Introduction

United States of America is the world’s only super power, after the fall of Soviet Union in 1991. This country gained independence from the British Government in 1776 and was recognized as a nation in 1783 following the Treaty of Paris. This nation lacks an official language at Federal level. However, English is the most common language.

The variation with which they speak this language makes it be referred to as American English. Over 90% of the inhabitants can communicate comfortably in this language. Other commonly used languages are Spanish, French, Germany, Japanese, Chinese, and American Sign Language among other local languages. The currency commonly used in this country is the American dollar.

The country is ranked the world’s largest economy, with most of its companies dominating the world’s market. Some of the United States’ firms dominating the world markets are the Coca Cola Company in beverage industry, The Wal-Mart in retail industry, General Electrics and General Motors in manufacturing sector among a host of other multinational corporations.

Certo reports that United States of America has the largest and most advanced military. This country is technologically advanced, and the living standard of its populace is well above average. Although there are a few Americans living below a dollar a day, most of its citizens are in stable employment, earning decent salaries.

The political system in the U.S. has been relatively stable over the years, making it the leading democracy in the world. The transition of power from one party to another or from one president to another has been done smoothly, making the economy very stable. There are two predominant political parties in this country: the Democrats and the Republicans.

Politics has played a big role in the economic development the U.S. In their manifestos, these political parties always put forth their economic plans for the country. This has increased accountability and transparency in the management of public funds. Other than the Great Depression of 1930’s that shook the economy and rendered almost a third of its citizens jobless, the country has enjoyed a relatively consistent positive growth in its economic growth.

However, this stability in economy was shaken once again in 2008, when the country was hit by another economic recession. Many industries registered negative returns, and many financial institutions had to be rescued by the government from eminent fall.

Employment opportunities became scarce, and the government revenues sharply declined. Currie reports that the rate of unemployment reached a record high of 9%. The government had to act swiftly in order to reverse this unfortunate situation. Currently, there is recovery from the economic slum. The country’s economy is growing positively, estimated at about 3% in this last quarter.

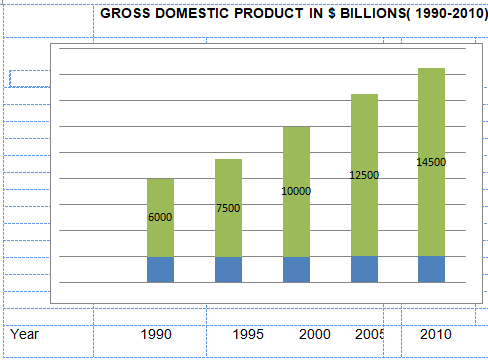

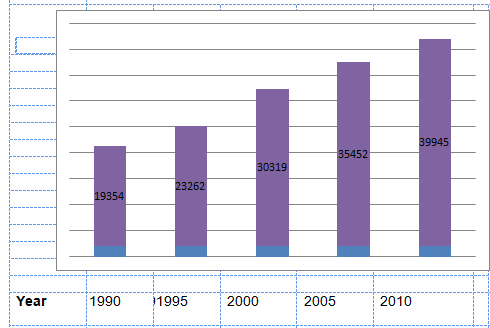

Gross domestic product has had a consistent growth since the end of the economic recession of 1930’s. For the last twenty years, American Gross Domestic Product has grown from six thousand billion dollars to fourteen thousand five hundred billion dollars in the year 2010. This is a growth of over 250%. The country’s gross domestic per capita has also improved from $ 19,354 in 1990, to $ 39,945 in 2010.

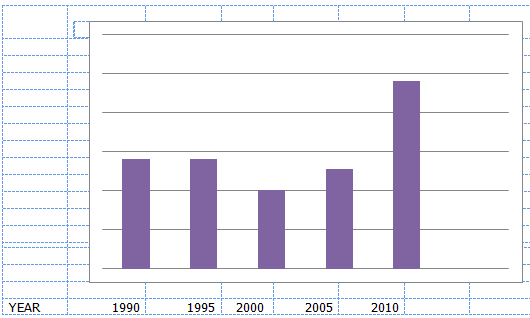

Despite this positive trend in the two economic indicators, the country’s unemployment rate has been very inconsistent. Since 1990, the rate was highest in the year 2009, when it was estimated to be at 9%. This was attributed to the economic recession which started out in the late 2007 and ran till mid 2009. War on Iraq has had negative impact on the economic growth of the country.

