Introduction

Business in economics is defined as every activity that a person or an organization can engage in that would lead to earning or realizing profits. Business environment is on the other hand the surrounding circumstances that influence or affect a business activity. In this case, business environment can be defined as all possible conditions; political, social, economical or internal conditions, that influence the direct performance of a company or any business entity. Business environments are classified as either internal or external conditions.

Internal business conditions are those that the company can control. They include the five Ms which are man, material, money, machinery and management (Economic swatch, 2010).These factors are directly influenced by the company’s internal actions. The external conditions on the other hand are factors that affect the company’s activities but are beyond the company’s control. Examples of these factors include; political stability, legal requirements, geographical factors, cultural disparities, demographical factors to mention but a few.

External factors are further classified into macro and micro operating environments. Micro operating environments are those factors that directly affect the volumes of production. This includes raw materials, competition from other firms, change in customer’s preferences and the general market flow. Macro operating environments on the other hand are aspects surrounding the business that can pose as threats or better still work for the advantage of the company in light of profitability. These include economic factors as well as the non-economic factors like political, social, natural, demographic and international factors (Economic swatch, 2010). This paper will discuss and describe the effects of factors with regards to the British airline.

British economic response to the increase in world interest rates

Britain like any other world leading economy felt the pinch caused by the world’s economic meltdown. The effects of this event led to different reactions across the world’s biggest economies Britain being one of them. According to a report released on the economic watch website (2010), Britain is the slowest growing in the world’s economic giants. In response to the effects of the tragic economic meltdown and the rise in the world’s interest rates, the British government has put in place strategies to cushion the possible implications.

The famous UK austerity plan is one of the measures employed to minimize or limit the level of national debt (Economic swatch, 2010). Cutting and reducing government spending was also a major way through which the UK cushioned itself against the serious implications threatening the economy. By increasing the interest rates, the government saw a significant increase in tax collection which ultimately led to reduced federal debt. However, many economists say that the recovery strategies are not sufficient enough to shield the economy from the dangers ahead. They warn against an unforeseen probability of a more damaging economic meltdown and stagnation of the economy.

British airways; Company’s background

In the airline business, British airways is a household name and a respected organization in the aviation industry. Its dominance in the aviation market is supported by its giant fleet size with numerous international flights. For quite along time the company has been the leading airline with regards to passenger numbers till it lost the coveted position to Easy Jet at least in the UK’s market. The company went through a series of transformation before it was finally privatized in 1987(Economic swatch, 2010). Soon after it was privatized, it took over a number of other airlines including the British Caledonia airline which was much smaller compared to BA.

The airline was branded ‘the world’s favorite’ in the early 90s and by then it was one of the most profitable airlines on the face of the earth. The company was doing so well that it kept on absorbing smaller airlines such as the Delta air and the TAT European Airlines. The biggest expansion made by the British airline was in 1993, when the company bought 25% of Qantas an Australian airline, 24% of the American USAir and full acquisition of Brymon airways (Economic swatch, 2010). Nonetheless, as the market was developing, other players were attracted and the British airways was receiving competition from new players who gave better price deals than they did. Such new market players were Ryanair and Easy Jet who brought forth very stiff competition.

Economic challenges

The British airline is faced by many economic challenges including the common global economic meltdown that has affected every player in the aviation industry as well as in other industries. Some of these challenges include the debt crisis experienced in the UK, the air transport crisis influenced by the economic meltdown, the economic meltdown it’s self and the financial crisis. Other challenges include the emergence of low cost airline like the easy jet airline that is threatening the existence of the British airline in the UK’s market. The prevailing rise on the fuel prices is also a viable issue to be seen as a challenge (Economic swatch, 2010).

Competitiveness is the principle cause of concern in this industry and the most competitive airline carries the day. However, while the British airline was one of the best the world could offer, some other new airlines have been penetrating the market with highly competitive rates which makes them more attractive to customers. In this segment, the British airline is losing to the competitors who come with lucrative deals on the table to woo customers. In addition, environmental factors and a number of changes effected by the government have adversely affected the operations of the British airline. A good example is the carbon emission policy considering that air crafts are a major source of emissions.

