling system, and maintenance in LCC analysis other than the established stages of cost.

Jeromin et al. (2009) conducted an LCC analysis of the transmission and distribution system assets in order to ascertain the lifelong safety and economic viability of the machines. The study shows that the LCC done on a single machine can be transferred to a complete system. In other words, an LCC analysis on a transformer can be utilized to understand the viability of all the transformers used in the power transmission process. According to their study, the main cost-driving factors are the cost of acquisition, outage, and overhaul (Jeromin et al. 2009).

Bian et al. (2014) use the probabilistic life cycle cost analysis method of power transformers. In order to show the practical viability of using a probabilistic LCC model, they show the different investment alternatives of power transformers. The results of the analysis show that probabilistic approach provides a more practical and viable study of life cycle cost of assets that the deterministic cost analysis.

The review of literature of transformers shows that both deterministic and probabilistic models have been used for LCC analysis. Both are utilized to ascertain the cost-effectiveness of continued usage of an asset. However, it is believed the probabilistic approach helps to ascertain the future costs more effectively than the deterministic approach. This is so because it also takes into account all the maintenance costs that may occur as the machine becomes older. However, it can be intuitively determined from the literature review that using both deterministic and probabilistic approaches together can present a holistic understanding of the LCC cost of an asset.

LCC Analysis and Decision-Making

LCC analysis not only helps in understanding the financial and operational viability of assets but it also helps with decision-making (Blanchard & Blyler 2016). Thus, it benefits both technology and management based decision-making. This is so because top management must provide all the support required for the implementation of the project in an organization. Hence, without a supportive organizational environment, LCC is not viable. Therefore, it is essential to understand the effectiveness of LCC to the organizational decision-making process.

Previous studies have confirmed that LCC analysis helped to assess the viability and cost-effectiveness of assets (Marchi et al. 2016). The analysis conducted by Marchi et al. (2016) confirms that LCC helps to do a complete cost assessment, assimilate savings and cost of the operation and flow into the cooling system, and understand hazardous outbreaks of the machine. These are important information that engineers use to decide if an asset should be continued or deposed.

Thus, LCC establishes a monitoring and control system that helps in the maintenance of the asset and improves their lifecycle (Marchi et al. 2016). Further, this cost assessment model helps decision-makers to ascertain the expense of maintaining a machine and so they can easily decide when the asset should be removed (Jeromin et al. 2009). A probabilistic LCC analysis conducted by Bian et al. (2014) showed that this technique helps to provide hypothetical and realistic support for evaluation of optimal investment alternatives. Clearly, the literature on LCC analysis shows that it is a good method to be used for engineering decision-making.

Having established that LCC analysis is helpful in decision-making, the pertinent question that arises is how can it help in the policymaking of actual engineering asset management of a particular asset or assets. LCC analysis helps to provide a long-term planned maintenance and usability process for transformers. LCC cycle management is an important procedure for engineering decision-making process as this helps to optimize the power plant’s operation lifespan and improve the long-term life of the hydroelectric plant.

This helps to ensure the reliability and safety of the power plant, constrained within the acceptable limits and achieves cost-effectiveness of investment in the plants. Undertaking an economic analysis of the overall cost that would be incurred to keep the transformer running for the power plant will show how long it is viable to keep it in operation. As all transformers have a lifespan of around 30 years, the cost of depreciation and amortization are considered to understand the real cost of keeping the machine in operation and not just the nominal cost. This helps to understand if the machine is a sustainable option for the plant. LCC analysis helps the management to make these decisions about an asset.

LCC Analysis

Before explaining the process in which LCC analysis can be done, it should be noted that it is the process that effectively helps in minimizing long-term operational and unplanned capability cost (Yang 2015). This also helps in minimizing safety hazards. The LCC analysis takes into consideration non-technical issues such as the average age of the management, obsolete technology, and the process of replacing or redesigning an existing asset.

Therefore, LCC analysis is a holistic approach to understand the system, structure, and component of the assets that are necessary for the safety of the plant. Hence, the analysis considers factors such as safety, plant performance, reliability, and value while analyzing the long-term maintenance cost of the asset. Hence in a power plant like DEWA, it is important to use LCC analysis to estimate the optimal life cycle plan to ensure economic and operational reliability.