The budgetary allocation to the military is as huge as what the rest of the world put together spends on their military. This has seen the country forced to run on a budget deficit in order to finance its operations. Gomez and Balkin report that the country has been running on a budget deficit since 1969.

This year’s budget deficit was projected at $ 1.3 trillion. This is 8.5% of the country’s gross domestic product. Analysts predict that the country may not be able to finance all its operations in the year 2012, and therefore may need to borrow for the government to keep running.

However, they predict that it will be lower than the current deficit. United States of America is one of the world’s greatest exporters. Most of the world’s top companies dominating international markets currently are Americans. Companies like the Coca Cola Company and the General Motors are known in the world markets.

There are many other manufacturing firms, service providers like the Hollywood Films and virtually all other industries which are American. This would therefore make one believe that this country will have a zero balance of payment or even a positive one. However, this is not the case. The United States of America has had a negative balance of payment for several years in a row. This may be attributed to the war on Iraq, war on terror, willingness of American consumer to purchase more on credit, constant US budget deficits and the emerging of China as the world’s top exporter.

Since 1995, the US has experienced a free fall on its balance of payment. By then, the balance of payment for this country was standing at -1.85%. This trend deteriorated and by the end of 2006, the figure was standing at -7.45. The economic recession of 2008 to 2009 worsened the situation.

Basically, inflation may be defined as the general increase in price of commodities in a given country over a specific period of time. This country has not experienced any serious inflation in the recent past. However, there has been some form of inflation felt within this country. Inflation has been ranging from 1.59% to 3.85% since 2000, with the country experiencing deflation of -0.34% in 2008.

The Behavioral Patterns of the Economic Indicators for the Last Since 1990

Since the fall of the Soviet Union, the United States of America had experienced a relative dominance in the world’s economy. However, emergence of China as a world economic powerhouse has put this country in an awkward position. China is eating most of the US world markets at a speed that Washington had not predicted it would. China is currently the preferred trading partner to many African nations.

Some of the markets that was predominated by American firms are now going east. Mankin reports that China has devalued its currency, making its exports cheaper in the world market, while the imports to this nation are relatively expensive. This has seen it export more of its manufactured goods to foreign countries, challenging the US as the world’s top exporter.

Although the Gross Domestic Product has been on the rise, this has not been happening at a proportionate rate to the country’s expenditure. The graph below shows the country’s growth in Gross Domestic Product since 1990.

For the last twenty years, United States of America has experienced a positive growth in its gross domestic product. By the last quarter of 1990, its GDP was estimated to be six thousand billion dollars. This has consistently grown and by end of 2010, this figure was at fourteen thousand five hundred billion dollars.

The rise can be attributed to the consistent increase in production of the country. Many American firms are still very productive. Other American firms like Apple have based their production in China, but the proceeds go back to the US. Most of its citizens are also very entrepreneurial, making it one of the countries in the world with the highest business start-ups.

These private firms are employing the highest percentage of the Americans. Over the years, unemployment has been put under control. Other than the unfortunate economic recession of 2008-2009, the rate of unemployment has never been more than 5.5%. The graph below shows the percentage rate of unemployment since 1995.

This low unemployment rate has made living standards of the Americans be well above average. Although there are many of its citizens who are super rich, the national wealth is evenly distributed to the citizens. Majority of the population are in employment, which would translate to increased gross domestic product.

The GDP per capita is one of the best in the world. With most of the population absorbed in various employments, the per capita has also increased over the years since 1990. By the end of 2010, the country’s per capita was standing at $39,945.

The graph below shows the growth in per capita since 1990.

The graph above shows that the living standard of the Americans has been on the rise since 1990. This is despite the 2008-2009 economic down turn that affected many industries in America and the world at large.

Historical Analysis of the Relationship of Economic Indicators

Economic status of any country is determined by its political temperatures. A stable political atmosphere will mean a stable environment for doing business. More investors will be attracted to such a market and the infrastructural developments will be witnessed.

The United States of America has experienced a rare political calmness since the end of the civil war soon after its independence. This has seen it grow to become the economic giant it is today. The First World War worked to its benefit. At first this country did not align itself to any country. It remained neutral, making it able to form economic pact with any side of the warring nations.

