Introduction

Singapore has enjoyed stable economic conditions over the past decades. However, the situation was not the norm this year, as it reported an increasing high rate of inflation. The Strait Times article on Singapore’s’ escalating inflation is an illustration of the debacle that faces the economy.

Although it can be argued that inflation is a common phenomenon in a country, its increase beyond the expected level pose a challenge in the economy. The article highlights the current inflationary situation in Singapore and provides the various perceptions of analysts and their speculated economic condition in the near future.

Economic Condition of Singapore

The current high levels of inflation, demonstrated by Singapore economy, as reported on March economic analysis distorts the country’s economic performance. Various factors have been attributed to the high inflation rate ranging from printing excess money, rise in labor and production costs, decline in the exchange rate, lending levels escalating to increase in taxes.

The policy in Singapore has been to allow global prices to be reflected in domestic prices. For several essential foodstuffs, such as rice, the government has a rotating stockpiling programme which can act as a moderating buffer mechanism for short-term changes (Smithers, 2009).

Indeed, domestically generated cost-push inflation in Singapore can take place but, given a very high foreign leakage, will largely take the form of reducing the competitive edge of Singapore’s exports and increasing the volume of its imports. So long as the balance-of-payments position continues to be in surplus, however, this deterioration in export competitiveness does not necessarily result in external depreciation of the Singapore dollar.

Some of the effects of high inflation rate that has been felt in the economy are the increase of the housing prices, and cost of fuel increased by approximately 5%, thereby increasing the cost of transport in the economy. As fuel is the main determinant of the prices of most of the commodities in the economy, the foodstuffs became expensive making the life in Singapore unbearable (Keynes, 2006).

The increase of money supply, particularly of the high-power variety, has plagued the country’s economic condition. Singapore normally operates a Government budget surplus, besides having a Currency Board System, whereby high-power money supply is rigidly controlled.

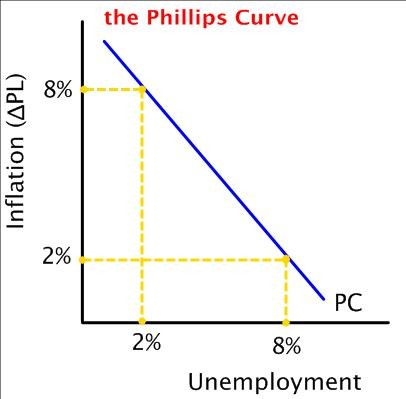

Imported inflation, as illustrated above, cannot be insulated through prudent monetary and fiscal policies. Ideally, Philips curve demonstrates the effect of inflation on the rate of unemployment in an economy. Where the inflation rate is high, rate of unemployment is lower.

The Philips Curve denotes the effect on the rate of inflation on the employment of the individuals in the economy. As illustrated above, the current inflation rate of 5.2%, in the month of March, depicts that the unemployment rate is at its lowest as compared to that of January and February—having inflation rates of 4.8 and 4.6 percent respectively.

This is attributed to the money supply in circulation in the economy. Inflation rate is normally depicted by money surplus, through printing of excess money by the government, as such enabling the companies to circulate the available surplus money in the society by providing employment to the individuals.

As such, the government finds it difficult to mitigate the increase in the prices of the commodities in the economy. Therefore, the companies will have no option but to lay-off employees in order to reduce expenditures—creating unemployment. The table below analyzes annual unemployment rate on Singapore economy.

Table: Unemployment Rate (Annual)

P: Preliminary estimates

From the information above, there is minimal difference between the unemployment rate for the resident individuals and non-residents in the economy. Although as compared to other economies in the world, Singapore is not badly-off as its annual unemployment rate is below 5 per cent—both overall and resident’s rate. However, the current trend cannot be ignored as the increase has been rampant over the past six months (Eskesen, 2009).

The Monetary Authority of Singapore will need to enact strategies that will appreciate Singapore dollar in relation to other currencies. In the case where measures are not initiated, the economy will ultimately face impromptu financial impacts. As the economy relies heavily on exports to increase its revenue outlay, the balance of trade will be affected. The imports will be expensive while the exports will be cheap; thereby depicting unfavorable balance of trade in the economy.

The Monetary Authority of Singapore, because of the openness of the Singapore economy and operation of the Currency Board monetary system, is very much inclined towards relying on the exchange rate as a domestic price stabilization device.

However, domestic price inflation can be multi-causal (Baum & Hartzell, 2012). In Singapore, there are the twin anxiety-causing phenomena of house-asset inflation and car-asset inflation. In addition, demand-pull inflation and cost-push inflation have played a key role in the current situation, in the economy.

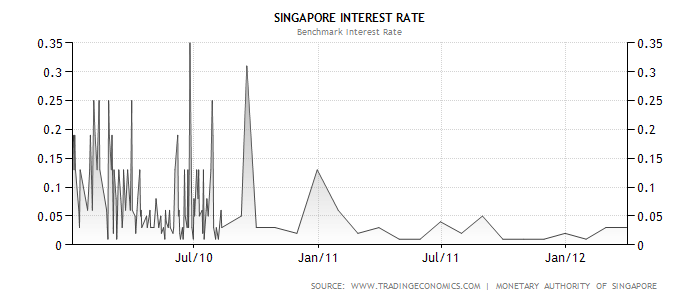

From the figure below, the Singapore’s interest rates has been fluctuating due to changes in the economic conditions. The government did not impose stringent measures to mitigate the volatility of the interest rates over the past years.

The Central Bank needs to reduce the amount that it lends to commercial banks in order to minimize money surplus in the economy. Such a strategy will ensure that the amount in circulation is minimal; thereby, enhancing appreciation of Singdollar, which ultimately reduce the inflation rate in the economy (Allen & Gale, 2007).

Recommendations

The government, in conjunction with Central Bank, should undertake measures that will reduce of end inflation in the economy. One of the vital issues to be undertaken is the reduction of interest rates by Central banks. This will ensure that the interest rates of commercial banks increases. In addition, the short-term measure will be to regulate exchange rates that normally fluctuate (Smithers, 2009).

Consequently, having a wage and price control system will ensure that the stability in both prices and employees’ salaries are realized. Though it might necessitate a change in the budget for the Singapore’s economy, the government should provide allowances to the citizens to cater for their cost of living. This will ensure that the commodities and standard of living of the citizens are well-catered.

Conclusion

The article provides the clear situation that currently affects the Singapore economy. Globally, inflation has been on the rise. Singapore has been the latest victim on the imminent effects of inflation. Some of its effects have been an increase in the prices of the commodities, housing prices escalated, and the price of purchasing and maintaining Automotives also increased.

However, the government can undertake strategies that will mitigate the adversity of inflation—both short-term and long-term strategies. The case enlightens the investors on the effects of their investments in Singapore’s economy.

References

Allen, F. & Gale, D. (2007). Understanding Financial Crises, New York: Oxford University Press

Baum, A. & Hartzell, D. (2012). Global Property Investment: Strategies, Structures, and Decisions, London: John Wiley & Sons

Eskesen, L. (2009). The Role for Counter-Cyclical Fiscal policy in Singapore, New York City: McGraw Hill

Keynes, J. (2006). The General Theory of Employment, Interest and Money, London: Routledge

Smithers, A. (2009). Wall Street Revalued: Imperfect Markets and Inept Central Bankers, London: John Wiley & Sons