Executive Summary

Companies use the merger strategy as an essential business strategy. It aims at joining the efforts of two or more companies rather than one. As a result, the companies work together in mutual benefit to attain their individual and collaborative goals.

In this case, the companies attain equal status and enjoy their benefits in equal proportions (World Finance World Economy, 2007). I have chosen DHL and FedEx companies for this proposal because they have a long and reputable history in business. The DHL Company was formed over 40 years ago in San Francisco (DHL, 1994).

It was formed by three businesspersons and entrepreneurs who wanted to endorse the ideology of parcel and paper delivery in San Francisco. These entrepreneurs included Robert Lynn, Larry Hillblom and Dalsey Adrian. They started by shipping and delivering papers to Honolulu from San Francisco before opening an office in London for global shipping in 1974 This office served 3000 customers around the world.

On the other hand, FedEx was conceived in year 1973. It was founded when the Caliber System Company was acquired by the Federal Express (FedEx, 1995). Originally, the Caliber System offered express shipping only. After acquisition, FedEx extended it services leading to market extension.

The company’s headquarters is located in Memphis and headed by Fredrick Smith. In 2012, the total revenue was amounting to $ 42.7 billion, and the operating income was $ 3.19 billion. The companies would have a horizontal relationship in a merging environment since they offer similar products. The companies have various weaknesses as well as strengths that will be integrated in the merging process.

Background

In this light, I would propose that the two companies merge to form an alliance. In this case, the two companies will merge to form a single company that will be offering the same services. In addition, they should merge into a merger of equals. As a result, the companies will have equal shares in the merging. They will abandon their individual logos and obtain a common logo. Also, they will use a common business name. Therefore, the new company name will be DHL and FedEx Co.

There are various reasons as to why the two companies will merge into a single company. In the executive summary, it is clear that the two companies have strengths and weaknesses. The merging will allow the company to make an all-inclusive alliance. In this light, the strengths of DHL will complement the weaknesses of FedEx Company.

On the other hand, the strengths of the FedEx Company will compensate for the weaknesses of DHL. For example, the DHL Company has a network of about 230 countries around the world. This implies that FedEx will widen the network. On the other hand, the DHL Company will be able to penetrate the USA market through the various FedEx subsidiaries. This interdependence forms the true rationale of the merging.

Market Analysis

Current Position

The current market is a competitive market between the two companies. In this light, their market share is almost equal around the world. In a financial report that was released in 2012, the company had a network of about 221 countries. On the other hand, DHL Company had reached about 230 countries around the world.

This implies that the two companies have an extremely high competition in the market. However, the countries are not exactly the same. Therefore, there are some countries that get services from FedEx and not from the DHL Company. In fact, this forms the basis of this merging. However, the competition does not involve the two companies only.

There are about six other companies which struggle for the same market share. These include ARAMEX, Choice Logistics, BAX Global, Purolator Courier, TNT N.V and United Parcel Service (Parsons, 1997). As a result, the market share faces an extremely high competition. In addition, the two companies targets different clients within the market share. In this light, the DHL Company offers their services at high prices.

This implies that they target the wealthy clients who are above the middle class. This is because they have invested a lot of funds on their logistics and systems. Therefore, the company offers high class services that can be afforded by the wealthy people only. On the other hand, FedEx Company has subsidized its prices allowing for the wealthy and the middle class. This market segmentation is the most challenging issue evolving around the target market.

Future Position

The future position of the market seeks to analyze the nature of the market in the face of merging. In this light, it is crucial to understand that the two companies are the most vital. This means that they are financially stable and solvent. As a result, the merging will reduce the competition that exists in the market. In fact, the two companies have the ability to dominate the market. Therefore, they will suppress the other companies significantly.

The companies will join up their networks leading to increased coverage. The companies will harmonize the prices into common rates. In this case, the DHL prices will reduce while the FedEx prices might be increased. These common market rates will ensure that the market is harmonized. As a result, the market segments will disappear. Therefore, the harmonized prices will target all clients. The alliance will get more customers in the market share than the rest. This will lead to an increase in the market share.

Benefits

Customers’ Benefits

In reference to customers, they will enjoy the subsidy of prices. Particularly, the DHL clients will be served at lower rates than before. In addition, the alliance will enhance the improvement of the technological systems. This will ensure that customers receive efficient and fast services than the original setup.

Companies’ Benefits

For the companies, the most significant benefit is the mutual interdependence between the two companies. In this light, the companies will help each other to obscure its weaknesses and improve on the strengths. For example, the popularity of DHL Company is USA is lower than FedEx. Therefore, FedEx will enable the DHL Company to increase its popularity. On the other hand, FedEx has a smaller foreign network than DHL Company. Therefore, DHL will help FedEx to penetrate the global market widely.

Marketing Plan

The merging of the two companies will result into a new brand in the market. As a result, there will be an efficient marketing and advertising plan that will aim at popularizing the joint brand. These are some of the marketing strategies.

Media

Media reaches a large number of people. In this light, the two companies will seek to advertise their merging in the televisions, radio stations, newspapers, financial magazines and newspapers. In this case, they will incorporate these advertising bodies during the launching day.