The American nation had then just attained industrial revolution. Its industries produced goods in mass because the world’s economic powerhouses like Britain, France, Germany, Japan and many others were too busy fighting to make any production. The U.S. had to export food to these nations because they could not engage in any agricultural activity. It was also the main supplier of arms and ammunitions to both rivals. This incident helped the economy grow at supernormal speed, making it narrow the economic gap between it and the then economic leader, the Great Britain.

When it joined the war latter, it emerged as one of the strong nations both economically and military wise. The GDP, GDP per capita and employment rate was on the rise. The government employed many of its citizens in the military, drastically reducing the rate of unemployment that was on the rise.

Unfortunately, this positive trend was brought to an end in the late 1929 when the country was struck by its worst economic recession that would last for almost a decade. Many firms closed down or were bought off by foreign investors who relocated them to other countries, laying off the employees. This trend was reversed by the Second World War of 1939 to 1945. Since then, the economy of this nation has been relatively stable. These economic indicators have direct relationship with one another.

Relationship between Real GDP and Labor Productivity

Labor productivity is a ration of real GPD. It refers to the effectiveness of the labor force of a given country. It is the measure of what the labor can produce within an hour against what it is expected to produce within the same period. Real GDP refers to a country’s output, having taken into consideration factors such as inflation and deflation. The output of labor will have a direct bearing on the total output of the nation.

Growth in productivity of labor will have a positive bearing to firms because they will be in position to meet their strategic plans within the set timeline. This will lead to their expansion. Labor productivity translates to increased living standards as the populace will have enough to spend from their productive work in various companies.

Real GPD will be felt if the population can afford to make purchase of what they consider basic to them. This therefore means that labor productivity directly influences the real GDP. Classical theorists have related GDP and labor productivity. Adams Smith agued that output is directly affected by labor productivity. This relationship can be illustrated as Y = ∫ L, K, T; where, T – land, L – Labor, and K – capital.

Relationship between Real Economic Growth and Labor Productivity

Real economic growth is achieved when there is a trickle down effect to the general public. It is achieved when the population experiences improvement in the infrastructure and other facilities that improve their living standards. Real economic growth can only be attained when the labor force positively work towards having a better economy.

Labor productivity will determine this economic growth. If the labor force is able to meet the set target in their respective working places, the economy will witness an improved growth. This will in turn enable the government achieve its development plans within the stipulated time. Basically, these development plans are always infrastructural. This would mean that citizens will feel this effect in form of improved living standards. Labor productivity therefore leads to real economic growth.

In the United States of America, labor productivity is very high. Many of the Americans have the entrepreneurial ability, hence unemployment is reduced. This means that many Americans are employed, making it one of the nations with the highest per hour output of labor. This has been directly reflected in its real economic growth. The country has some of the best schools, hospitals, roads and other infrastructural facilities in the world.

Relationship between Real GDP and Unemployment

Unemployment is a situation where individuals with the right qualification and willingness to work are not able to get the right job. This occurrence is very common in developing nations. Unemployment is a direct result of poor growth in real GDP. If real the GDP is having a positive growth, it will translate to more jobs for the citizens, hence leading to increased per hour output of labor.

This will in turn increase the real GDP. This creates a circle, where failure in one will lead to failure in the entire circle. If labor productivity becomes low, the real GDP will fall, and a fall in GDP will lead to increased unemployment which directly translates to reduced per hour output of labor.

This system is open to external forces. Any disturbances from the external environment may affect one of the two players, and this would interfere with the entire system. The relative political stability of this country has seen its labor productivity improve, thereby improving the real GPD which in turn reduces the rate of unemployment.

Relationship between the Variable

These variables are related. Labor productivity has a direct bearing on real GDP. A positive growth in real GPD will lead to increased employment. An increased employment means that per hour output of labor is increased; which translates to increased labor productivity. Increased real economic growth lowers the rate of unemployment.

This is reflected in the Macroeconomic Theory and policy, which holds that a country’s economic growth is directly dependent on the ability of its population to produce more than it can consume. This theory holds that local population should have the ability and willingness to purchase. This would help local companies experience growth. For this reason, unemployment will hinder both real GDP and real economic growth.