Benefit of LCC Analysis

The lifespan of transformers in a power plant is around 30 years. This, however, is an economic estimation as the technical life is often extended from 40 to 60 years (Yang 2015). This happens when the transformer is used under normal conditions for 30 years and is then repaired or upgraded for the next 10 to 30 years. Most management decision-makers do this. LCC analysis is conducted on the basis of the current reliability of the transformers. For this purpose, the transformers that we consider are operating on the assumption that they will function for a period of 40 years. These three alternatives will enable us to understand how the LCC changes over the operational lifetime of the asset. Therefore, four alternatives are assumed for the transformer lifespan in the power plant:

- unchanged operational strategy,

- replacement of transformer in a single phase,

- three-phase transformer replacement,

- overall replacement of the transformer (Amoiralis et al. 2007).

Based on this, the present value of the transformers is used to estimate its LCC.

Net present value (NPV) calculation is used to estimate the residual life of the transformers. This is commonly used economic analysis and is calculated using net cash flow every year during the service life of the assets. The net cash flow is equal to the discounted sum of the present value calculated using the discounted rate, which equals the total sum of the investment done by the plant for the asset over its lifetime. In order to calculate the NPV, it is essential to estimate the expenses paid for each of the four alternative models. This is important to estimate the investment cost of the various options.

Benefit/investment ratio (B/I ratio) compares the corrective maintenance cost (CM), the amount of lost production cost, preventive maintenance cost (PM), of the other three alternatives to that of the base alternatives. The B/I ratio helps to calculate the investment income of the assets for the different alternatives when compared to the base.

In order to do an LCC analysis, it is imperative to do a transformer failure analysis to calculate the transformer failure rate. For this analysis, X is assumed to be transformer failure rate, Y is forced failure rate of transformers, Z is the number of operating years, and A is the number of power stations. The failure of transformers includes forced outages (FO), forced extension to the planned outage (FEPO), and forced power de-rating (FD) (Yang 2015). These are converted to forced outages for the asset. Using these, the failure rate of the transformers may be calculated as follows:

Here, F/R is the rate of transformer component failure, Nfail is the number of transformer failures, NG is the number of components in a transformer, and T0 is the number of years the transformer has been operational.

The evaluation of the economic indicators of the transformer is presented by the calculation of the net present value index (NPVI), which is the ratio of NPV of total benefits and investments. The total benefit NPV is the sum of the difference of corrective maintenance cost and loss of production cost of the alternative and the base plan. The total investment NPV is calculated as the preventive maintenance cost difference in the alternative and the base models. This can be mathematically shown as follows:

Here, NPVCM is the present value of the corrective maintenance cost of the asset, ![]() is the present value of the lost of production cost, and

is the present value of the lost of production cost, and ![]() is the present value of the cost of preventive maintenance.

is the present value of the cost of preventive maintenance.

For the economic analysis of the LCC of transformers, PM is calculated as the sum of the annual outage and the existing PM costs. If there is no annual outage, then only the existing PM is considered. This can be shown by the following equation.

In this equation, CPM represents the current cost of maintenance of the transformers, CM1 represents the annual cost of raw material used for the daily operation of the assets, CS1 and CO1 are the daily operation and maintenance cost respectively, Ci is the cost of i number of labor and Ti is the time taken for the daily work time of the asset. The failure rates are usually compared to the industry data in order to estimate the future failure probability of the machine. This estimate will change from time to time as it depends on the maintenance action done on the assets.

Now, if there is an outage of the asset, then PM will also include the daily outage PM, daily PM, and the replacement cost of the alternative current. Therefore, the equation will become as follows:

In the above equation, CPM is the outage maintenance cost, CM2 is the material cost of maintaining outage, CS2 is the cost of annual outage maintenance and C2i is the cost of labor and T2i is the time taken. CSPM is the cost of specific maintenance process for annual outage.

The NPV is calculated using the cost of annual PM derived from equation 3 and 4. The following equation demonstrates how the NPV can be converted into that of the base year:

Here, NPVPM is the sump f the annual PM converted to the base year values. The other elements denote the measures of the last year and the present year. This is used to calculate the NPV in the values of the base year.

Calculation of LCC

Some of the economic variables are assumed. The assumed economic variables are shown (Table 1).

Table 1: Economic data.

The economic analysis is done with the help of the economic factors shown in the table. The ongoing and the outage cost are obtained from the operating cash flow of DEWA for 2015 and 2016 (DEWA 2016a).