The aviation industry is facing difficult environmental challenges especially with the recent vibrant campaigns to control the global warming through the reduction of carbon emissions. This has challenged the British airways and is threatening to slow down business as usual as a remedy is not easy to come by. It is important to note that the environmental issues raised against aircrafts are not about carbon emissions only. There are other gases emitted by aircrafts that are harmful to the environment such as nitrogen oxides not to mention the noise pollution that has over the years affected populations living around the airport.

Macroeconomics effects on the economy

Macroeconomic factors as discussed earlier are external factors that affect the company’s performance. Some of these factors include the environmental conditions, political influences, demographical effects and other external factors that influence the function-ability of the British airline. The recent and perfect instance is the environmental conditions that recently caused a stand-off in the routine operations of the British airline. The volcanic ash crisis affected the airline as the government moved in to effect a flight ban as a safety measure to safeguard the citizens. This ban left the airline with no choice but to comply and have all flights cancelled.

It is painful to look into how much this event influenced by the uncontrollable acts of nature caused the British airways and the aviation industry as a whole. According to statistics released by Allen, Massey and Freeman, (2010), this natural disaster caused the airlines players a collective £200million every single day that the ban was in effect. However, these are natural effects that man has no control over and the government’s reaction was the best move towards controlling the implications of such a natural disaster. Nonetheless, the government came under heated critism on their decision to ban the flights and was accused of making decisions based on theory rather than factual evaluation and risk assessment.

The economic effects of the blanket approach were immensely felt by the economic implications. Economists argued that while the blanket approach was an effective way to cushion the economic implications of the volcanic ash crisis, their may have been other more practical ways to do the same. A more practical approach would have served the purpose according to Allen, Massey and Freeman, (2010). Compared to the economics effects on the aviation industry after the 9/11 bomb attack in the USA, the volcanic ash crisis effects had a higher scale. The closure of the entire air space for three days crippled the entire industry costing the British airways billions of Euros in profits not forgetting the inconveniences cause to travelers. Below is a picture taken in Heathrow Airport.

Increase in the world’s interest rates has its implications in response to the same. Worlds increase in interest rates was influenced by the economic melt down worldwide that saw world’s greatest economies like the UK suffer critical economic drains(Economic swatch, 2010). The effects of high interest rates have varied effects as will be discussed below. The main visible effects as seen in the UK were; an increase in the borrowing cost, mortgage payments interest hike, savings as opposed to spending, there was a fall in consumer and companies consumption as well as low levels of investments, public debt went up as the high interest increased the government payment margin and ultimately, the rise in interest rates affected greatly the consumers’ confidence in the economy.

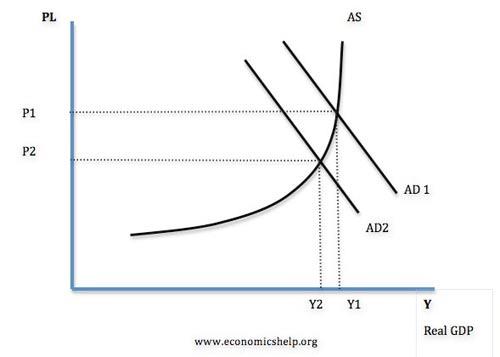

The graph below shows the effects of high interest rates on the economy:

Effect of Higher Interest Rates.A rise on interest rates increases the rate of payment on borrowed loans and credit cards (). The effect of this is that people stay away from borrowing and limit their spending on credits hence reduced business activities. This has adverse effects to the economy as consumption drastically assumes a fall. Mortgage plans based on low interest rates will also rise and as a result, this will further strain the consumers forcing them to reduce spending on other items. Reducing spending means that money will not be in use and will be kept in banks. While this has the advantage of increase the currency value, the economic benefits based on this are not many compared with an investing culture.

Impact of macroeconomics on the company’s performance

Political, social and economic factors have impacts on the British airways company. Political actions for example led to the loss of billions of shillings recorded by the airline during the period through which an airspace ban was effected due to the ash volcanic crisis. Other actions like the pension policy have changed the approach of the British airways in regards to accounting for pensions, a factor that has seen the recent confrontation between the management and the workers (Economics help.org, 2012). Recent strikes were as a result of the same (Allen, 2010). The government has at the same time changed the retirement age which now gives both the pilot and the cabin crew 5 and 10 more years of service respectively. This increases the wage bill hence undesirable to the company.