Historical Analysis of Economic Indicators

The United States of America has had a stable economy despite its constant budget deficits. Inflation has always been put under check as supply of money is regulated. The following is an analysis of the relationship between various economic indicators.

Relationship between Inflation and Real Economic Growth

Inflation refers to an economic situation where price of commodities are above normal. This phenomenon happens when the supply of money exceeds the output of the country. Inflation can deal a dangerous blow to a country’s real economic growth. For a country to experience a healthy economy, it should be in a position to balance its exports and imports.

Inflation will always make a country’s products appear more expensive in the world market, while imports would be relatively cheap. This will make its products less attractive in the world market; hence its exports will be reduced. On the other hand, imports will increase.

This imbalance is dangerous as the country will spend more on importing but gets little from its exports. This situation may force a country to run on a budget deficit; hence it may not be able to experience real economic growth.

Relationship between Inflation and Money Supply Growth (M1)

Money supply has direct effect on the rate of inflation. When the supply of money exceeds a country’s total output, the value of such currency will fall. This will mean that one would need more of such currency to buy a similar item that was costing less before the surplus currency was introduced. Money supply should be a reflection of the level of economy. If the economy has grown, there should be a proportionate supply of money.

The United States of America has had a tight check on its supply of the dollar. Dollar is used by many nations and therefore its devaluation would affect many other countries besides the US. Despite the economic recession of 2008-2009, the rate of inflation was maintained at manageable levels. This was because the supply of money to the economy was put under check.

Relationship between Unemployment and Money Supply Growth (M1)

In as much as there is no direct link between money supply growth and employment, the effects of money supply affects the rate of employment. If the supply of money is more than the total output of a country, there will be an overflow of the currency. This would in turn increase the production cost as manufacturers will have to pay more for the inputs they use in the process of production. The increased cost of production may make some firms consider relocating, down sizing or complete closure.

In whichever way, the ultimate effect will be a reduced rate of employment. To reverse such a situation, a country may be forced to withdraw the excess currency. These economic variables have close relation. Money supply in the economy will have a bearing on the rate of inflation. Inflation directly affects real economic growth. Unemployment is affected by and affects real economic growth.

High rate of unemployment leads to reduced real economic growth. Reduced real economic growth in turn affects the rate of employment as many firms will be producing below their capacity and therefore will have to employ lesser number of individuals.

Historical Analysis of the Relationship between Accounts of Balance of Payment, Average Interest Rate, and the Government Budget Balance

Balance of payment accounts refers to a record of all the financial transactions of a given country to other countries in the world. This is done after a specific period of time, in the concerned country’s currency.

All the incomes from the production process are recorded as surplus, while all the payments are recorded as balance deficits. Average interest rate is a ratio of a country’s liabilities. Government budget balance refers to the budget deficit. This happens when the proposed expenditure exceeds the expected income within a specific accounting year.

The United States of America has constantly been forced to have a budget deficit because its total expenditure exceeds the income. The economic survey done by the end of 2009 indicated that the average interest rate of this country stood at 3.290. This was reduced to 2.992 by the end of 2010. This was because of reduced government budget deficit. Balance of payment for the country is also experiencing positive growth.

Conclusion

United States of America is the leading economic powerhouse in the world. Although it faces serious challenges in the growth of the economy, it has maintained a positive trend over the years. Economic indicators are showing the same.

Rate of unemployment has been completely put under check, making majority of its populace economically productive. This in turn increases the gross domestic product, which in turn affect the real economic growth. If the currency supply of a country exceeds its output, chances are high that such a country may experience inflation, a fact that may destabilize the economic growth.

Works Cited

Certo, Samuel. Modern Management: Concepts and Skills. New York: Prentice Hall, 2011. Print.

Currie, David. Country Analysis: Understanding Economic and Political Performance. Burlington: Gower Publishing Limited, 2011. Print.

Gomez-Mejia, Luis and Balkin, David. Management: People, Performance and Change. New York: Prentice Hall, 2011. Print.

Mankin, Gregory. Principles of Economics. New York: Cengage Learning, 2009. Print.

Moss, David. A Concise Guide to Macro Economic Analysis. Massachusetts: Harvard Business School Publishers. 2000. Print.

Whelan, Charles. Naked Economics: Undressing the Dismal Science. New York: W.W. Norton and Company, 2010. Print.