Costing Types Definitions

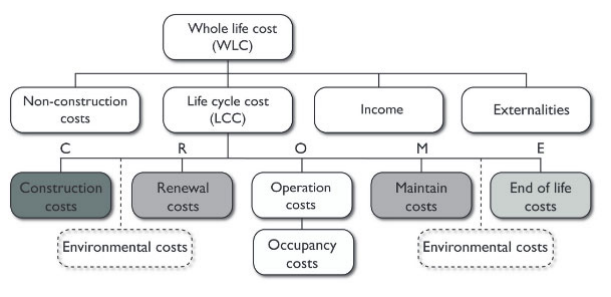

Whole life costing (WLC) concerns the economic evaluation of all relevant assets during the period of construction. Therefore, WLC covers a broad range of various expenses related to the provided services of the construction company, including non-construction costs, income, and externalities (RICS, 2016). Moreover, WLC comprises repair, upgrade, and maintenance costs, which are necessary for the construction process and are generally governed by life cycle cost (LCC) expenditures.

As seen from the previous explanation, LCC is a narrower form of an economic assessment that primarily accounts for construction costs. Hence, LCC expenditures include construction, renewal, maintenance, operation, and end-of-life costs, but it does not account for income, non-construction costs, and externalities (see Figure 1) (RICS, 2016).

In this sense, LCC is the most effective instrument of economic analysis that reveals the project’s general expenses over a determined period of time. Ultimately, both costing types are crucial to understanding the construction process and all associated expenditures.

Costing Types Benefits

Although WLC and LCC are both applicable in construction, they have distinct benefits and purposes. The primary advantage of WLC is the analysis of the costs outside the scope of LCC. In other words, a thorough overview of non-construction costs, income, and externalities is crucial to determining the validity of the project and evaluating the potential alternatives. In the scope of WLC, non-construction costs refer to rental services, land acquisition, various fees, taxes, and other indirect expenditures that should be accounted for in the assessment report (RICS, 2016). Consequently, externalities concern all incurred costs that are not explicitly present in the transaction history. For instance, expenses paid by the customer before the project implementation generally belong to the category of externalities (RICS, 2016). Ultimately, since LCC does not consider the mentioned expenditures, WLC plays a vital part in the economic evaluation of the project and presents a more detailed overview of the associated costs.

On the other hand, LCC is the primary form of financial assessment that has an extensive number of benefits and secondary objectives. First, it presents a thorough analysis of all costs related directly to the project, such as construction, maintenance, renewal, and environmental costs (RICS, 2016). These metrics allow managers and buyers to understand the financial validity of the building and evaluate any potential alternatives. For instance, the distribution of professional fees and third-party costs for the construction phase presents an illustrative explanation of the expenses to the potential buyers who might have difficulties understanding the associated financial operations. As a result, LCC promotes effective communication in the provider/client relationship and makes the project more transparent, which is generally a highly beneficial initiative for both parties. Ultimately, LCC’s emphasis on details is its primary benefit, ensuring the unproblematic construction process.

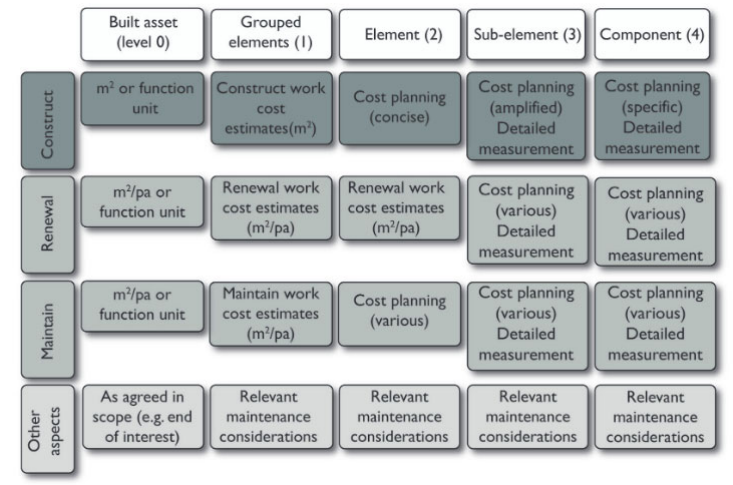

Consequently, since LCC provides a highly detailed overview of each construction aspect, it allows managers and buyers to confirm the most cost-effective approach. This model is functional in all development stages of the project, ranging from the strategic outline to post-occupancy (RICS, 2016). It allows the managers to thoroughly evaluate the cost of each aspect during various phases, leading to an accurate financial assessment of the whole project. Therefore, this model significantly improves the risk management framework and presents a realistic estimation of the initiative’s costs and dates (RICS, 2016). Furthermore, LCC utilizes the comparisons between the actual performance and expected data to review the most challenging aspects of the project and predict the financial metrics. This operation enables benchmarking for each project stage, which enhances the project’s transparency (see Figure 2).

Ultimately, WLC and LCC have an extensive range of benefits for the project, primarily concerning a thorough evaluation of financial metrics, improved project transparency, and effective provider/client communication.

Costing Types Comparison

Finally, it is essential to present the general comparison between WLC and LCC by overviewing the examined differences and similarities. The first difference is the scope of the economic evaluation – WLC provides a broader but less specific assessment report (see Figure 1). Secondly, the costing types differ in the detailing aspect of the evaluation – LCC presents highly accurate data for each of the associated construction phases (RICS, 2016). The two mentioned factors lead to another unique difference between WLC and LCC. Namely, WLC utilizes external inputs, such as assistance from accountants and advisors outside the project, to calculate externalities and non-construction costs (RICS, 2016). On the other hand, LCC primarily deals with the internal expenditures during the period of analysis. Lastly, the distinction between WLC and LCC might differ depending on the national practices. For instance, the UK standards address occupancy costs in the LCC report, but other regions calculate them in WLC (RICS, 2016). In summary, while the two costing types have unique purposes and benefits, they are both crucial for the construction process.

References

RICS. (2016). Life cycle costing (1st edition). Web.