The British airways have had environmental and social impacts which have influenced the livelihoods of many citizens. However, most of the environmental effects of the British airline are mostly causes of international concerns. As discussed above, emissions of carbon and nitrogen oxide in the environment are the major concerns. Nonetheless, noise pollution in the neighboring estates has brought a number of complains (Economics help.org, 2012). The move to reduce the international level of carbon emissions to control the prevailing global warming is perceived and expected to affect the aviation industry greatly.

Macroeconomics Exposure

The British airways is the center of the aviation industry in the world and any shift in the market structure would have severe implications on its operations. This is an established company with the majority shareholding in numerous other airlines around the globe. This means that any slight implications caused by any of the macroeconomic factors would have an impact on it. The British airline is vulnerable to the slightest shift in the political decisions made around the world. This is so due to the numerous destinations the airline has. A shift in government’s policies in these destinations would affect the airline in response to the positivity or negativity of the policies in place.

The airline is vulnerable to the slightest changes also in economic alterations and safety conditions of its destination countries. Insecurity and economic mismanagement in other countries where the airline operates would largely affect the companies operations and hurt its financial stability. The British airline being one of the biggest airlines in the world is also one of the most vulnerable airlines taking into account the above discussed situations. The company is more vulnerable to the macroeconomic factors surrounding it than other smaller airlines like the Easy Jet airline.

British airline market exposure and factors shielding its vulnerability

The British airline is advantaged by its financial capacity to explore other alternative markets globally. The company is large enough to be able to carry out this global task. The large number of air planes at the company’s disposal is the major advantage that the airline can mobilize to cease the opportunities in the new markets. The air line has however been in the same mission to increase its market share globally by absorbing some other major airlines in different nations and partnering with others as well. The travelling culture among the Britons gives the company a stable market and an assured business. The reputation gathered over the years of operation has put the company ahead of its competition and other micro and macro economic factors enabling the airline to be highly favored by the market trends.

Vulnerability includes the internal economics of a company that negatively affects its operations. In this case, the British airways has to deal with the rising employee-employer conflict. Employees’ dissatisfaction demoralizes them hence prompting inadequate commitment to their job. This can hurt the company’s long lasting image which may translate to devastating economic losses. Other factors that can hurt the company include change of preferences by the customers and more importantly political activities in the countries of destination. Security uncertainty may reduce the number of travelers to the affected destination hence reduce the number of customers visiting the country.

Aspect of corporate strategy

Corporate strategies to evolve from the current disappiointments in the economic world are of crucial and supreme importance. Companies are currently shifting focus on emerging markets as a cover up strategy to shield themselves from the cutting economic times. These are ways through which companies can maintain their presence in the market and increase their market share. Research on the viability and feasibility of emerging markets should be given precedence. British airways can not fully depend on the current market. The current market is already fully exploited and possibilities for it to create new opportunities are minimal (Sullivan, 2012).

However, there are a number of rising economies that are potential emerging markets that can be exploited (Sullivan, 2012). This would increase the ultimate influence of the British airline in the aviation industry leave alone increasing its profitability and market share. Emerging markets are new and young markets that when exploited can yield economic benefits that a company can find feasible to risk it resources in. identifying new markets increases the chances for the growth of a company and increases its capital base as well as value.

Conclusion

This research has exhaustedly discussed the effects of interest rates using the British airways as an example. The paper has within given a graphical account to support the claims on the effects of interest rates. In the body of this paper, it is evidently agreed that the economic meltdown had adverse effects on the world’s larger economy as it had on the individual economic power houses like the UK. Economic stimulus plans may have helped elevate the problem but in the UK, the move to cut government spending and increase interest rates was not so effective (Dellot, 2012). The factors that affect the existence and function-ability of a company can be internal or external as explained in the body of the paper and the authorities should take the responsibility to check on their actions to avoid negative responses.

References

Allen, V, Massey, R & Freeman, S 2010, Send for the Ark Royal! Three Navy warships to spearhead dramatic operation to rescue stranded Brits. Web.

Dellot, B 2012, Are there better ways to surface undeclared work? Web.

Effects of Rising Interest Rates in UK; why do interest rates have a big impact on the UK economy? 2012. Web.

Sullivan, R 2012, ‘Shift to emerging markets will persist’. Web.

The Economy of the UK, GB, British Isles (or whatever you Want to Call It!). 2010. Web.