As a result, many clients will be aware of the new company formation. The social media will be involved in advertising and marketing the brand. The public relations officers will open a page of the brand and invite people to like the page. In this page, they will be making advertisement about their new services and processes.

Sports

Sports have been the central mark of leisure. Therefore, the companies will be sponsoring teams in various games. Mainly, they will sponsor footballs teams owing to the large number of football fans. As a result, the companies will create awareness of their merging.

Community Support

The companies will be sponsoring various community projects aiming at creating awareness. In this light, the companies will sponsor education for the needy students. This will assist the company in creating a good reputation. Consequently, it will earn popularity and increase their market share.

Timelines

The merging plan will take a little time. In this light, the possible time will be estimated at two years. In the first six months, the companies should agree on the process of merging. This will involve a close evaluation of the pros and cons. After the agreement, the companies will design the new logos and company name. In addition, they will make a detailed budget of the merging process. Also, they will identify the possible sources of these funds.

In the next six months, the company should work on the integration the technological system. This will ensure that the systems are harmonized to reflect common rates. During this period, the companies will change the brand names in all their delivery vessels. These include the vehicles, ships and airplanes. They will change their organizational goals and processes to incorporate the two companies.

For the last one year, the company will select new organizational leadership. These include the Chief Executive Officer, Board of Governors, departmental heads. In addition, they will consolidate their employees and train them on the new organizational processes.

Finance

Cost

Normally, the cost of merging is significantly high. However, the cost of merging between DHL and FedEx will be lower than the expected cost. This is because the two companies have already made strong systems. Therefore, the integration will be quite easy. This table represents the cost of various items in one financial year 2013-2014.

Revenue

The integration of the two companies will help in the efficiency of the system and create a stronger brand than the original one. Therefore, the total revenue will increase by 40 percent.

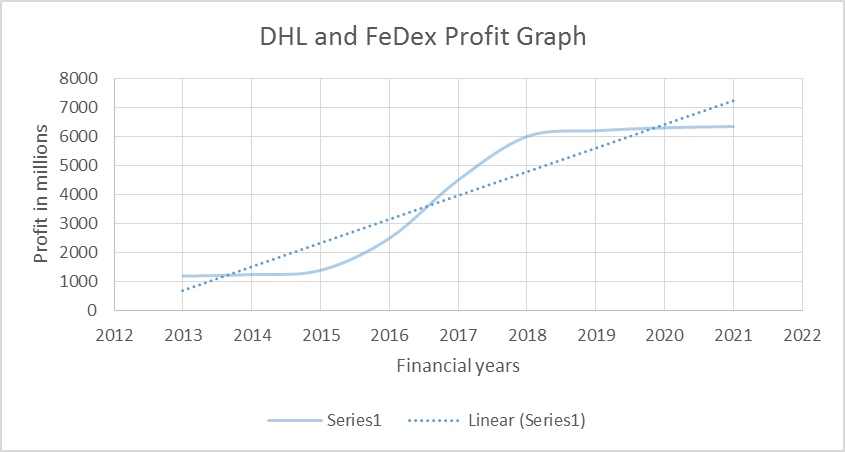

Considering, nine years of operation this proposal will seek to speculate on the graph for profit margin. The proposal will present a graph for nine financial years which will show the expected general trend for the profit margins.

Explanation

The graph shows that the profits of DHL and FedEx will remain constant for the first two financial year. This is due to the introduction of the new brand in the market share which has not been marketed. As a result, the customers will need time to adopt the changes that are brought about by the merging process.

From the year 2015 to 2016 the graph is extremely steep owing to high profits. In this case, the companies will combine their individual market shares and strengths that will allow the companies to make high profits. At the same time, customers will be familiar with the new brand resulting from the merging process.

Therefore, customers from both companies will join their financial capability resulting to elevated profits. From the year 2018 to 2021 will increase at a low rate owing to customer deterioration in the market share. The companies, which will have attracted most of the customers, will have little effect on their number of customers. Therefore, the level of profit will remain constant, but it will not reduce.

Conclusion

The proposal has created an all-inclusive framework for the merging of DHL and FedEx. In this light, it has explained the reason for choosing DHL and FedDex and proposing a merging process between them. Secondly, the proposal has explained the historical background of the two companies alongside their financial experiences. The proposal has analyzed the current and future positions.

Moreover, it has provided an in-detailed plan of the marketing plan that include social media, sponsorship, clothing and media. In this case, the proposal has provided details pertaining to the implementation of the plan of marketing. Lastly, the proposal has included a financial table containing the current and future revenue alongside the cost incurred in the merging process. Importantly, the proposal has represented the profit projections for the two companies over the next nine year starting from the year 2013 to 2021.

References

World Finance World Economy: Merger and Acquisition Strategies (2007). Web.

Parsons, R. (1995). Businessweek: Business News, Stock market & Financial Advice. Web.

DHL: Global (1994). Web.

FedEx: Shipping, Logistics Management and Supply Chain Management (1995). Web.