Calculating the probability of breakdown of the transformer components provides the failure of operation cost. The failure data is a comparison of the plant and industry based data. As DEWA is a government-run organization and the sole producer and distributor of electricity in Dubai, there is no point of comparison. The failure rates therefore change from time to time depending on the maintenance mechanism adopted by the plant. The analysis shows that LCC helps to find the longevity of machines used in plants.

An economic analysis of the LCC model shows that the cost of PM, CM, lost of production, and their NPV values can be calculated using equations 2, 3, 4, and 5. The analysis shows the data tabulated using the equations for alternatives 1 and 2 (Table 2).

Table 2: Data analysis of LCC based on NPV values of PM and CM.

The analysis of transformers of DEWA shows that the LCC of the transformers for 30 years or 40 years is different (Table 2). The result shows that benefit of running the transformers is higher for 40 years than 20 years as the NPVI is higher for the latter (9.25) than the former (6.26). Thus, less NPV is lost less for 40 years period. Clearly, the analysis shows that the LCC analysis is a holistic measure for understanding cost-effectiveness of the assets and gives a clear view to the policymakers as to the number of years the machines can be used for optimally, minimizing the cost incurred due to failure.

Conclusion

LCC analysis is relevant to the process of estimating the optimal cost-effectiveness of using an asset. Transformers are an integral part of power plant transmission. Transformers help the plants to change the voltage from high to low and vice versa and are then transferred to the power grids to be transmitted to the consumers. The LCC analysis helps the engineers to optimize the lifetime usage of the transformers and maximize the value and long-term benefit of using the assets.

In order to ascertain that the usage of the transformers is constrained within the reliable measures of usage, the LCC analysis helps to show the point to which the assets can be used to increase their longevity keeping their output optimum. This process also ensures that the assets are used cost effectively. Based on the technical and economic analysis of the transformers used at DEWA, it can be concluded that they can be used for 40 years with standard maintenance in place.

However, without regular maintenance and preventive measures, the lifecycle of the machines will reduce as shown in case 1 in table 2. Hence, the life of a transformer in a power plant is almost 40 years and the maintenance cost during the lifetime of the transformer must be necessarily incurred for a longer lifespan of the machine. The analysis also undertakes an analysis of the NPV, total benefit and total investment cost to ascertain eh advantages and disadvantages of using LCC model.

The LCC analysis demonstrated in the paper can be used for engineering decision-making to determine the lifespan of transformers in power plants. The paper clearly shows that LCC analysis is a holistic and reliable measure for analyzing the lifetime and expected performance of assets. Based on this analysis, policymakers can decide when the older machines should be discarded.

Reference List

Amoiralis, EI, Tsili, MA, Georgilakis, PS & Kladas, AG 2007, ‘Energy efficient transformer selection Implementing life cycle costs and environmental externalities’, 9th International Conference Electrical Power Quality and Utilisation, Barcelona, Spain, pp. 1-6.

Bian, J, Sun, X, Wang, M, Zheng, H & Xing, H 2014, ‘Probabilistic analysis of life cycle cost for power transformer’, Journal of Power and Energy Engineering, vol. 2, pp. 489-494.

Blanchard, BS & Blyler, JE 2016, System engineering management, 5th edn, John Wiley & Sons, Hoboken, NJ.

DEWA 2016a, Consolidated financial statements for the year ended 2016. Web.

DEWA 2016b, Power supply guidelines for major projects. Web.

Hegedic, M, Opetuk, T, Dukic, G & Draskovic, H 2016, ‘Life cycle assessment of power transformer – case study’, Management of Technology–Step to Sustainable Production, Zagreb, Croatia, pp. 1-8.

Jeromin, I, Balzer, G, Backes, J & Huber, R 2009, ‘Life cycle cost analysis of transmission and distribution systems’, 20th International Conference on Electricity Distribution, Prague, Czech Republic, pp. 8-11.

Marchi, B, Zanoni, S, Mazzoldi, L & Reboldib, R 2016, ‘Energy efficient EAF transformer – a holistic life cycle cost approach’, Procedia CIRP, vol. 48, pp. 319-324.

Sinisuka, NI & Nugraha, H 2013, ‘Life cycle cost analysis on the operation of power generation’, Journal of Quality in Maintenance Engineering, vol. 19, no. 1, pp. 5-24.

Yang, CF 2015, ‘Life cycle management for main transformers at nuclear power plants’, International Conference on Social Science, Education Management and Sports Education, Beijing, China, pp. 1551-1554