According to Brewer & Gavin (2002), a developed country is defined with several factors in consideration, and this can be seen where different scholars have looked at this in different ways. Some scholars determine whether a country is developed by considering the Gross domestic product per capital income.

However, the scholars do not singly use this as a reason of terming a country as being developed but also adds on to the fact that people in that country should be having the freedom to do as they please. For instance, some countries in the Middle East have high GDP but cannot be said to be developed since they do not experience the same kind of freedom as most of their counterparts do.

From the point of view of macroeconomists, a developed country is one where economic growth is high and steadily increases. A country that is considered developed also has low inflation and in most cases, the rate of unemployment is considerably low. Broaman, Paas & Welfens (2006) says that developed countries also boast a healthy balance of payment.

Such countries have alleviated poverty especially the type that is absolute and to this effect, the literacy of the individuals is improved. Feldstein (2003) adds that some resources are made available such as water and wholesome food to ensure that the individuals are healthy and they can be productive hence reducing poverty in that country.

Heale (2011) suggests that developed countries seem to have reached the epitome of financial stability but with time, this can be destabilized by different circumstances. The United States of America is a developed country and even at some point referred to as a superpower. However, some disadvantages came along with this in the year 2008. It faced severe financial crisis that had to be evaluated.

The United States of America is a developed country and with years, it has even supported other countries that are developing by giving donations. One disadvantage that was felt in 2008 when the country was going through financial crisis was that other countries were also disrupted in their economies.

Hemming & Schimmelpfennig (2003) suggest that there is a common saying that goes, ‘when America sneezes, the east gets a cold and Africa gets pneumonia”. From this, we can deduce that America economy’s stability really is vital in the general development of the world’s economy.

America is heavily industrious and it may supply the east with products, which they need for their activities to continue. In 2008 when the financial crisis hit America, the production reduced and the amount of resources exported from Africa was greatly reduced. This also brought about the financial strain in Africa as well as the east since they were also financially destabilized.

Hemming & Schimmelpfennig (2003) continue to argue that, America facilitated the free market system in the world. However, after the crisis in 2008 this was bound to change greatly. The two investment banks in the United States of America, which were responsible in financing most transactions, had to undergo a restructuring after the financial crisis in 2008.

They changed to banks that were holding companies as a way of ensuring security, which would bring forth potential rewards. The federal government to offer guidance on the market development uses the institutions, but after the crisis subsides, the institutions may be sold, nationalized or regulated heavily by the government. This is a disadvantage since the institutions, which were once funding investments are reduced to just policy regulators.

According to Jordan, Messe, Nielsen & Taylor (2009) the taxpayers also in the country face great change as the government has changed the order of previous priorities. This can be seen through the health plans that had previously been given prominence before the 2008 financial crisis.

The alternative form of energy may be considered but it may not be on top of the list for the individuals. However, it might be on top of the list for the industries. Improvements on Infrastructure are also set to slow down as a way of reducing the expenses that may come along with the costs to be met. The government is trying to cut down on the cost on every area that before had been heavily financed so that they can sustain the basic requirements of the country for its continuity.

The crisis is seen to have its roots in various areas. The failure of several banks and insurance companies may have been responsible in the halting of financing for the investors or for the activities that contribute to the general income of the country. Orszag (2002) says that the institutions as mentioned earlier were taken over by the government and after the crisis, their fate seems to be uncertain and this has led some to go into bankruptcy or even restructuring to another form that will secure their returns and survival.

Koggel (2006) says that the real estate industry is also seen to be a root of the crisis. In 1998, the prices of houses seemed to have increased and subsequently at the same time, the banks and financing companies seem to have lost their power and they were not able to finance mortgages, as it was the case earlier.

Subsequently, the standards were lowered and this brought about the mortgages to be sold to unqualified buyers for whom it was not intended. When the prices for the real estate do not rise, people do not have enough finances to purchase the houses, and this leads the banks to acknowledge write-downs. This led to the insolvency and bankruptcy of so many financing institutions in America.

Pieper & Wos (1999) indicate that during the financial crisis in 2008, there was a weakening in the regulation of various policies. This led to some institutions breaching policies for their own gain at the expense of the society. For example, some industries exceeded on the amount of gases they emitted to the environment as the policies had not been enforced.

This is a major disadvantage as it contributed to the global warming having in mind America holds most of the industries that emit these gases. This has effects on agriculture, which is responsible for the reduction in food production.

There is development of a new culture that sprung up in the United States of America after the financial crisis of 2008. People were subjected to the attitude of acquiring their own good sustenance.

This led to materialistic attitudes that meant that where people gained an avenue to acquiring resources they did it at their own benefit and did very little to contribute to the general development of the country. People are required to rebuild an economy and if they do not work for the benefit of everyone then it becomes rather tasking to get the objectives set by the country (Cherunilam 2006).

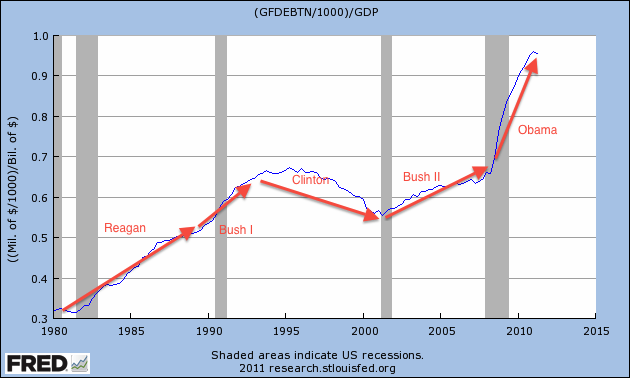

Graph for the change in GDP over several years indicating the financial depression in 1998

The financial situation in the United States of America can be seen to have gradually risen from the year in context, which is 1980. From 1980 to around 1995, it rose steadily from 0.3 Bll. of $ to over 0.6 Bll. of $. It can be concluded the decline started from around 1996 and the deepest depression from the chart was experienced at 1998 and seen by the steep decline from 0.6 Bll. $ to almost 0.5 bll. $.

References

Brewer, T & Gavin, B 2000, Globalizing America: the USA in world Integration, Edward Elgar Publishing Limited, Cheltenham.

Broadman, H, Paas, T & Welfens, P 2006, Economic Liberation and Integration Policy: options for Eastern Europe, Library of Congress, New York.

Cherunilam, F 2006, International Eco, 4E, Tata, McGraw-Hill Publishing Company Limited, New Delhi.

Feldstein, M 2003, Economic and Financial Crisis in Emerging Market Economies, University of Chicago, Chicago.

Heale, M 2011, Contemporary America: Power, Dependency, And Globalization Since 1980, Blackwell Publishing, west Sussex.

Hemming, R, Kell, M & Schimmelpfennig, A 2003, Fiscal Vulnerability and Financial Crises in Emerging Market Economies, International Monetary Fund, Washington.

Jordan, A, Messe, M & Nielsen S, Taylor, W 2009, American National Security, the John Hopkins University Press, Baltimore.

Koggel, C 2006, Moral Issues in Global Perspective, Broadview Press, Ontario.

Orszag, P 2002, American Economic Policy in the 1990s, Massachusetts Institute of Technology, United States.

Pieper, G & Wos, L 1999, A fascinating country in the world of computing, World Science Publishing, London.